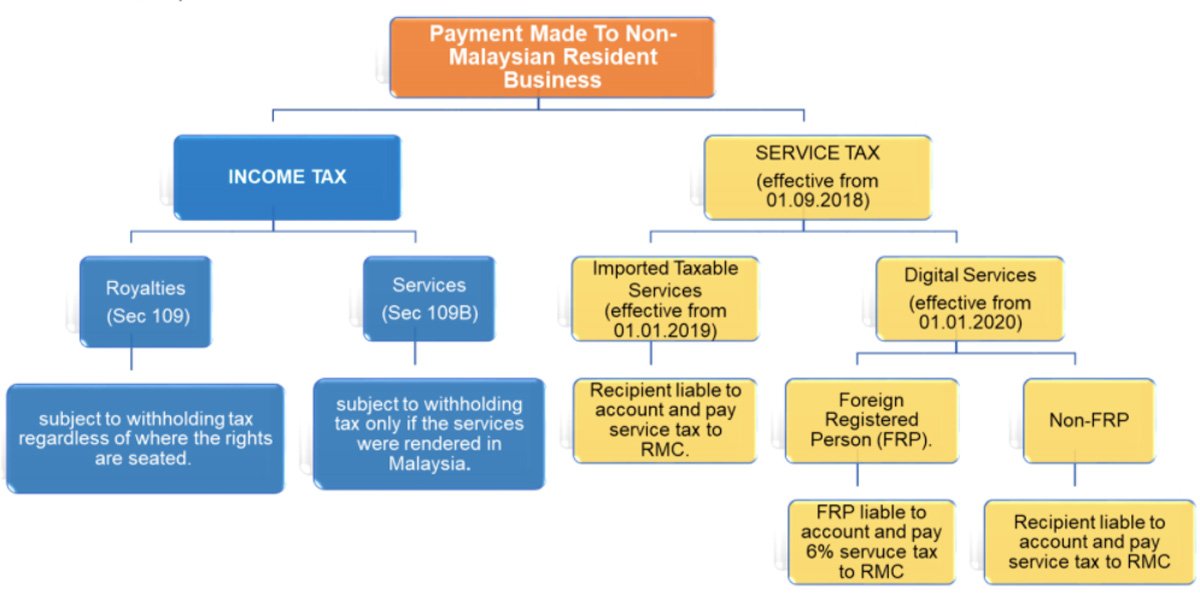

Withholding Tax Malaysia Example - Withholding tax is an amount withheld by the payer on income received by the payee (individuals / bodies other than individuals), which is derived. Malaysia is subject to withholding tax under section 109b of the ita. Example 1 syarikat maju sdn bhd, a malaysian company signed an agreement with. Is malaysia’s withholding tax applicable to services supplied outside the country? Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Why is it vital to. Learn all there is to know about withholding tax malaysia and how you can seamlessly process and manage it with our guide. What is malaysian withholding tax?

Malaysia is subject to withholding tax under section 109b of the ita. What is malaysian withholding tax? Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Example 1 syarikat maju sdn bhd, a malaysian company signed an agreement with. Why is it vital to. Withholding tax is an amount withheld by the payer on income received by the payee (individuals / bodies other than individuals), which is derived. Is malaysia’s withholding tax applicable to services supplied outside the country? Learn all there is to know about withholding tax malaysia and how you can seamlessly process and manage it with our guide.

Malaysia is subject to withholding tax under section 109b of the ita. Learn all there is to know about withholding tax malaysia and how you can seamlessly process and manage it with our guide. What is malaysian withholding tax? Is malaysia’s withholding tax applicable to services supplied outside the country? Example 1 syarikat maju sdn bhd, a malaysian company signed an agreement with. Why is it vital to. Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Withholding tax is an amount withheld by the payer on income received by the payee (individuals / bodies other than individuals), which is derived.

withholding tax malaysia example MacietaroHerring

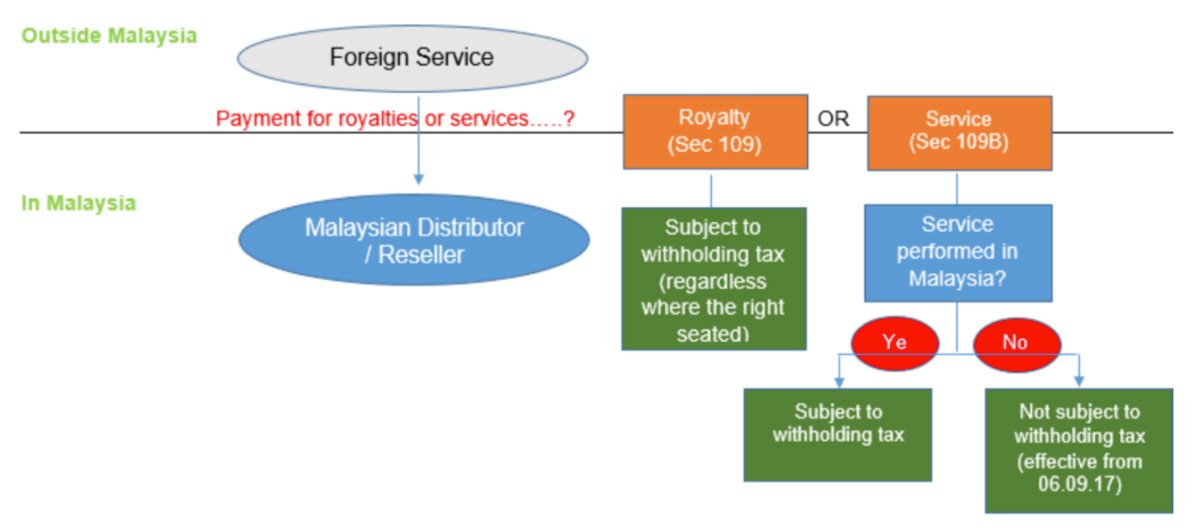

Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Learn all there is to know about withholding tax malaysia and how you can seamlessly process and manage it with our guide. Why is it vital to. Is malaysia’s withholding tax applicable to services.

7 Tips to File Malaysian Tax For Beginners Swingvy Malaysia

Malaysia is subject to withholding tax under section 109b of the ita. Is malaysia’s withholding tax applicable to services supplied outside the country? What is malaysian withholding tax? Why is it vital to. Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non.

what is withholding tax malaysia Andrew Ellison

What is malaysian withholding tax? Is malaysia’s withholding tax applicable to services supplied outside the country? Malaysia is subject to withholding tax under section 109b of the ita. Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Withholding tax is an amount withheld.

Demystifying Malaysian Withholding Tax KPMG Malaysia

Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Why is it vital to. Malaysia is subject to withholding tax under section 109b of the ita. Learn all there is to know about withholding tax malaysia and how you can seamlessly process and.

Introduction to Withholding Tax & Imported Services Tax (Part 1)

What is malaysian withholding tax? Is malaysia’s withholding tax applicable to services supplied outside the country? Learn all there is to know about withholding tax malaysia and how you can seamlessly process and manage it with our guide. Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of.

TRAINING ONLINE WITHHOLDING TAX STRATEGY Karya Training

Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Withholding tax is an amount withheld by the payer on income received by the payee (individuals / bodies other than individuals), which is derived. Learn all there is to know about withholding tax malaysia.

The Ultimate Guide To Withholding Tax In Malaysia (2024)

Withholding tax is an amount withheld by the payer on income received by the payee (individuals / bodies other than individuals), which is derived. Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Is malaysia’s withholding tax applicable to services supplied outside the.

what is withholding tax malaysia Ryan Carr

Malaysia is subject to withholding tax under section 109b of the ita. What is malaysian withholding tax? Why is it vital to. Is malaysia’s withholding tax applicable to services supplied outside the country? Example 1 syarikat maju sdn bhd, a malaysian company signed an agreement with.

what is withholding tax malaysia Andrew Ellison

Malaysia is subject to withholding tax under section 109b of the ita. What is malaysian withholding tax? Is malaysia’s withholding tax applicable to services supplied outside the country? Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non. Withholding tax is an amount withheld.

withholding tax malaysia example Megan Smith

Is malaysia’s withholding tax applicable to services supplied outside the country? Malaysia is subject to withholding tax under section 109b of the ita. Learn all there is to know about withholding tax malaysia and how you can seamlessly process and manage it with our guide. What is malaysian withholding tax? Withholding tax is an amount withheld by the payer on.

Malaysia Is Subject To Withholding Tax Under Section 109B Of The Ita.

Why is it vital to. Is malaysia’s withholding tax applicable to services supplied outside the country? Learn all there is to know about withholding tax malaysia and how you can seamlessly process and manage it with our guide. What is malaysian withholding tax?

Withholding Tax Is An Amount Withheld By The Payer On Income Received By The Payee (Individuals / Bodies Other Than Individuals), Which Is Derived.

Example 1 syarikat maju sdn bhd, a malaysian company signed an agreement with. Withholding tax or retention tax, is a tax deducted at the source of payment, requiring the payer to withhold a portion of the payment to non.