Tax Form From 401K - Tips on how to find, fix and avoid common errors in 401 (k). Helps you keep your 401 (k) plan in compliance with important tax rules. However, if a person takes. As such, they are not included in your taxable income.

Tips on how to find, fix and avoid common errors in 401 (k). As such, they are not included in your taxable income. Helps you keep your 401 (k) plan in compliance with important tax rules. However, if a person takes.

Helps you keep your 401 (k) plan in compliance with important tax rules. As such, they are not included in your taxable income. Tips on how to find, fix and avoid common errors in 401 (k). However, if a person takes.

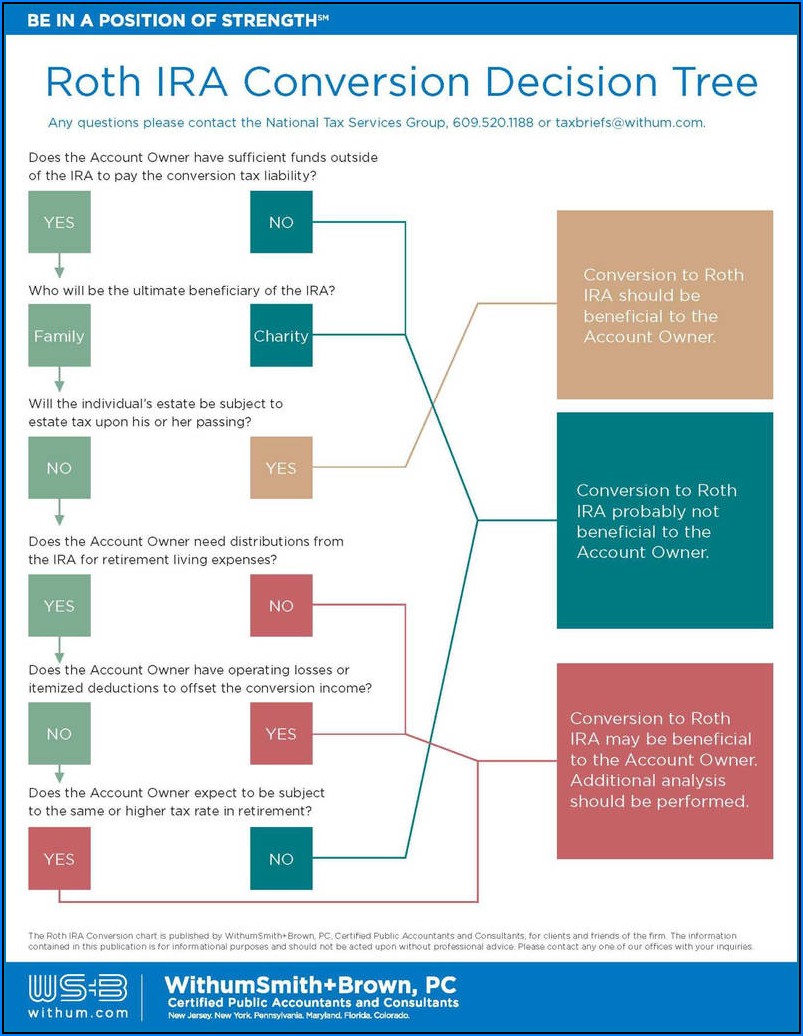

What Is a Roth 401(k)? Here's What You Need to Know theSkimm

However, if a person takes. Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k). As such, they are not included in your taxable income.

Why Is The Difference Between Wages And Medicare Wages On W2

Helps you keep your 401 (k) plan in compliance with important tax rules. However, if a person takes. Tips on how to find, fix and avoid common errors in 401 (k). As such, they are not included in your taxable income.

Withdrawal Request 401 K Form Fill Online, Printable, Fillable, Blank

However, if a person takes. Tips on how to find, fix and avoid common errors in 401 (k). Helps you keep your 401 (k) plan in compliance with important tax rules. As such, they are not included in your taxable income.

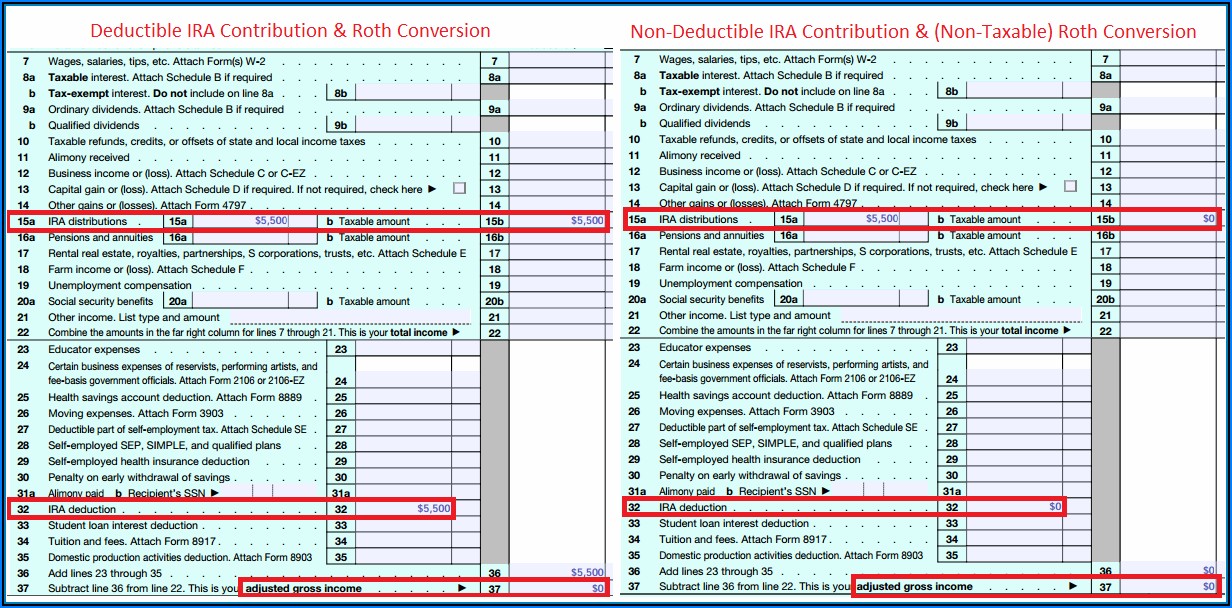

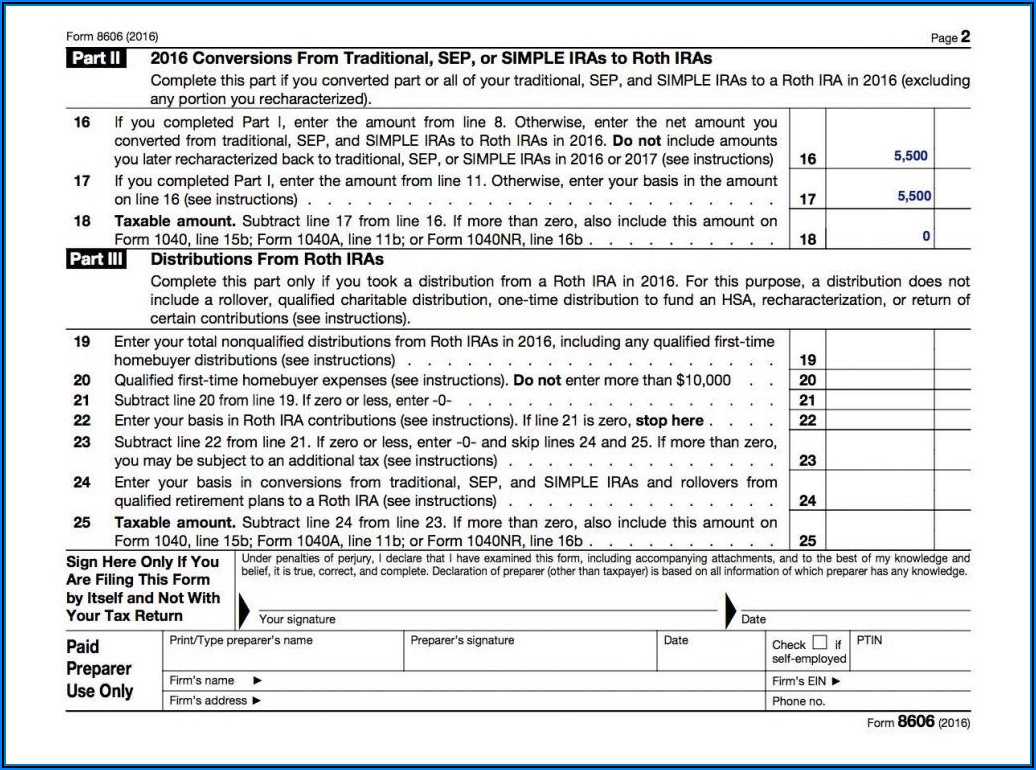

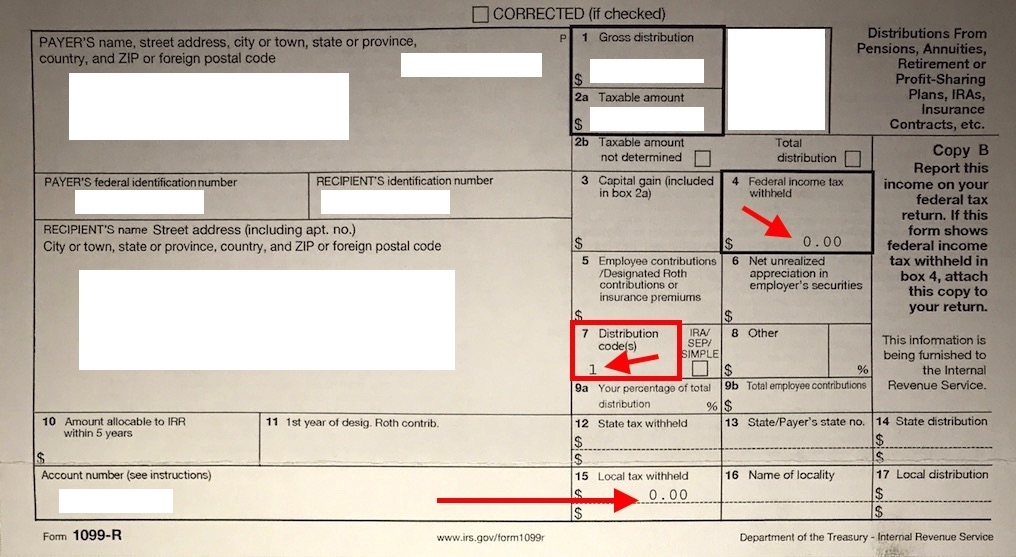

401k Conversion To Roth Ira Tax Form Form Resume Examples dP9l71Dq2R

Helps you keep your 401 (k) plan in compliance with important tax rules. As such, they are not included in your taxable income. Tips on how to find, fix and avoid common errors in 401 (k). However, if a person takes.

Prudential 401k Rollover Form Universal Network

Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k). As such, they are not included in your taxable income. However, if a person takes.

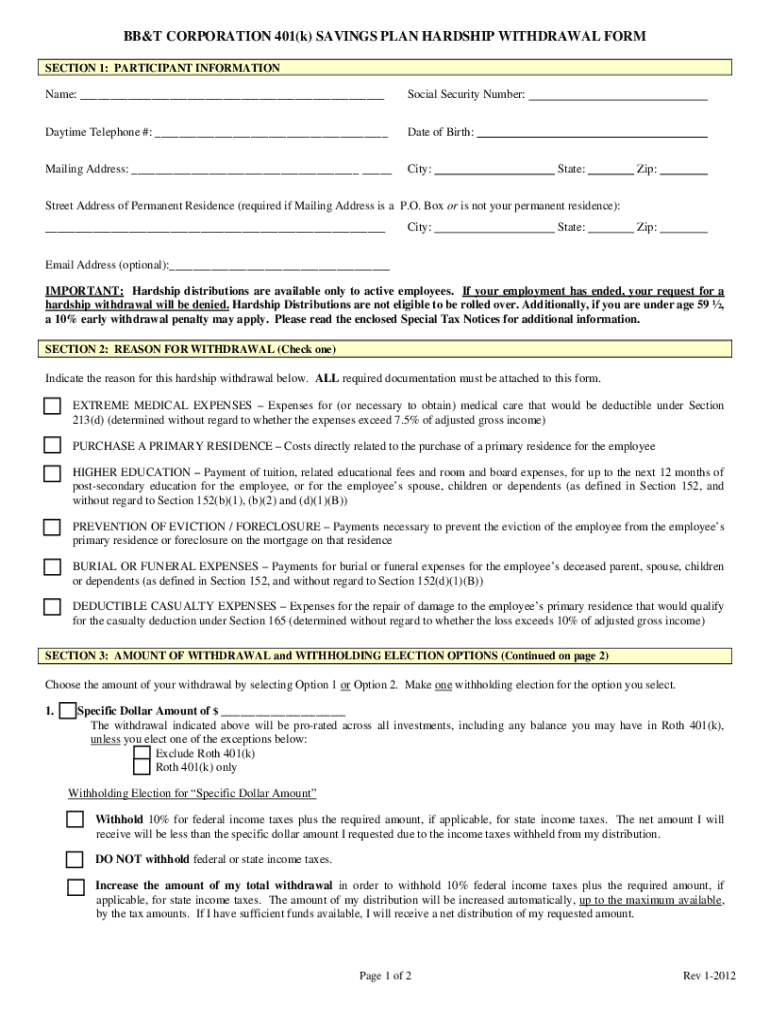

BB&T Corporation 401(k) Saving Plan Hardship Withdrawal Form 20122022

However, if a person takes. Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k). As such, they are not included in your taxable income.

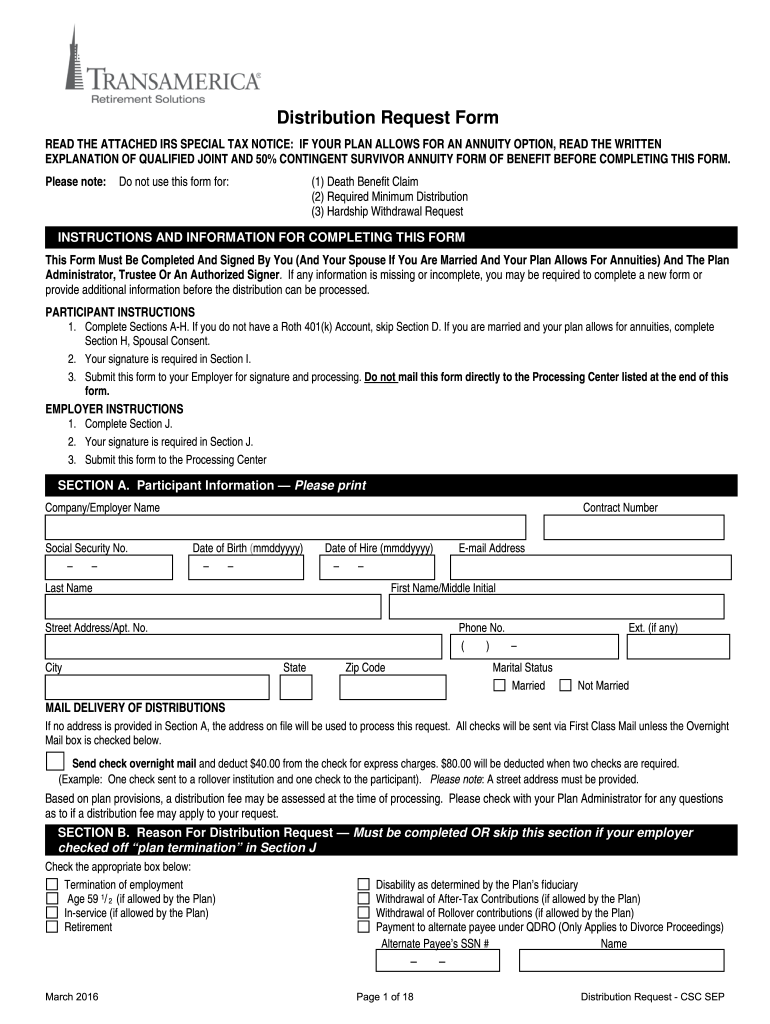

Fillable Online transamerica 401k withdrawal form Fax Email Print

As such, they are not included in your taxable income. Helps you keep your 401 (k) plan in compliance with important tax rules. However, if a person takes. Tips on how to find, fix and avoid common errors in 401 (k).

401k Conversion To Roth Ira Tax Form Form Resume Examples dP9l71Dq2R

However, if a person takes. As such, they are not included in your taxable income. Tips on how to find, fix and avoid common errors in 401 (k). Helps you keep your 401 (k) plan in compliance with important tax rules.

401k Conversion To Roth Ira Tax Form Form Resume Examples dP9l71Dq2R

However, if a person takes. As such, they are not included in your taxable income. Helps you keep your 401 (k) plan in compliance with important tax rules. Tips on how to find, fix and avoid common errors in 401 (k).

As Such, They Are Not Included In Your Taxable Income.

Tips on how to find, fix and avoid common errors in 401 (k). However, if a person takes. Helps you keep your 401 (k) plan in compliance with important tax rules.