Tax Form 2441 Provider Amount Paid - What should i put for provider paid amount? If you hire someone to care for a dependent or your disabled spouse, and you. Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. The following link will provide more information: You should enter the amount you paid the provider for childcare.

What should i put for provider paid amount? The following link will provide more information: If you hire someone to care for a dependent or your disabled spouse, and you. Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. You should enter the amount you paid the provider for childcare.

What should i put for provider paid amount? Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. If you hire someone to care for a dependent or your disabled spouse, and you. You should enter the amount you paid the provider for childcare. The following link will provide more information:

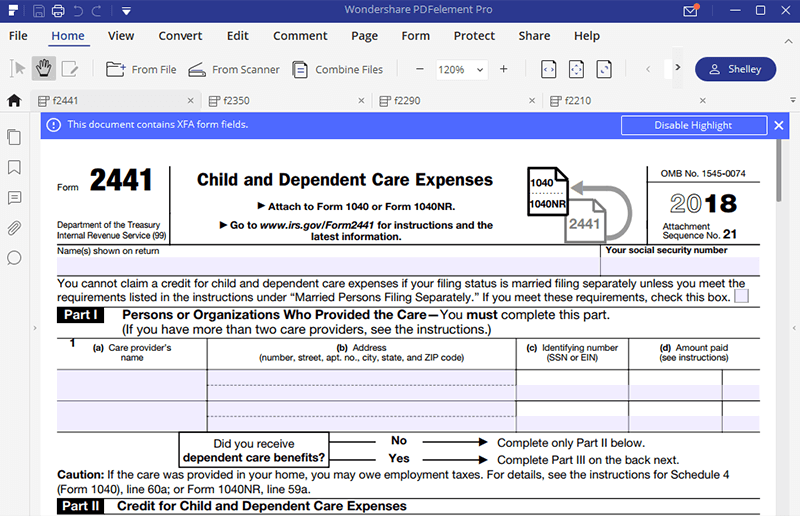

What is Form 2441 Complete with ease airSlate SignNow

The following link will provide more information: Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. What should i put for provider paid amount? You should enter the amount you paid the provider for childcare. If you hire someone to care for a dependent.

Filing Tax Form 2441 Child and Dependent Care Expenses Reconcile Books

You should enter the amount you paid the provider for childcare. Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. What should i put for provider paid amount? If you hire someone to care for a dependent or your disabled spouse, and you. The.

IRS Form 2441 What It Is, Who Can File, and How to Fill It Out

You should enter the amount you paid the provider for childcare. The following link will provide more information: What should i put for provider paid amount? If you hire someone to care for a dependent or your disabled spouse, and you. Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s).

Irs Form 2441 Printable Printable Forms Free Online

What should i put for provider paid amount? Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. If you hire someone to care for a dependent or your disabled spouse, and you. The following link will provide more information: You should enter the amount.

Tax Form 2441 Filing Child and Dependent Care Expenses Top Daycare

If you hire someone to care for a dependent or your disabled spouse, and you. What should i put for provider paid amount? Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. You should enter the amount you paid the provider for childcare. The.

Child Care Tax Credits on IRS Form 2441 YouTube

You should enter the amount you paid the provider for childcare. What should i put for provider paid amount? If you hire someone to care for a dependent or your disabled spouse, and you. Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. The.

What is IRS Form 2441, and How Do I Claim it? Civic Tax Relief

Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. You should enter the amount you paid the provider for childcare. If you hire someone to care for a dependent or your disabled spouse, and you. The following link will provide more information: What should.

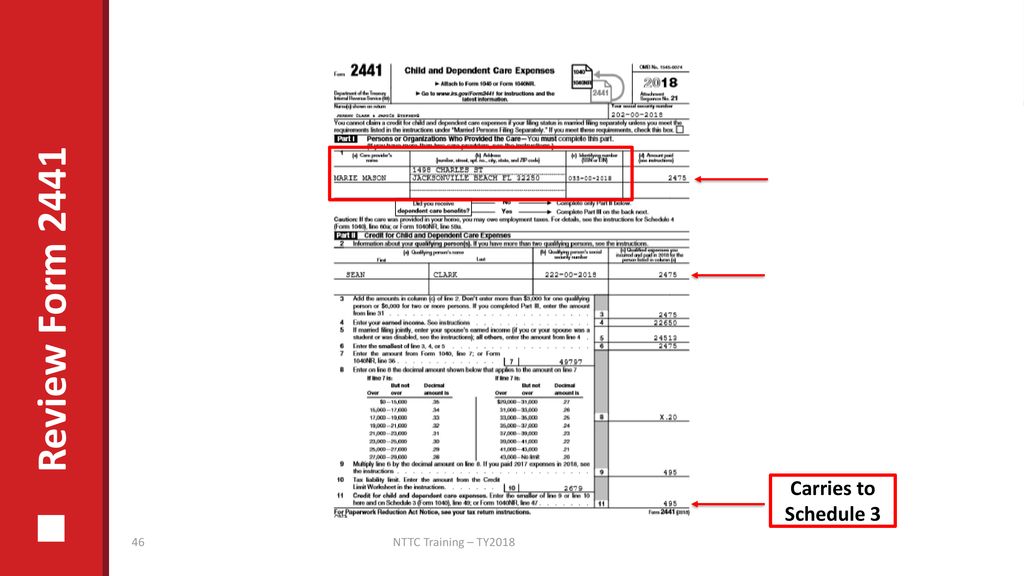

Quality Review of Tax Return ppt download

If you hire someone to care for a dependent or your disabled spouse, and you. What should i put for provider paid amount? The following link will provide more information: Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. You should enter the amount.

IRS Form 2441. Child and Dependent Care Expenses Forms Docs 2023

What should i put for provider paid amount? You should enter the amount you paid the provider for childcare. Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. The following link will provide more information: If you hire someone to care for a dependent.

Form 5695 For 2024 Keri Selena

If you hire someone to care for a dependent or your disabled spouse, and you. You should enter the amount you paid the provider for childcare. The following link will provide more information: Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market. What should.

You Should Enter The Amount You Paid The Provider For Childcare.

If you hire someone to care for a dependent or your disabled spouse, and you. The following link will provide more information: What should i put for provider paid amount? Amounts your employer paid directly to either you or your care provider for the care of your qualifying person(s) while you worked, the fair market.