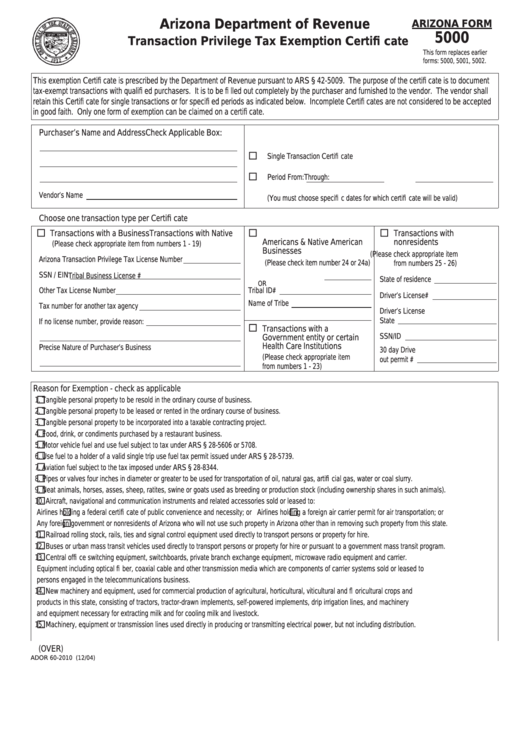

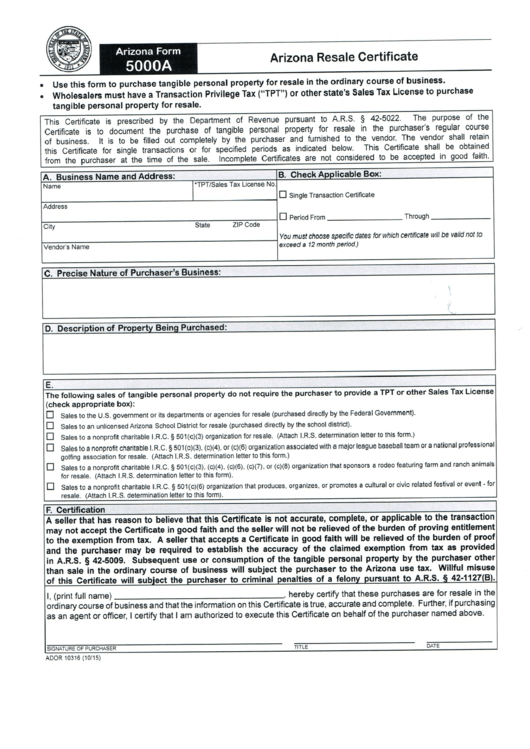

Arizona Tax Exempt Form 5000A - The form does not need to be sent to the arizona department of revenue. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. The purpose of the certificate is to document the purchase. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from vendors when making purchases for resale where tax will be. 5000a arizona resale certificate • use this form to purchase tangible personal property for resale in the ordinary course of business.

Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. 5000a arizona resale certificate • use this form to purchase tangible personal property for resale in the ordinary course of business. The purpose of the certificate is to document the purchase. The form does not need to be sent to the arizona department of revenue. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from vendors when making purchases for resale where tax will be. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale.

Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. The purpose of the certificate is to document the purchase. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from vendors when making purchases for resale where tax will be. 5000a arizona resale certificate • use this form to purchase tangible personal property for resale in the ordinary course of business. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. The form does not need to be sent to the arizona department of revenue.

Downloads

The form does not need to be sent to the arizona department of revenue. 5000a arizona resale certificate • use this form to purchase tangible personal property for resale in the ordinary course of business. The purpose of the certificate is to document the purchase. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department.

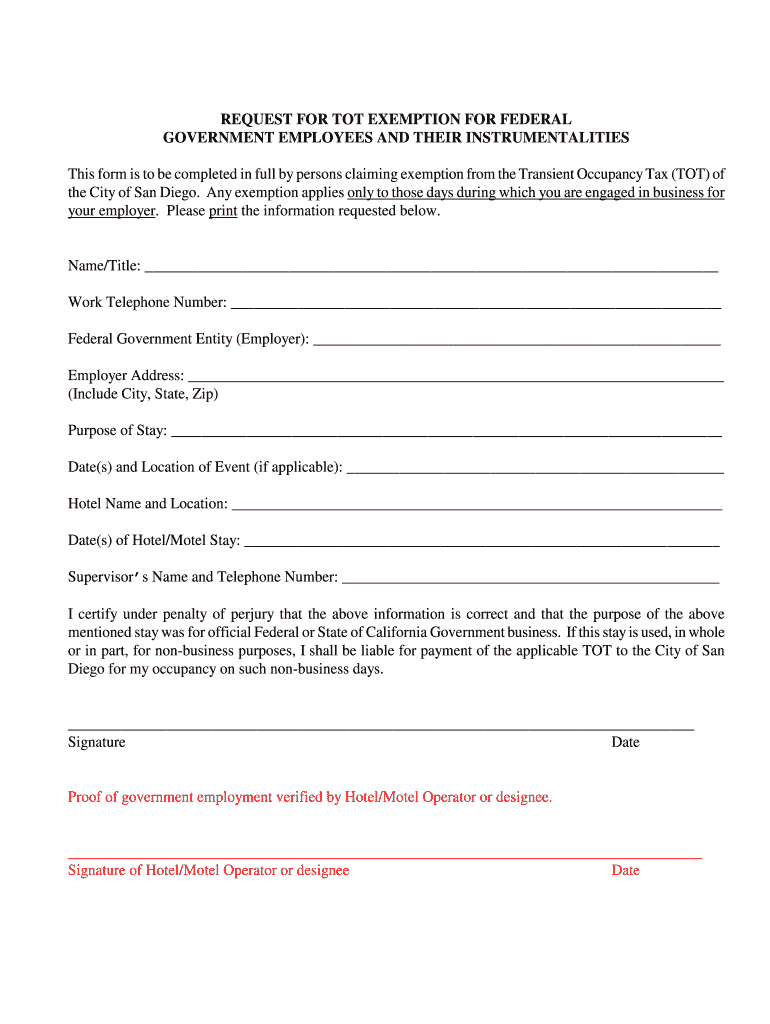

HomeOwners Exemption Form Homeowner Property Tax San Diego County

The form does not need to be sent to the arizona department of revenue. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from vendors when making purchases for resale where tax will be. The purpose of the certificate is to document the purchase. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from.

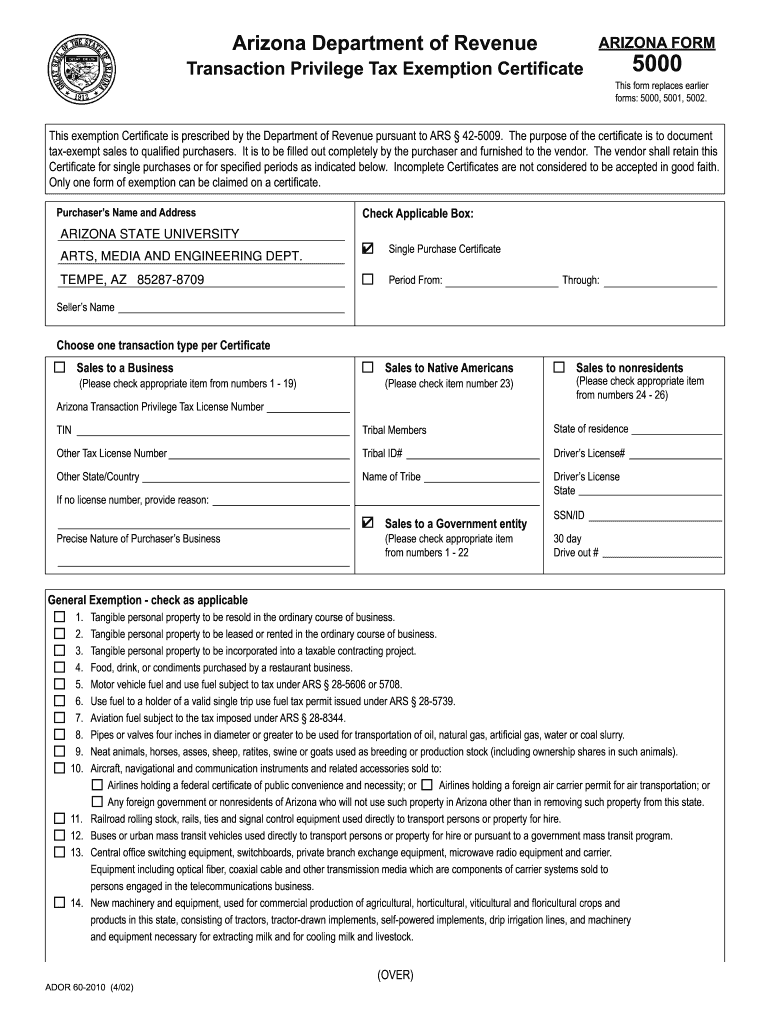

Fillable Arizona Form 5000 Transaction Privilege Tax Exemption

The purpose of the certificate is to document the purchase. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from.

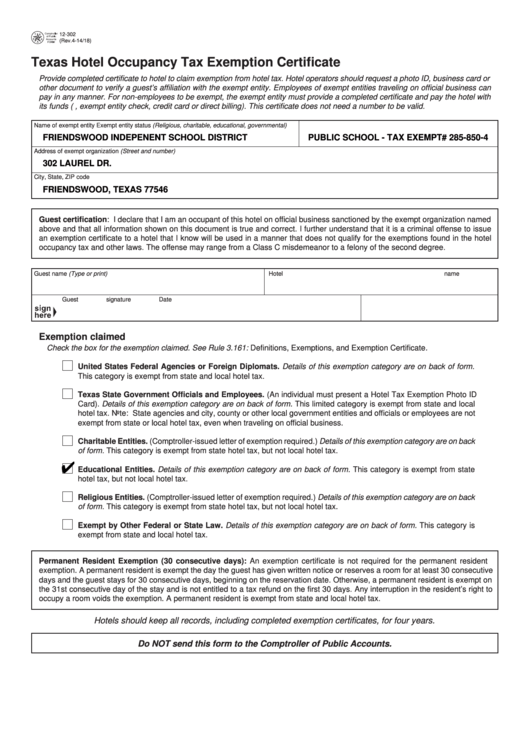

Fillable Texas Hotel Occupancy Tax Exemption Certificate Printable Pdf

The form does not need to be sent to the arizona department of revenue. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from vendors when making purchases for resale where tax will be. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. 5000a arizona resale certificate • use.

Fillable Online NEW LETTERHEAD General Instructions for Arizona Form

The form does not need to be sent to the arizona department of revenue. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from vendors when making purchases for resale where tax will be. 5000a arizona resale.

Top 46 Louisiana Tax Exempt Form Templates Free To Download In PDF

Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. The form does not need to be sent to the arizona department of revenue. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. The purpose of the certificate is to document the.

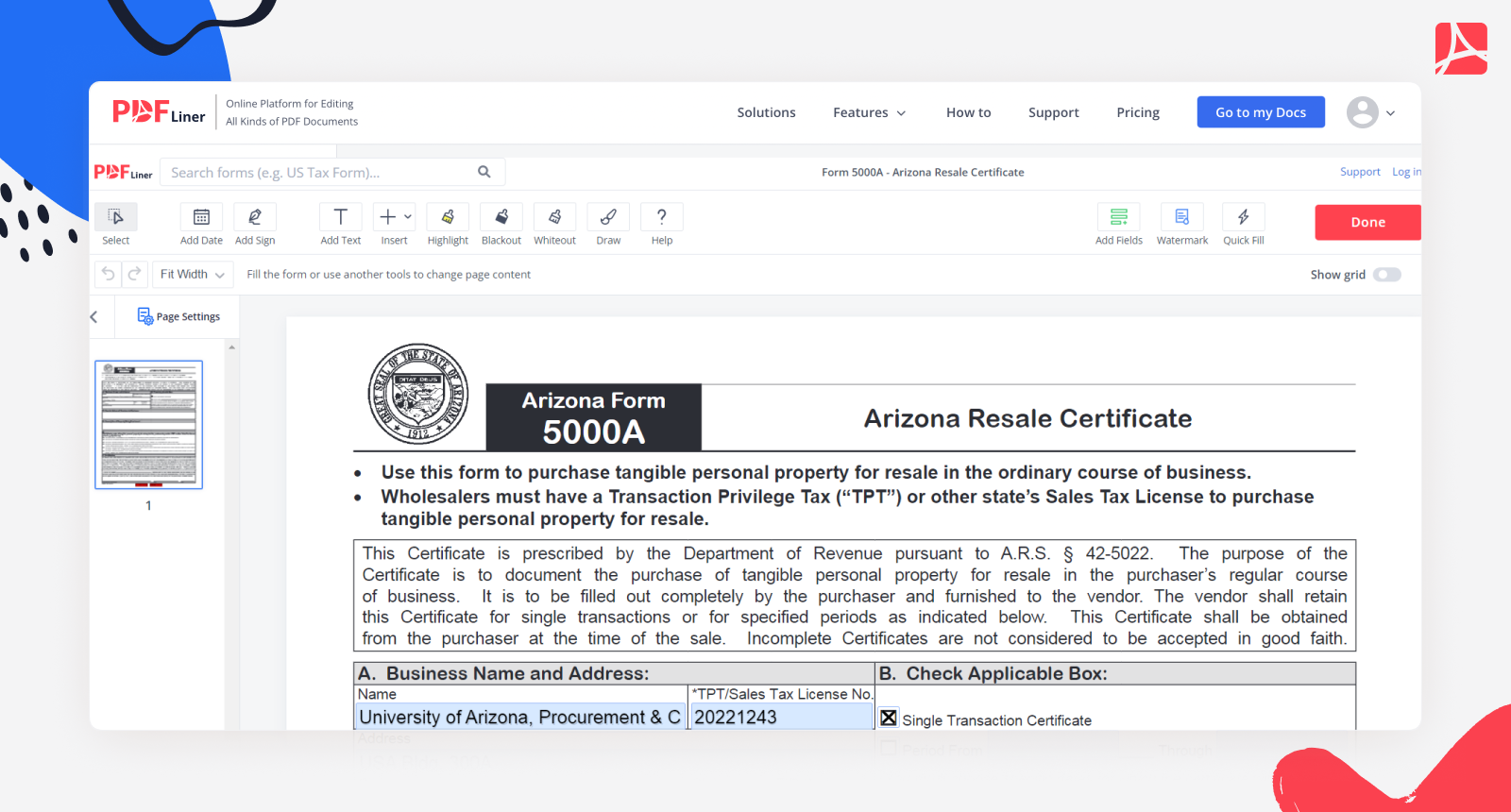

Fillable Form 5000A Arizona Resale Certificate PDFliner

Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. The form does not need to be sent to the arizona department of revenue. Arizona forms 5000a are used to claim arizona tpt.

How to Fill Out Arizona Form 5000 Fill Out and Sign Printable PDF

The purpose of the certificate is to document the purchase. The form does not need to be sent to the arizona department of revenue. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. 5000a arizona resale certificate • use this form to purchase tangible personal property for resale in.

AZ Form 5000A & Priveledge Tax License

Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. The purpose of the certificate is to document the purchase. The form does not need to be sent to the arizona department of revenue. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from vendors when making.

Arizona Form 5000a Fillable Printable Forms Free Online

Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from vendors when making purchases for resale where tax will be. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue. The form does not need to be sent to the arizona department of revenue. Arizona form 5000a is used to.

Arizona Forms 5000A Are Used To Claim Arizona Tpt (Sales Tax) Exemptions From Vendors When Making Purchases For Resale Where Tax Will Be.

Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. 5000a arizona resale certificate • use this form to purchase tangible personal property for resale in the ordinary course of business. The form does not need to be sent to the arizona department of revenue. Arizona form 5000 transaction privilege tax exemption certificate this certificate is prescribed by the department of revenue.