Utah Sales Tax Form - 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. There are a total of.

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

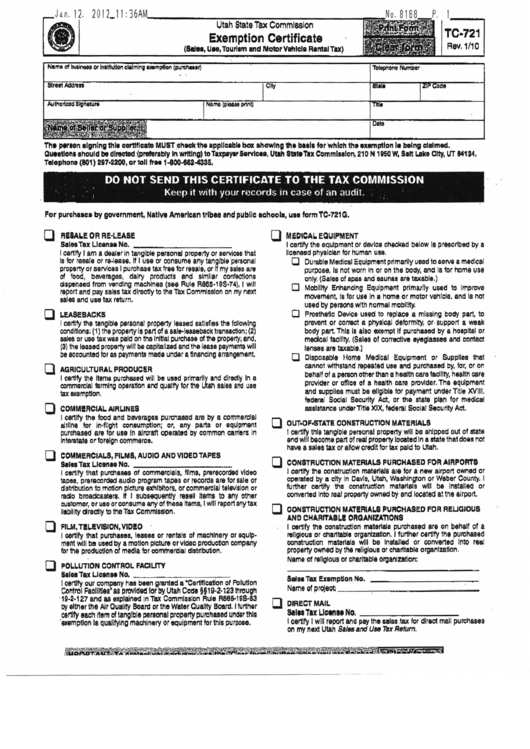

Fillable Online Utah Sales Tax Exemption Certificate Fax Email Print

There are a total of. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

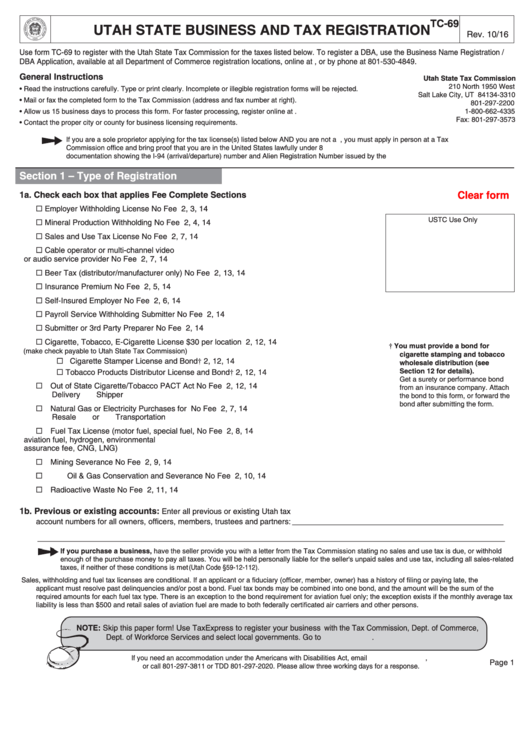

Register Utha Sales Tax, UT Reseller Pertmit Sales tax, Tax, Registration

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

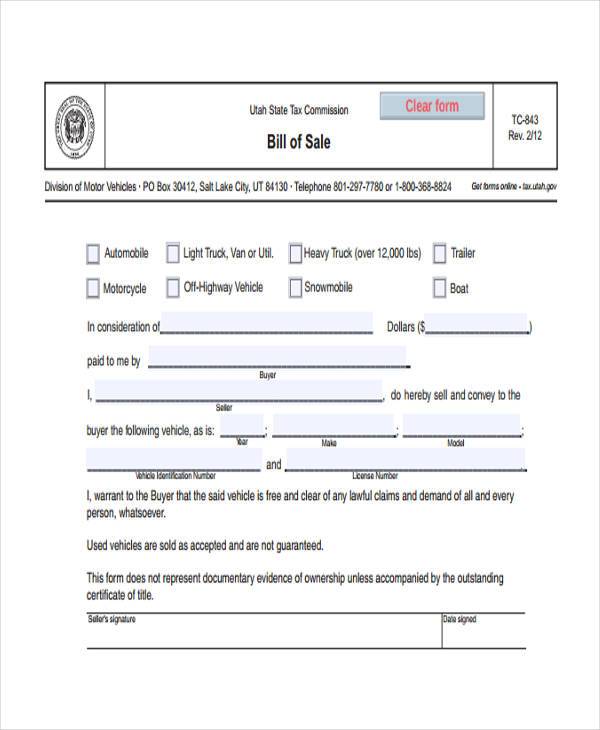

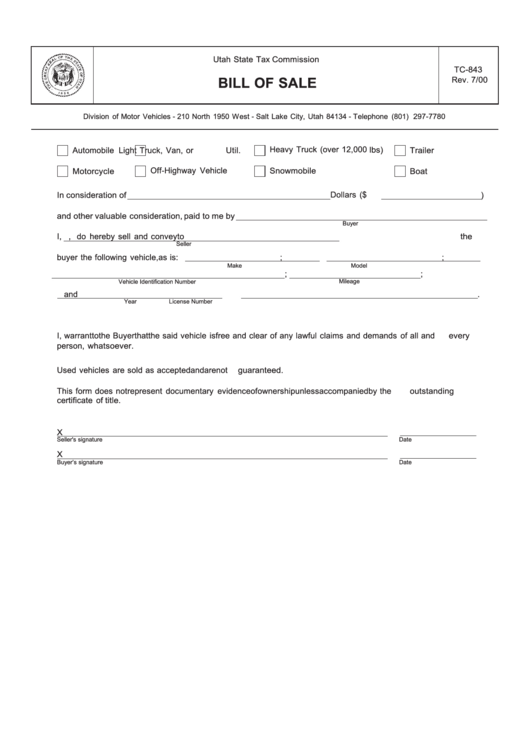

Free Utah Vehicle Bill Of Sale Form Tc 843 Download Pdf Word Images

270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

Fillable Form Tc69 Utah State Business And Tax Registration

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

Bill Of Sale Utah Printable

There are a total of. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

State Of Utah Tax Exempt Form Form example download

270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. There are a total of.

Fillable Online Free fillable Tax Exempt Certificate TC721G, Utah

There are a total of. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

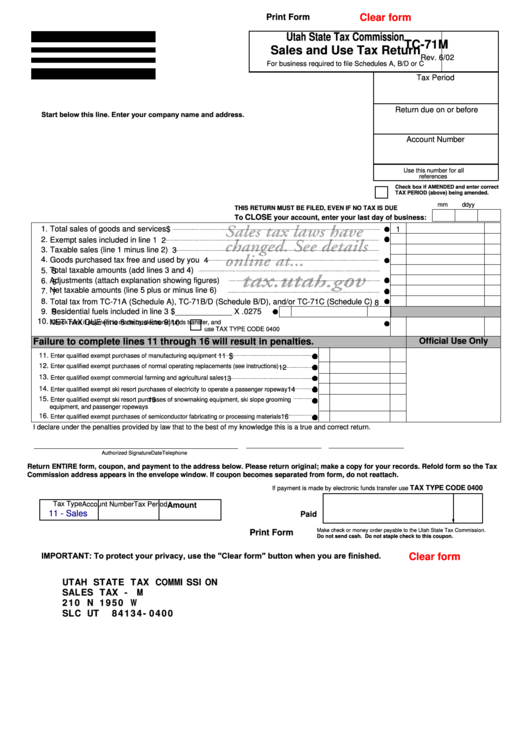

Fillable Form Tc71m Sales And Use Tax Return Utah State Tax

There are a total of. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

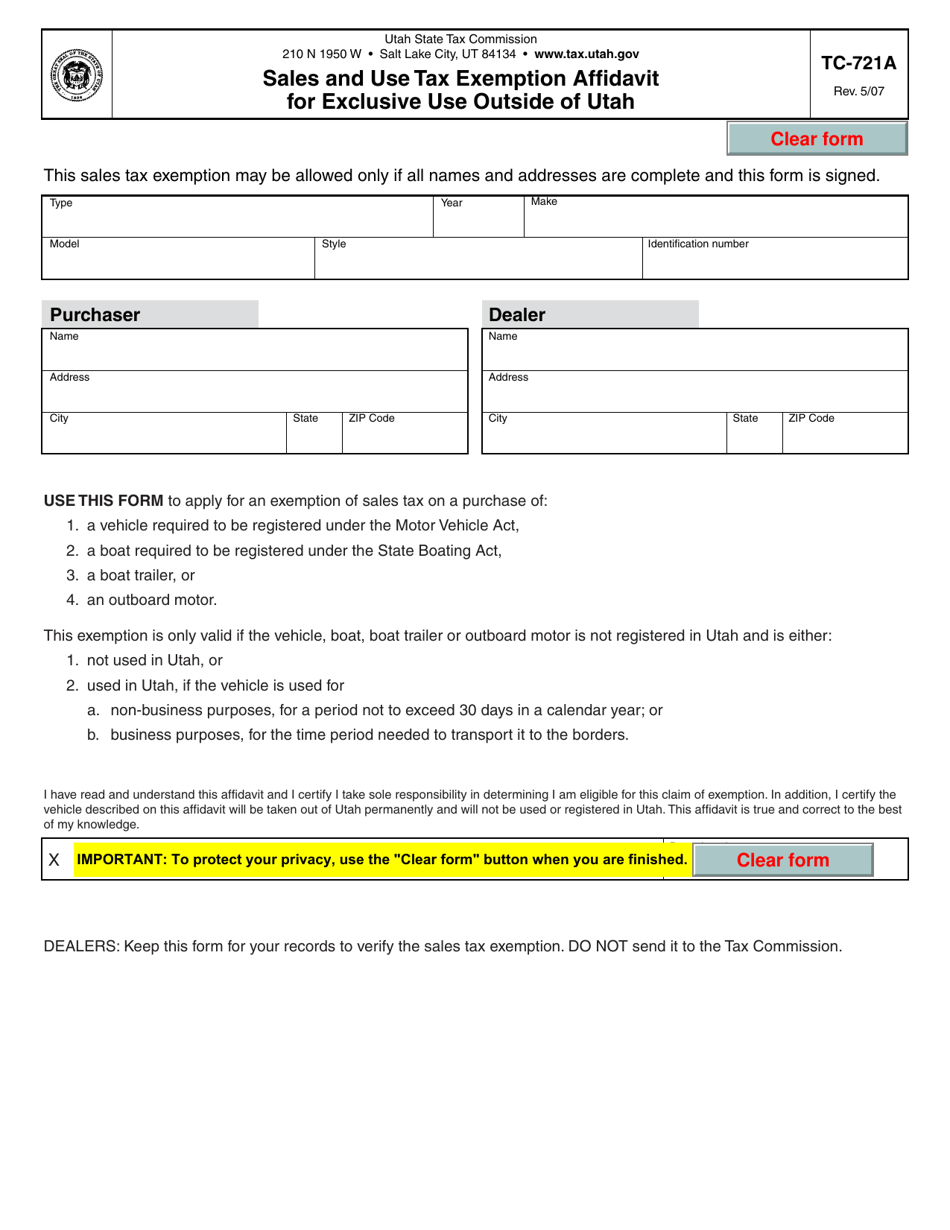

Form TC721A Fill Out, Sign Online and Download Fillable PDF, Utah

270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.

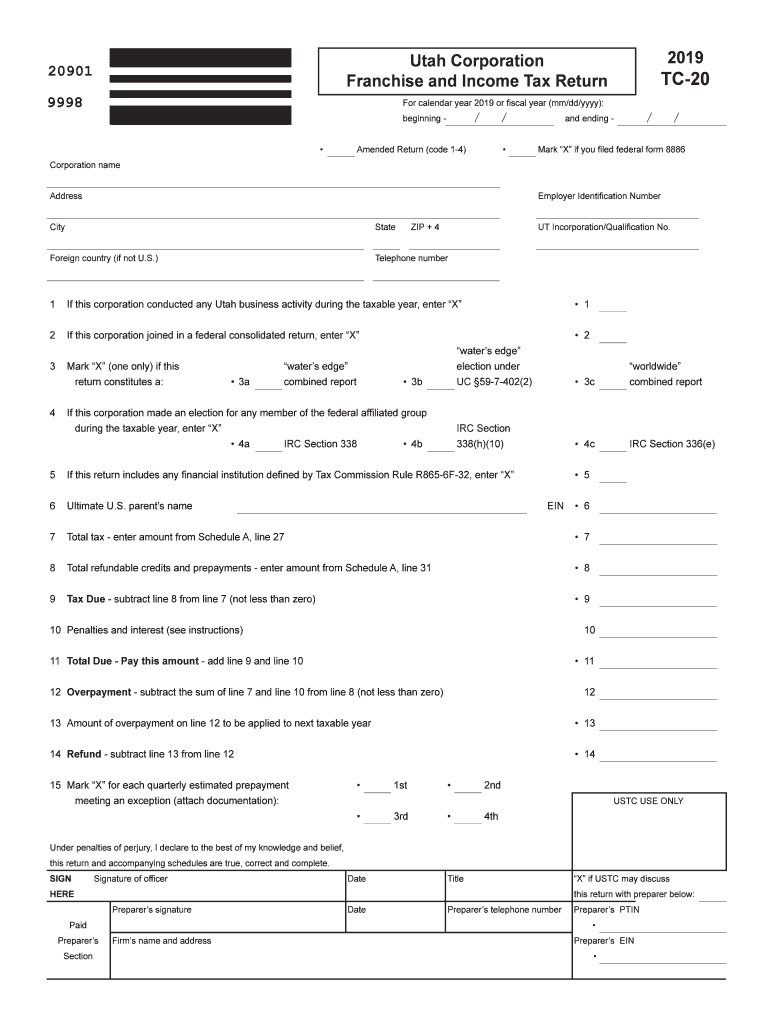

Vadrs Utah Complete with ease airSlate SignNow

I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return. 270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. There are a total of.

There Are A Total Of.

270 rows utah has state sales tax of 4.85%, and allows local governments to collect a local option sales tax of up to 3.35%. I certify i will report and pay the sales tax for direct mail purchases on my next utah sales and use tax return.