Where Do You Mail Form 9465 - We'll help you get started or pick up where you left off. The irs may also require you to. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should. If you have already filed your. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Do you have a turbotax online account?

The irs may also require you to. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should. Do you have a turbotax online account? Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. We'll help you get started or pick up where you left off. If you have already filed your.

Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you have already filed your. We'll help you get started or pick up where you left off. The irs may also require you to. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should. Do you have a turbotax online account?

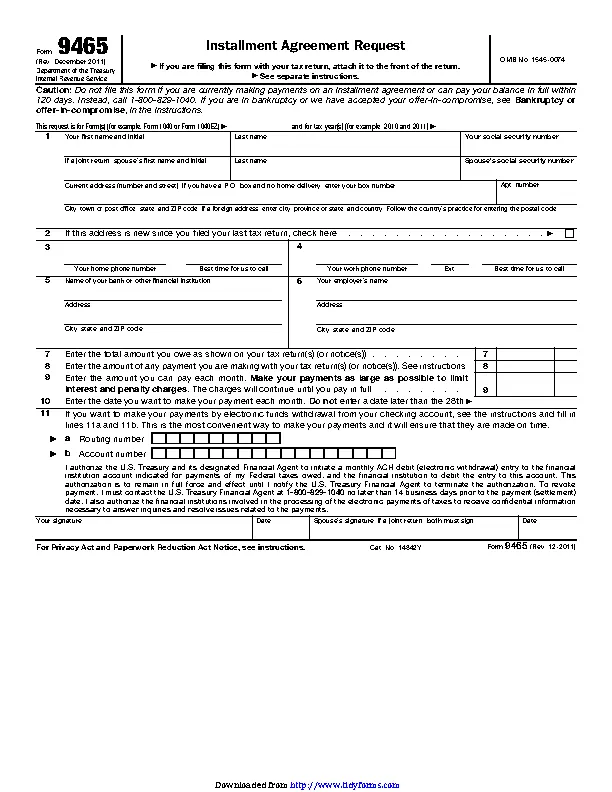

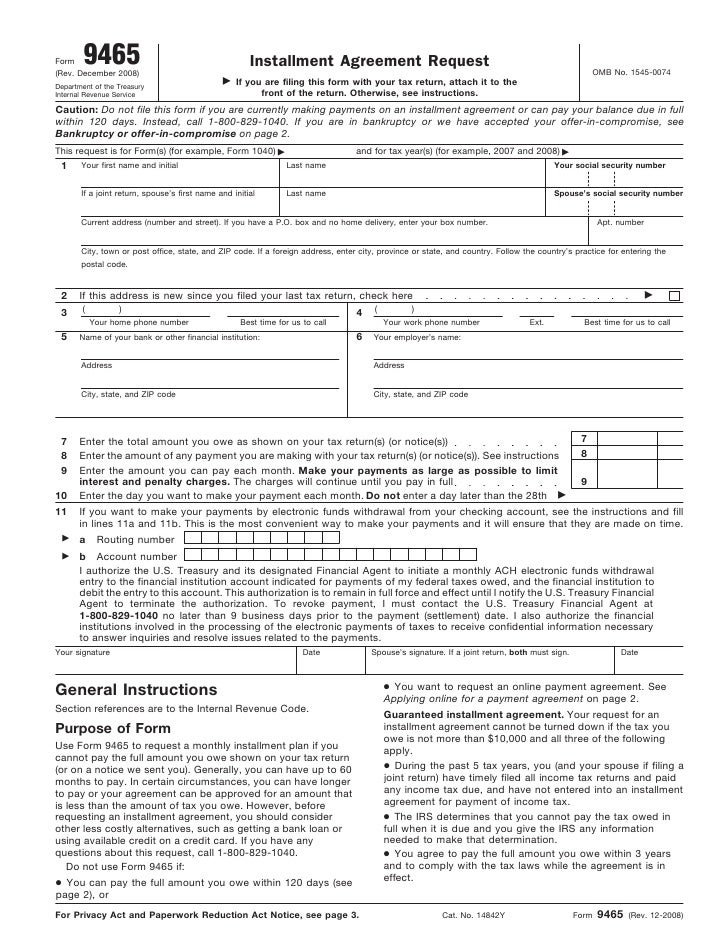

Form 9465 Installment Agreement Request Meaning Overview Contact Irs By

Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you have already filed your. All individual taxpayers who mail form 9465 separate from their.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. The irs may also require you to. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should. If you have already.

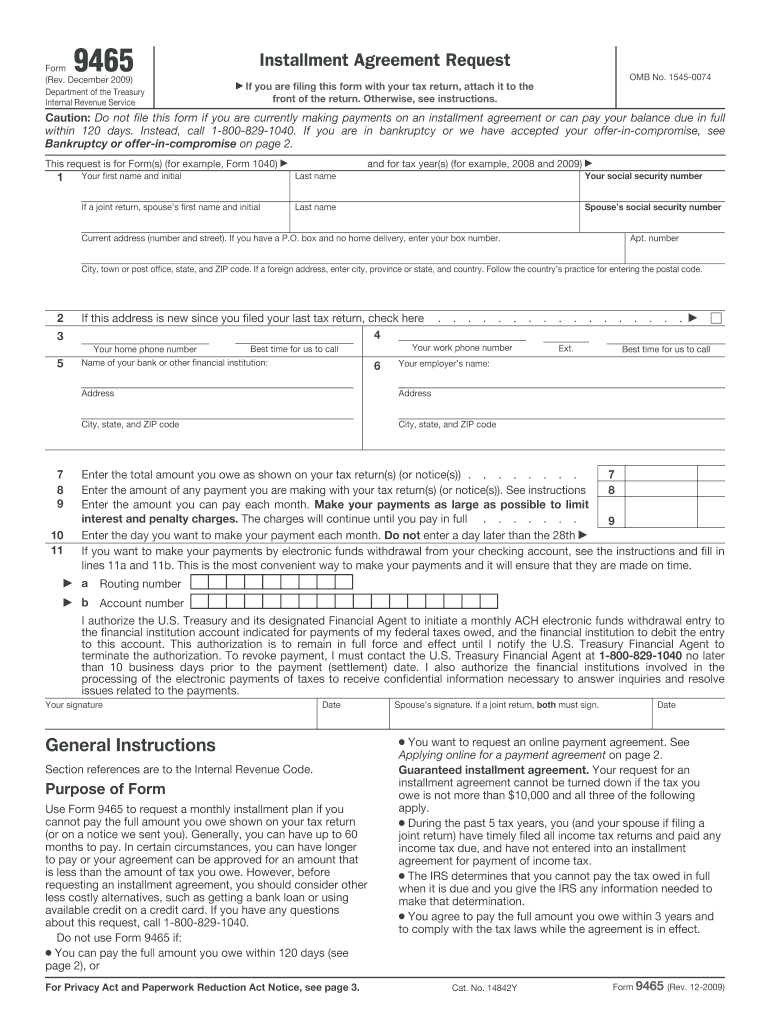

2009 Form IRS 9465 Fill Online, Printable, Fillable, Blank pdfFiller

If you have already filed your. The irs may also require you to. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. Do you have a turbotax online account? We'll help you get started or pick up where you left off.

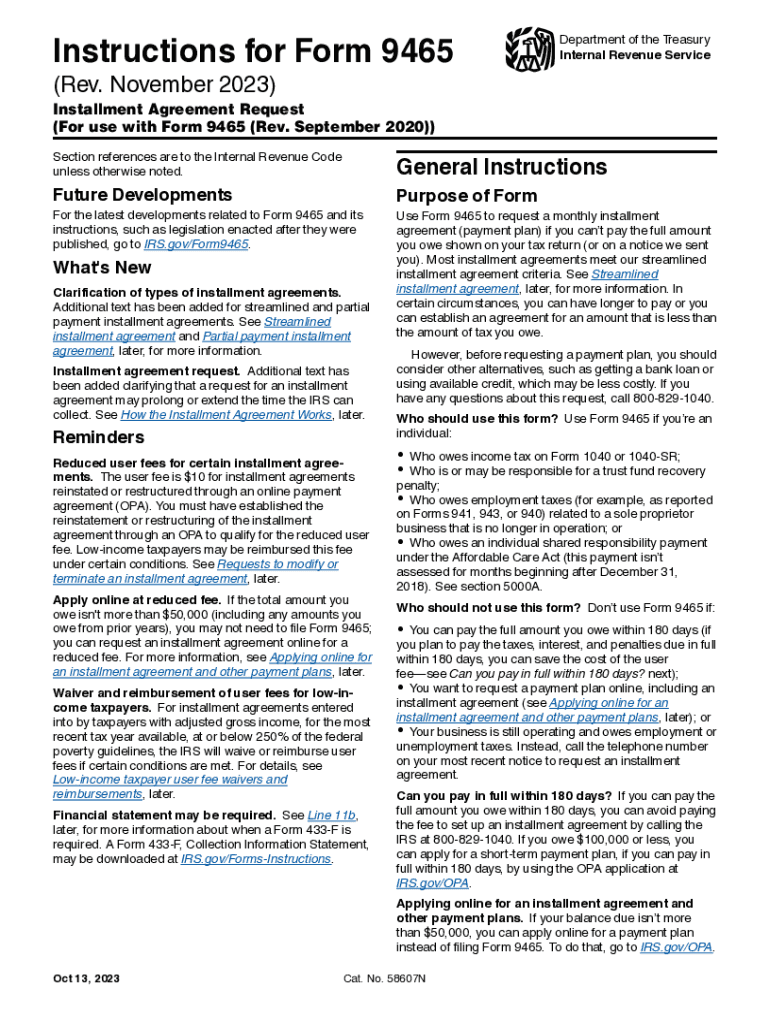

9465 Instructions Blank Sample to Fill out Online in PDF

All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should. Do you have a turbotax online account? We'll help you get started or pick up where you left off. If you have already filed your. The irs may also require you to.

Where to mail form 9465 Fill out & sign online DocHub

All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should. We'll help you get started or pick up where you left off. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If.

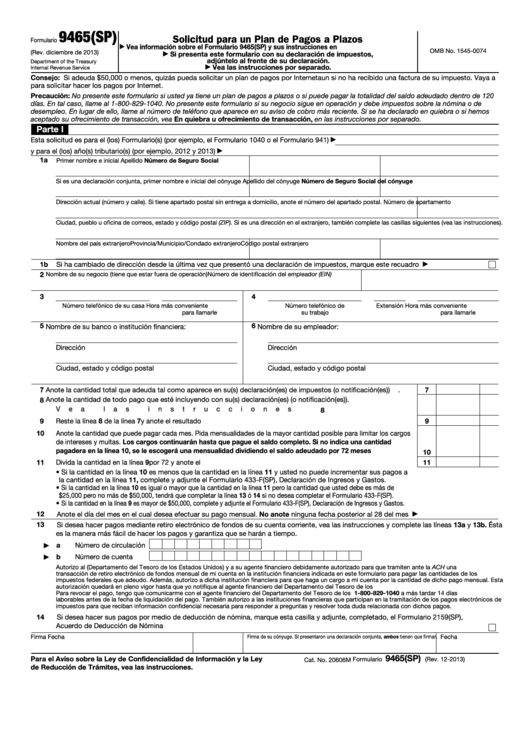

Form 9465 PDFSimpli

Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Do you have a turbotax online account? We'll help you get started or pick up where you left off. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with.

Irs Form 9465 Printable

The irs may also require you to. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. If you have already filed your. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Do you have.

IRS Form 9465 Instructions Your Installment Agreement Request

Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. We'll help you get started or pick up where you left off. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should. The.

Form 9465Installment Agreement Request

If you have already filed your. We'll help you get started or pick up where you left off. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should. Do you have a turbotax online account? The irs may also require you to.

I CAN'T PAY MY TAXES! What do I do? (How To File IRS Installment

Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Do you have a turbotax online account? We'll help you get started or pick up where you left off. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of.

The Irs May Also Require You To.

Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. We'll help you get started or pick up where you left off. Do you have a turbotax online account? If you have already filed your.

Attach Form 9465 To The Front Of Your Return And Send It To The Address Shown In Your Tax Return Booklet.

All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f, should.

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/9465-usa-federal-tax-form-form-9465-instructions-ss.jpg)