Where Do You Mail Form 843 - Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Mail the form to the address indicted in the instructions. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. These are based on if you are responding to a notice and. Where do i mail form 843? According to this irs webpage, california residents should mail returns without payments to:

According to this irs webpage, california residents should mail returns without payments to: Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. These are based on if you are responding to a notice and. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Mail the form to the address indicted in the instructions. Where do i mail form 843? Page provides taxpayers and tax professionals the mailing address for submitting form 843

These are based on if you are responding to a notice and. Where do i mail form 843? Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. According to this irs webpage, california residents should mail returns without payments to: Page provides taxpayers and tax professionals the mailing address for submitting form 843 Mail the form to the address indicted in the instructions. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to.

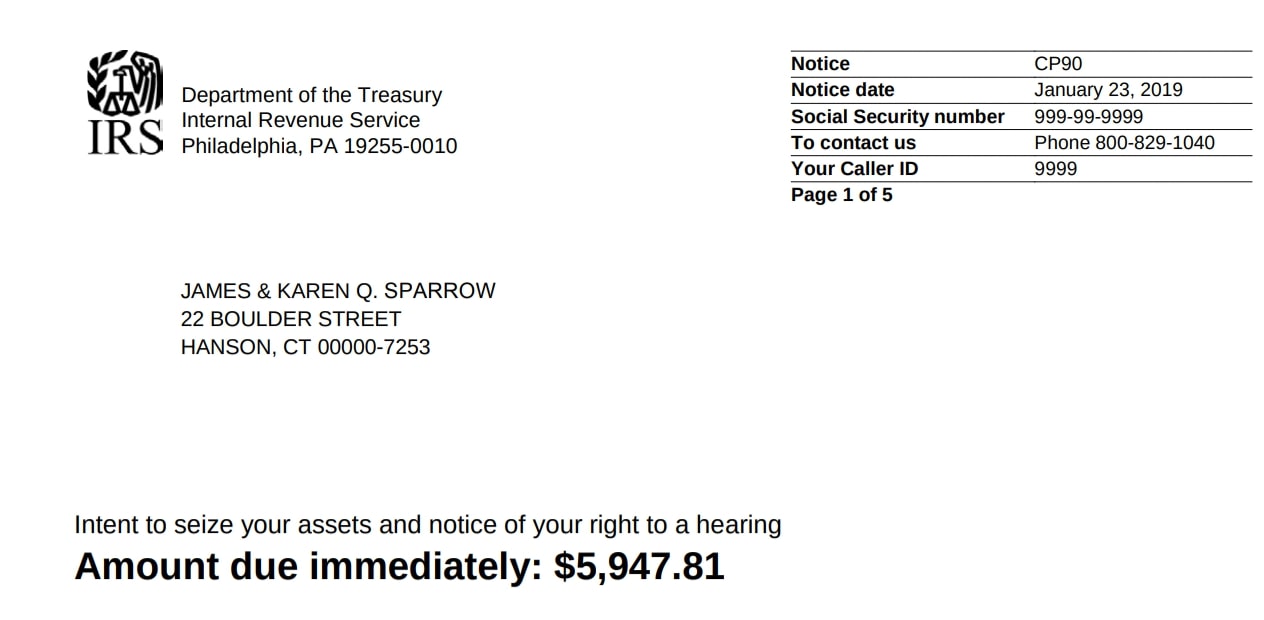

IRS Certified Mail Understanding Your Letter And Responding

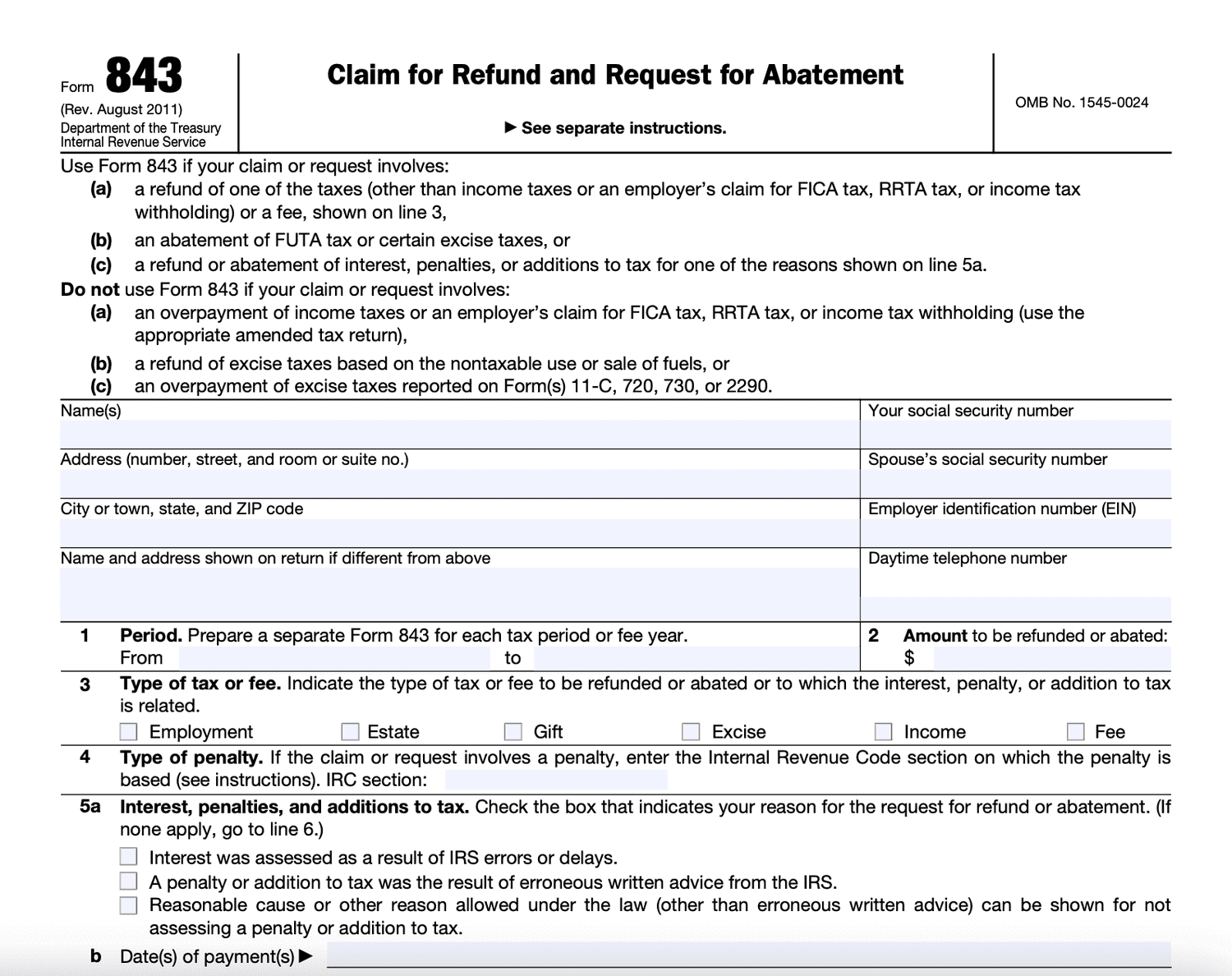

Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Where do i mail form 843? Page provides taxpayers and tax professionals the mailing address for submitting form.

Irs Penalty Abatement Templates

Where do i mail form 843? Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Mail the form to the address indicted in the instructions. Page provides taxpayers and tax professionals the mailing address for submitting form 843 According to this irs webpage, california residents should mail returns.

Form 843 Understanding Refunds and Penalties SuperMoney

Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Where do i mail form 843? Mail the form to the address indicted in the instructions. These are based on if you are responding to a.

Where To Mail Form 843 To The IRS LiveWell

These are based on if you are responding to a notice and. Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. According to this irs webpage, california residents should mail returns without payments to: Mail the form to the address indicted in the instructions. Information about form 843,.

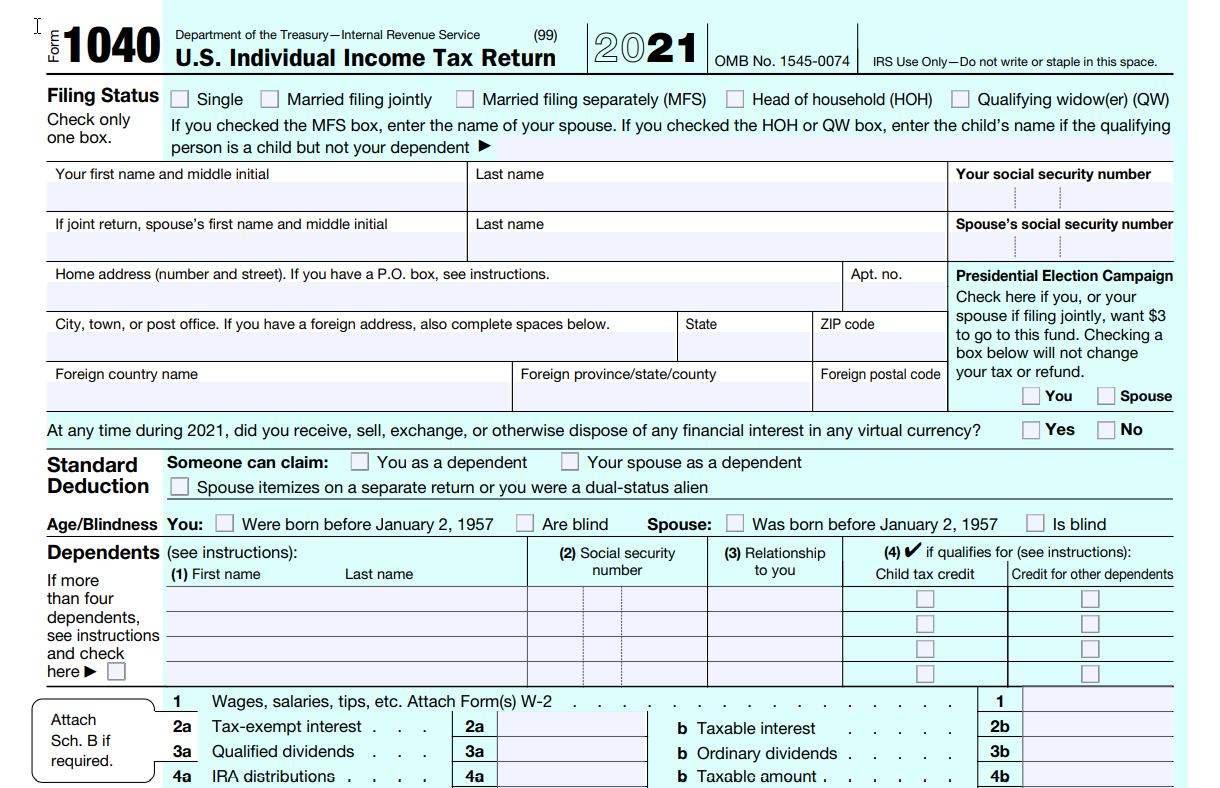

Where do I mail my Personal Tax Form 1040?

Mail the form to the address indicted in the instructions. Where do i mail form 843? These are based on if you are responding to a notice and. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions.

How to Write an Email by Anne Helen Petersen

Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Mail the form to the address indicted in the instructions. According to this irs webpage, california residents should mail returns without payments to: These are based on if you are responding to a notice and. Information about form 843,.

Form 843 Request for Penalty Abatement YouTube

These are based on if you are responding to a notice and. Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Mail the form to the address indicted in the instructions. Where do i mail form 843? According to this irs webpage, california residents should mail returns without.

When do the Royal Mail strikes end? Full list of postal strike dates in

Page provides taxpayers and tax professionals the mailing address for submitting form 843 These are based on if you are responding to a notice and. Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. According to this irs webpage, california residents should mail returns without payments to: Where.

Printable Tax Form

Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Mail the form to the address indicted in the instructions. Where do i mail form 843? Page provides taxpayers and tax professionals the mailing address for submitting form 843 These are based on if you are responding to a.

Where To Mail Form 843 To The IRS?

According to this irs webpage, california residents should mail returns without payments to: Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to. Page provides taxpayers and tax professionals the mailing address for submitting form 843 Use form 843 to claim a refund or request an abatement of certain.

Mail The Form To The Address Indicted In The Instructions.

Where do i mail form 843? Page provides taxpayers and tax professionals the mailing address for submitting form 843 Use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. According to this irs webpage, california residents should mail returns without payments to:

These Are Based On If You Are Responding To A Notice And.

Information about form 843, claim for refund and request for abatement, including recent updates, related forms and instructions on how to.