State Of Nebraska Tax Exempt Form - Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that. It is unlawful to claim an exemption for purchases. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. The department is committed to the fair administration of the nebraska tax laws.

The department is committed to the fair administration of the nebraska tax laws. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. It is unlawful to claim an exemption for purchases. Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that.

8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that. The department is committed to the fair administration of the nebraska tax laws. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. It is unlawful to claim an exemption for purchases.

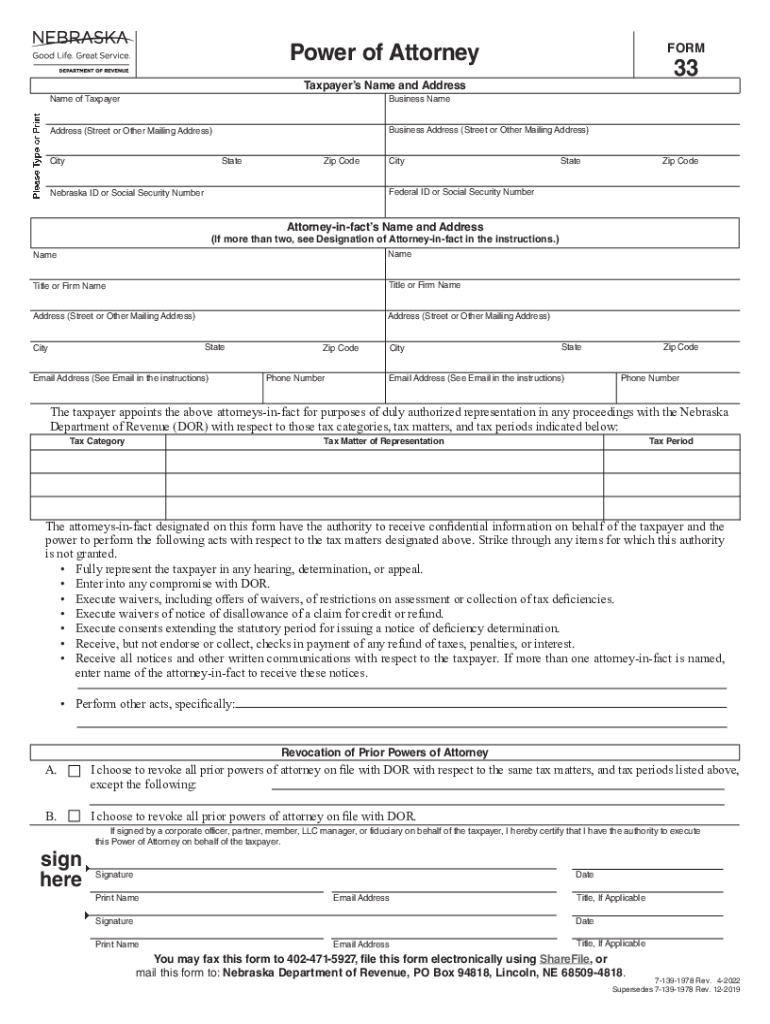

Ne Power Attorney 20222024 Form Fill Out and Sign Printable PDF

8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. The department is committed to the fair administration of the nebraska tax laws. Pursuant.

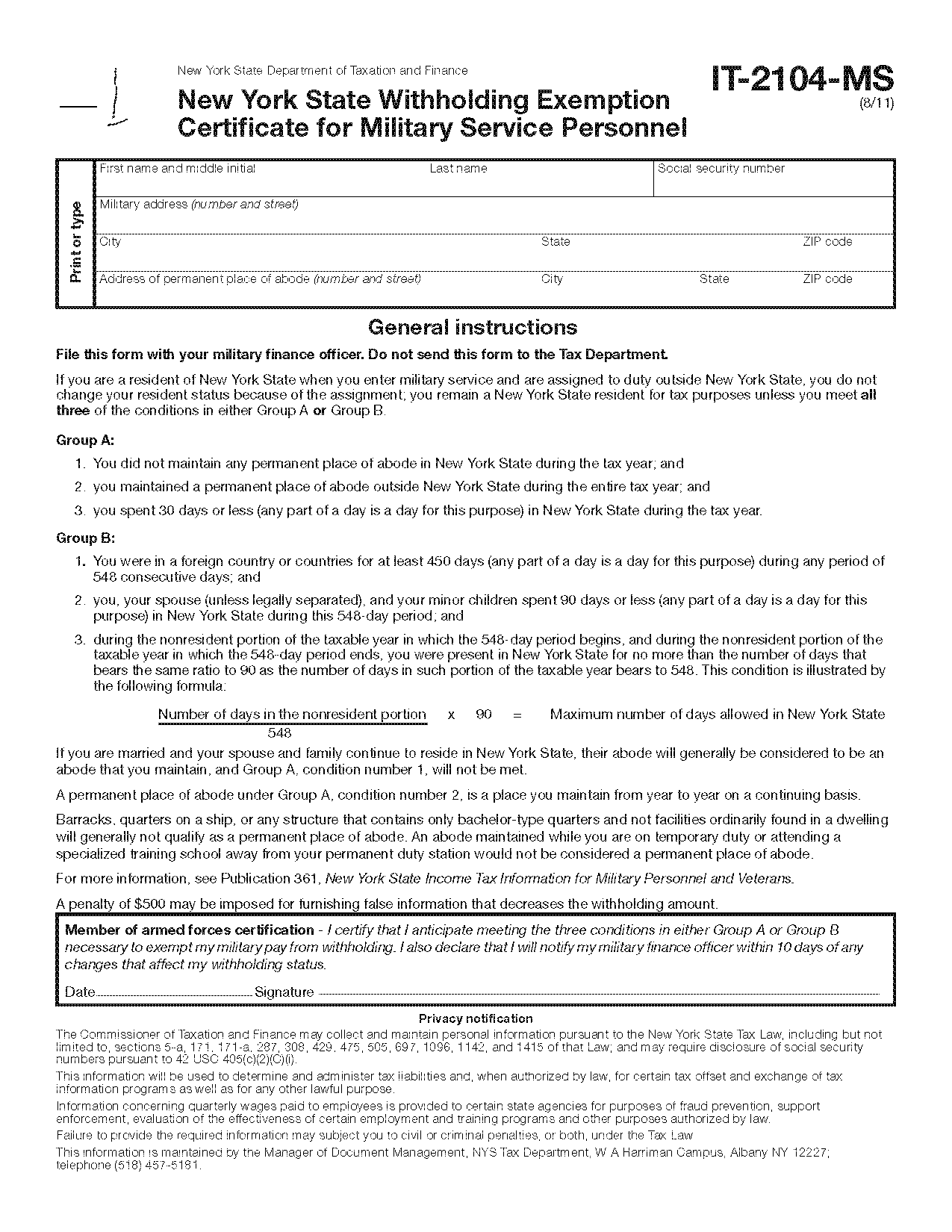

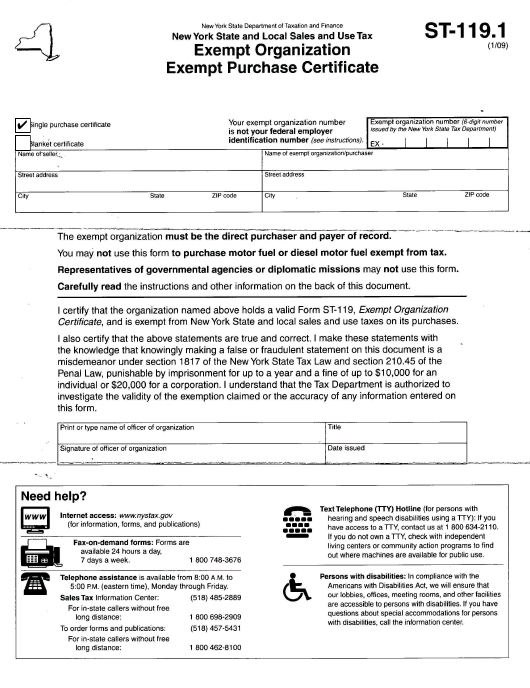

New York State Tax Exempt Form

I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. The department is committed to the fair administration of the nebraska tax laws. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. I.

Nebraska Sales Tax Exempt Sale Certificate

I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing.

Nebraska Form 13 (Nebraska Resale or Exempt Sale Certificate for Sales

The department is committed to the fair administration of the nebraska tax laws. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. It.

Non Profit Sales Tax Exemption Form Nebraska

The department is committed to the fair administration of the nebraska tax laws. 8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that. It is unlawful.

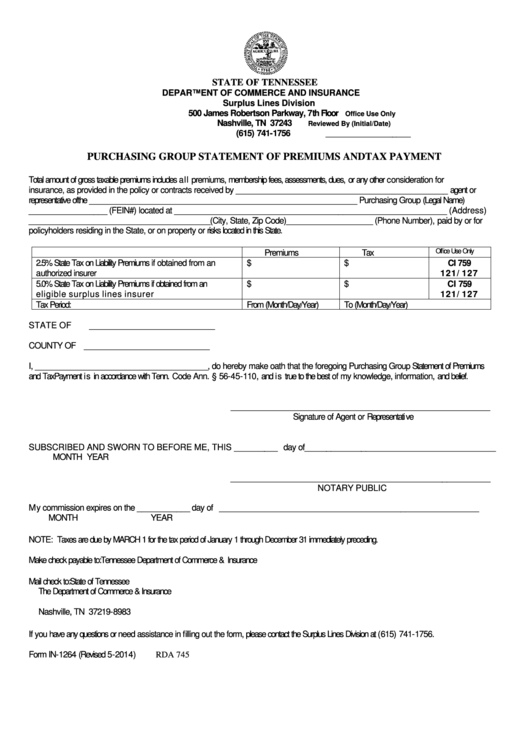

North Dakota Sales Tax Exempt Form

Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. It is unlawful to claim an exemption for purchases. I hereby certify that the.

Harbor Freight Tax Exempt Form

Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that. The department is committed to the fair administration of the nebraska tax laws. It is unlawful to claim an exemption for purchases. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from.

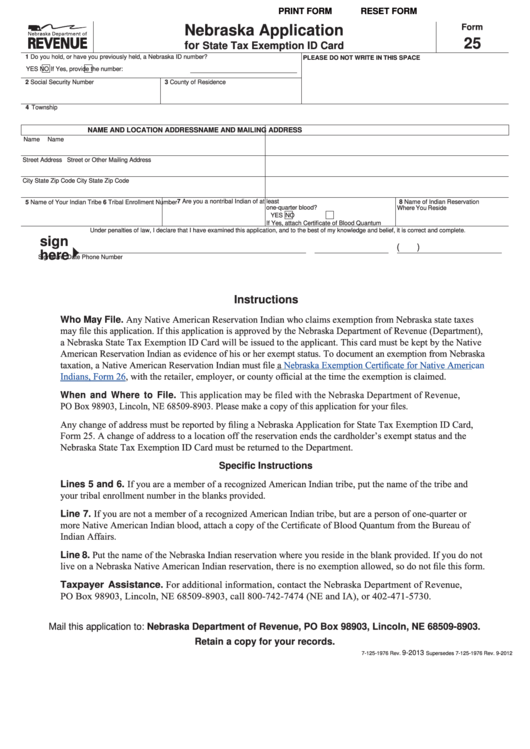

Fillable Form 25 Nebraska Application For State Tax Exemption Id Card

The department is committed to the fair administration of the nebraska tax laws. It is unlawful to claim an exemption for purchases. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. I hereby certify that the purchase, lease, or rental by the above purchaser is.

Nebraska Sales Tax Exempt Sale Certificate

8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from.

New York State Tax Exempt Form Farm

I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. Pursuant to an attached purchasing agent appointment and delegation of authroity for sales and use tax, form 17, i hereby certify that. The department is committed to the fair administration of the nebraska tax laws. I.

It Is Unlawful To Claim An Exemption For Purchases.

8 rows code, ch.1, § 012 the nebraska department of revenue (dor) is publishing the following sales tax exemption list of most. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:. The department is committed to the fair administration of the nebraska tax laws. I hereby certify that the purchase, lease, or rental by the above purchaser is exempt from the nebraska sales tax for the following reason:.