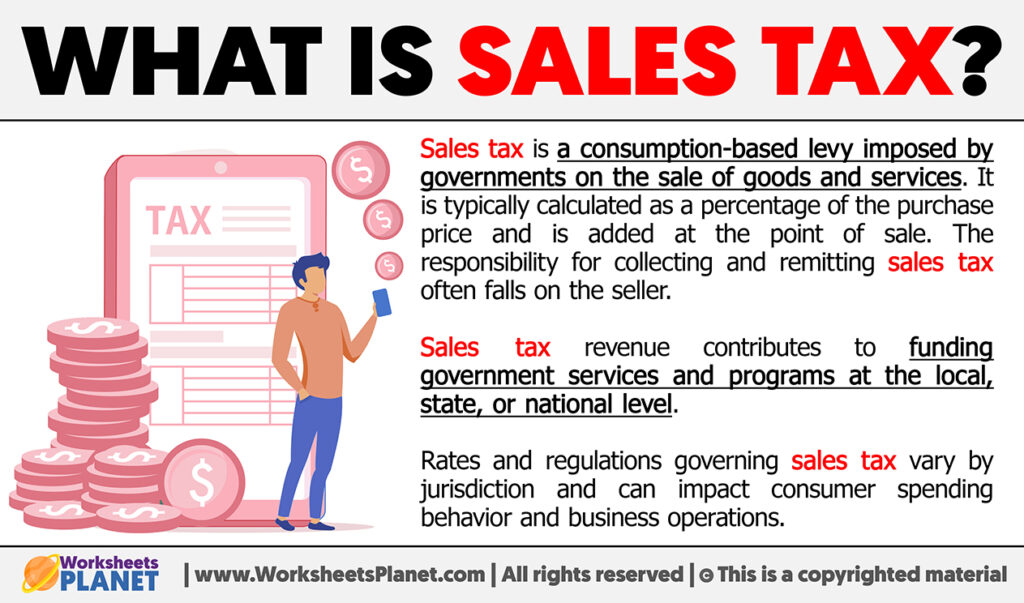

Sales Tax Definition Math - Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. The rates of tax on purchase of different. It is typically calculated as a percentage of the. It is based on a certain percent of the price. A sales tax is a tax that is paid for the sale of certain goods and services. In the united states, different states have different sales tax rates,. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. The formula to calculate the sales. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for.

A sales tax is a tax that is paid for the sale of certain goods and services. It is typically calculated as a percentage of the. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. The formula to calculate the sales. In the united states, different states have different sales tax rates,. Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. It is based on a certain percent of the price. Sales tax is a consumption tax imposed by governments on the sale of goods and services. A tax charged by the government to raise money so it can provide public services.

The rates of tax on purchase of different. It is based on a certain percent of the price. It is typically calculated as a percentage of the. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. A tax charged by the government to raise money so it can provide public services. The formula to calculate the sales. Sales tax is a consumption tax imposed by governments on the sale of goods and services. Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. In the united states, different states have different sales tax rates,.

4 Ways to Calculate Sales Tax wikiHow Sales tax, Tax, Sales and

It is based on a certain percent of the price. In the united states, different states have different sales tax rates,. Sales tax is a consumption tax imposed by governments on the sale of goods and services. The rates of tax on purchase of different. It is typically calculated as a percentage of the.

4 Tips on Amended Sales Tax Returns CPA Practice Advisor

A sales tax is a tax that is paid for the sale of certain goods and services. The rates of tax on purchase of different. It is based on a certain percent of the price. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. The formula to.

What is Sales Tax?

Sales tax is a consumption tax imposed by governments on the sale of goods and services. The formula to calculate the sales. It is typically calculated as a percentage of the. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. A tax charged by the government to.

Sales Tax Presentation

It is based on a certain percent of the price. The rates of tax on purchase of different. A sales tax is a tax that is paid for the sale of certain goods and services. The formula to calculate the sales. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on.

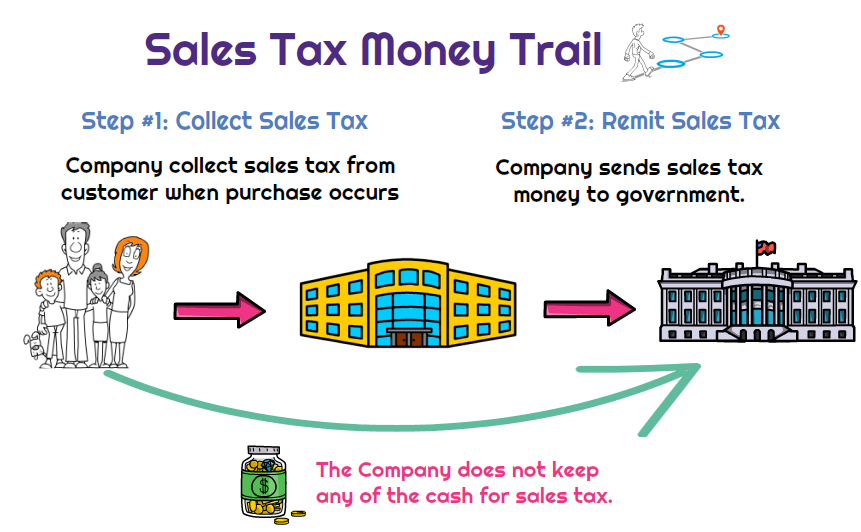

Why is sales tax considered pass through for a company? Universal CPA

A tax charged by the government to raise money so it can provide public services. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for..

How to Calculate Sales Tax? The Complete Guide ProPakistani

It is typically calculated as a percentage of the. Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. The rates of tax on purchase of different. A.

sales tax A Maths Dictionary for Kids Quick Reference by Jenny Eather

It is typically calculated as a percentage of the. It is based on a certain percent of the price. In the united states, different states have different sales tax rates,. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for. A tax charged by the government.

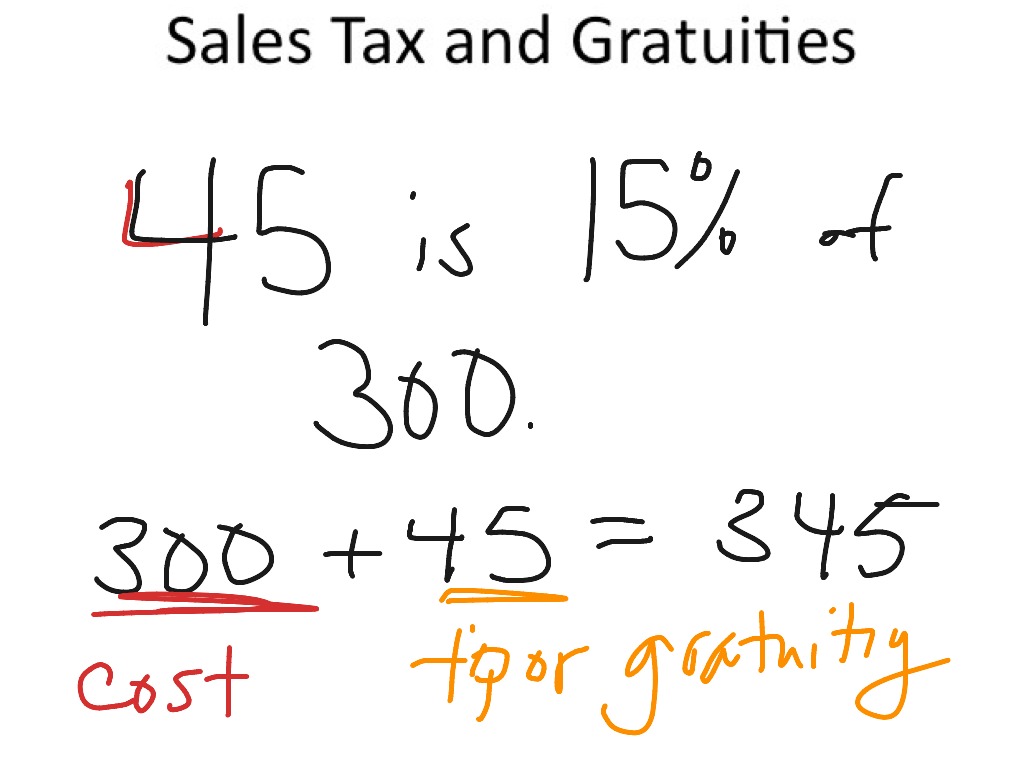

Sales Tax and Gratuities Math ShowMe

Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. It is based on a certain percent of the price. A tax charged by the government to raise money so it can provide public services. A sales tax is a tax that is paid for the sale of certain goods.

How To Calculate Percentage Vat Haiper

The rates of tax on purchase of different. Sales tax is a percentage added to the actual price of a product charged during the time of the transaction. Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. It is based on a certain percent of the price. A.

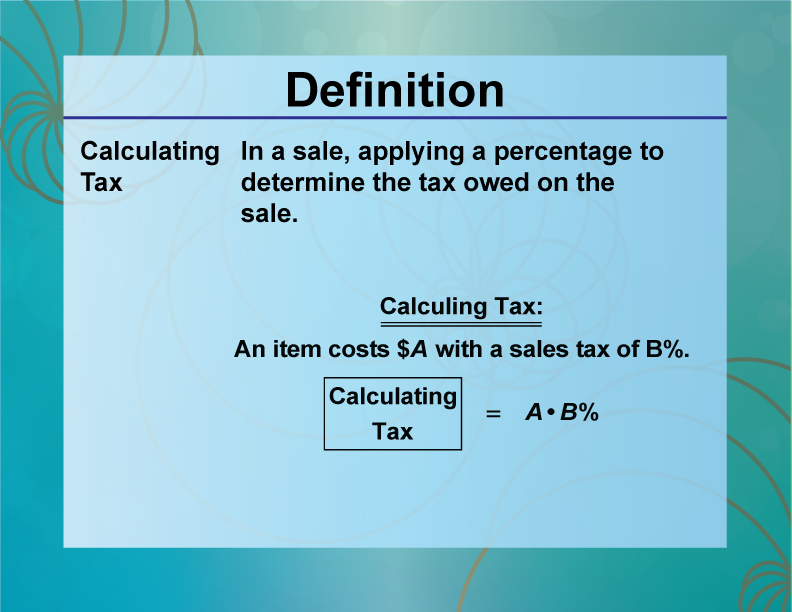

DefinitionRatios, Proportions, and Percents ConceptsCalculating Tax

The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. A sales tax is a tax that is paid for the sale of certain goods and services. The formula to calculate the sales. The rates of tax on purchase of different. It is based on a certain percent.

A Tax Charged By The Government To Raise Money So It Can Provide Public Services.

It is typically calculated as a percentage of the. The sales tax is the sum of money a buyer pays over and above the price of a commodity to buy it. In the united states, different states have different sales tax rates,. Sales tax, value added tax, goods and services tax are the types of taxes imposed by the government on the products and services for.

Sales Tax Is A Consumption Tax Imposed By Governments On The Sale Of Goods And Services.

Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer’s cost. A sales tax is a tax that is paid for the sale of certain goods and services. The formula to calculate the sales. It is based on a certain percent of the price.

Sales Tax Is A Percentage Added To The Actual Price Of A Product Charged During The Time Of The Transaction.

The rates of tax on purchase of different.