Income Tax Payable On Balance Sheet - However, there is a difference. See how income tax payable. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet.

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. See how income tax payable.

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. See how income tax payable. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet.

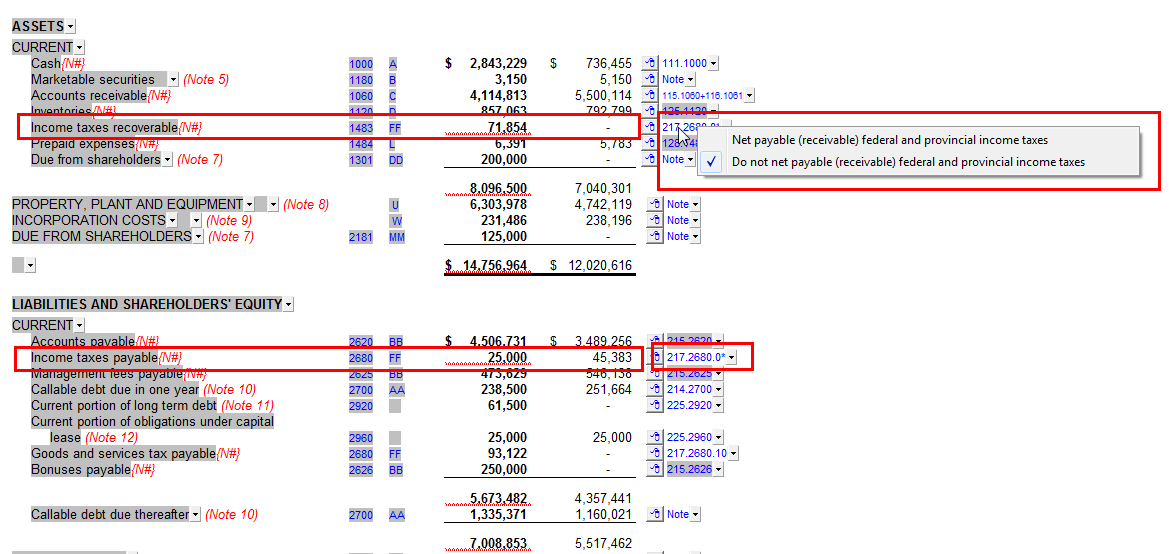

Option to net balances recoverable/payable on the balance sheet?

However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. See how income tax payable. Income taxes payable and deferred tax liabilities are both recorded on the liability.

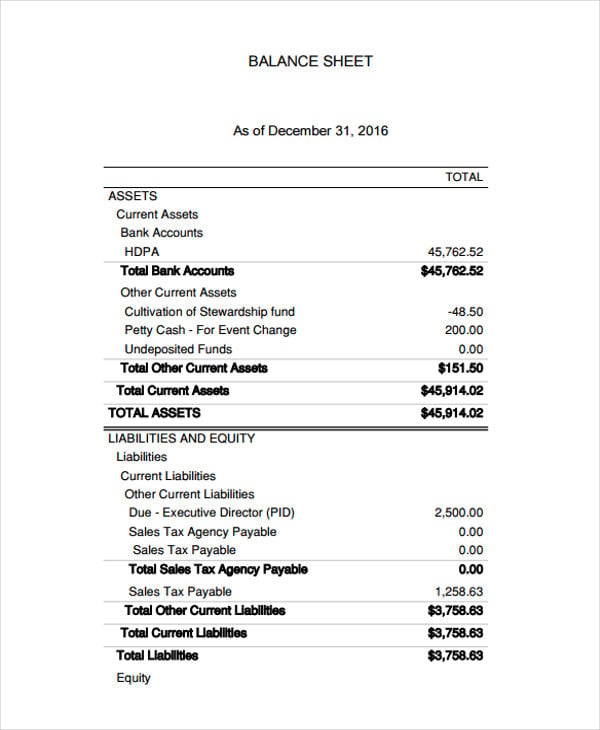

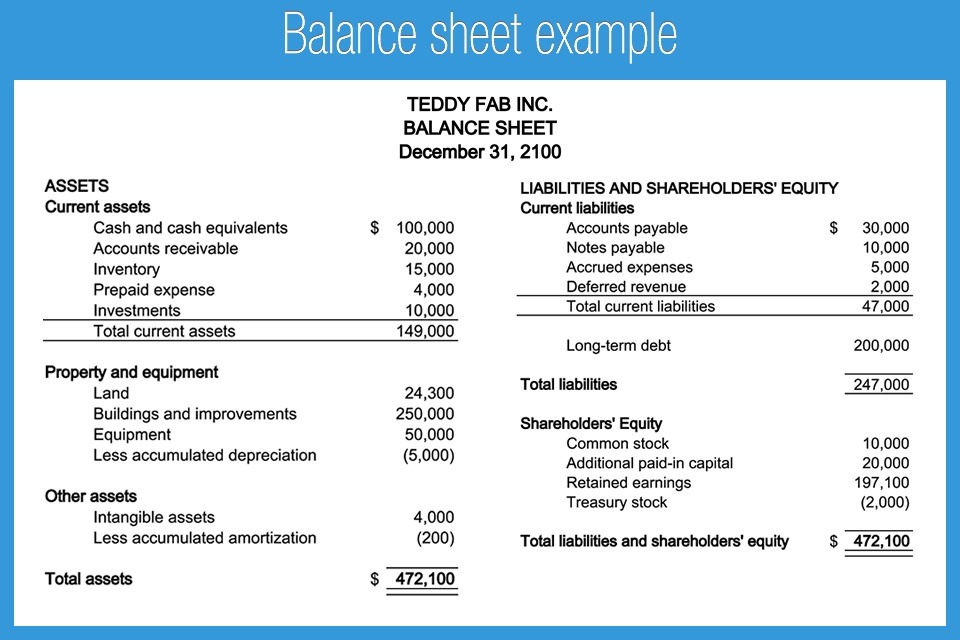

Tutorial Download Balance Sheet For Free Printable PDF DOC

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. However, there is a difference. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. See how income tax payable. Learn what income tax payable is, how it is calculated, and how it is.

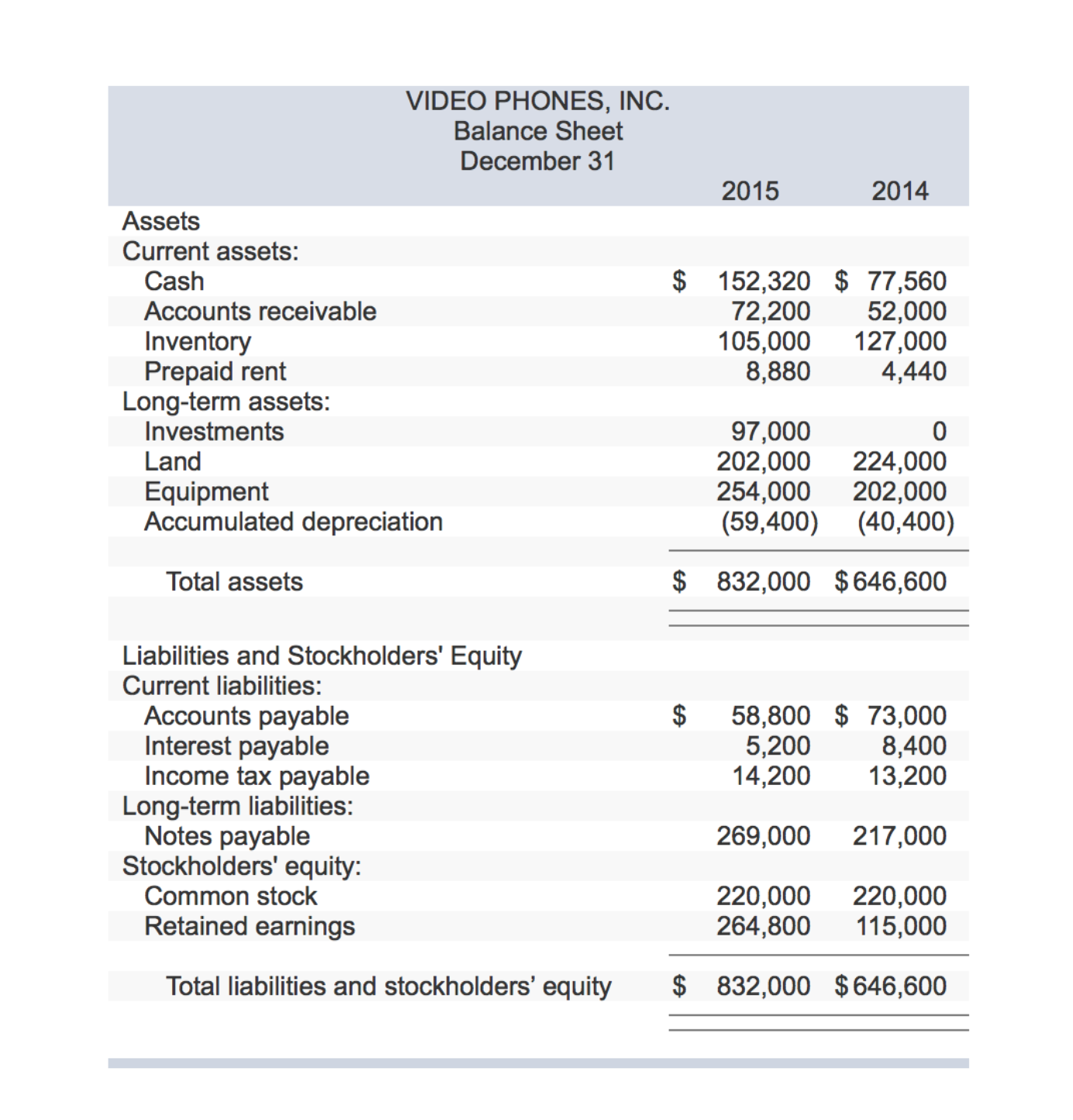

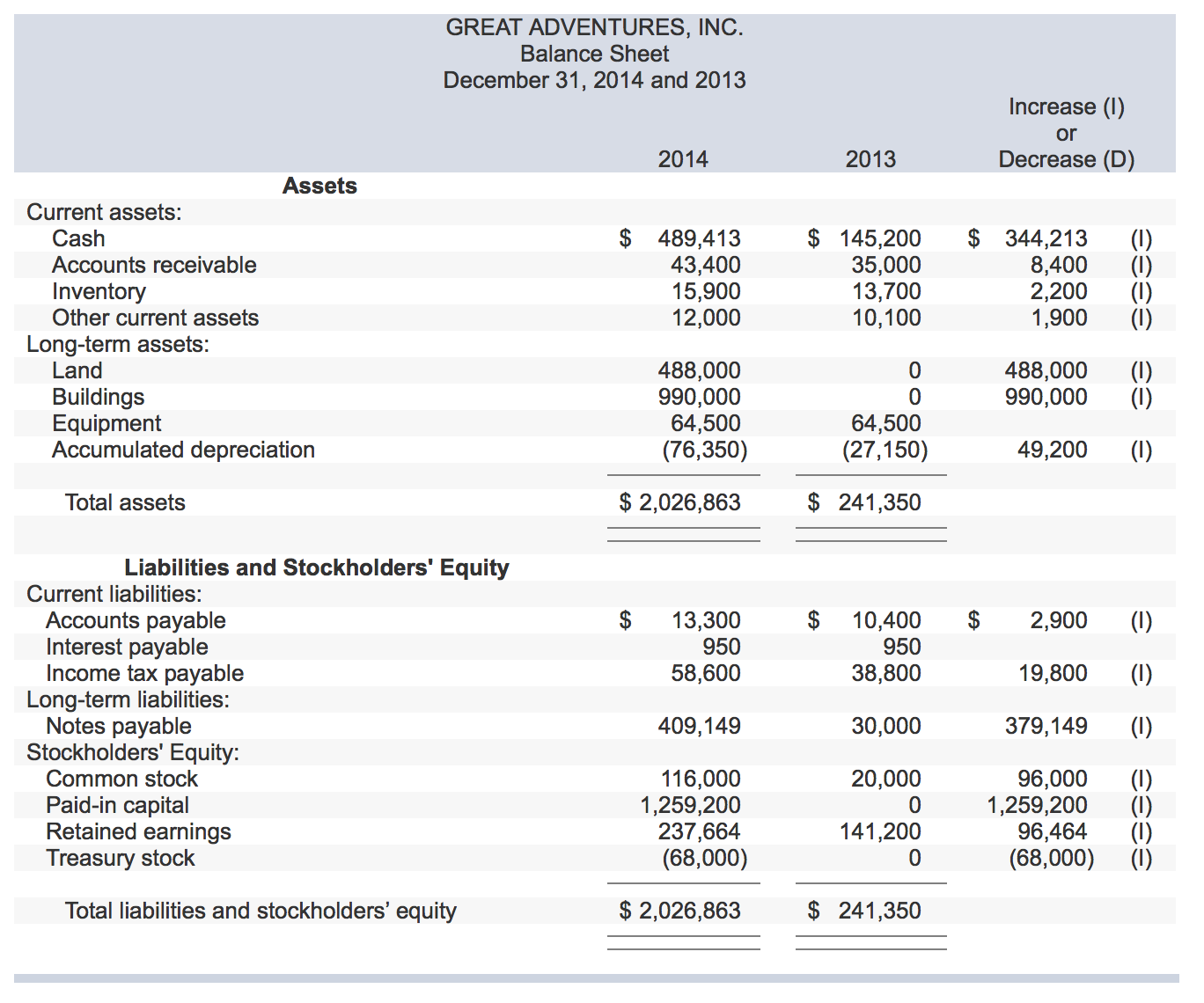

Tax Basis Balance Sheet Example

Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. See how income tax payable. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet..

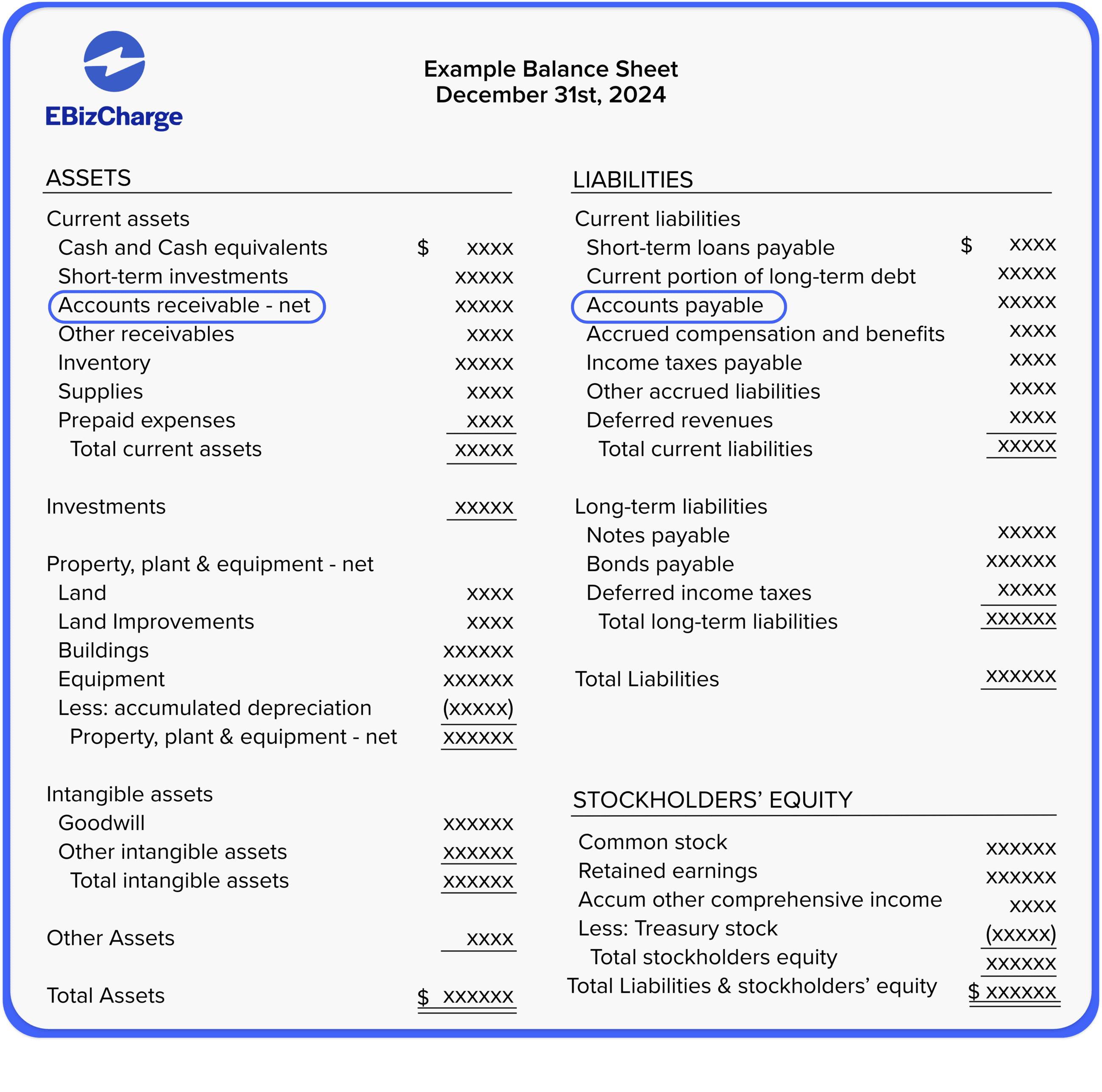

A Guide to Balance Sheets and Statements

Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. See how income tax payable. However, there is a difference. Learn what income tax payable is, how it is calculated, and how it is.

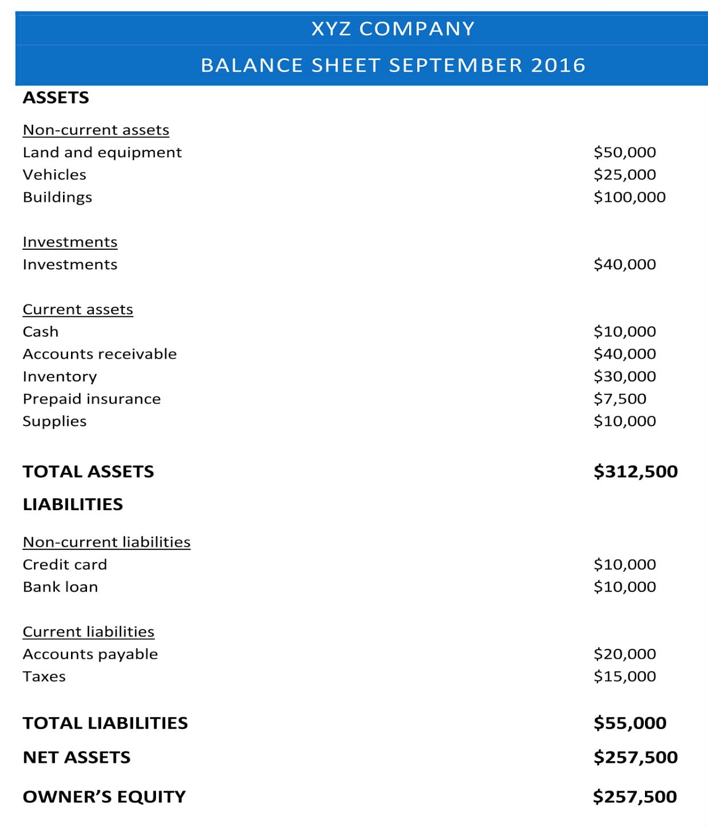

How Do Accounts Payable Show on the Balance Sheet?

Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. However, there is a difference..

What is taxes payable BDC.ca

See how income tax payable. However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is.

BALANCE SHEET Central Africa Tax Guide

This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference..

Taxes Payable on Balance Sheet Owing Taxes — 1099 Cafe

Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. However, there is a difference. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities..

Tutorial Download Balance Sheet For Free Printable PDF DOC

Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. However, there is a difference. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet. See how income tax payable. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets.

What are Accounts Receivable and Accounts Payable?

However, there is a difference. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. Learn what income tax payable is, how it is calculated, and how it is presented on the balance sheet..

Learn What Income Tax Payable Is, How It Is Calculated, And How It Is Presented On The Balance Sheet.

However, there is a difference. See how income tax payable. Income taxes payable and deferred tax liabilities are both recorded on the liability side of the balance sheet. This whitepaper addresses determining the current taxes payable or refundable, deferred tax assets (dtas), and deferred tax liabilities.