What Is Rsu In Box 14 Of W2 - Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). How do i report my rsu? Company provides rsu and psu and converts the amount into stock. Taxpayers will simply translate the figure listed in.

Taxpayers will simply translate the figure listed in. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). How do i report my rsu? Company provides rsu and psu and converts the amount into stock. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain.

Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Company provides rsu and psu and converts the amount into stock. Taxpayers will simply translate the figure listed in. How do i report my rsu?

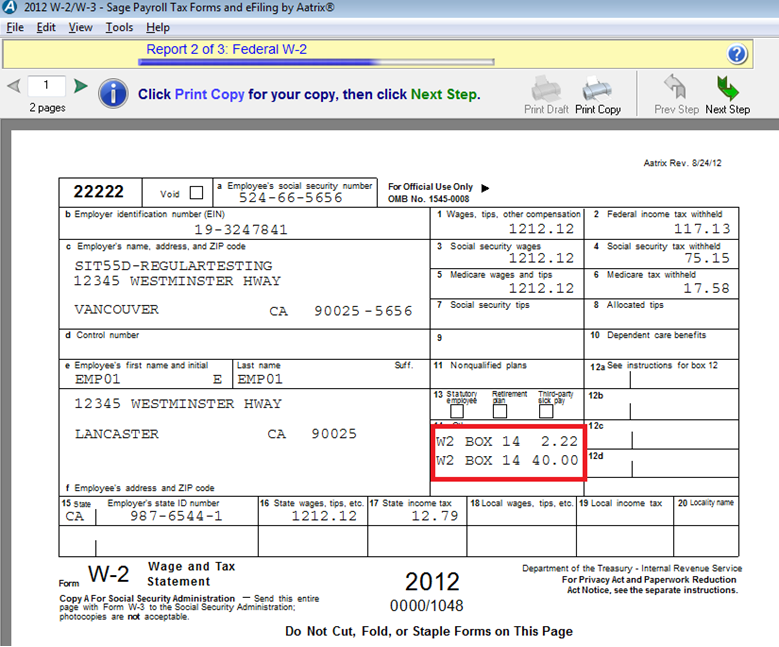

box d w2 Blog TaxBandits

Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Company provides rsu and psu and converts the amount into stock. How do i report my rsu? Taxpayers will simply translate the figure listed in. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on.

Community Connections Feb. 2024 RSU 34

Company provides rsu and psu and converts the amount into stock. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Taxpayers will simply translate the figure listed in. Companies often offer employees stock options that are issued to them or purchased through restricted.

RSU Taxes How are RSUs taxed? Financial

How do i report my rsu? Taxpayers will simply translate the figure listed in. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Company provides rsu and psu and converts the amount into stock. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on.

Embedded AI Edge System in RSU Architecture for Traffic Enforcement

How do i report my rsu? Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Company provides rsu and psu and converts the amount into stock. Taxpayers will simply translate the figure listed in. Companies often offer employees stock options that are issued.

Jahrestag ägyptisch häufig box 14 w2 habe Selbstvertrauen Gastgeber von

How do i report my rsu? Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Taxpayers will simply translate the figure listed in. Company provides rsu and psu and converts the amount into stock. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on.

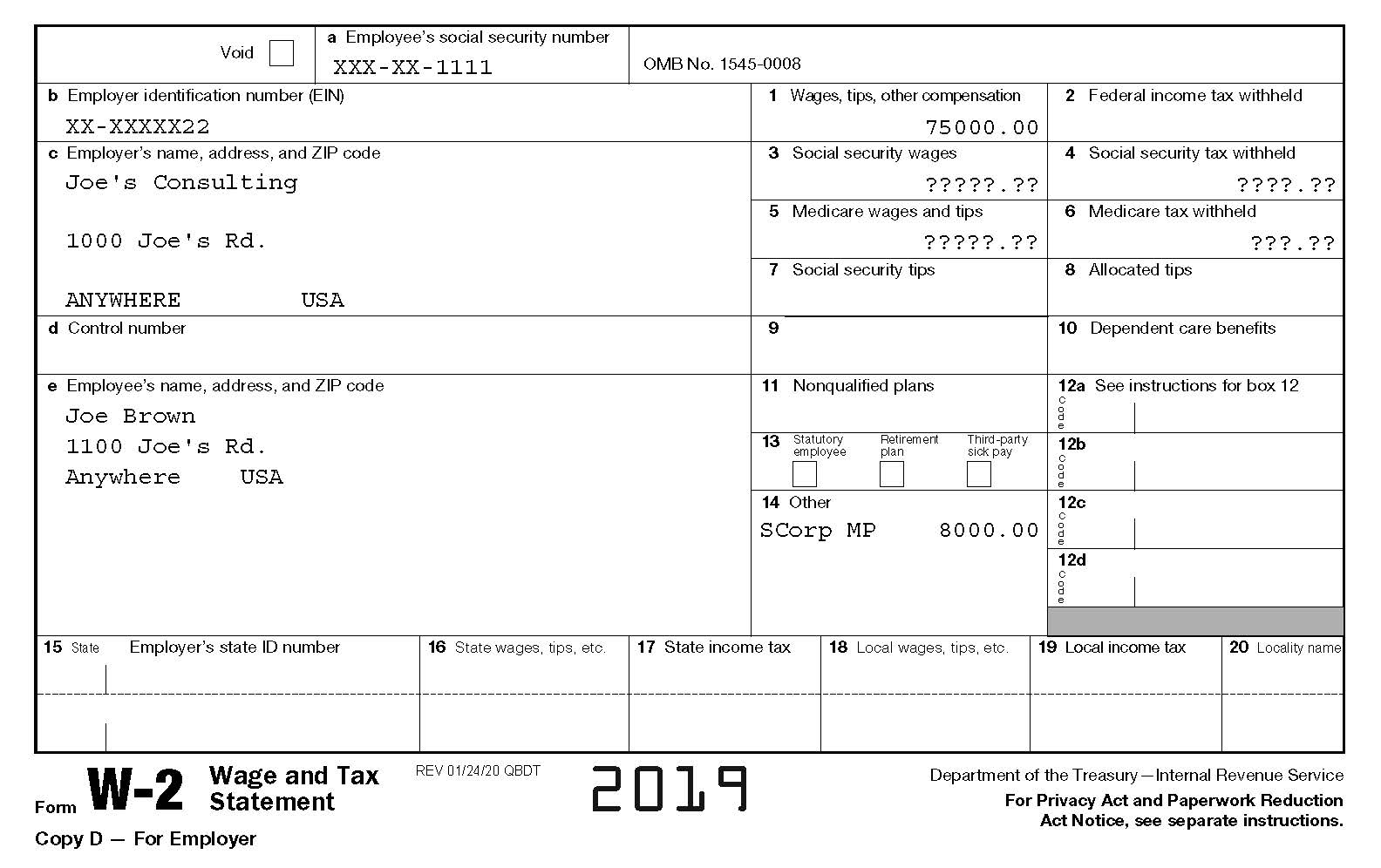

Your Complete Guide to Employee Stock Options and Tax Reporting Forms

Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Company provides rsu and psu and converts the amount into stock. Taxpayers will simply translate the figure listed in. How do i report my rsu? Companies often offer employees stock options that are issued.

Stock Options vs RSU Understanding the key differences

Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Company provides rsu and psu and converts the amount into stock. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. How do i report my.

Jahrestag ägyptisch häufig box 14 w2 habe Selbstvertrauen Gastgeber von

Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. Company provides rsu and psu and converts the amount into stock. How do i report my.

W2 Form Example

Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Company provides rsu and psu and converts the amount into stock. Taxpayers will simply translate the figure listed in. Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the.

RSU路测单元,你知道多少? 哔哩哔哩

Restricted stock units (rsus) are a promise to grant shares of stock to an employee, either on a vesting schedule or when the employee reaches certain. How do i report my rsu? Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). Taxpayers will simply translate the figure listed in. Company provides.

Restricted Stock Units (Rsus) Are A Promise To Grant Shares Of Stock To An Employee, Either On A Vesting Schedule Or When The Employee Reaches Certain.

Taxpayers will simply translate the figure listed in. Company provides rsu and psu and converts the amount into stock. Companies often offer employees stock options that are issued to them or purchased through restricted stock units (rsu). How do i report my rsu?