Wh 1 Form Indiana - You'll receive your account number and tax rate. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Register online with the indiana department of workforce development. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Discover essential forms for withholding tax. Find important information regarding withholding tax forms from the indiana department of revenue.

Discover essential forms for withholding tax. You'll receive your account number and tax rate. Register online with the indiana department of workforce development. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Find important information regarding withholding tax forms from the indiana department of revenue. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana.

Find important information regarding withholding tax forms from the indiana department of revenue. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. You'll receive your account number and tax rate. Register online with the indiana department of workforce development. Discover essential forms for withholding tax. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana.

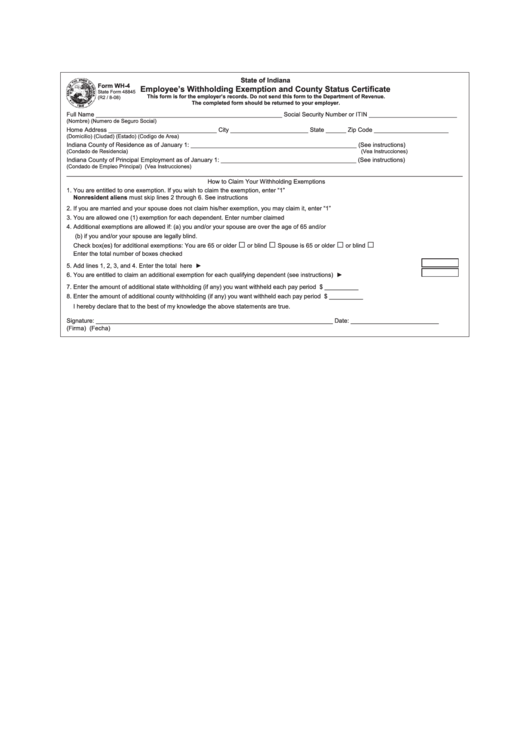

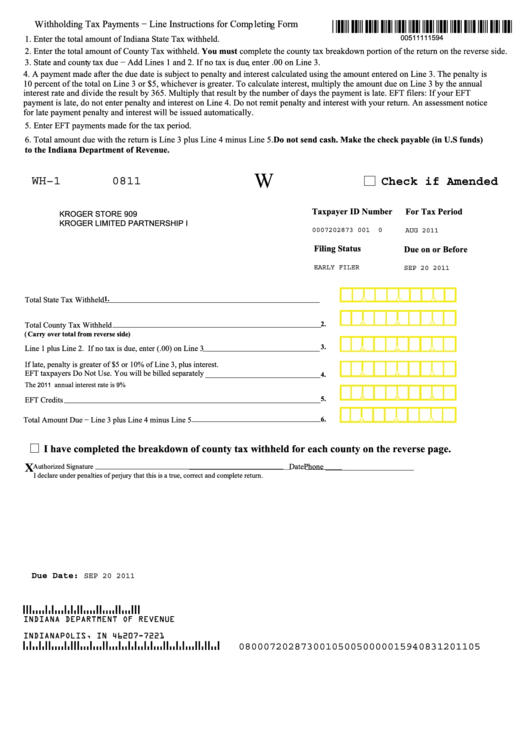

WH 1 Form Fill Out and Sign Printable PDF Template airSlate SignNow

Find important information regarding withholding tax forms from the indiana department of revenue. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Register online with the indiana department of workforce development. Discover essential forms for withholding tax. You'll receive your account number and tax rate.

Printable Indiana Form Wh 1 Printable Form 2024

Find important information regarding withholding tax forms from the indiana department of revenue. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Discover essential forms for withholding tax. You'll receive your account number and tax rate. Register online with the indiana department of workforce development.

2023 Irs W 4 Form Hrdirect Fillable Form 2023 Images and Photos finder

This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Find important information regarding withholding tax forms from the indiana department of revenue. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Discover essential forms for withholding tax. You'll receive your account number.

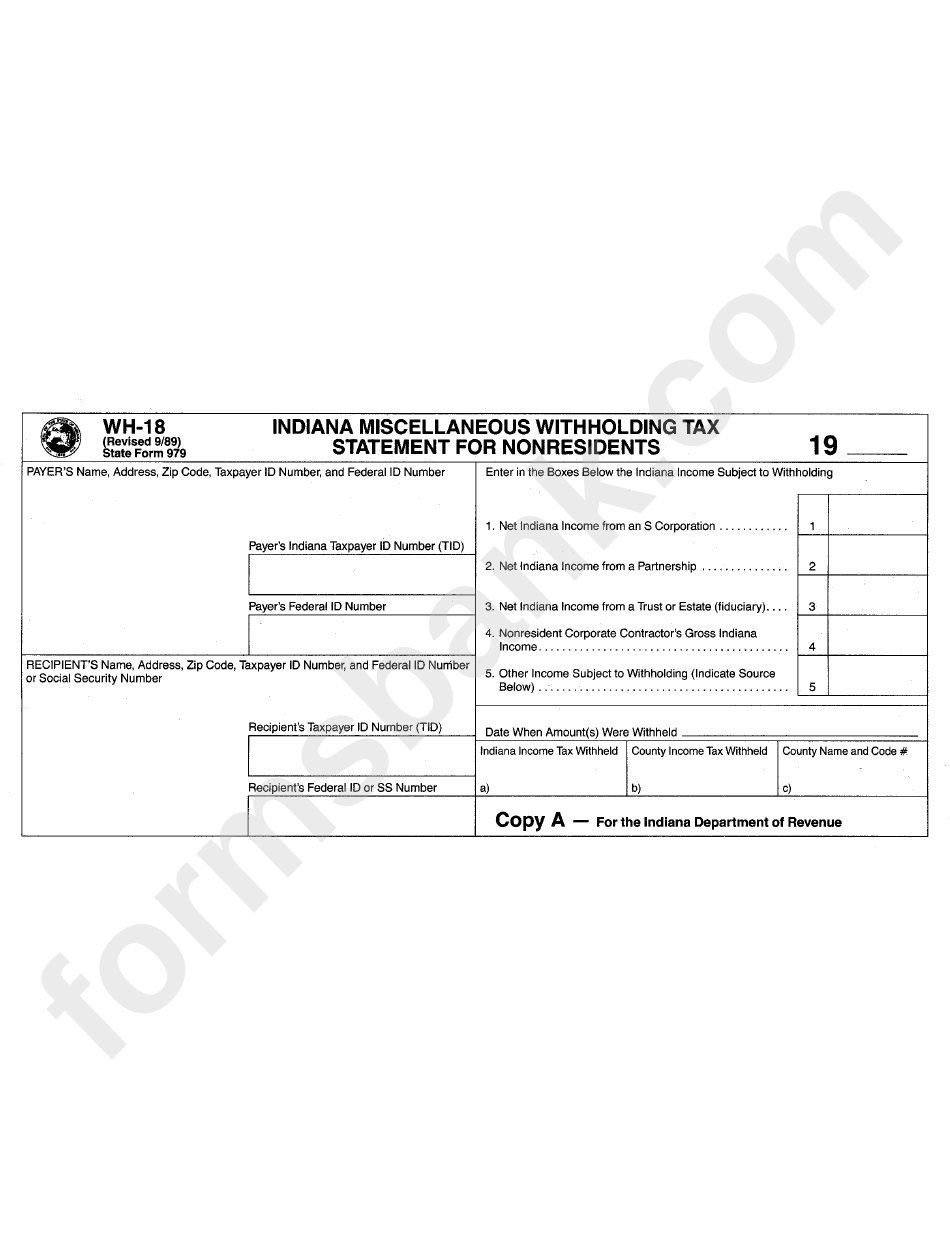

Fillable Form Wh18 Indiana Miscellaneous Withholding Tax Statement

This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. You'll receive your account number and tax rate. Discover essential forms for withholding tax. Register online with the indiana department of workforce development. Find important information regarding withholding tax forms from the indiana department of revenue.

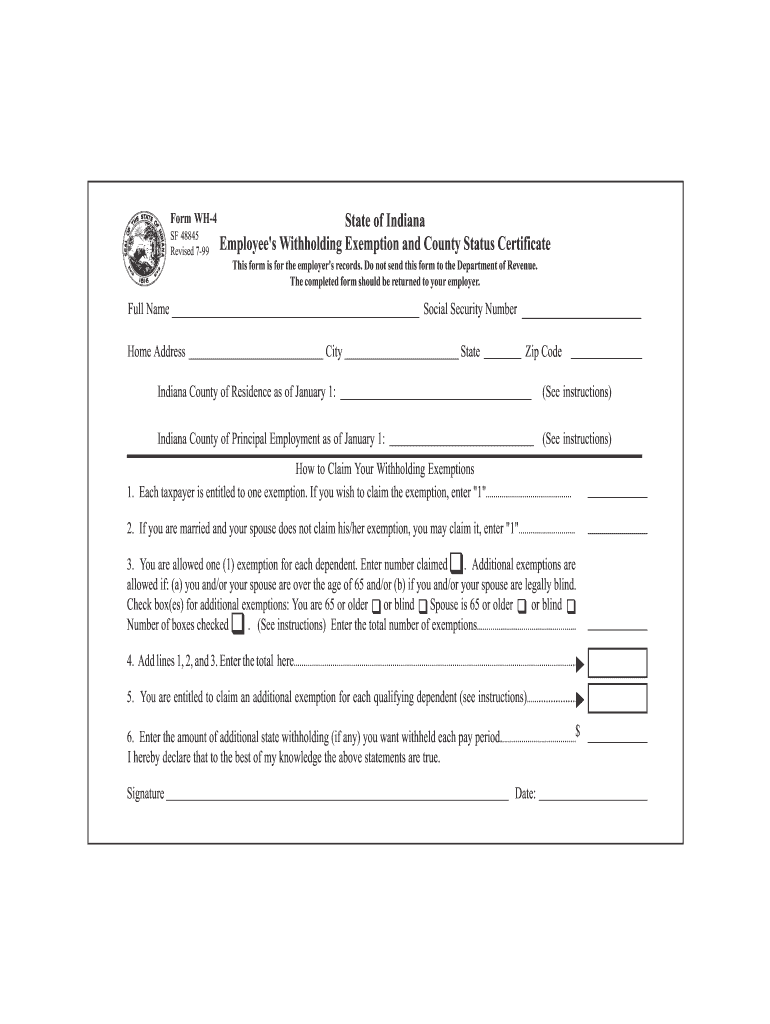

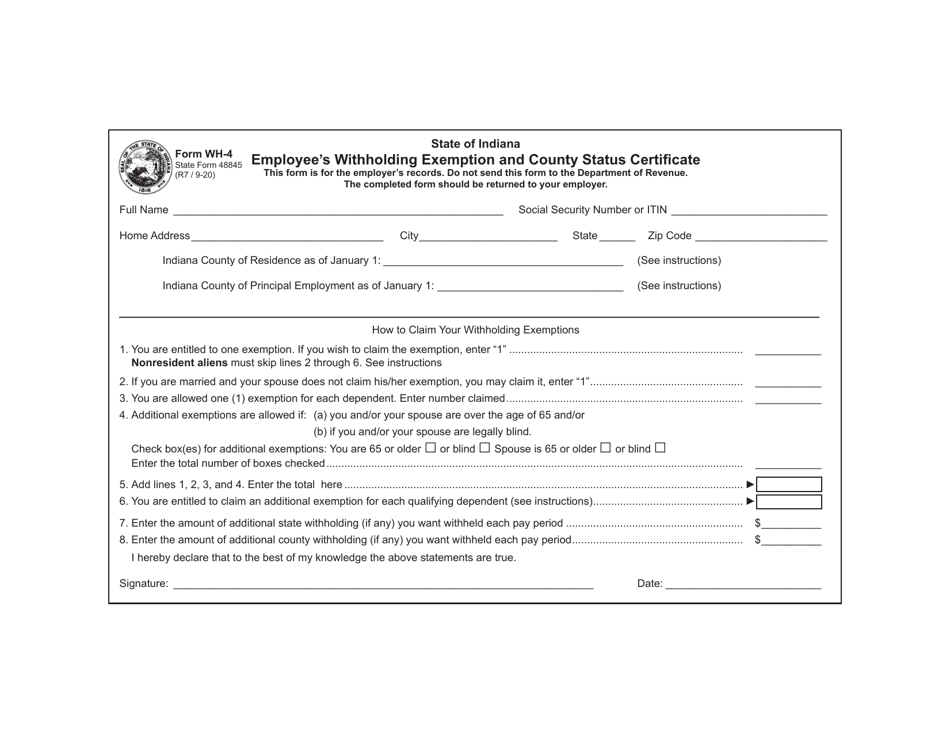

Indiana WH 4 Form Fill Out and Sign Printable PDF Template airSlate

Find important information regarding withholding tax forms from the indiana department of revenue. Register online with the indiana department of workforce development. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Discover essential forms for withholding tax. You'll receive your account number and tax rate.

Fillable Online Indiana Form Wh 1 Instructions Fax Email Print pdfFiller

Find important information regarding withholding tax forms from the indiana department of revenue. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. You'll receive your account number and tax rate. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Register online with.

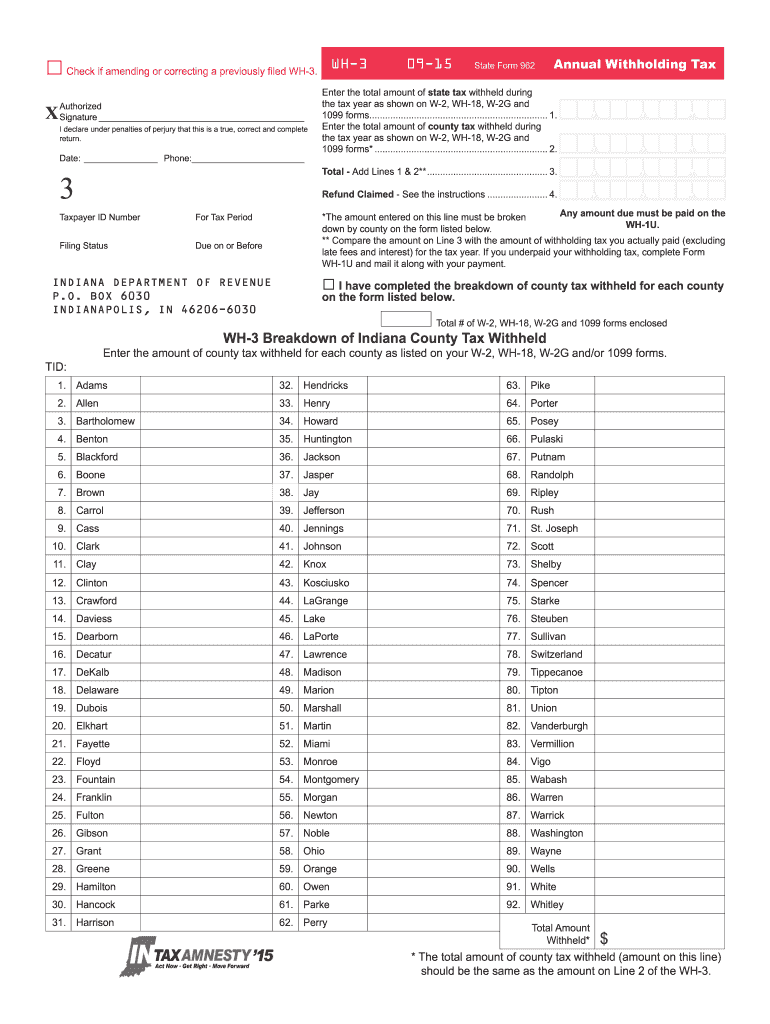

Wh 3 20152024 Form Fill Out and Sign Printable PDF Template

Discover essential forms for withholding tax. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Register online with the indiana department of workforce development. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Find important information regarding withholding tax forms from the.

Fillable Form Wh3 Breakdown Of Indiana County Tax Withheld printable

You'll receive your account number and tax rate. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Discover essential forms for withholding tax. Find important information regarding withholding tax forms from the indiana department of revenue. This form should be filed by all withholding agents who withhold state and/or county income.

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Discover essential forms for withholding tax. Find important information regarding withholding tax forms from the indiana department of revenue. You'll receive your account number and tax rate. This form should be filed by all withholding agents who withhold state and/or county income.

Mo State Tax Withholding Form

This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. Discover essential forms for withholding tax. Find important information regarding withholding tax forms from the indiana department of revenue. You'll receive your account number.

Discover Essential Forms For Withholding Tax.

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Register online with the indiana department of workforce development. You'll receive your account number and tax rate.