Pa Inheritance Tax Waiver Form - The inheritance tax return has to be prepared to ascertain the tax after all assets. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. If three beneficiaries, each gets 33.3%, etc. Oakmark says the waiver form is not required. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). It is important to check with an. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa.

1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. If three beneficiaries, each gets 33.3%, etc. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. It is important to check with an. Oakmark says the waiver form is not required. The inheritance tax return has to be prepared to ascertain the tax after all assets. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa.

It is important to check with an. If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. If three beneficiaries, each gets 33.3%, etc. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). The inheritance tax return has to be prepared to ascertain the tax after all assets. Oakmark says the waiver form is not required.

Inheritance Tax Waiver Form Missouri Form Resume Examples Ze12OJAKjx

Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). If three beneficiaries, each gets 33.3%, etc. A mutual fund company is saying they need an inheritance tax.

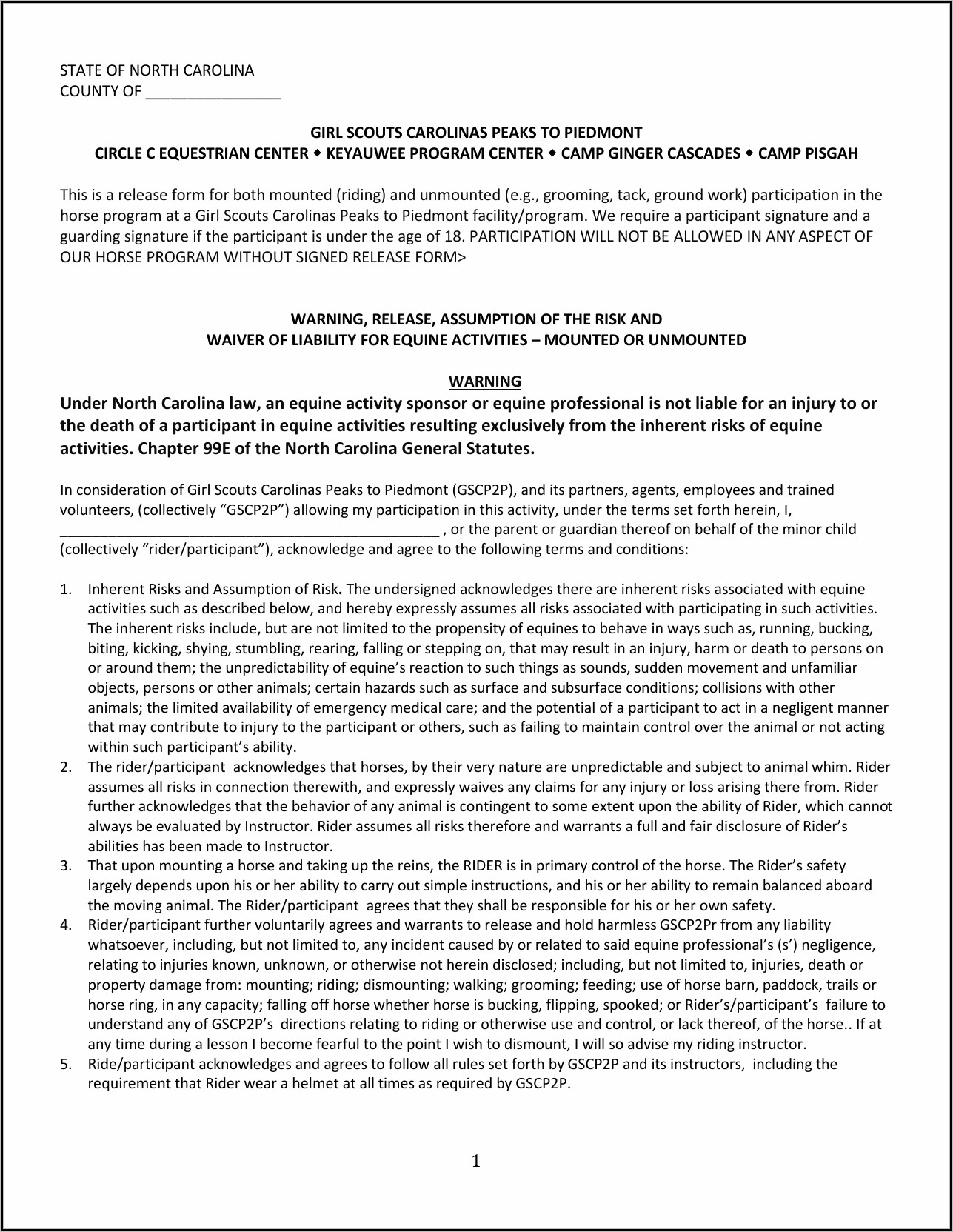

Horseback Riding Waiver Form Template 1 Resume Examples 76YGex432o

The inheritance tax return has to be prepared to ascertain the tax after all assets. It is important to check with an. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. Vanguard and byn mellon are asking for a.

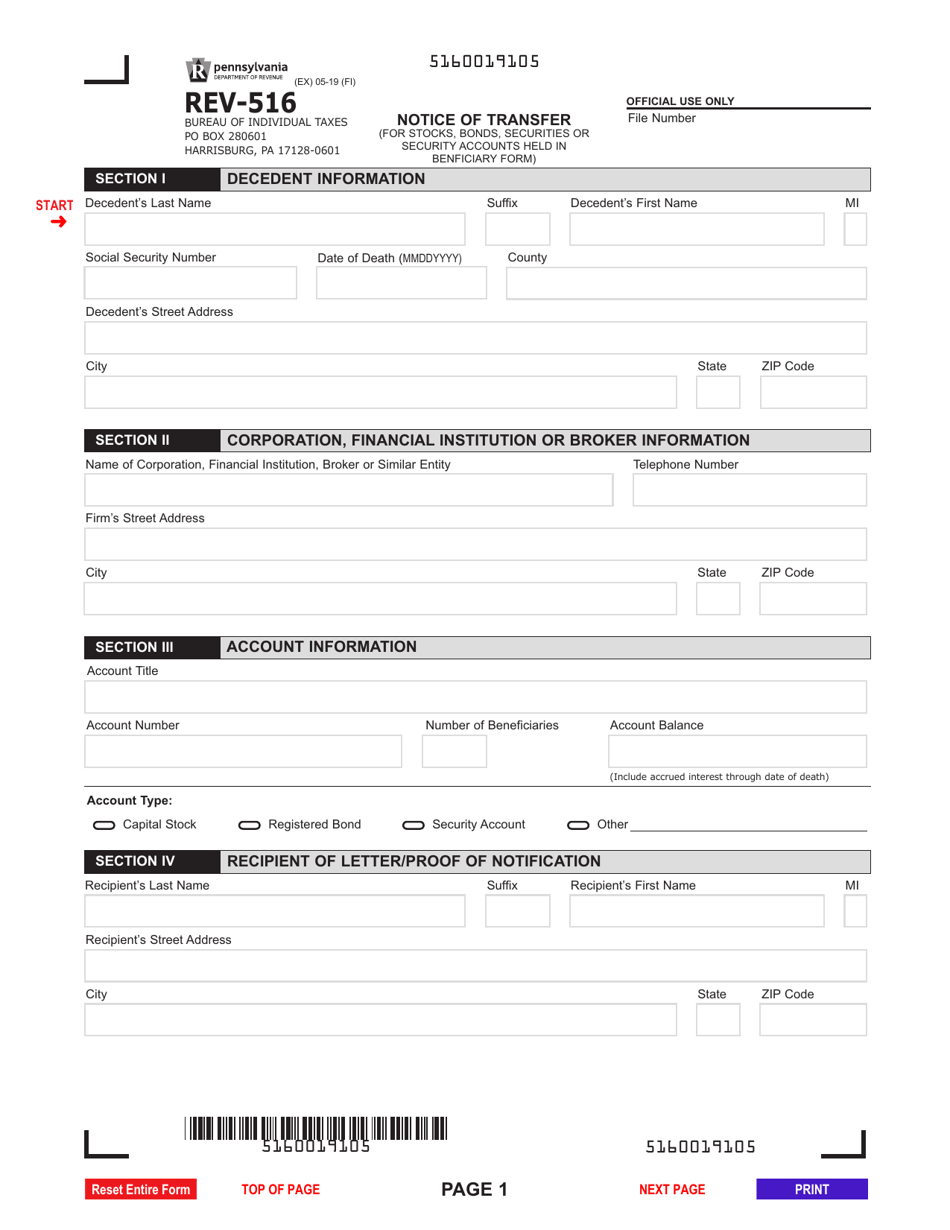

Inheritance Tax Waiver Form Nebraska

The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). A mutual fund company is saying they need an inheritance tax waiver before they can transfer.

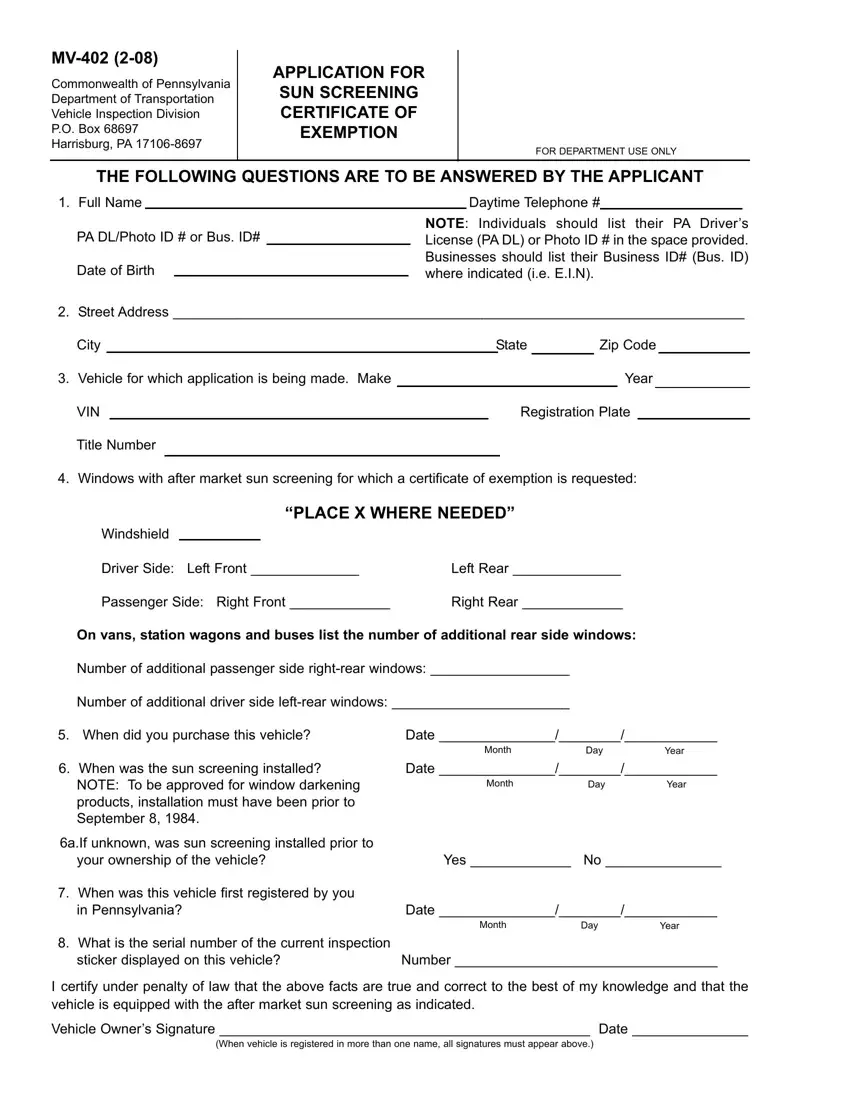

pa inheritance tax waiver request Derailing Site Photos

The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. Oakmark says the waiver form is not required. If three beneficiaries, each gets 33.3%,.

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the pa. It is important to check with an. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). If a decedent has a will, it may have.

Edris Wisniewski

The inheritance tax return has to be prepared to ascertain the tax after all assets. Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. The pa dept of revenue uses this information to send out a tax bill to each beneficiary for their respective share of the.

Inheritance Declaration Form For Pa US Legal Forms

Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. The inheritance tax return has to be prepared.

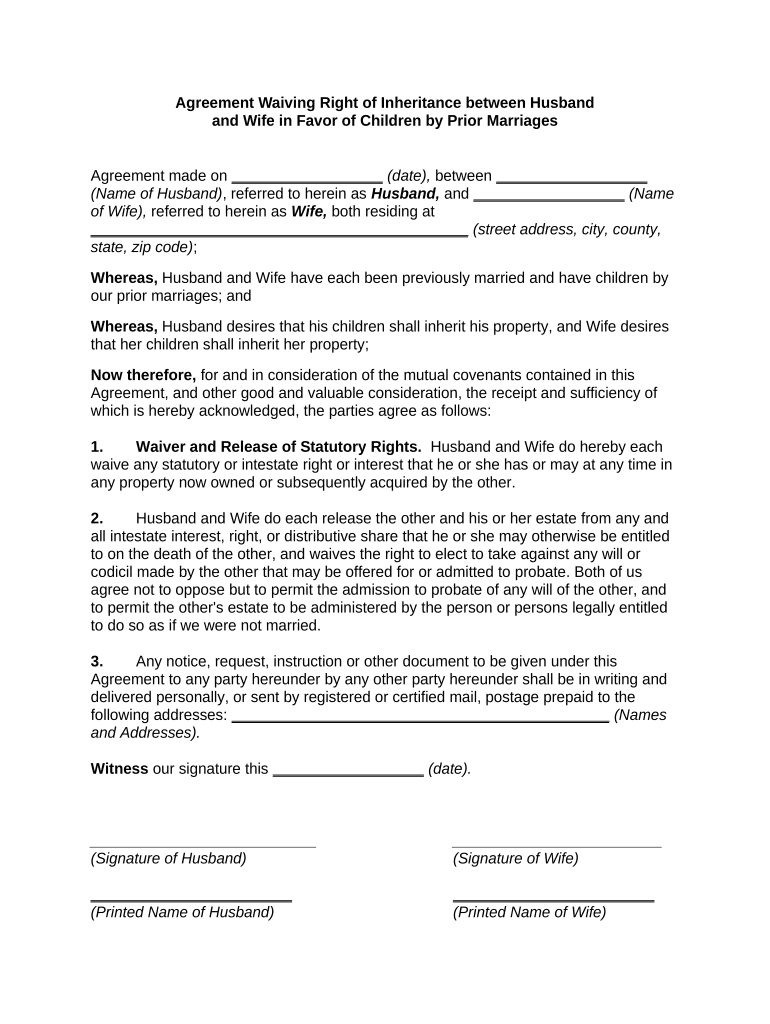

inheritance agreement template Doc Template pdfFiller

A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death. The inheritance tax return has to be prepared to ascertain the tax after all assets. Oakmark says the waiver form is not required. 1.) if the real estate is in.

Pa Inheritance Tax Waiver Form Rev 516 Tax Preparation Classes

If a decedent has a will, it may have a tax clause that directs the estate to pay the inheritance tax, even for assets passing outside the will. The inheritance tax return has to be prepared to ascertain the tax after all assets. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5%.

Waiver Of Inheritance Form For Probate US Legal Forms

Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. It is important to check with an. 1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). If three beneficiaries, each gets 33.3%, etc. The pa dept of.

If A Decedent Has A Will, It May Have A Tax Clause That Directs The Estate To Pay The Inheritance Tax, Even For Assets Passing Outside The Will.

If three beneficiaries, each gets 33.3%, etc. Oakmark says the waiver form is not required. The inheritance tax return has to be prepared to ascertain the tax after all assets. It is important to check with an.

The Pa Dept Of Revenue Uses This Information To Send Out A Tax Bill To Each Beneficiary For Their Respective Share Of The Pa.

1.) if the real estate is in pa it is subject to pa inheritance tax of 4.5% to children (you.). Vanguard and byn mellon are asking for a pa inheritance tax waiver form from us before they will distribute my mother's shares. A mutual fund company is saying they need an inheritance tax waiver before they can transfer ownership of the ira of a deceased person, who had specified payable on death.