What Were Q4 Profits For 2018 Of Dei - Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. We had a very successful year in 2018: Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up.

(nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. We had a very successful year in 2018: • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up.

We had a very successful year in 2018: Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised.

The Strategy for Q4Like Profits Year Round Quadra Marketplace

Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019.

39+ What Were Q4 Profits For 2018 Of Golf TayyabClive

We had a very successful year in 2018: (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average.

Paytm Q4 Results Preview How Were The Results Of Paytm In Q4? Watch

• we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. We had a very successful year in 2018: Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

(nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. We had a very successful year in 2018: Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. • we grew our funds from operations by 12.7% and our adjusted.

What Were Q4 Profits for 2018 of Tdf Find Out the Astonishing Figures

Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. We had a very successful year in 2018: (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. • we grew our funds from operations by 12.7% and our adjusted funds from operations.

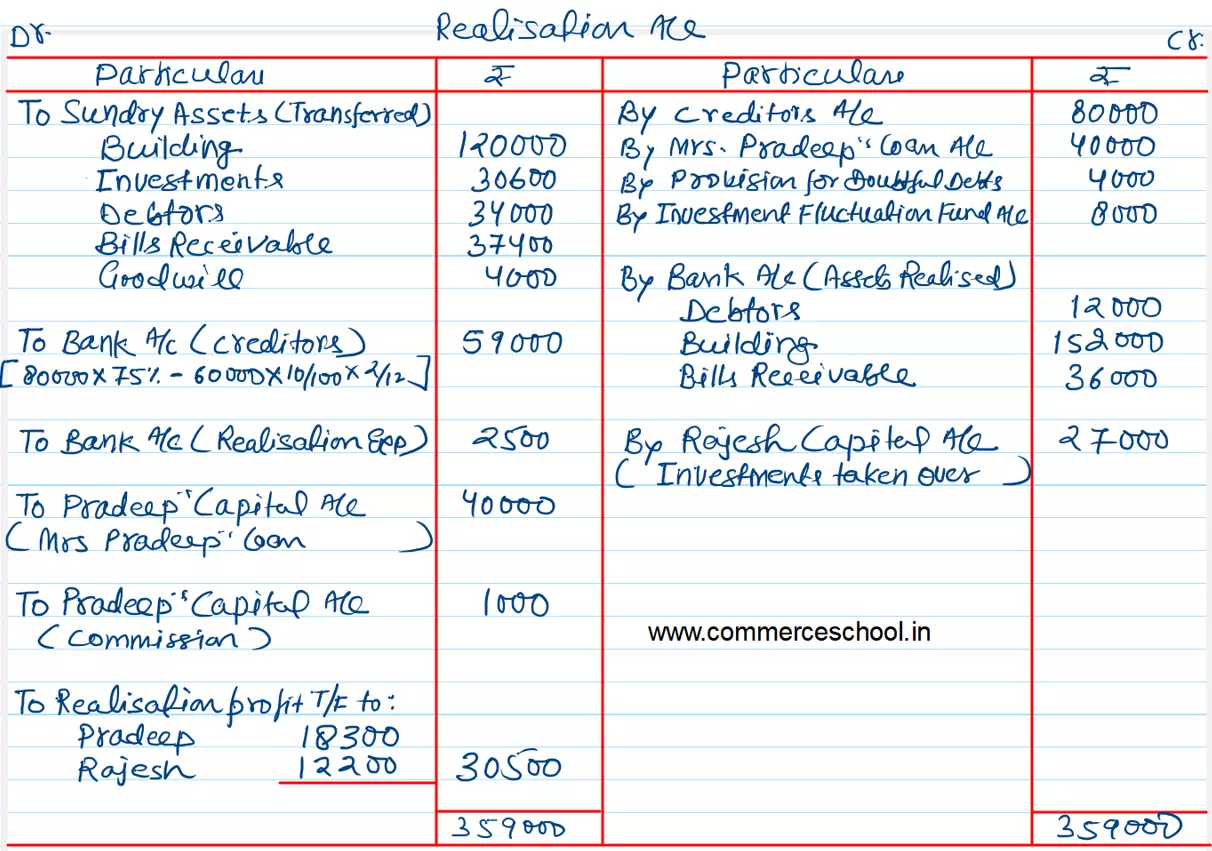

Pradeep and Rajesh were partners in a firm sharing profits and losses

• we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34.

Maximizing Q4 Profits Best Products to Sell on Amazon in the Last

• we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34.

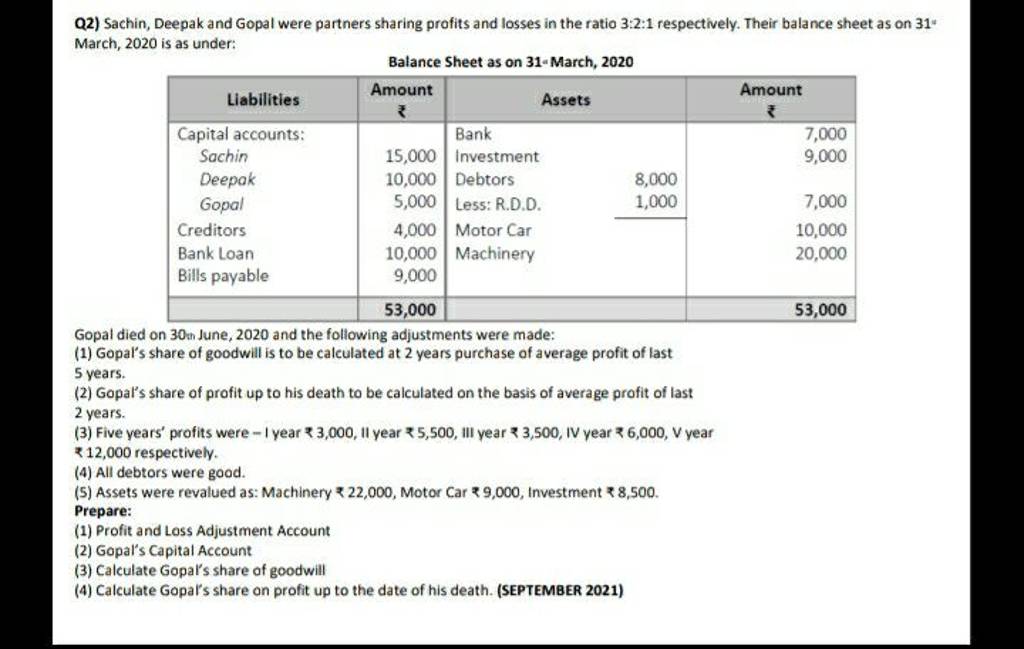

Q2) Sachin, Deepak and Gopal were partners sharing profits and losses in

Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. • we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34.

Corporate profits were down slightly in Q2 Kevin Drum

We had a very successful year in 2018: (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. • we grew our funds from operations by 12.7% and our adjusted.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

We had a very successful year in 2018: Nvidia today reported record revenue for the fourth quarter ended january 28, 2018, of $2.91 billion, up 34 percent from $2.17 billion a year earlier, and up. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart. Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps.

Nvidia Today Reported Record Revenue For The Fourth Quarter Ended January 28, 2018, Of $2.91 Billion, Up 34 Percent From $2.17 Billion A Year Earlier, And Up.

• we grew our funds from operations by 12.7% and our adjusted funds from operations by 7.4%, raised. We had a very successful year in 2018: Am reported management margin of 30.3 bps for q4 2018/ 30.7 bps for fy 2018, annualised management fees divided by average assets under management. (nyse:nyse:dei) q4 2018 earnings conference call february 13, 2019 2:00 pm etcompany participantsstuart.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)