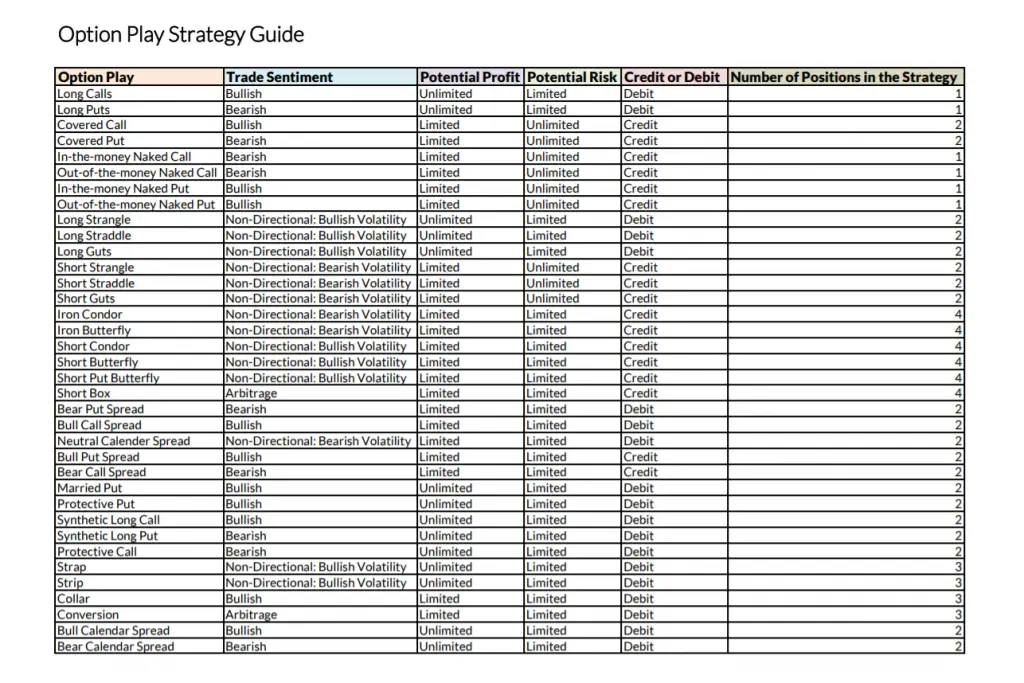

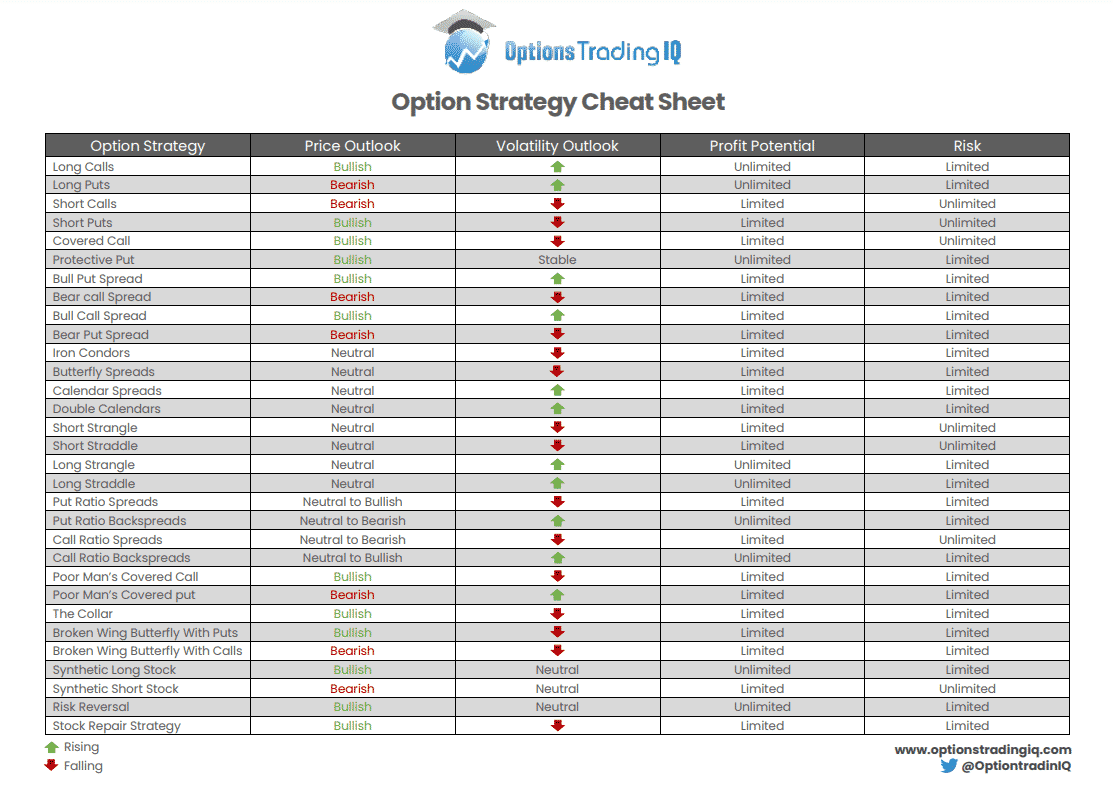

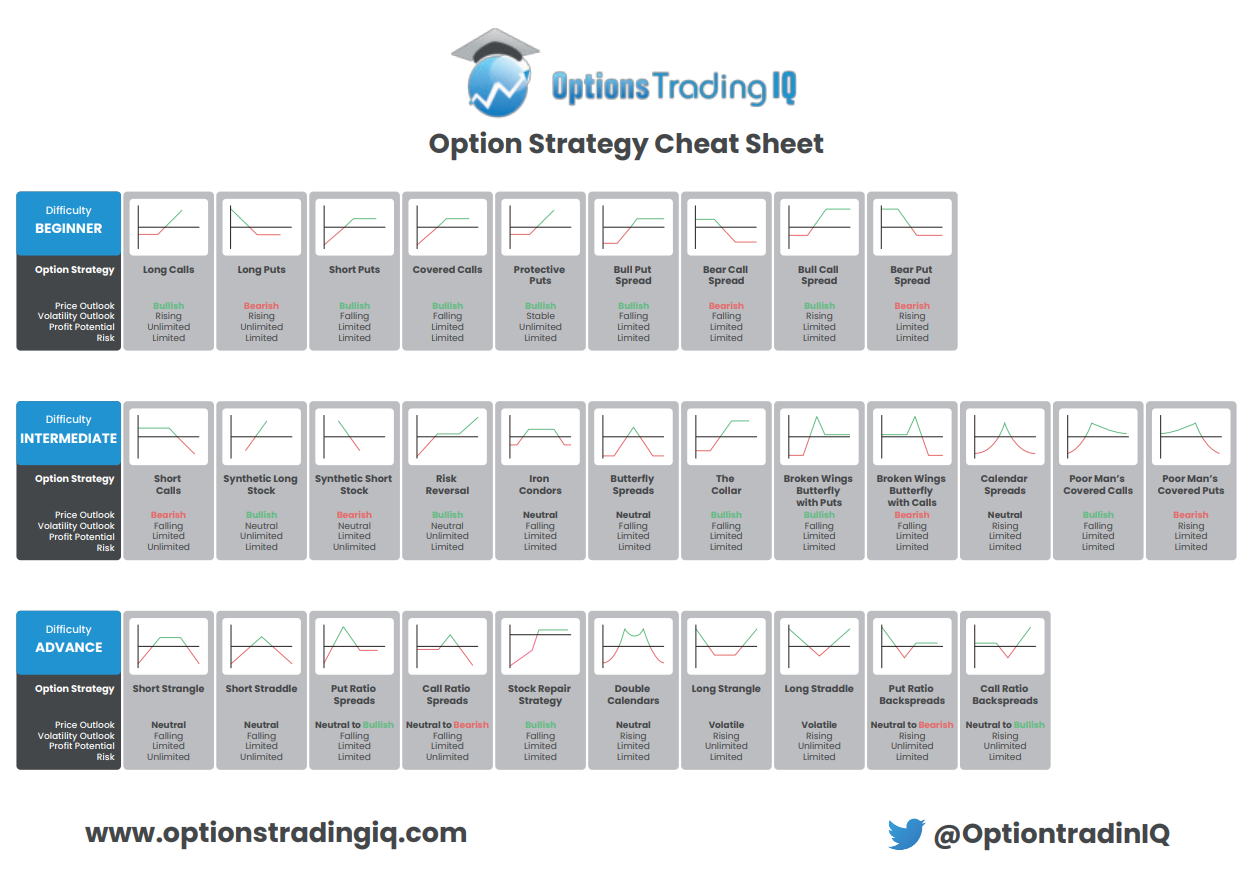

Options Strategy Cheat Sheet - A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Buying a put option makes it a ‘long put’.

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price.

Option Strategy Cheat Sheet Two Free Downloads

Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price.

Options Strategies Cheatsheet. Here is a ready referral to Option… by

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Buying a put option makes it a ‘long put’.

Option Strategy cheatsheet Trader Journal Options, Equities, and

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Option Strategies Cheat Sheet New Trader U

Buying a put option makes it a ‘long put’. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Options Strategies Cheat Sheet [FREE Download] How to Trade

Buying a put option makes it a ‘long put’. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Investing

Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price.

the greeks option trading risk guide vega, gamma, theta, delta

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Buying a put option makes it a ‘long put’.

Basic Options Strategies Explained The Options Bro Stock Options

Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Buying a put option makes it a ‘long put’.

Design Patterns Cheat Sheet Pdf everassistant

Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price.

Option Strategies Cheat Sheet New Trader U

Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Buying a put option makes it a ‘long put’. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price.

A Bull Call Spread Is A Vertical Spread Created By Buying A Call Option (Long Call) At A Lower Strike Price.

Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

![Options Strategies Cheat Sheet [FREE Download] How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-1170x827.png)