What Happens If I Don T File Form 8958 - The irs may presume an equal split of community income, which might not be accurate for your situation. Relief from liability for tax attributable to an item of community income. You are not responsible for the tax relating to an. What happens if i don't file form 8958? Therefore, it would not be subject to splitting on form 8958 when filing married filing separately. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic. For whatever it is worth, still no penalty or contact from the irs, for completely ignoring form 8958 in my and my wife's mfs tax returns (year 2018). The laws of the state where the taxpayer is.

Therefore, it would not be subject to splitting on form 8958 when filing married filing separately. What happens if i don't file form 8958? Relief from liability for tax attributable to an item of community income. The irs may presume an equal split of community income, which might not be accurate for your situation. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic. You are not responsible for the tax relating to an. For whatever it is worth, still no penalty or contact from the irs, for completely ignoring form 8958 in my and my wife's mfs tax returns (year 2018). The laws of the state where the taxpayer is.

Relief from liability for tax attributable to an item of community income. Therefore, it would not be subject to splitting on form 8958 when filing married filing separately. You are not responsible for the tax relating to an. For whatever it is worth, still no penalty or contact from the irs, for completely ignoring form 8958 in my and my wife's mfs tax returns (year 2018). The irs may presume an equal split of community income, which might not be accurate for your situation. The laws of the state where the taxpayer is. What happens if i don't file form 8958? Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic.

What happens if you don't file a tax return UK? YouTube

Relief from liability for tax attributable to an item of community income. You are not responsible for the tax relating to an. The irs may presume an equal split of community income, which might not be accurate for your situation. Therefore, it would not be subject to splitting on form 8958 when filing married filing separately. What happens if i.

DON'T FILE WITHOUT THIS FORM! VA Benefit Tips YouTube

The laws of the state where the taxpayer is. Therefore, it would not be subject to splitting on form 8958 when filing married filing separately. What happens if i don't file form 8958? Relief from liability for tax attributable to an item of community income. For whatever it is worth, still no penalty or contact from the irs, for completely.

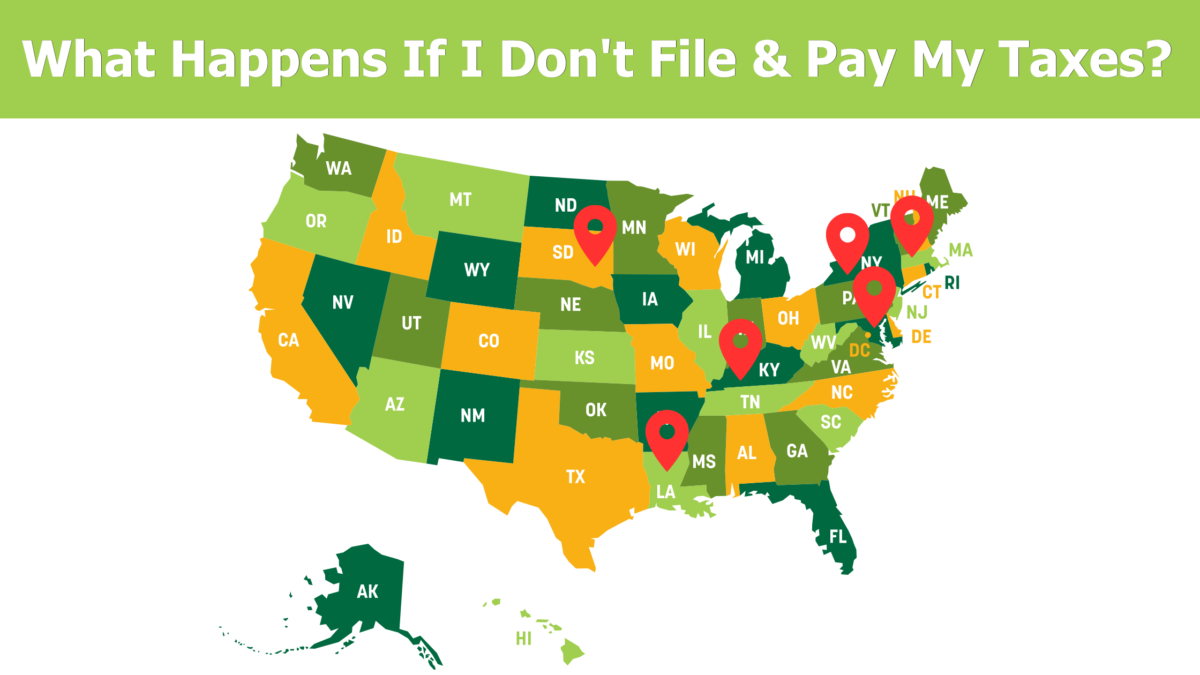

What Happens If I Don't File & Pay My Taxes? Abacus Trucking

The laws of the state where the taxpayer is. The irs may presume an equal split of community income, which might not be accurate for your situation. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic. What happens if i don't file form 8958? Therefore, it would not be subject to.

What happens if I don't file my taxes in Germany? YouTube

Relief from liability for tax attributable to an item of community income. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic. The irs may presume an equal split of community income, which might not be accurate for your situation. Therefore, it would not be subject to splitting on form 8958 when.

What Happens if You Don't File Taxes?

Therefore, it would not be subject to splitting on form 8958 when filing married filing separately. The laws of the state where the taxpayer is. You are not responsible for the tax relating to an. Relief from liability for tax attributable to an item of community income. The irs may presume an equal split of community income, which might not.

ITR What Happens If Don’t File ITR? Sharda Associates 2023

Relief from liability for tax attributable to an item of community income. The laws of the state where the taxpayer is. The irs may presume an equal split of community income, which might not be accurate for your situation. What happens if i don't file form 8958? For whatever it is worth, still no penalty or contact from the irs,.

What Happens If You Don’t File Your Taxes? The Insiderr

Therefore, it would not be subject to splitting on form 8958 when filing married filing separately. The irs may presume an equal split of community income, which might not be accurate for your situation. Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic. You are not responsible for the tax relating.

What Happens If You Don’t File Taxes Or File Taxes Late? CuraDebt

Relief from liability for tax attributable to an item of community income. You are not responsible for the tax relating to an. For whatever it is worth, still no penalty or contact from the irs, for completely ignoring form 8958 in my and my wife's mfs tax returns (year 2018). What happens if i don't file form 8958? The irs.

What Happens If You Don’t File Your GST Return?

Relief from liability for tax attributable to an item of community income. Therefore, it would not be subject to splitting on form 8958 when filing married filing separately. The irs may presume an equal split of community income, which might not be accurate for your situation. Use this form to determine the allocation of tax amounts between married filing separate.

What happens if you don't file your ITR before July 31? Zee Business

The irs may presume an equal split of community income, which might not be accurate for your situation. What happens if i don't file form 8958? Relief from liability for tax attributable to an item of community income. You are not responsible for the tax relating to an. The laws of the state where the taxpayer is.

The Irs May Presume An Equal Split Of Community Income, Which Might Not Be Accurate For Your Situation.

For whatever it is worth, still no penalty or contact from the irs, for completely ignoring form 8958 in my and my wife's mfs tax returns (year 2018). The laws of the state where the taxpayer is. What happens if i don't file form 8958? Use this form to determine the allocation of tax amounts between married filing separate spouses or registered domestic.

You Are Not Responsible For The Tax Relating To An.

Relief from liability for tax attributable to an item of community income. Therefore, it would not be subject to splitting on form 8958 when filing married filing separately.

:max_bytes(150000):strip_icc()/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png)