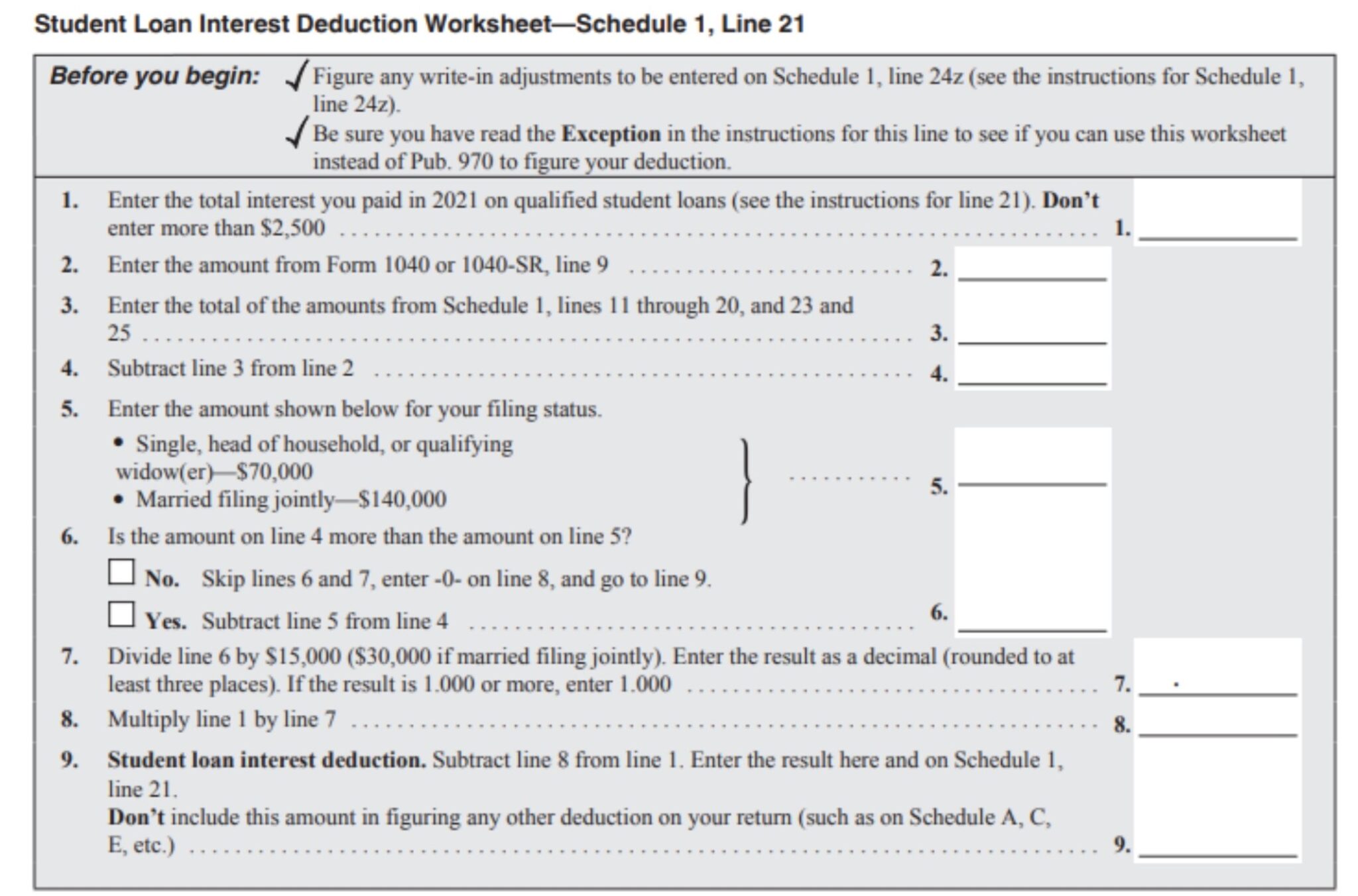

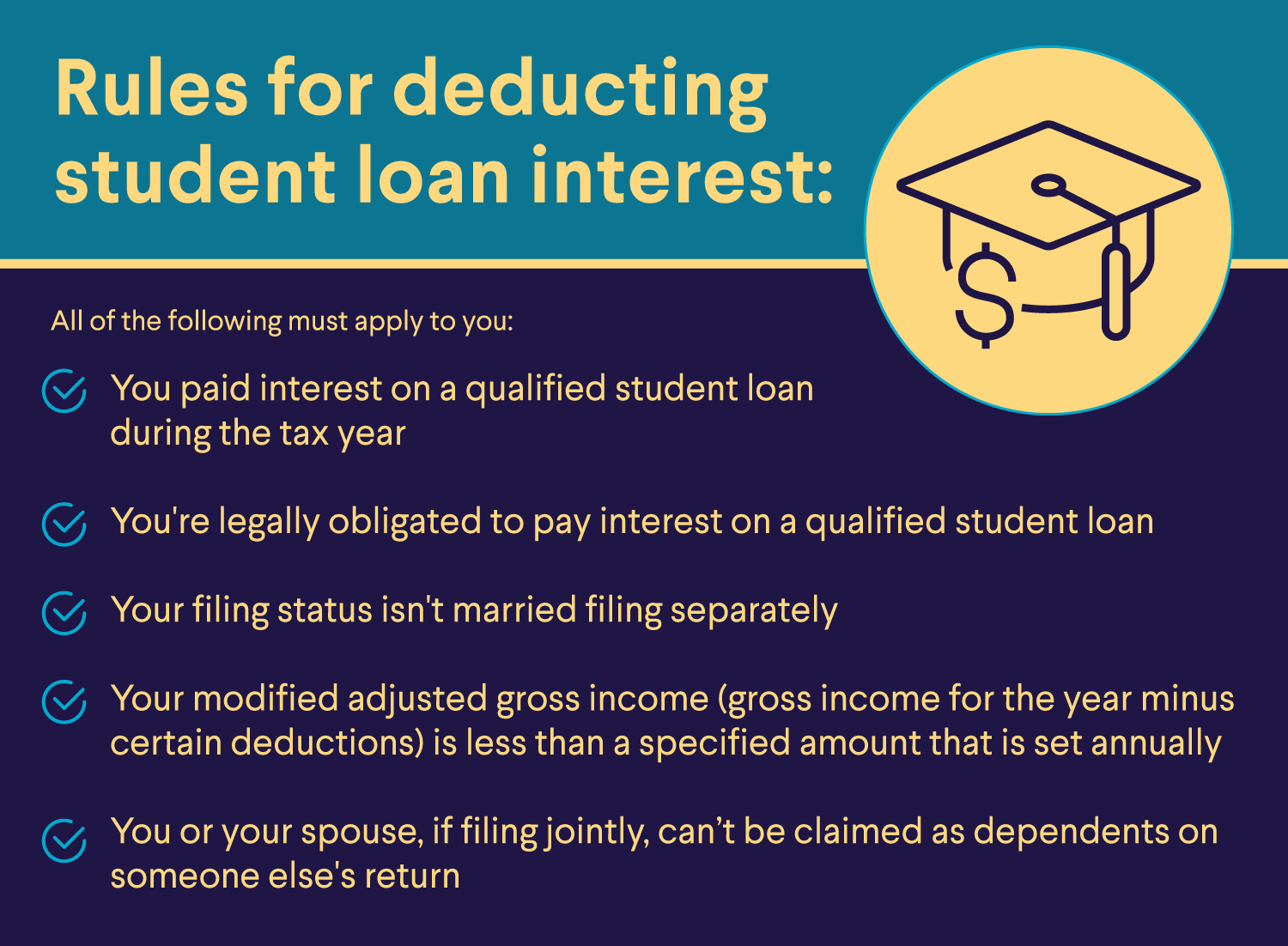

Student Loan Interest Deduction Worksheet 2021 - If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Don't enter more than $2,500. Updated for filing 2021 tax returns. As long as your filing status is not married filing separately and you are not. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). Paying back your student loan won’t. Student loan interest deduction worksheet. How do student loan interest payments lower my taxes owed?

If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Student loan interest deduction worksheet. How do student loan interest payments lower my taxes owed? As long as your filing status is not married filing separately and you are not. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). Don't enter more than $2,500. Updated for filing 2021 tax returns. Paying back your student loan won’t.

As long as your filing status is not married filing separately and you are not. Paying back your student loan won’t. Don't enter more than $2,500. Updated for filing 2021 tax returns. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). How do student loan interest payments lower my taxes owed? Student loan interest deduction worksheet. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude.

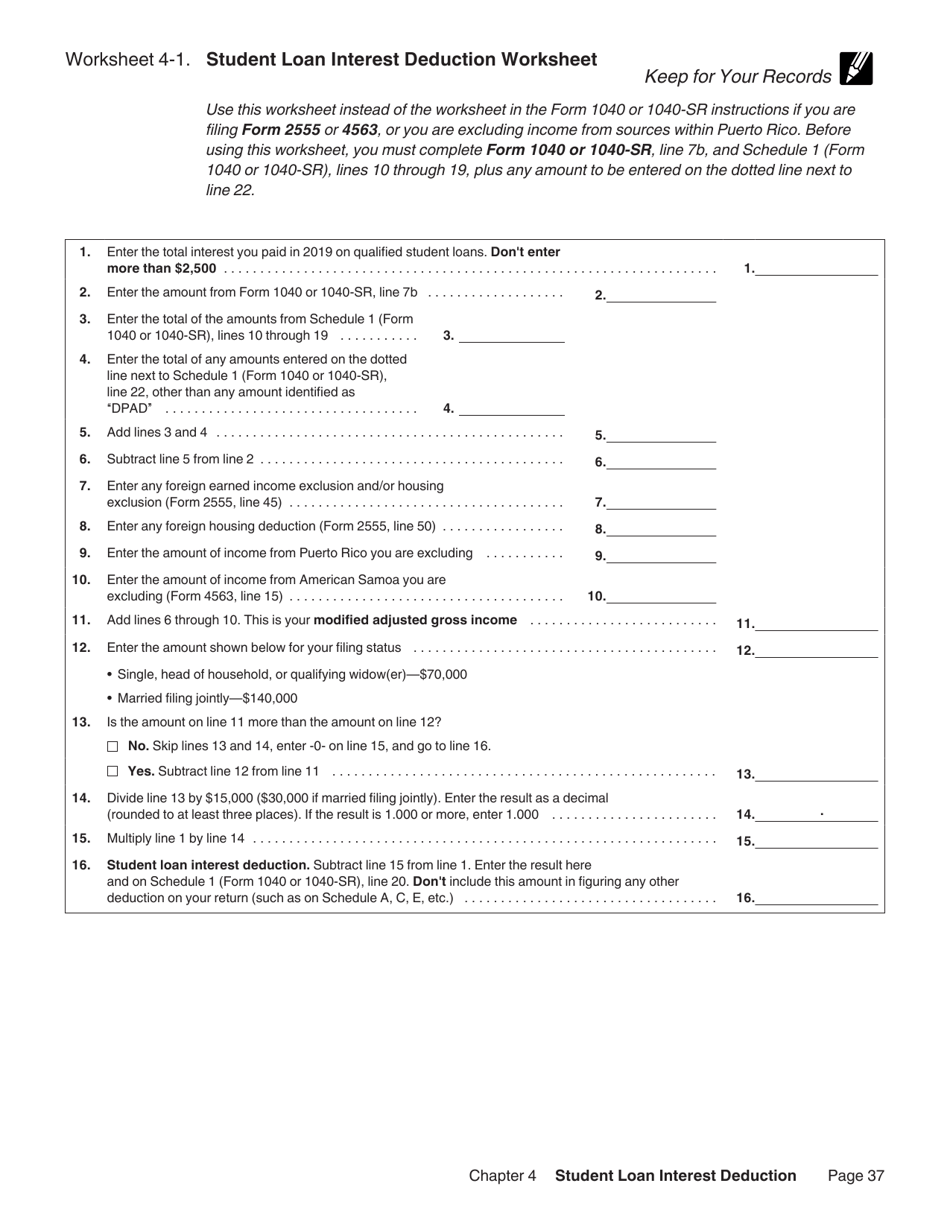

Student Loan Interest Deduction Worksheet (Publication 970) Fill Out

Don't enter more than $2,500. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Paying back your student loan won’t. Student loan interest deduction worksheet. Updated for filing 2021 tax returns.

Claiming The Student Loan Interest Deduction

Updated for filing 2021 tax returns. Student loan interest deduction worksheet. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Don't enter more than $2,500.

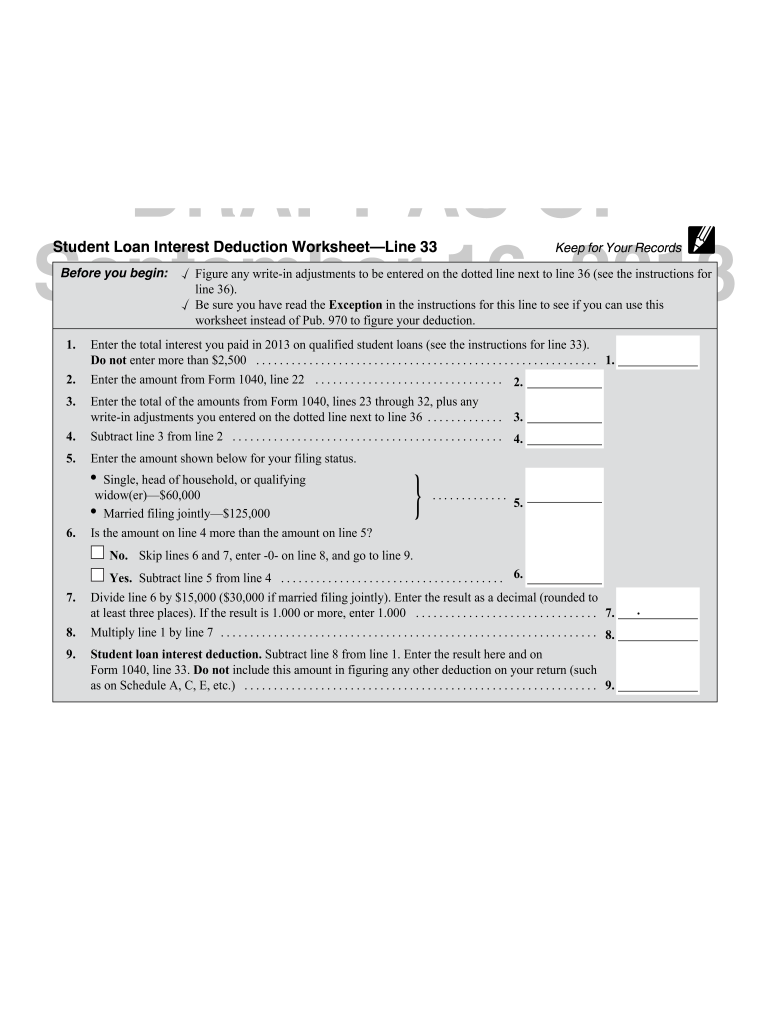

Tax and interest deduction worksheet 2023 Fill out & sign online DocHub

How do student loan interest payments lower my taxes owed? Updated for filing 2021 tax returns. Paying back your student loan won’t. As long as your filing status is not married filing separately and you are not. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if.

Student Loan Interest Deduction AwesomeFinTech Blog

Updated for filing 2021 tax returns. Paying back your student loan won’t. Don't enter more than $2,500. Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). How do student loan interest payments lower my taxes owed?

Student Loan Interest Deduction Worksheet Walkthrough (IRS

Student loan interest deduction worksheet. As long as your filing status is not married filing separately and you are not. If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Enter the total interest you paid in 2022 on qualified student loans (see instructions for.

Tax And Interest Deduction Worksheet 2023

If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Student loan interest deduction worksheet. Paying back your student loan won’t. Don't enter more than $2,500. How do student loan interest payments lower my taxes owed?

Learn How the Student Loan Interest Deduction Works

As long as your filing status is not married filing separately and you are not. How do student loan interest payments lower my taxes owed? If you file a form 2555, foreign earned income, form 4563, exclusion of income for bona fide residents of american samoa, or if you exclude. Updated for filing 2021 tax returns. Student loan interest deduction.

Is Student Loan Interest Tax Deductible? RapidTax

Student loan interest deduction worksheet. Paying back your student loan won’t. How do student loan interest payments lower my taxes owed? Don't enter more than $2,500. Updated for filing 2021 tax returns.

What You Should Know About the Student Loan Interest Deduction SoFi

Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). Paying back your student loan won’t. Don't enter more than $2,500. How do student loan interest payments lower my taxes owed? Student loan interest deduction worksheet.

Student Loan Interest Deduction Worksheet 2021 Printable Word Searches

How do student loan interest payments lower my taxes owed? Updated for filing 2021 tax returns. Paying back your student loan won’t. Don't enter more than $2,500. As long as your filing status is not married filing separately and you are not.

As Long As Your Filing Status Is Not Married Filing Separately And You Are Not.

Paying back your student loan won’t. How do student loan interest payments lower my taxes owed? Enter the total interest you paid in 2022 on qualified student loans (see instructions for line 21). Don't enter more than $2,500.

If You File A Form 2555, Foreign Earned Income, Form 4563, Exclusion Of Income For Bona Fide Residents Of American Samoa, Or If You Exclude.

Student loan interest deduction worksheet. Updated for filing 2021 tax returns.