What Is A 8300 Form - Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form.

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction.

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that.

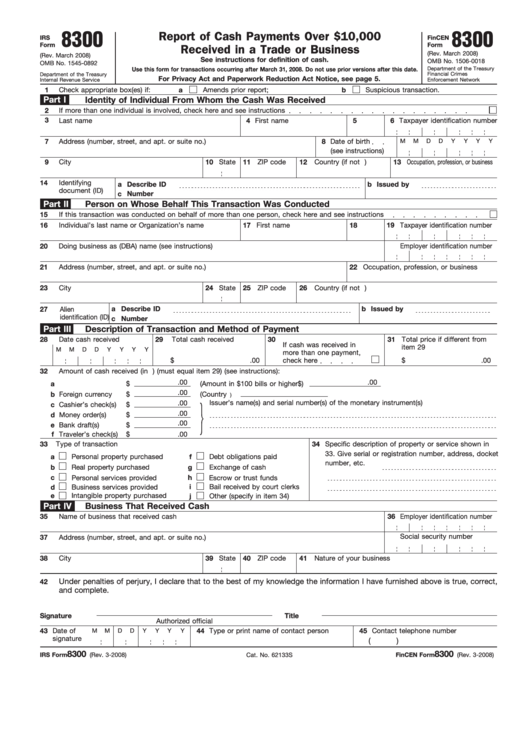

Fillable Form 8300 Report Of Cash Payments Over 10,000 Usd Received

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. The law requires trades and businesses report cash payments of more than.

Form 8300 Scuba Exchange Art

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Form 8300 is a document that businesses use to report cash payments received in excess of.

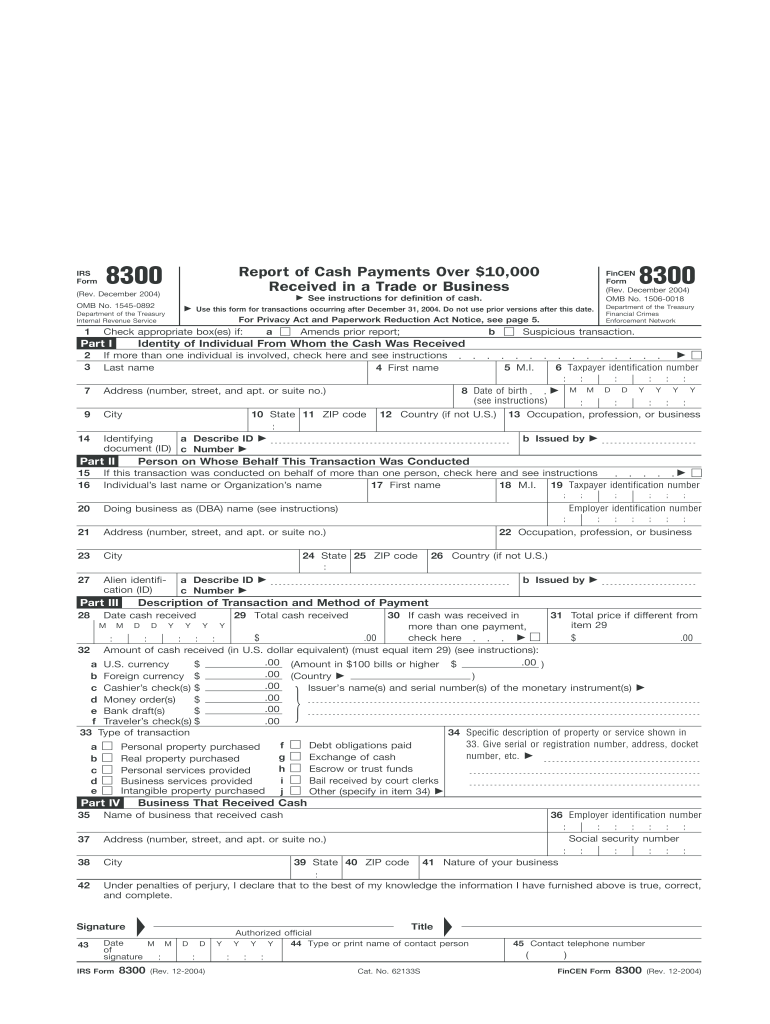

2004 Form IRS 8300 Fill Online, Printable, Fillable, Blank PDFfiller

Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Form 8300 is a document that businesses use to report cash payments received in.

8300 Irs Form 2023 Printable Forms Free Online

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that.

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Each person engaged in a trade or business who, in the course of that trade or business, receives.

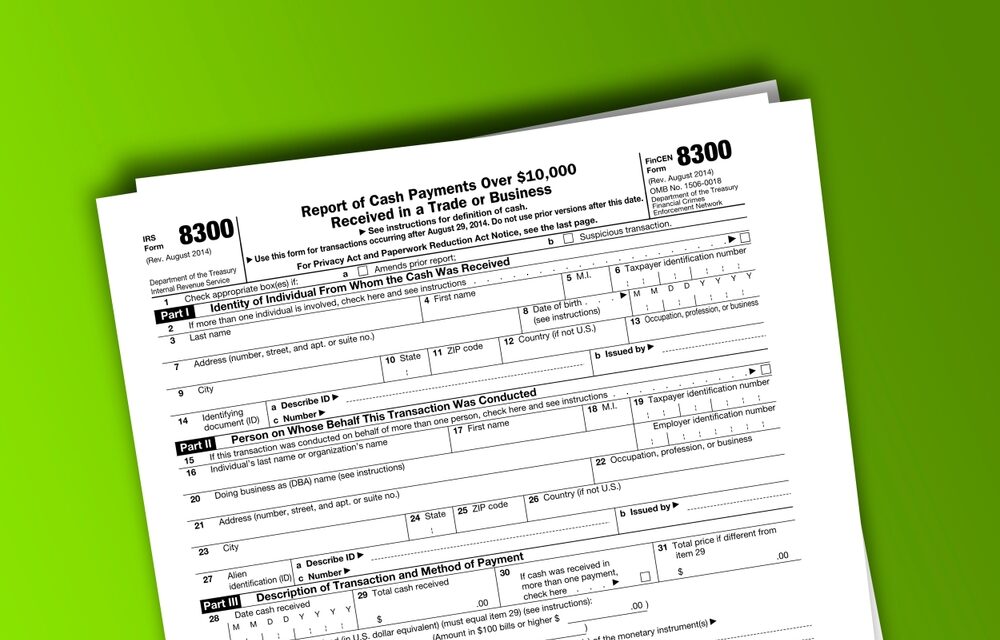

Form 8300 Reporting Cash Payments over 10,000 HM&M

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. The law requires trades and businesses report cash payments of more than $10,000 to the federal.

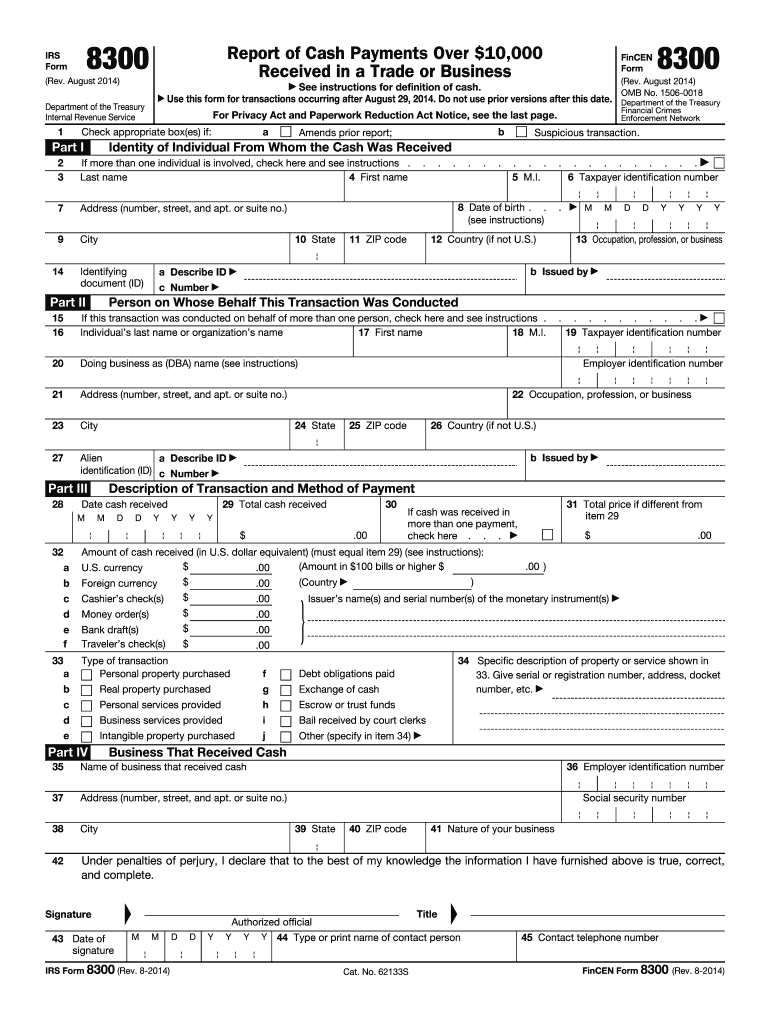

2014 Form IRS 8300 Fill Online, Printable, Fillable, Blank pdfFiller

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Form 8300 is a document that businesses use to report cash payments.

IRS Form 8300 Reporting Cash Sales Over 10,000

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Form 8300 is a document that businesses use to report cash payments received in excess of $10,000 from a single transaction. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. The law requires trades and businesses report cash payments of more than $10,000 to.

Form 8300 Is A Document That Businesses Use To Report Cash Payments Received In Excess Of $10,000 From A Single Transaction.

The law requires trades and businesses report cash payments of more than $10,000 to the federal government by filing irs/fincen form. Generally, any person in a trade or business who receives more than $10,000 in cash in a single transaction or in related transactions must file. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash.