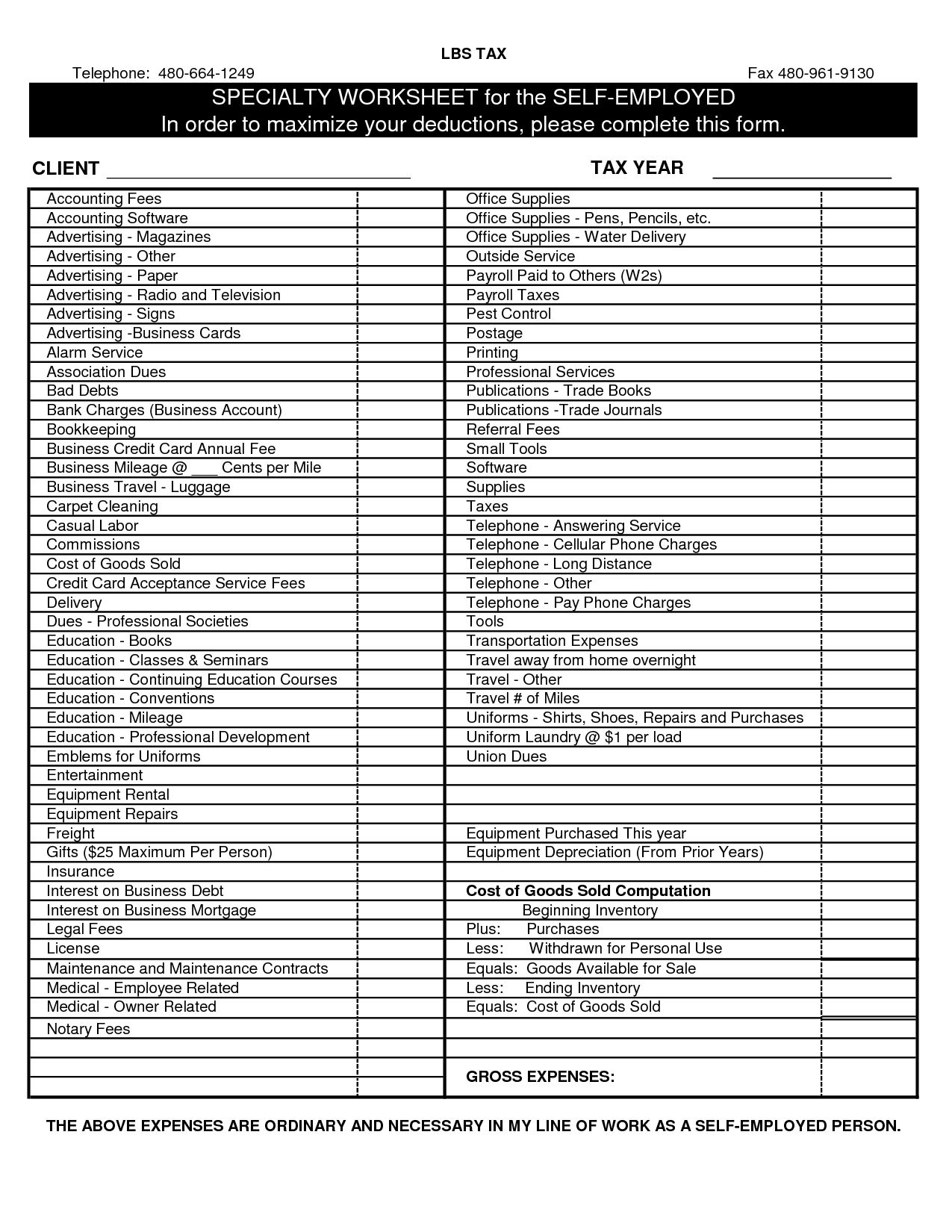

Self Employment Printable Small Business Tax Deductions Worksheet - The irs does not allow a. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Keep a written mileage log showing the date, miles, and business purpose for each trip. All forms 1099 and the detail. This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. If you checked none of these above, please continue by completing the worksheet below for each business.

The irs does not allow a. This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. Keep a written mileage log showing the date, miles, and business purpose for each trip. If you checked none of these above, please continue by completing the worksheet below for each business. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. All forms 1099 and the detail.

If you checked none of these above, please continue by completing the worksheet below for each business. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. The irs does not allow a. All forms 1099 and the detail. Keep a written mileage log showing the date, miles, and business purpose for each trip.

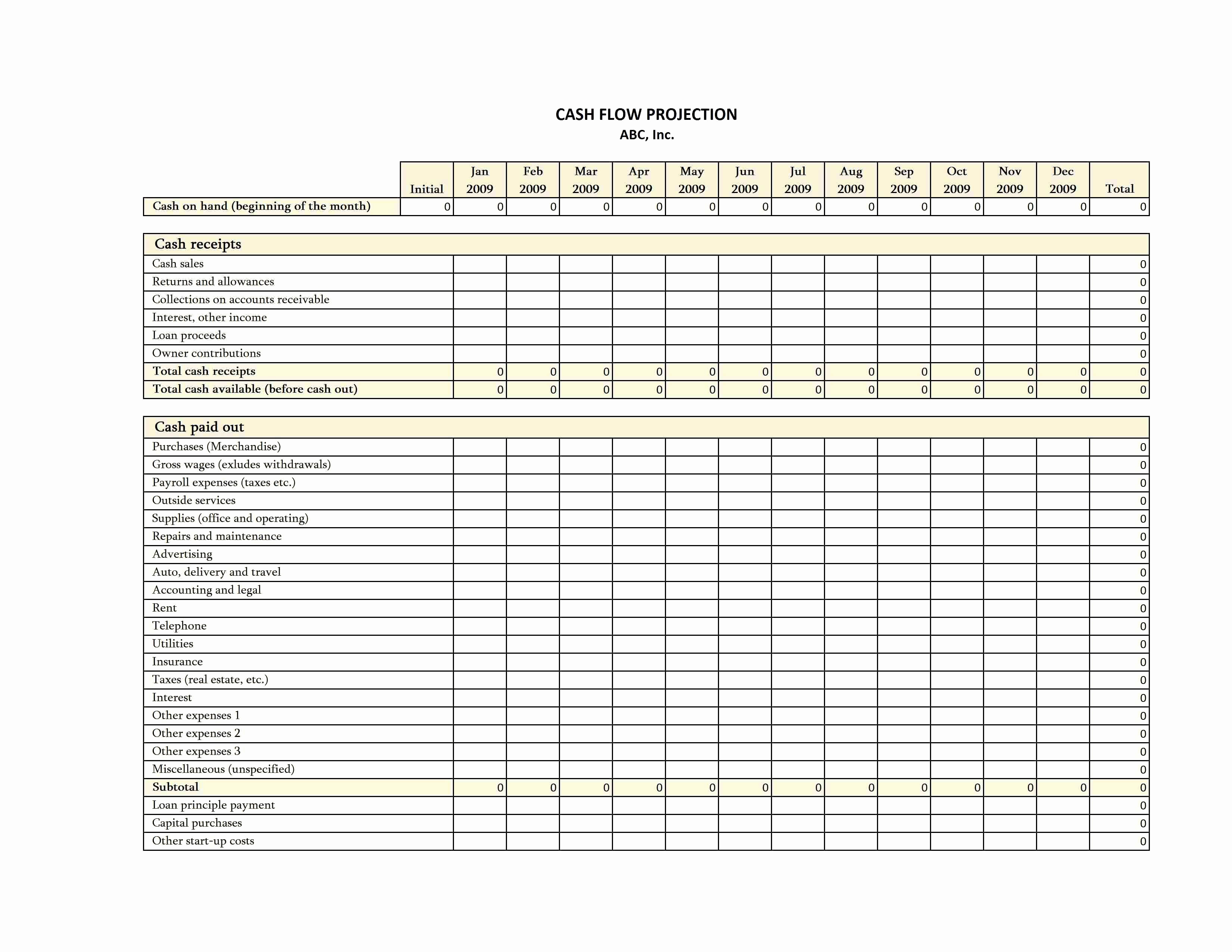

Printable Tax Organizer Template

This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. Keep a written mileage log showing the date, miles, and business purpose for each trip. If you checked none of these above, please continue by completing the worksheet below for each business. The irs does not allow a. A collection of relevant forms.

Self Employment Printable Small Business Tax Deductions Work

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Keep a written mileage log showing the date, miles, and business purpose for each trip. If you checked none of these above, please continue by completing the worksheet below for each business. The irs does not allow a. This downloadable file contains worksheets for, wages.

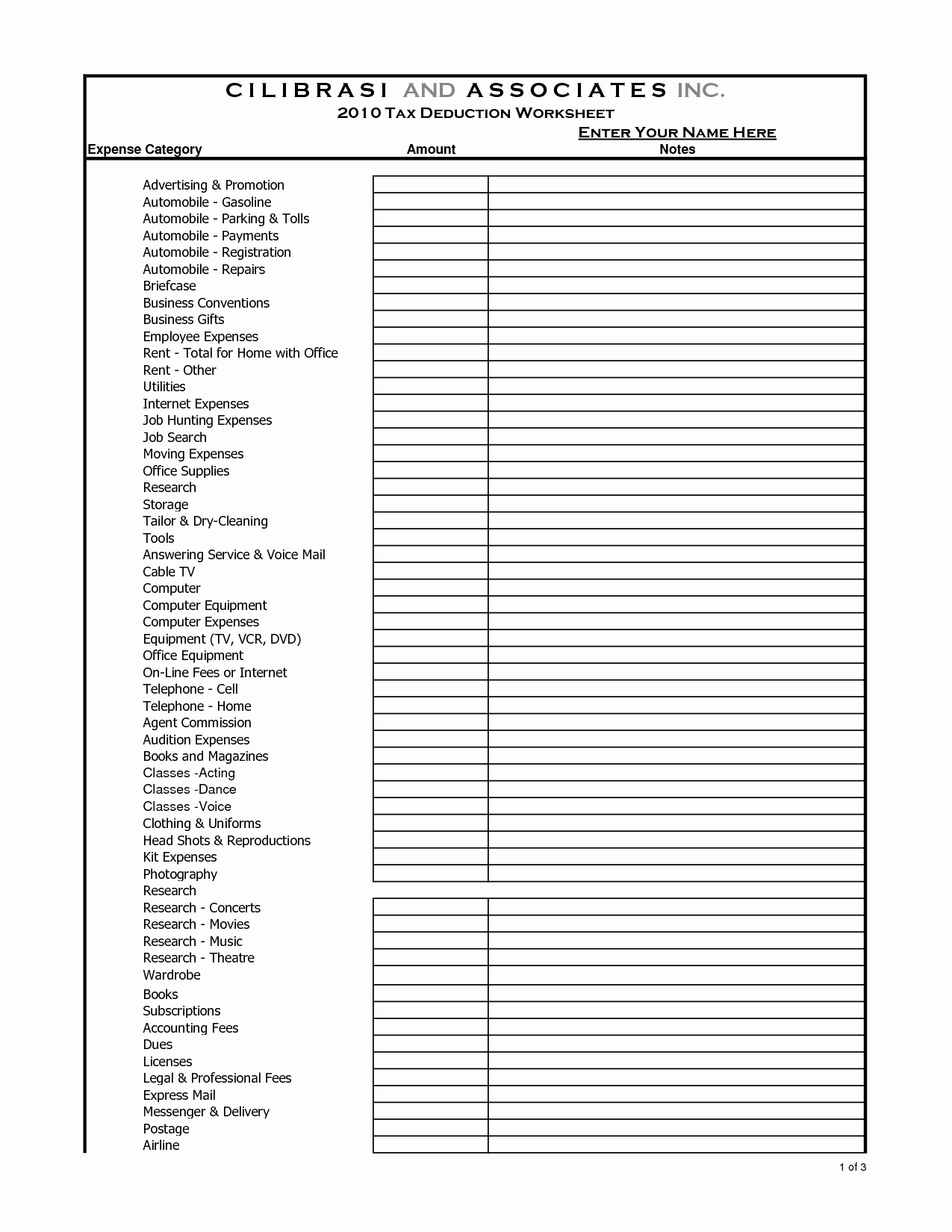

Printable Itemized Deductions Worksheet

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Keep a written mileage log showing the date, miles, and business purpose for each trip. All forms 1099 and the detail. The irs does not allow a. If you checked none of these above, please continue by completing the worksheet below for each business.

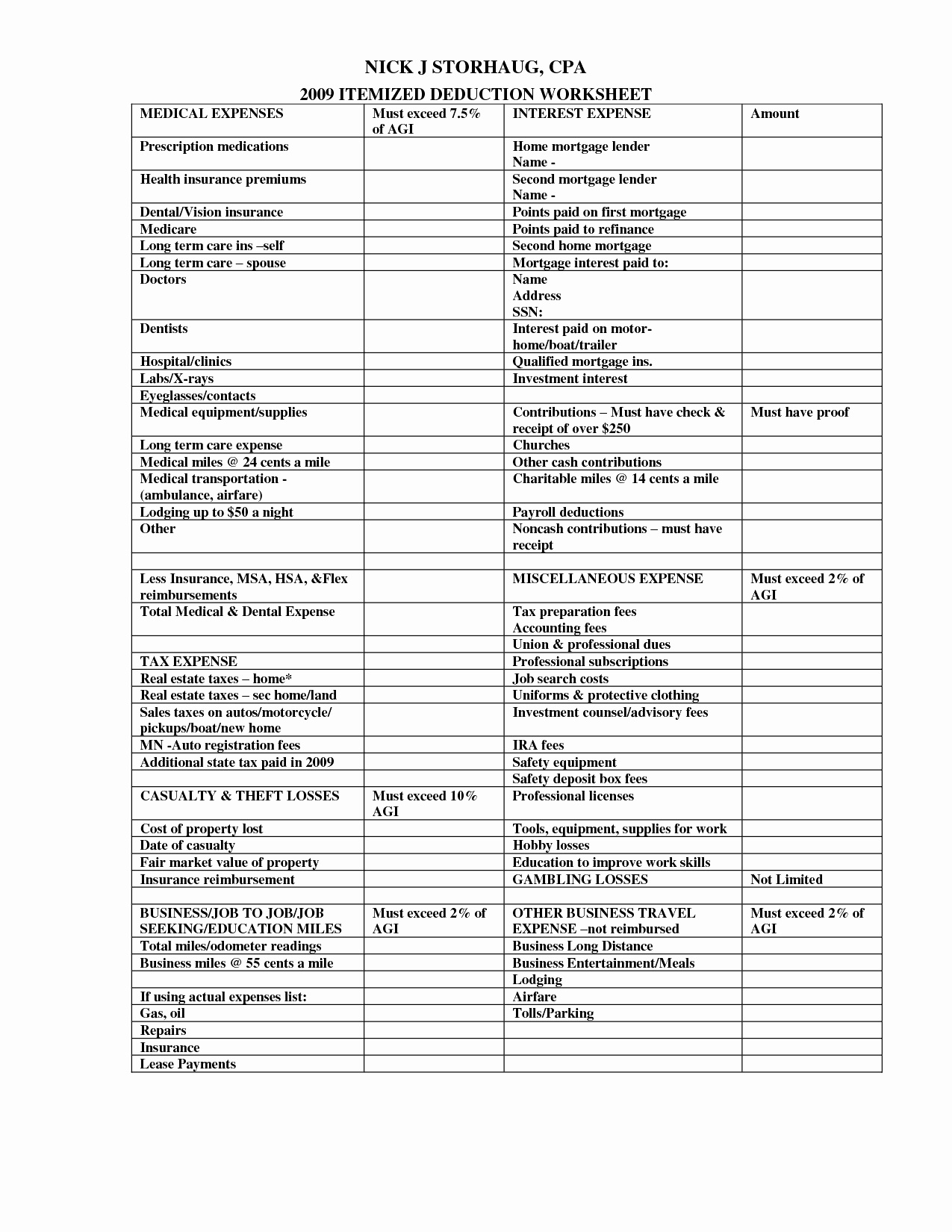

Small Business Tax Deductions Worksheet The Best Worksheets Image

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. The irs does not allow a. Keep a written mileage log showing the date, miles, and business purpose for each trip. If you checked none of these above, please continue by completing the worksheet below for each business. This downloadable file contains worksheets for, wages.

Small Business Tax Deductions Worksheet New Tax Deduction with Small

If you checked none of these above, please continue by completing the worksheet below for each business. Keep a written mileage log showing the date, miles, and business purpose for each trip. This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. All forms 1099 and the detail. The irs does not allow.

FunctionalBest Of Self Employed Tax Deductions Worksheet Check more at

This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. All forms 1099 and the detail. Keep a written mileage log showing the date, miles, and business purpose for each trip. If you checked none of these above, please continue by completing the worksheet below for each business. The irs does not allow.

Small Business Deductions Worksheet Inspirational Startup Business

Keep a written mileage log showing the date, miles, and business purpose for each trip. If you checked none of these above, please continue by completing the worksheet below for each business. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. The irs does not allow a. All forms 1099 and the detail.

Self Employment Printable Small Business Tax Deductions Worksheet

A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. Keep a written mileage log showing the date, miles, and business purpose for each trip. This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. The irs does not allow a. If you checked none of these above,.

The Ultimate Self Employed Deduction Cheat Sheet! Exceptional Tax

All forms 1099 and the detail. Keep a written mileage log showing the date, miles, and business purpose for each trip. The irs does not allow a. If you checked none of these above, please continue by completing the worksheet below for each business. This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income.

Self Employment Printable Small Business Tax Deductions Work

All forms 1099 and the detail. The irs does not allow a. This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements. If you checked none of these above, please continue by completing the worksheet below for each.

The Irs Does Not Allow A.

This downloadable file contains worksheets for, wages and pensions, ira distributions, interest and dividends, miscellaneous income (tax. If you checked none of these above, please continue by completing the worksheet below for each business. Keep a written mileage log showing the date, miles, and business purpose for each trip. A collection of relevant forms and publications related to understanding and fulfilling your filing requirements.