Utah Tax Extension Form Tc 546 - Use this worksheet to calculate your minimum required prepayment. Utah does not require quarterly estimated tax payments. To avoid penalties, taxpayers must prepay one of. Utah provides an automatic 6 month extension without filing a form or application. Pay the amount on line 9 on or before the return due date. You can also make a.

Utah provides an automatic 6 month extension without filing a form or application. Use this worksheet to calculate your minimum required prepayment. To avoid penalties, taxpayers must prepay one of. Utah does not require quarterly estimated tax payments. You can also make a. Pay the amount on line 9 on or before the return due date.

To avoid penalties, taxpayers must prepay one of. You can also make a. Use this worksheet to calculate your minimum required prepayment. Pay the amount on line 9 on or before the return due date. Utah does not require quarterly estimated tax payments. Utah provides an automatic 6 month extension without filing a form or application.

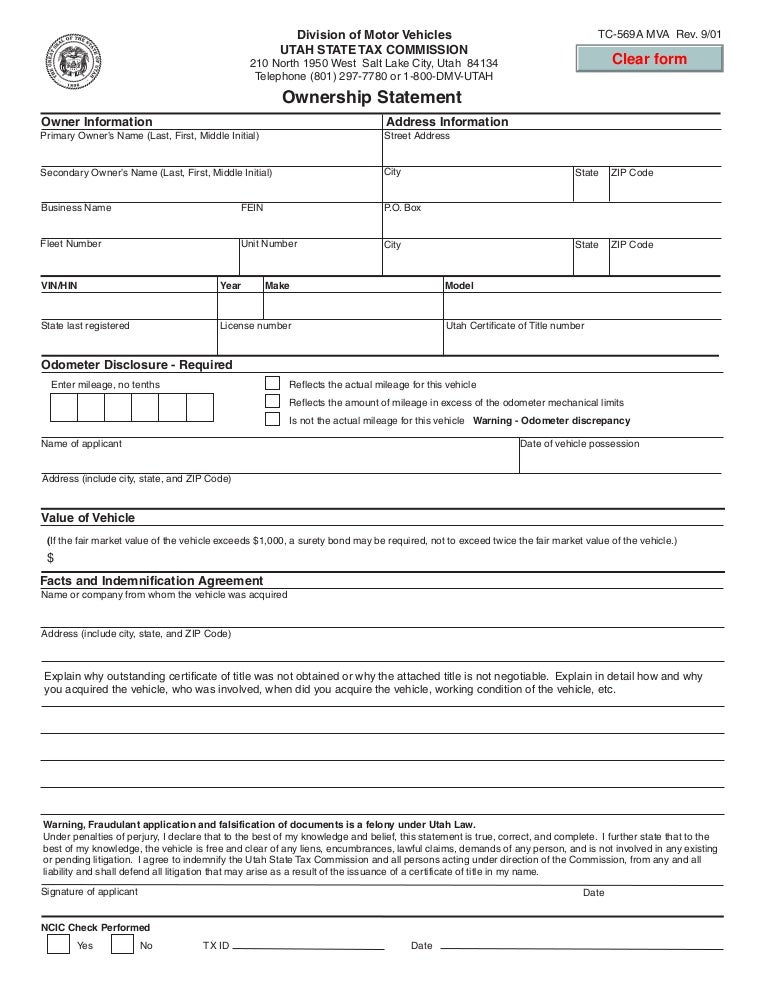

tax.utah.gov forms current tc tc569amva

Pay the amount on line 9 on or before the return due date. You can also make a. Use this worksheet to calculate your minimum required prepayment. Utah does not require quarterly estimated tax payments. Utah provides an automatic 6 month extension without filing a form or application.

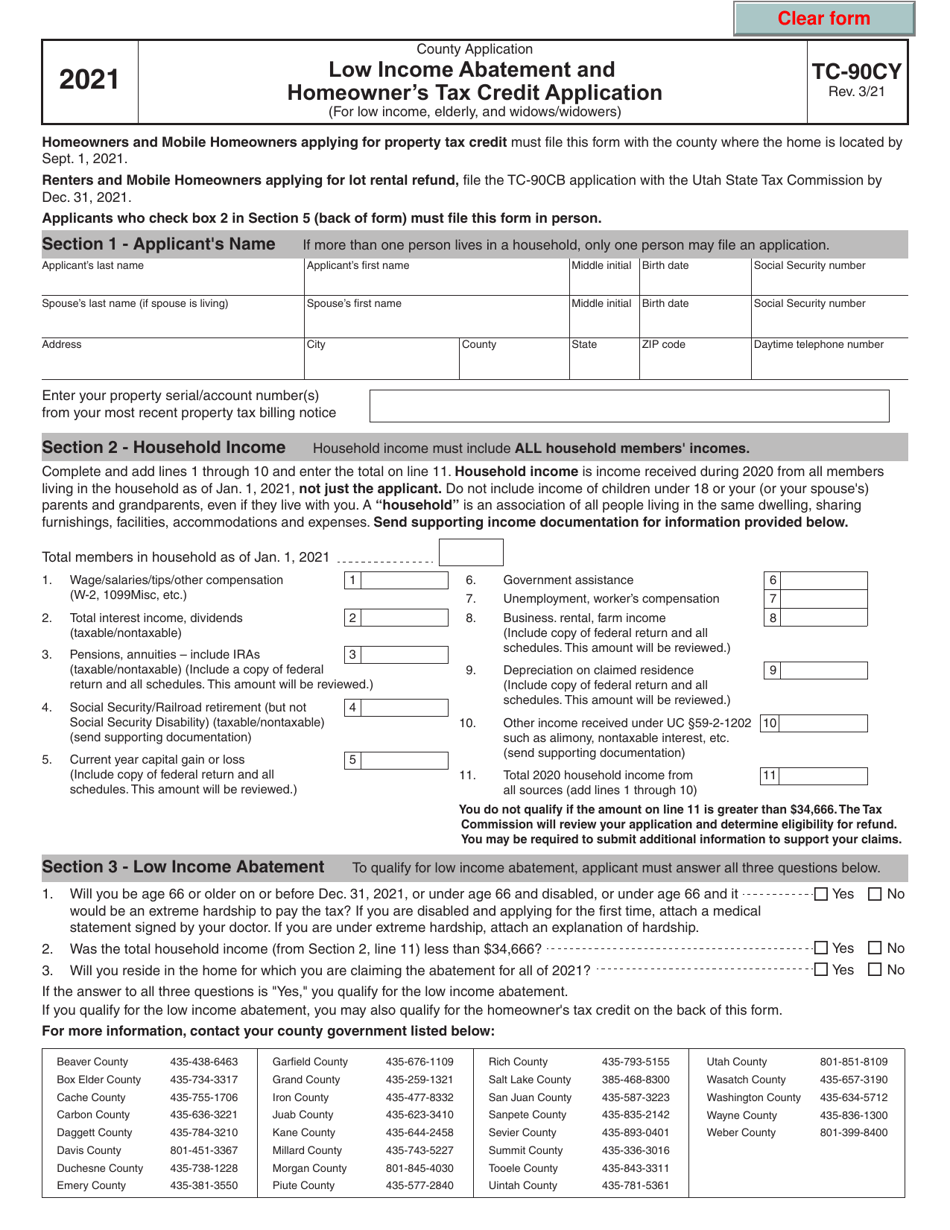

Form TC90CY Download Fillable PDF or Fill Online Low Abatement

Use this worksheet to calculate your minimum required prepayment. Pay the amount on line 9 on or before the return due date. To avoid penalties, taxpayers must prepay one of. You can also make a. Utah does not require quarterly estimated tax payments.

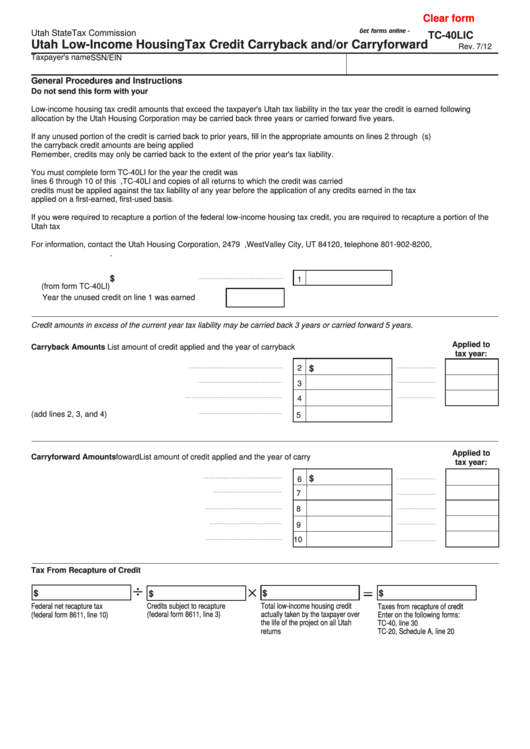

Fillable Form Tc40lic Utah Housing Tax Credit Carryback

Pay the amount on line 9 on or before the return due date. To avoid penalties, taxpayers must prepay one of. Utah provides an automatic 6 month extension without filing a form or application. Utah does not require quarterly estimated tax payments. You can also make a.

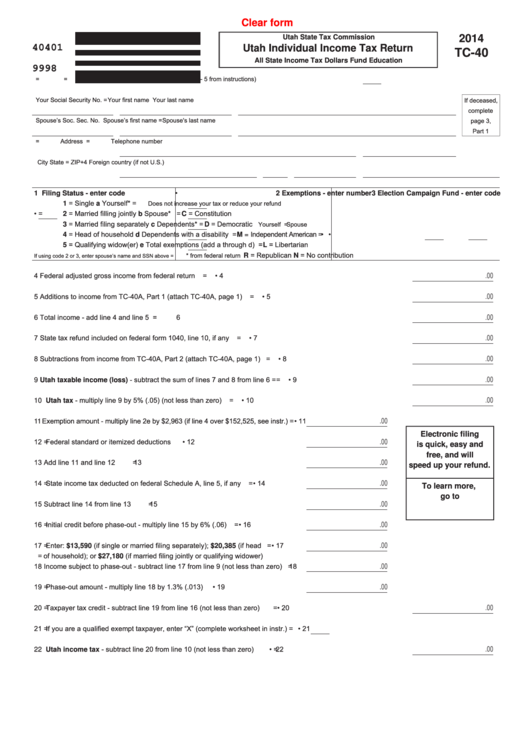

Fillable Form Tc40 Utah Individual Tax Return 2014

Utah does not require quarterly estimated tax payments. Use this worksheet to calculate your minimum required prepayment. To avoid penalties, taxpayers must prepay one of. Pay the amount on line 9 on or before the return due date. You can also make a.

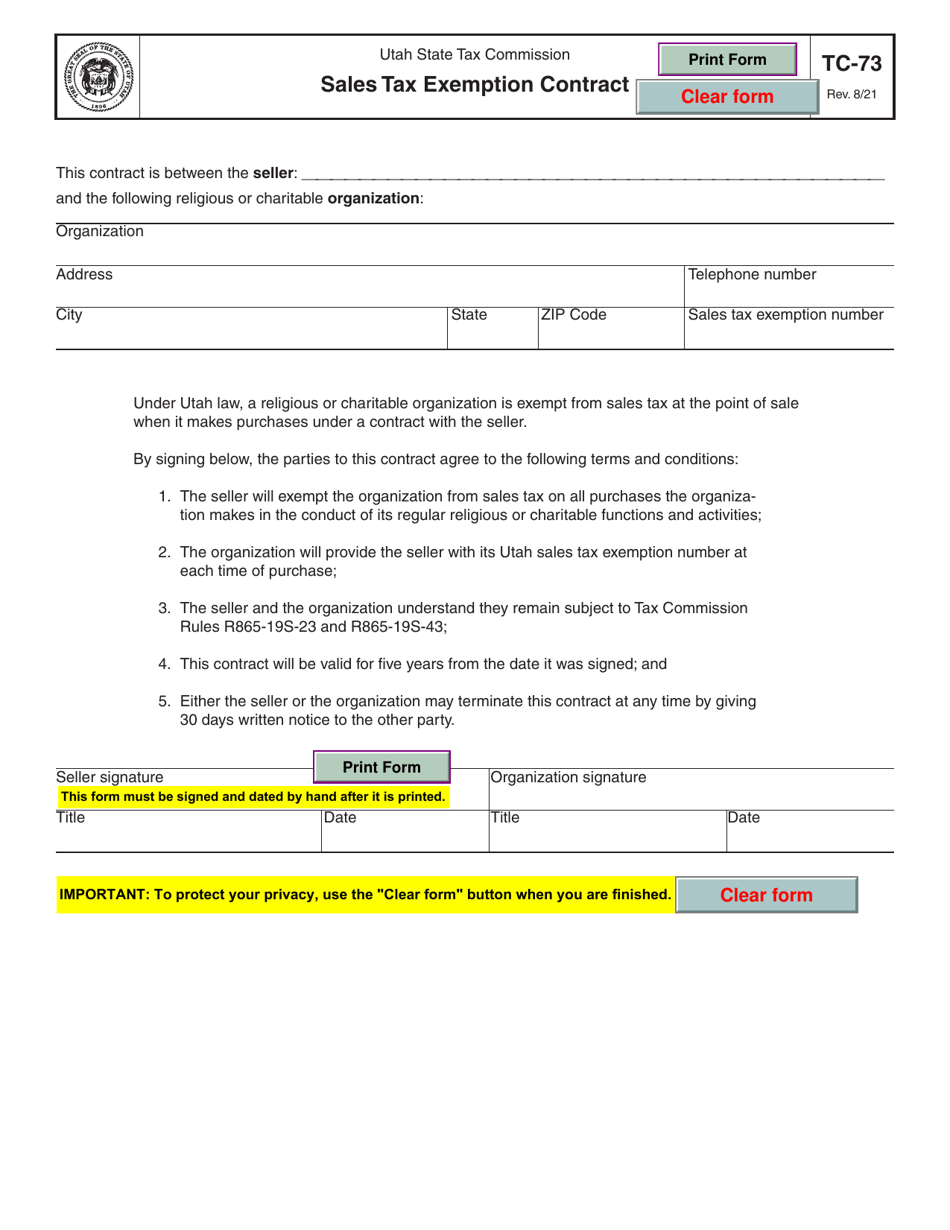

Form TC73 Download Fillable PDF or Fill Online Sales Tax Exemption

To avoid penalties, taxpayers must prepay one of. Pay the amount on line 9 on or before the return due date. Utah does not require quarterly estimated tax payments. Use this worksheet to calculate your minimum required prepayment. You can also make a.

tax.utah.gov forms current tc tc40hd

Use this worksheet to calculate your minimum required prepayment. To avoid penalties, taxpayers must prepay one of. Utah provides an automatic 6 month extension without filing a form or application. You can also make a. Pay the amount on line 9 on or before the return due date.

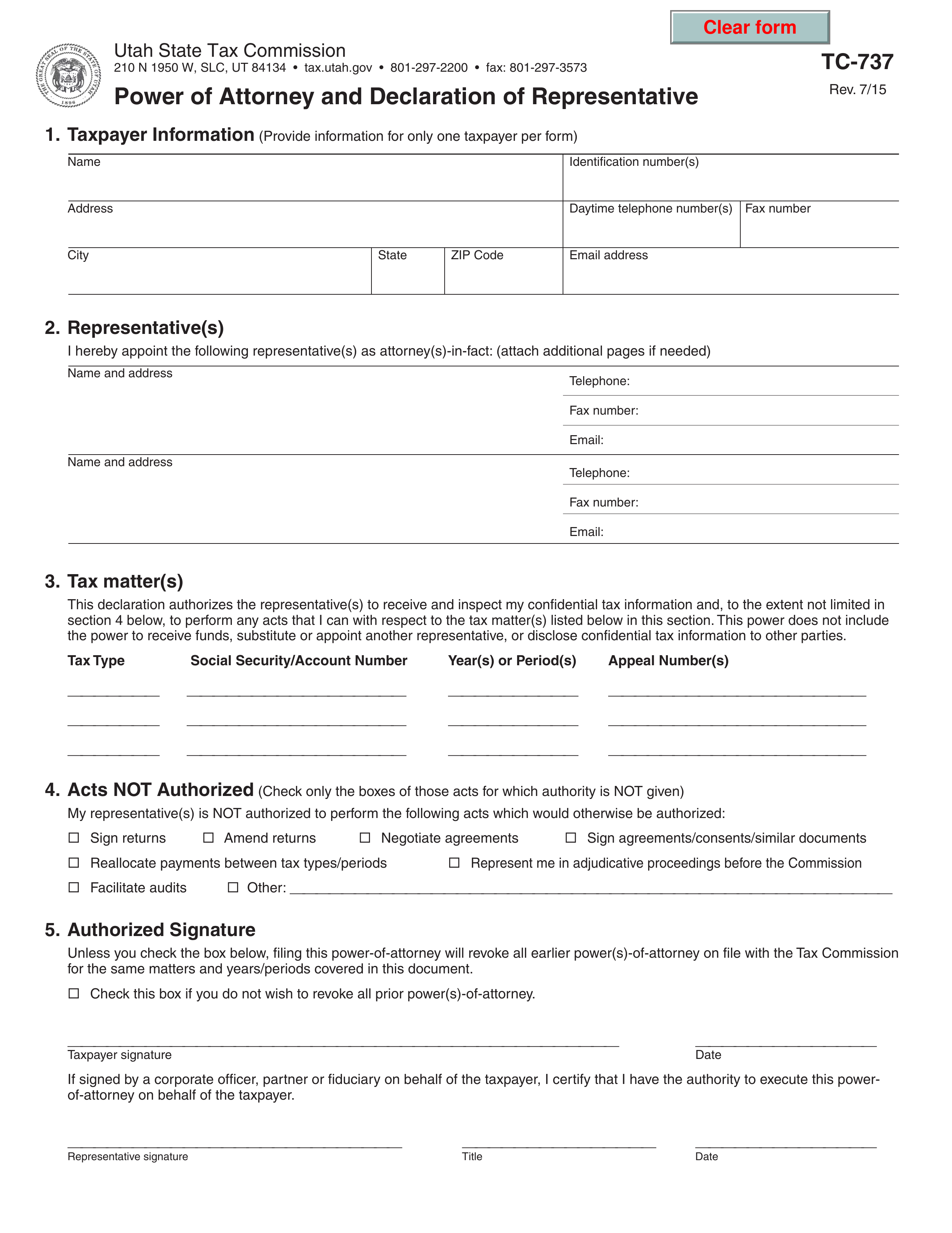

Free Utah Tax Power of Attorney (Form TC737) PDF eForms

To avoid penalties, taxpayers must prepay one of. Pay the amount on line 9 on or before the return due date. Utah does not require quarterly estimated tax payments. Use this worksheet to calculate your minimum required prepayment. You can also make a.

tax.utah.gov forms current tc tc922pages

You can also make a. Pay the amount on line 9 on or before the return due date. To avoid penalties, taxpayers must prepay one of. Utah provides an automatic 6 month extension without filing a form or application. Utah does not require quarterly estimated tax payments.

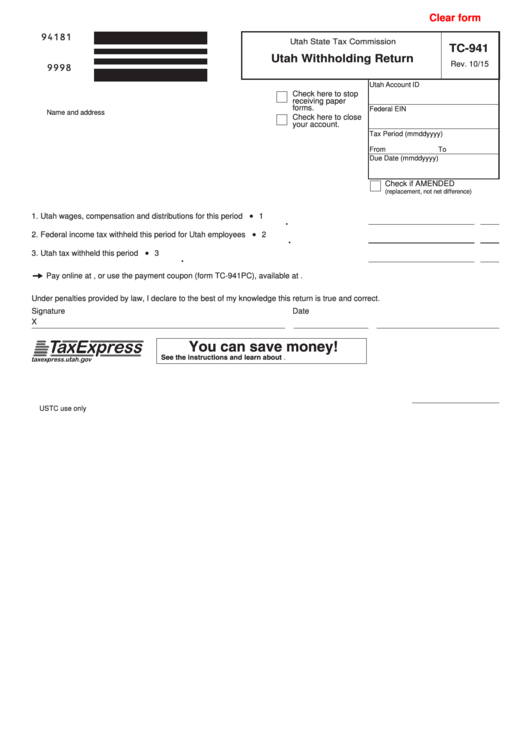

Fillable Form Tc941 Utah Withholding Return Utah State Tax

Utah does not require quarterly estimated tax payments. Utah provides an automatic 6 month extension without filing a form or application. Use this worksheet to calculate your minimum required prepayment. You can also make a. Pay the amount on line 9 on or before the return due date.

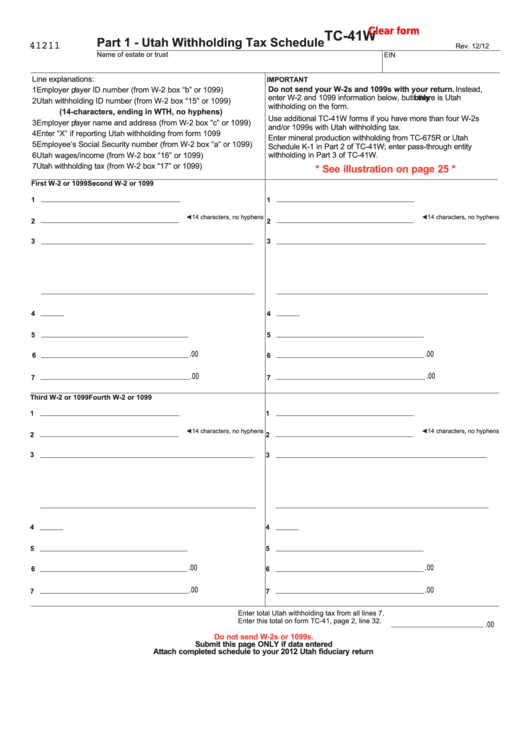

Fillable Form Tc41w Utah Withholding Tax Schedule printable pdf download

You can also make a. Use this worksheet to calculate your minimum required prepayment. Pay the amount on line 9 on or before the return due date. Utah does not require quarterly estimated tax payments. To avoid penalties, taxpayers must prepay one of.

Use This Worksheet To Calculate Your Minimum Required Prepayment.

To avoid penalties, taxpayers must prepay one of. You can also make a. Pay the amount on line 9 on or before the return due date. Utah provides an automatic 6 month extension without filing a form or application.