Multi Jurisdiction Tax Form - Uniform sales & use tax resale certificate — multijurisdiction. This multijurisdiction form has been updated as of october 14, 2022. In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. The commission has developed a uniform sales & use tax.

Uniform sales & use tax resale certificate — multijurisdiction. The commission has developed a uniform sales & use tax. This multijurisdiction form has been updated as of october 14, 2022. A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption.

A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. This multijurisdiction form has been updated as of october 14, 2022. In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. The commission has developed a uniform sales & use tax. Uniform sales & use tax resale certificate — multijurisdiction.

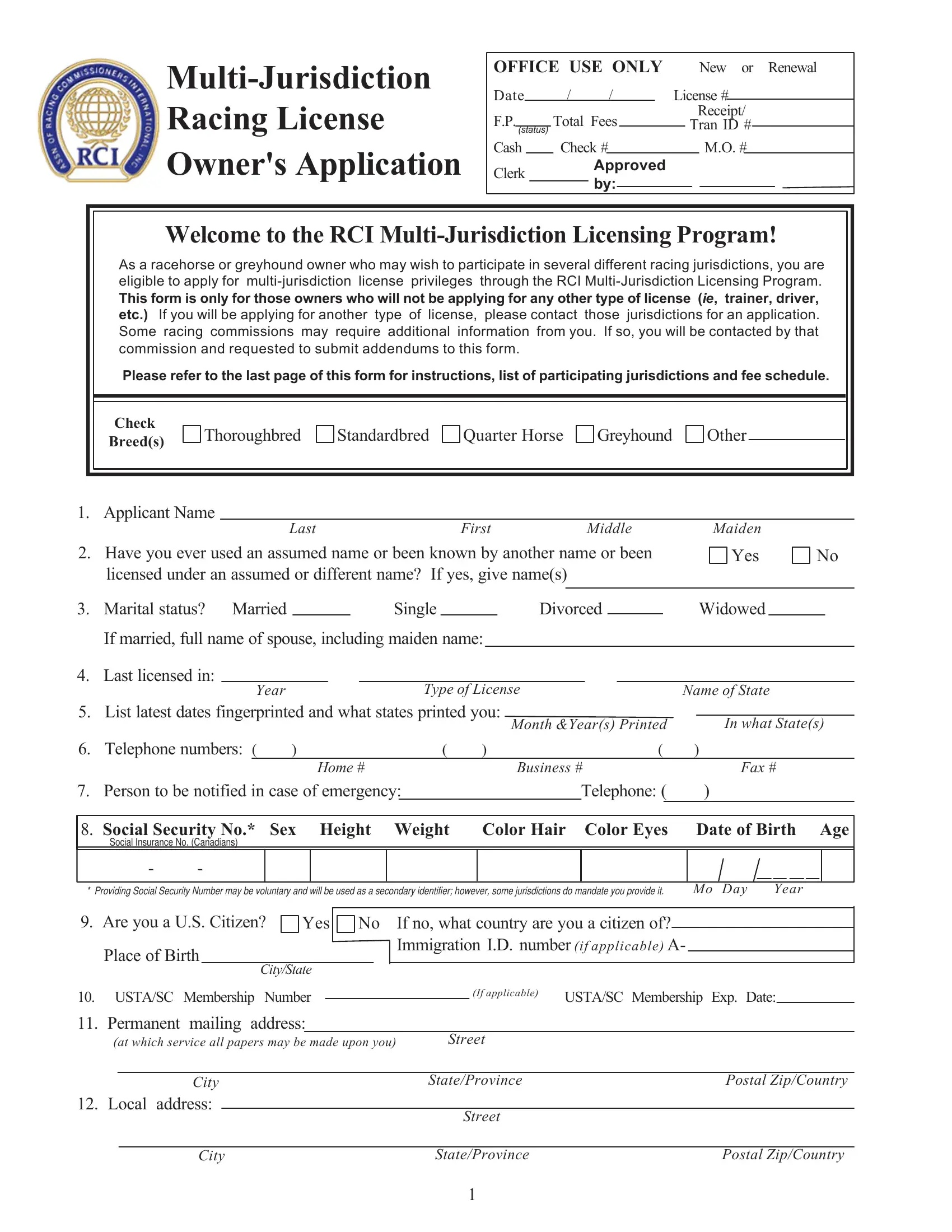

Multi Jurisdiction License PDF Form FormsPal

Uniform sales & use tax resale certificate — multijurisdiction. A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. The commission has developed a uniform sales & use tax. In order to comply with the majority of state and local sales tax law requirements, the seller must.

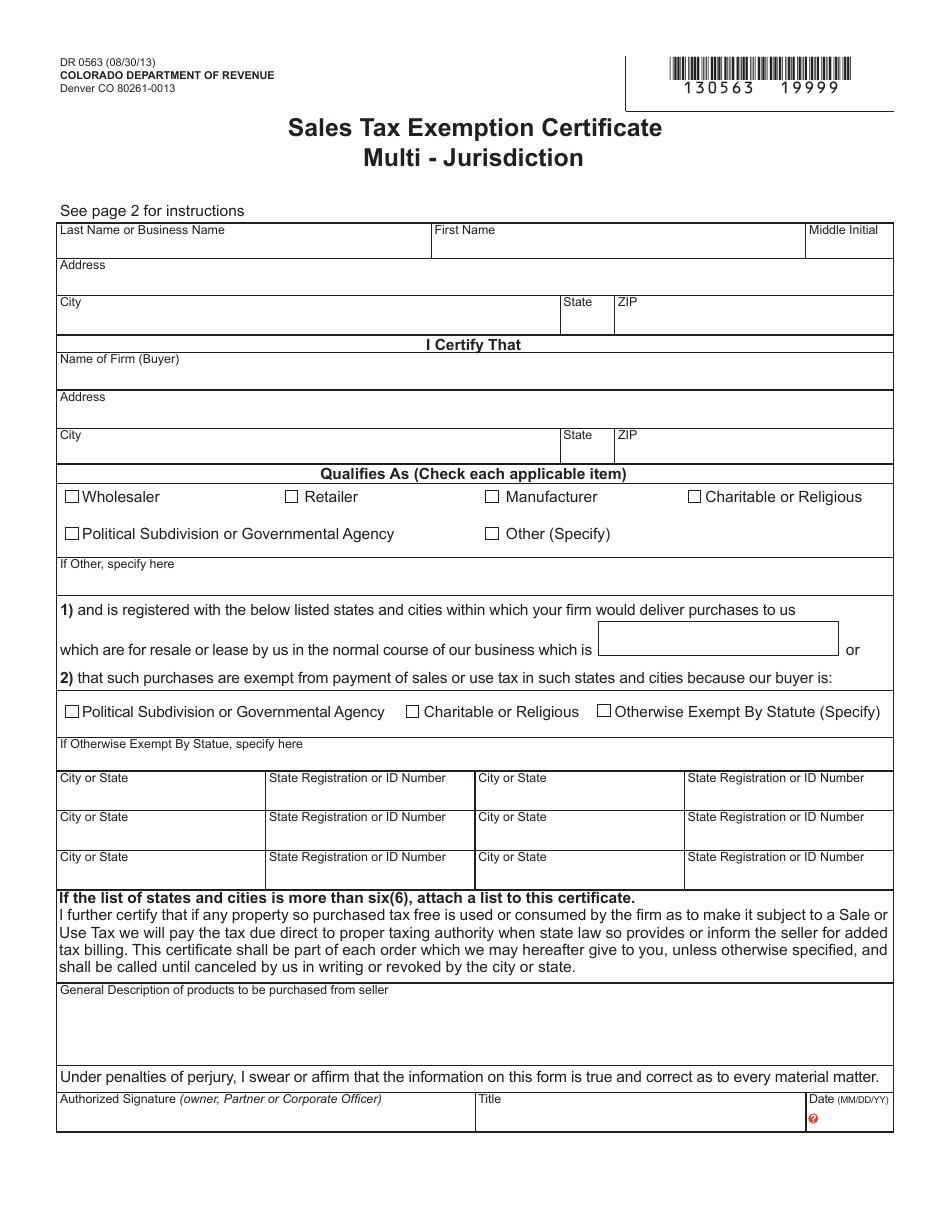

Multi Jurisdiction Sales Tax Exempt Form

Uniform sales & use tax resale certificate — multijurisdiction. The commission has developed a uniform sales & use tax. In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. This multijurisdiction form has been updated as of october 14, 2022. A buyer must be.

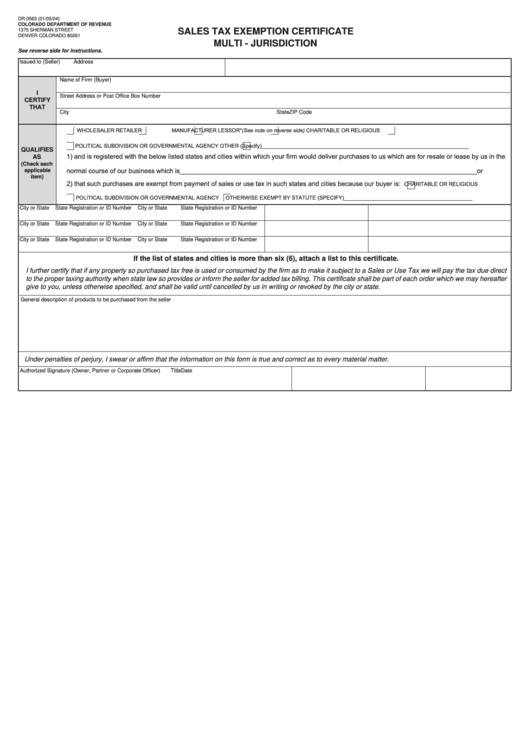

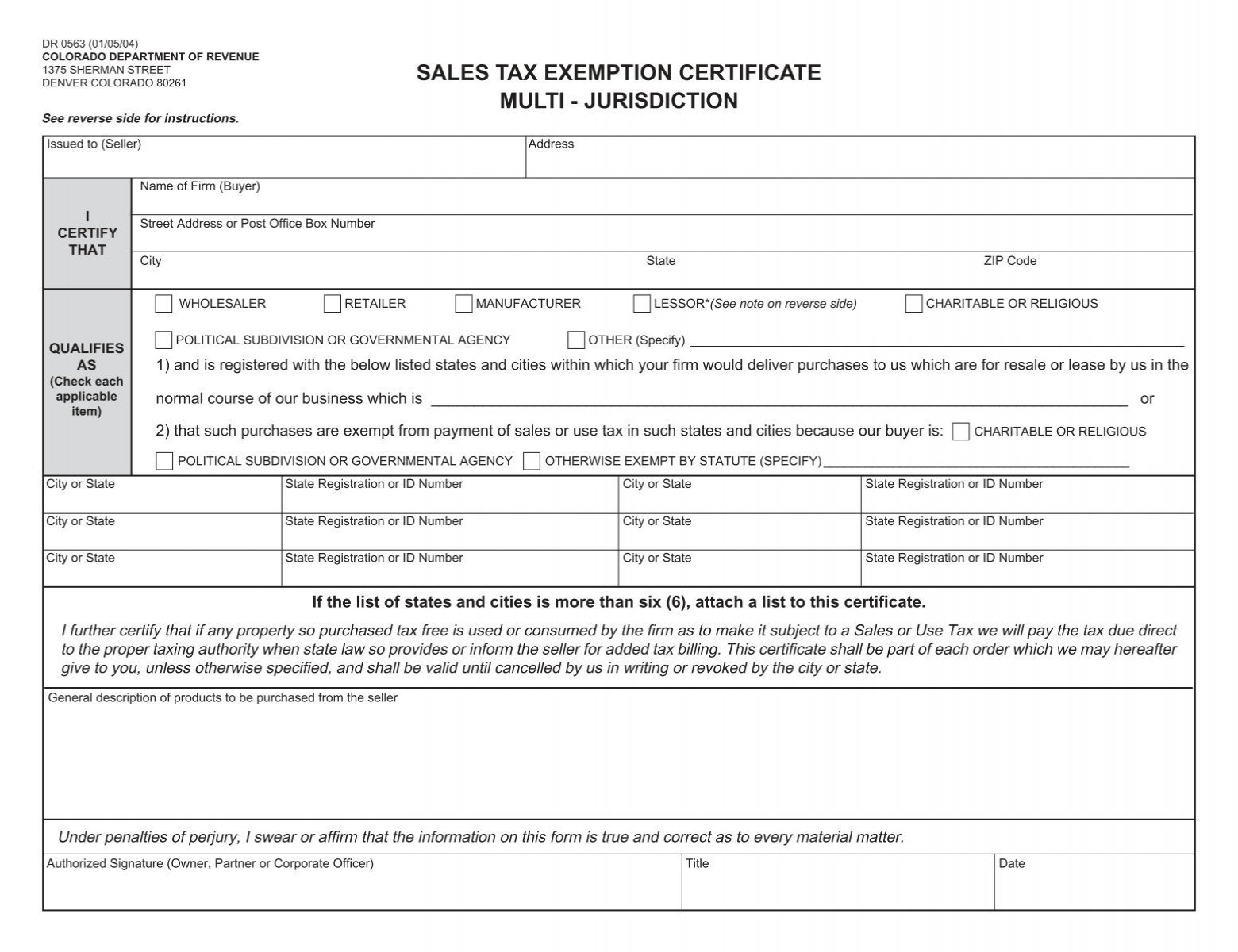

Fillable Online DR 0563 Sales Tax Exemption Certificate Multi

Uniform sales & use tax resale certificate — multijurisdiction. In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. This multijurisdiction form has been updated as of october 14, 2022. The commission has developed a uniform sales & use tax. A buyer must be.

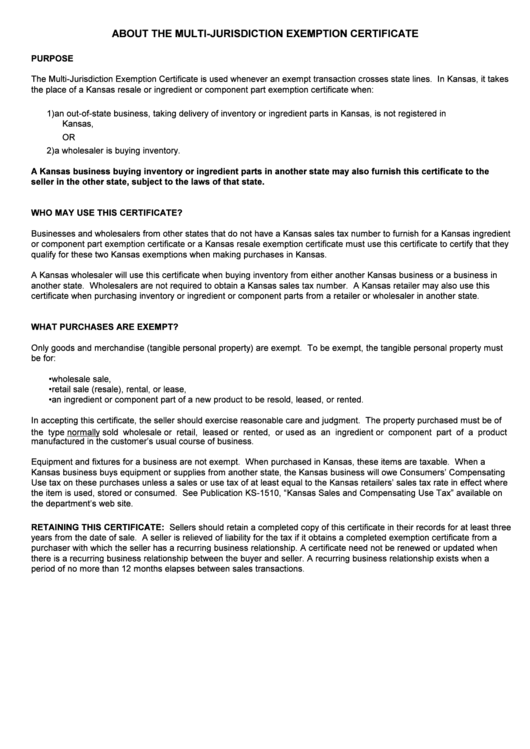

MultiJurisdiction Exemption Certificate Instructions printable pdf

This multijurisdiction form has been updated as of october 14, 2022. Uniform sales & use tax resale certificate — multijurisdiction. A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. In order to comply with the majority of state and local sales tax law requirements, the seller.

4 Reasons Why Personal Jurisdiction Is Required Law Stuff Explained

A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. Uniform sales & use tax resale certificate — multijurisdiction. This multijurisdiction form has been updated as of october 14, 2022. In order to comply with the majority of state and local sales tax law requirements, the seller.

Uniform Sales And Use Tax Certificate Multijurisdiction 2023 Form

In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. This multijurisdiction form has been updated as of october 14, 2022. The commission has developed a uniform sales & use tax. Uniform sales & use tax resale certificate — multijurisdiction. A buyer must be.

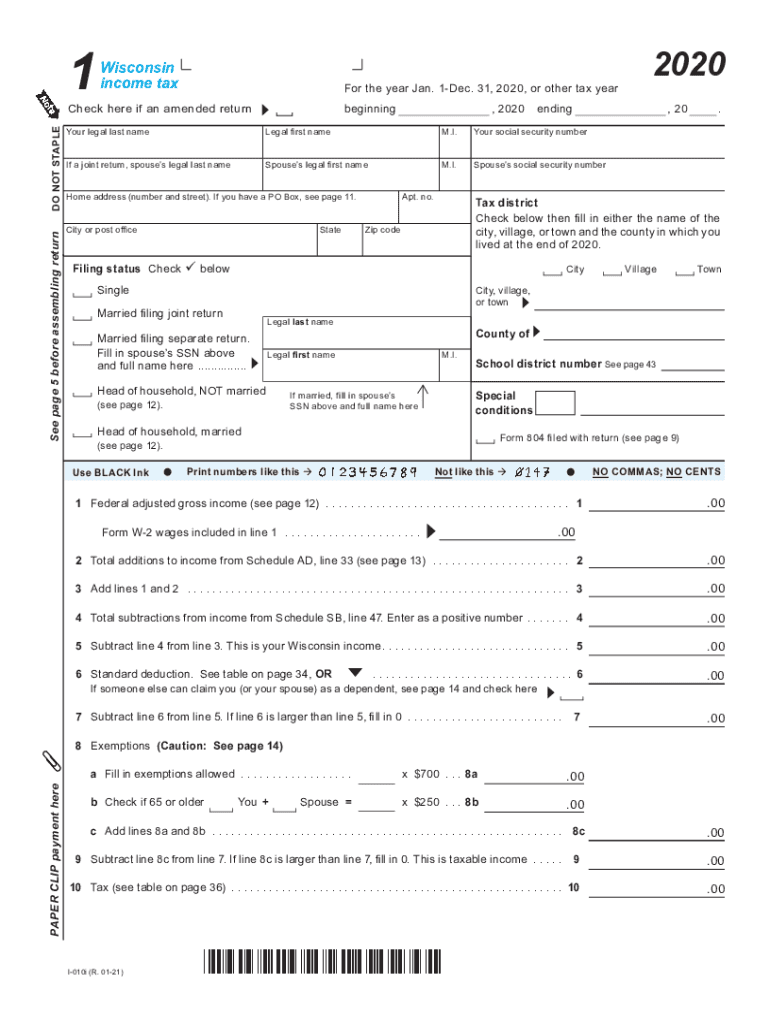

M1w Fillable Form Printable Forms Free Online

The commission has developed a uniform sales & use tax. A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. This.

Form DR0563 Fill Out, Sign Online and Download Fillable PDF, Colorado

A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. This multijurisdiction form has been updated as of october 14, 2022..

Fillable Online MultiJurisdiction Sales Tax Exemption Certificate Fax

This multijurisdiction form has been updated as of october 14, 2022. A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. The commission has developed a uniform sales & use tax. In order to comply with the majority of state and local sales tax law requirements, the.

sales tax exemption certificate multi jurisdiction The Branford Group

In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. Uniform sales & use tax resale certificate — multijurisdiction. The commission.

The Commission Has Developed A Uniform Sales & Use Tax.

A buyer must be registered as a retailer for sales/use tax in states where the buyer has sales/use tax nexus in a state. In order to comply with the majority of state and local sales tax law requirements, the seller must have in its files a properly executed exemption. Uniform sales & use tax resale certificate — multijurisdiction. This multijurisdiction form has been updated as of october 14, 2022.