Where Do I Send 941 Form With Payment - If you pay by eft, credit card, or debit card, file your return using the without a payment address under where should you file, earlier, and don't file form. The tax software requires a signature. Find out where to mail your completed form which include a payment. Find mailing addresses by state and date for form 941. The taxpayer has the option. Business owners may need to pay a fee to electronically file their returns.

The tax software requires a signature. Find mailing addresses by state and date for form 941. Find out where to mail your completed form which include a payment. Business owners may need to pay a fee to electronically file their returns. If you pay by eft, credit card, or debit card, file your return using the without a payment address under where should you file, earlier, and don't file form. The taxpayer has the option.

Find mailing addresses by state and date for form 941. If you pay by eft, credit card, or debit card, file your return using the without a payment address under where should you file, earlier, and don't file form. The tax software requires a signature. Business owners may need to pay a fee to electronically file their returns. The taxpayer has the option. Find out where to mail your completed form which include a payment.

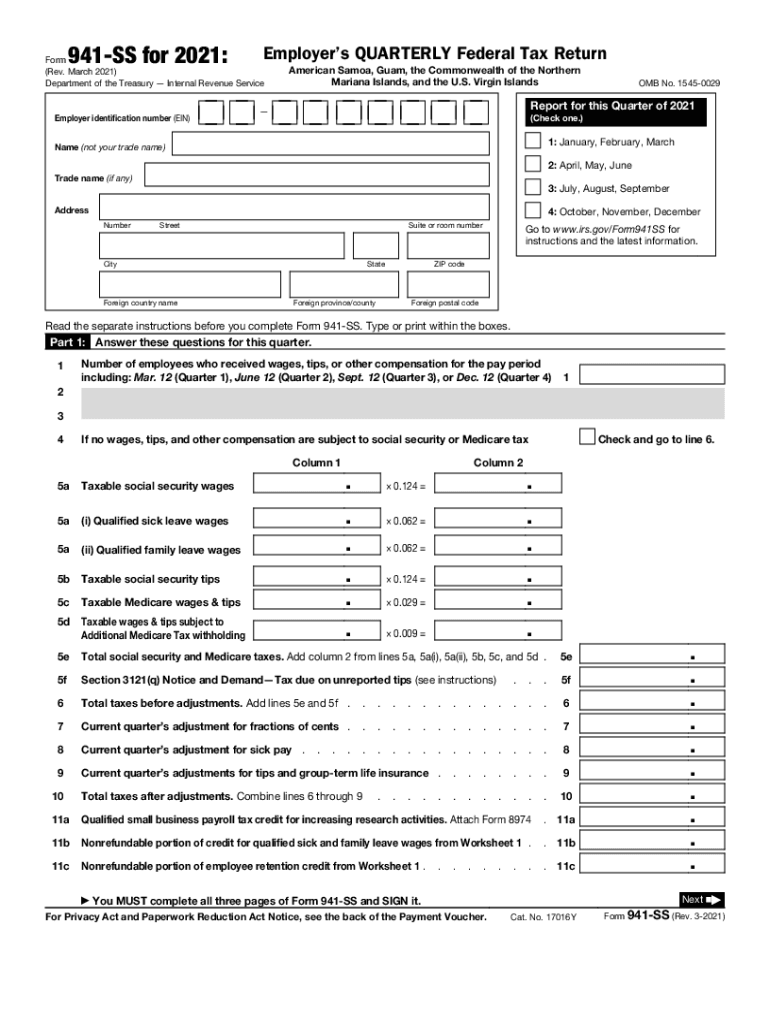

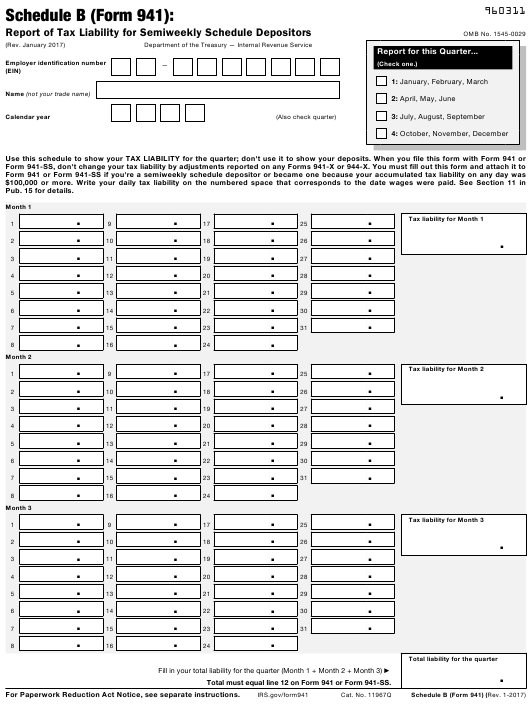

2021 form 941 schedule b Fill out & sign online DocHub

The taxpayer has the option. Find out where to mail your completed form which include a payment. Business owners may need to pay a fee to electronically file their returns. Find mailing addresses by state and date for form 941. The tax software requires a signature.

8 Form Payment 8 Important Facts That You Should Know About 8 Form

Find mailing addresses by state and date for form 941. Business owners may need to pay a fee to electronically file their returns. The tax software requires a signature. Find out where to mail your completed form which include a payment. If you pay by eft, credit card, or debit card, file your return using the without a payment address.

Mailing Address For 941 Without Payment 2024 Pdf Gertie Blanche

Find out where to mail your completed form which include a payment. The taxpayer has the option. Business owners may need to pay a fee to electronically file their returns. The tax software requires a signature. If you pay by eft, credit card, or debit card, file your return using the without a payment address under where should you file,.

Form 941 For 2024 Instructions 2024 Jeni Robbyn

The tax software requires a signature. Find out where to mail your completed form which include a payment. Business owners may need to pay a fee to electronically file their returns. Find mailing addresses by state and date for form 941. The taxpayer has the option.

Fillable Form 941 For 2023 Printable Forms Free Online

Find mailing addresses by state and date for form 941. If you pay by eft, credit card, or debit card, file your return using the without a payment address under where should you file, earlier, and don't file form. Business owners may need to pay a fee to electronically file their returns. The tax software requires a signature. Find out.

Irs Form 941 2024 Where To Send Calli Coretta

Find mailing addresses by state and date for form 941. Find out where to mail your completed form which include a payment. Business owners may need to pay a fee to electronically file their returns. The taxpayer has the option. The tax software requires a signature.

How To Efile Form 941 Late, Payments, Scorp) EMPLOYER

If you pay by eft, credit card, or debit card, file your return using the without a payment address under where should you file, earlier, and don't file form. Find out where to mail your completed form which include a payment. Business owners may need to pay a fee to electronically file their returns. Find mailing addresses by state and.

The Taxpayer Has The Option.

The tax software requires a signature. Business owners may need to pay a fee to electronically file their returns. Find mailing addresses by state and date for form 941. If you pay by eft, credit card, or debit card, file your return using the without a payment address under where should you file, earlier, and don't file form.