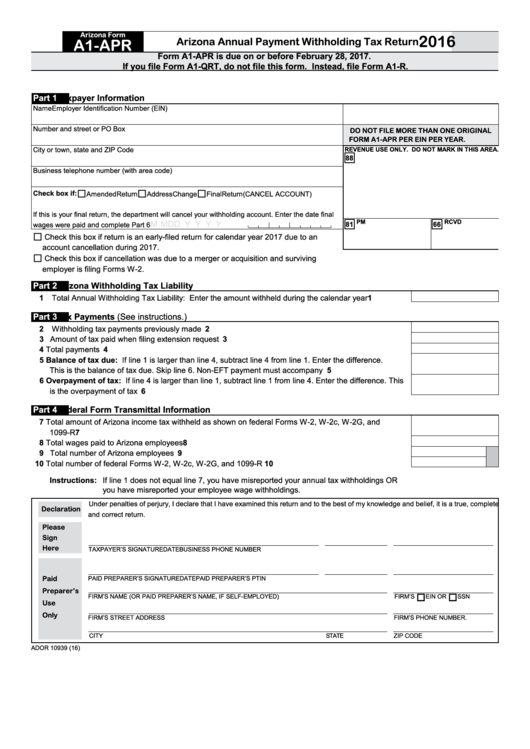

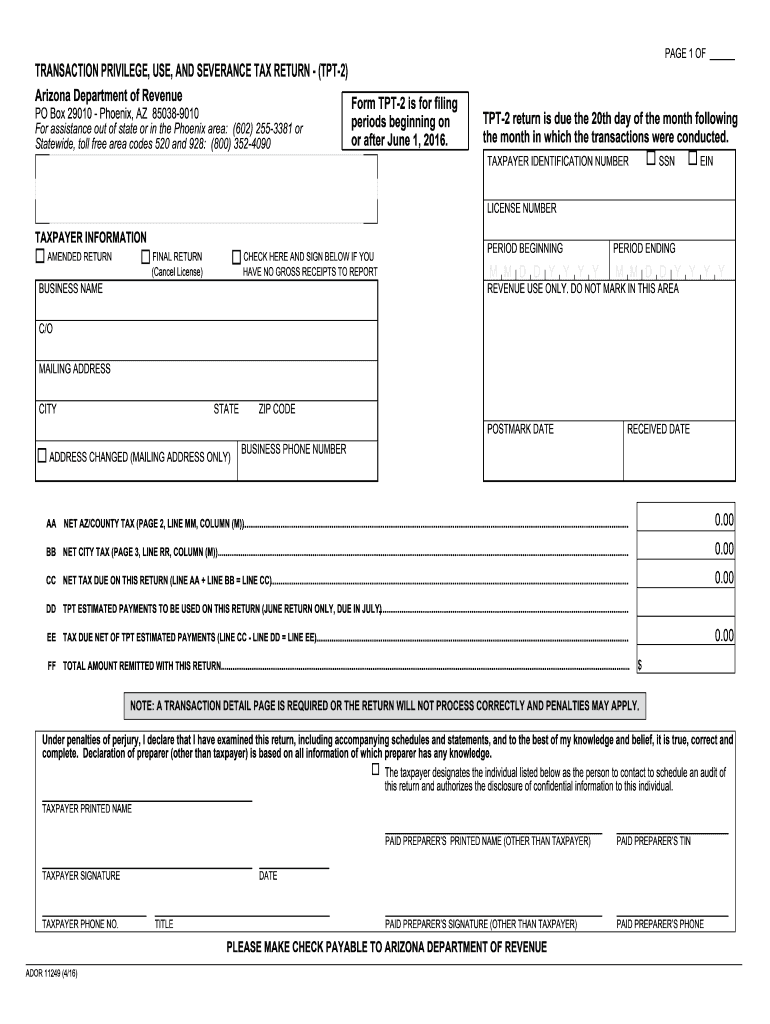

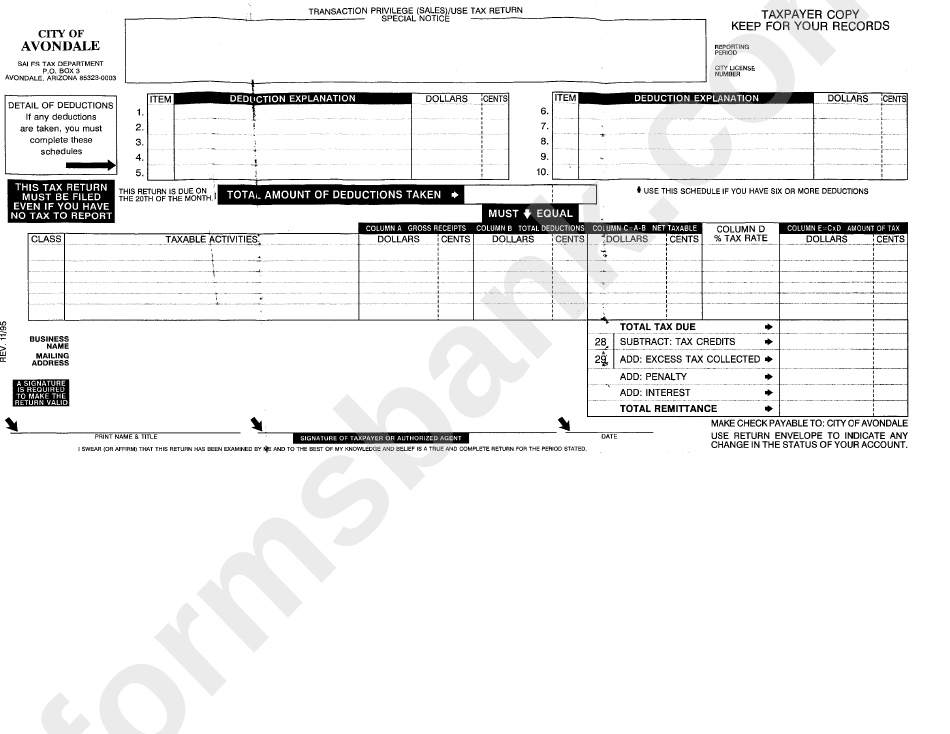

State Of Arizona Transaction Privilege Tax Form - If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will generally need to. Arizona transaction privilege tax (tpt) is a tax imposed on vendors for the privilege of doing business in the state of arizona. Although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the privilege of doing. This form is for filing periods beginning on or after june 1, 2016. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. Businesses with income subject to transaction privilege tax, county.

26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. This form is for filing periods beginning on or after june 1, 2016. Businesses with income subject to transaction privilege tax, county. If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will generally need to. Although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the privilege of doing. Arizona transaction privilege tax (tpt) is a tax imposed on vendors for the privilege of doing business in the state of arizona.

Businesses with income subject to transaction privilege tax, county. This form is for filing periods beginning on or after june 1, 2016. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will generally need to. Although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the privilege of doing. Arizona transaction privilege tax (tpt) is a tax imposed on vendors for the privilege of doing business in the state of arizona.

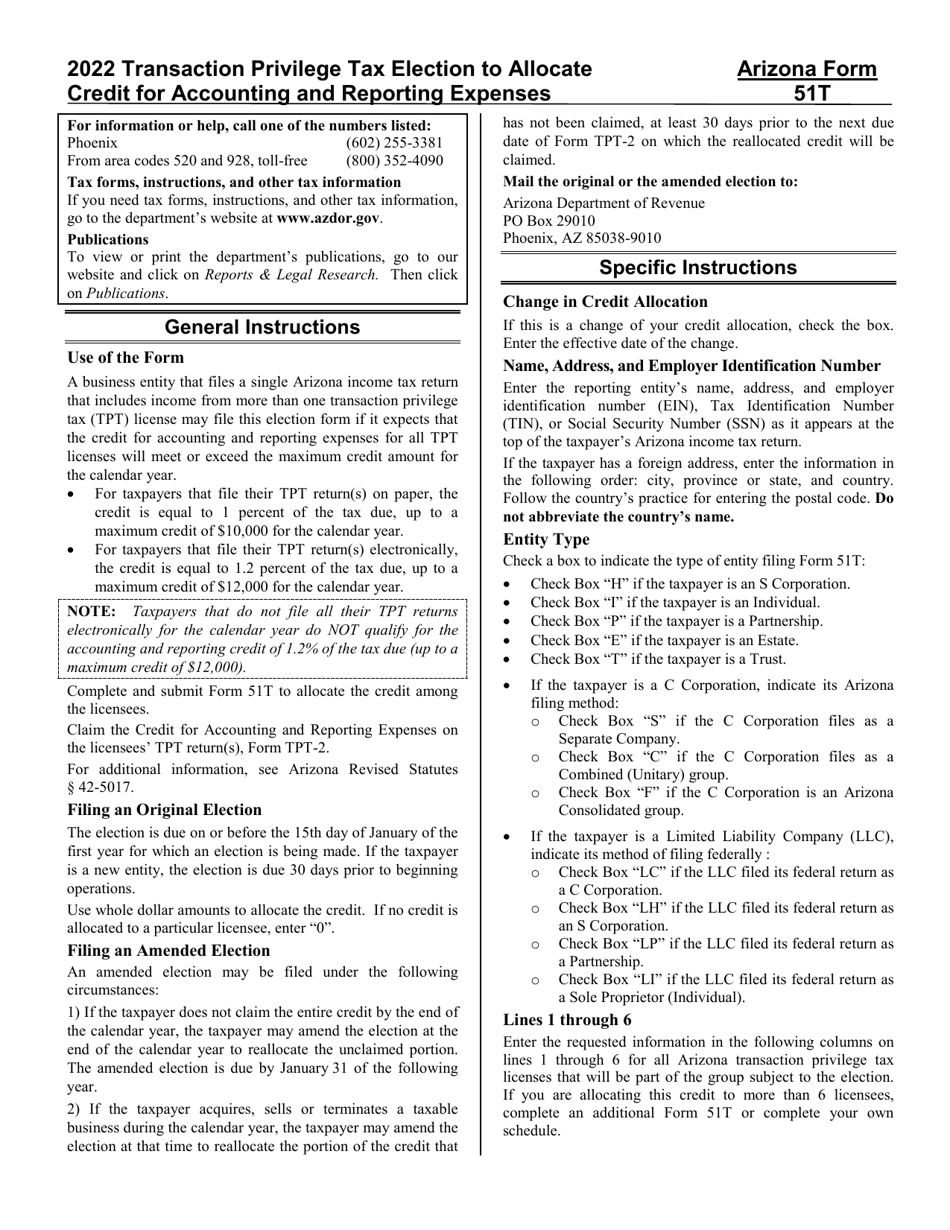

Download Instructions for Arizona Form 51T, ADOR10150 Transaction

This form is for filing periods beginning on or after june 1, 2016. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will.

Arizona Form 5000 Transaction Privilege Tax Exemption Certificate

Arizona transaction privilege tax (tpt) is a tax imposed on vendors for the privilege of doing business in the state of arizona. Businesses with income subject to transaction privilege tax, county. If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will generally need to. This.

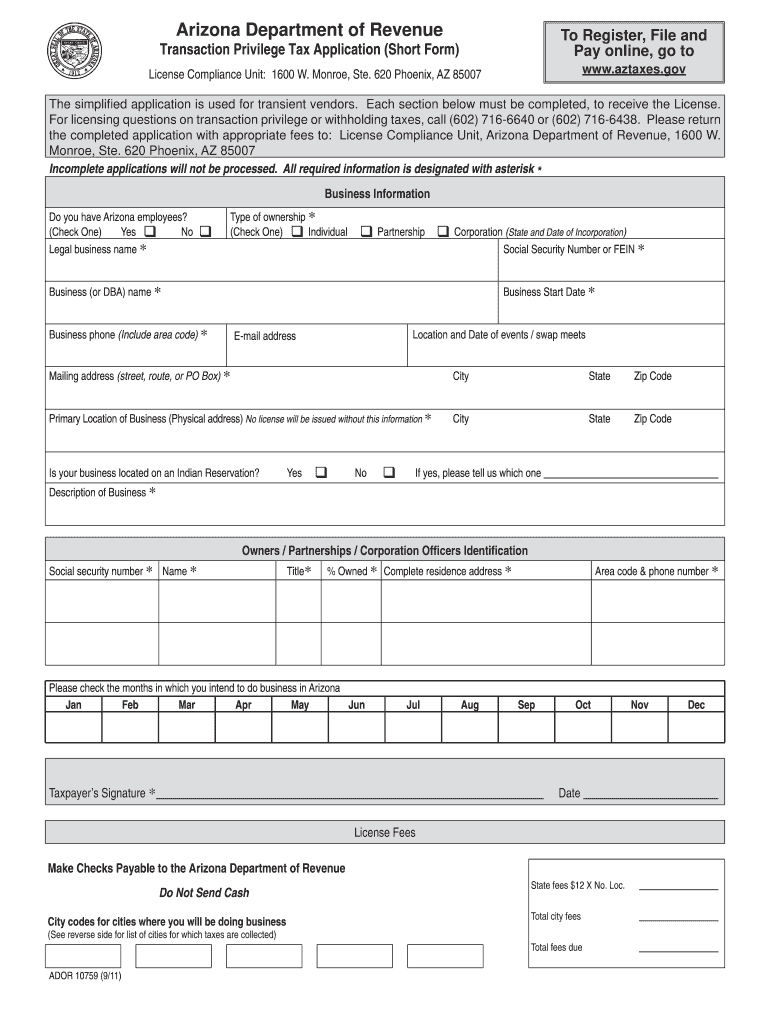

Arizona Transaction Privilege Tax Application Short Form Fill Out and

26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. Businesses with income subject to transaction privilege tax, county. This form is for filing periods beginning on or after june 1, 2016. If you plan to sell a product or engage in a service subject to state and/or.

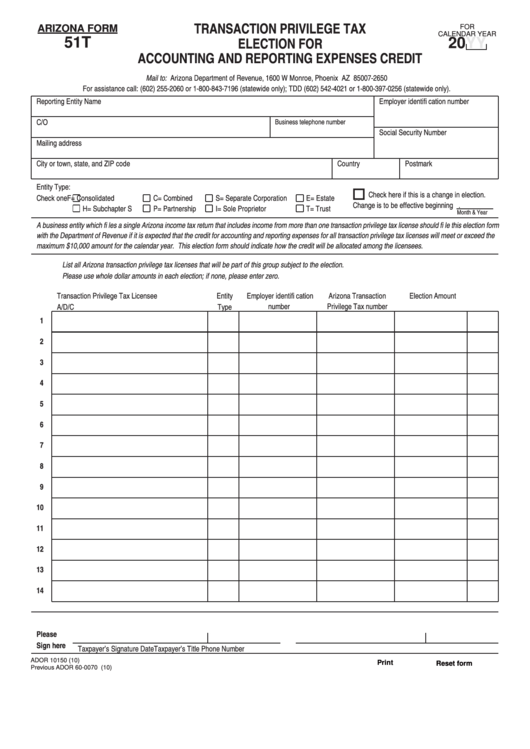

Fillable Arizona Form 51t Transaction Privilege Tax Election For

This form is for filing periods beginning on or after june 1, 2016. If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will generally need to. Although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on.

A Guide to Completing Arizona Form 5000 for Transaction Privilege Tax

This form is for filing periods beginning on or after june 1, 2016. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will.

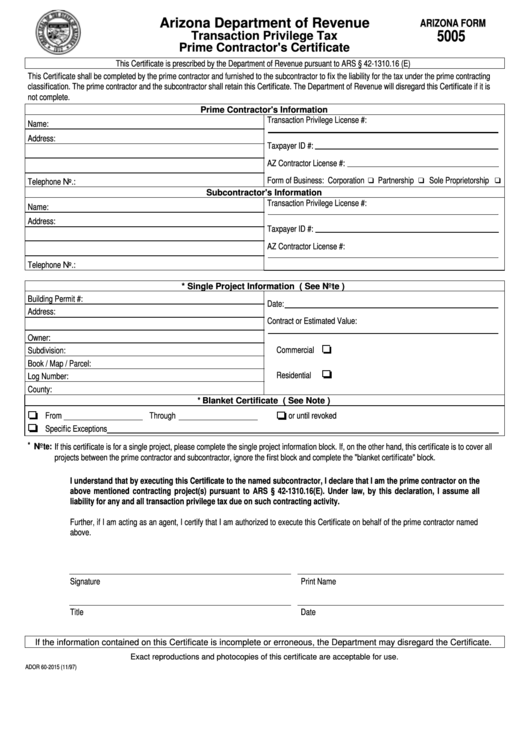

Fillable Arizona Form 5005 Transaction Privilege Tax Prime Contractor

26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. Businesses with income subject to transaction privilege tax, county. Arizona transaction privilege tax (tpt) is a tax imposed on vendors for the privilege of doing business in the state of arizona. If you plan to sell a product.

Arizona Tpt 1 Fillable Form Printable Forms Free Online

If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will generally need to. Arizona transaction privilege tax (tpt) is a tax imposed on vendors for the privilege of doing business in the state of arizona. This form is for filing periods beginning on or after.

Fillable Online Arizona Transaction Privilege Tax and Arizona Use Tax

Although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the privilege of doing. Arizona transaction privilege tax (tpt) is a tax imposed on vendors for the privilege of doing business in the state of arizona. 26 rows arizona transaction privilege tax (tpt) is a tax on the.

Blank Az Tpt 2 20162024 Form Fill Out and Sign Printable PDF

26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. This form is for filing periods beginning on or after june 1, 2016. Businesses with income subject to transaction privilege tax, county. If you plan to sell a product or engage in a service subject to state and/or.

Transaction Privilege (Sales)/use Tax Return Form State Of Arizona

Arizona transaction privilege tax (tpt) is a tax imposed on vendors for the privilege of doing business in the state of arizona. 26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. Businesses with income subject to transaction privilege tax, county. Although commonly referred to as a sales.

Arizona Transaction Privilege Tax (Tpt) Is A Tax Imposed On Vendors For The Privilege Of Doing Business In The State Of Arizona.

26 rows arizona transaction privilege tax (tpt) is a tax on the vendor for the privilege of doing business in the state. This form is for filing periods beginning on or after june 1, 2016. If you plan to sell a product or engage in a service subject to state and/or local transaction privilege (sales) or use tax,* you will generally need to. Although commonly referred to as a sales tax, the arizona transaction privilege tax (tpt) is actually a tax on a vendor for the privilege of doing.