What Is Sales Tax In Butler County Ohio - By law, ohio's counties and. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. There are a total of 576. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. The butler county sales tax rate is 0.75%. The calculator will show you the total sales tax. Look up the current rate for a specific address using the same geolocation technology that powers the. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code.

The calculator will show you the total sales tax. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. By law, ohio's counties and. The butler county sales tax rate is 0.75%. There are a total of 576. Look up the current rate for a specific address using the same geolocation technology that powers the. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code.

You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Look up the current rate for a specific address using the same geolocation technology that powers the. There are a total of 576. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. This page offers the latest information on sales tax rates as well as rate changes planned in any of ohio's 88 counties. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. The butler county sales tax rate is 0.75%. By law, ohio's counties and. The calculator will show you the total sales tax.

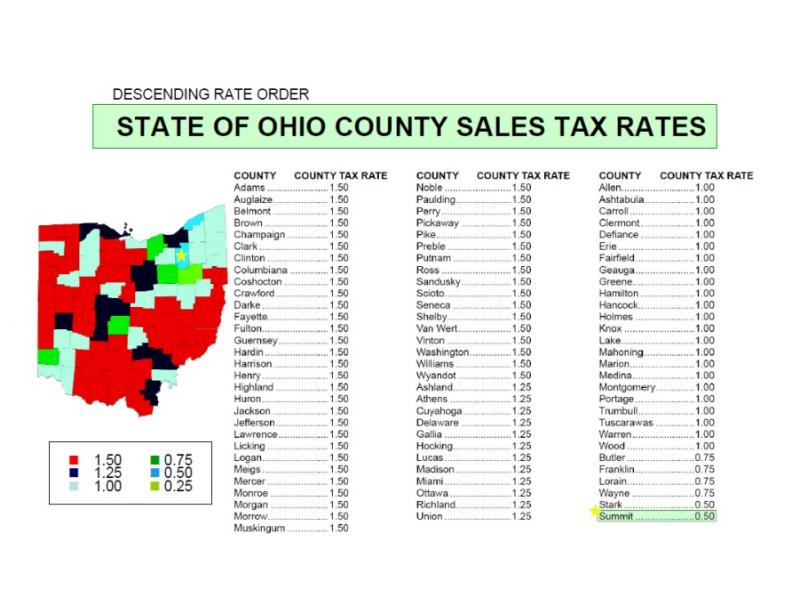

Ohio Tax By County Map Images and Photos finder

Look up the current rate for a specific address using the same geolocation technology that powers the. There are a total of 576. By law, ohio's counties and. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. This page offers the latest.

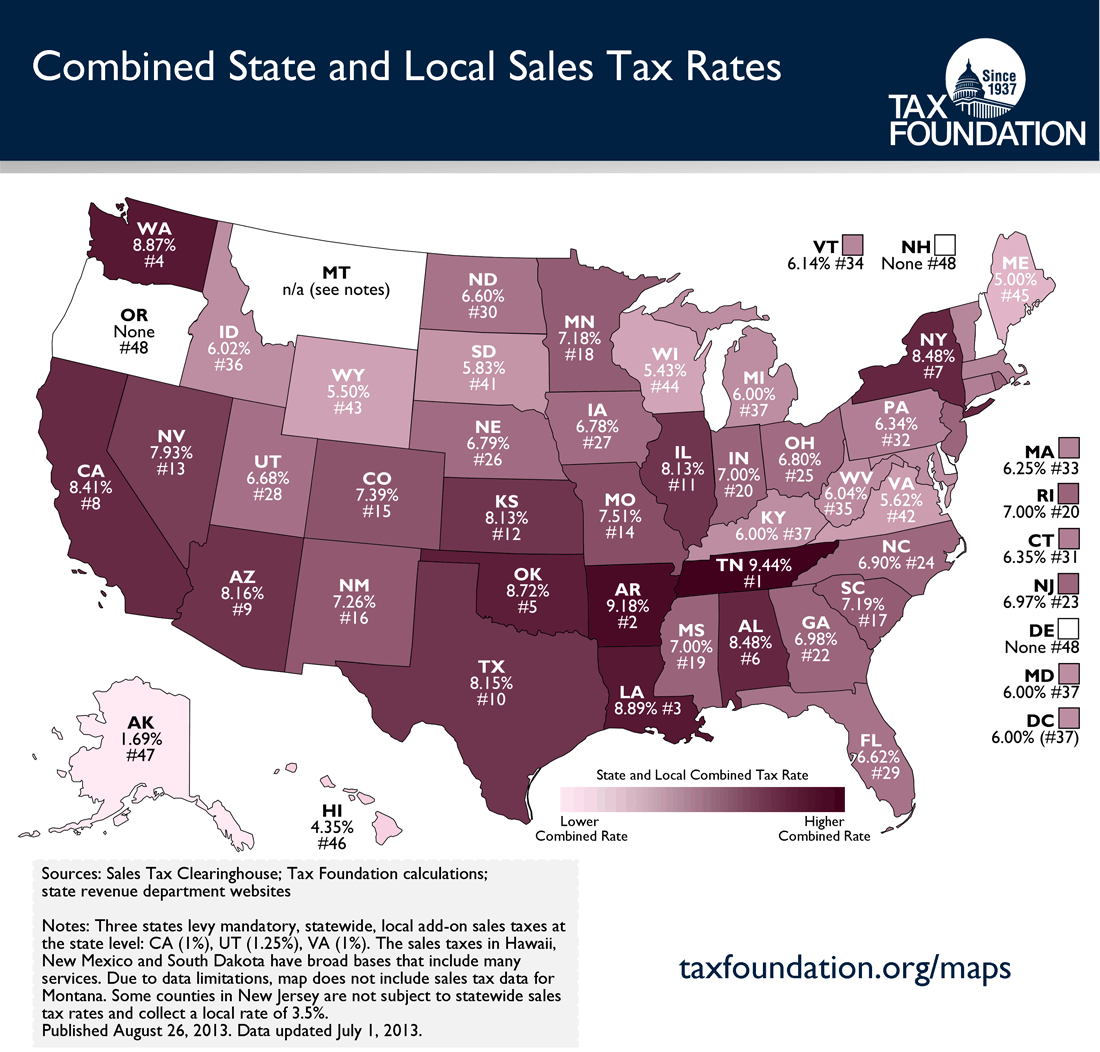

Ohio Sales Tax Rate 2024 By County Ranna Jessamyn

The butler county sales tax rate is 0.75%. Look up the current rate for a specific address using the same geolocation technology that powers the. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. By law, ohio's counties and. Ohio has a 5.75% sales tax and butler county.

Butler County Ohio Sales Tax Rate 2024 Belva Cathryn

The calculator will show you the total sales tax. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Look up the current rate for a specific address using the same geolocation technology that powers the. There are a total of 576. 1148 rows ohio has state sales tax.

Projected 42 Butler County property value hike is a ‘crisis’, auditor says

There are a total of 576. By law, ohio's counties and. The calculator will show you the total sales tax. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. You can use our ohio sales tax calculator to look up sales tax rates in ohio.

Butler County property taxes likely to rise as rollbacks expire

1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. The butler county sales tax rate is 0.75%. By law, ohio's counties and. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. The calculator.

Sales Tax Rates by County in Ohio PDF Ohio The United States

You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. 1148 rows ohio has state sales tax of 5.75%, and allows local.

Butler County Courthouse No. 5 Art of Frozen Time

The butler county sales tax rate is 0.75%. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. The calculator will show you the total sales tax. This page offers the latest information on sales tax rates as well as rate changes planned in any of.

Printable Sales Tax Chart

There are a total of 576. You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. By law, ohio's counties and. The.

Butler County Property Tax Map

You can use our ohio sales tax calculator to look up sales tax rates in ohio by address / zip code. There are a total of 576. Look up the current rate for a specific address using the same geolocation technology that powers the. The butler county sales tax rate is 0.75%. Ohio has a 5.75% sales tax and butler.

9 graphical things to know about Gov. Kasich's Ohio budget proposal

Look up the current rate for a specific address using the same geolocation technology that powers the. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. By law, ohio's counties and. This page offers the latest information on sales tax rates as well as rate.

You Can Use Our Ohio Sales Tax Calculator To Look Up Sales Tax Rates In Ohio By Address / Zip Code.

The calculator will show you the total sales tax. 1148 rows ohio has state sales tax of 5.75%, and allows local governments to collect a local option sales tax of up to 2.25%. The butler county sales tax rate is 0.75%. Look up the current rate for a specific address using the same geolocation technology that powers the.

This Page Offers The Latest Information On Sales Tax Rates As Well As Rate Changes Planned In Any Of Ohio's 88 Counties.

Ohio has a 5.75% sales tax and butler county collects an additional 0.75%, so the minimum sales tax rate in butler county is 6.5% (not including any. By law, ohio's counties and. There are a total of 576.