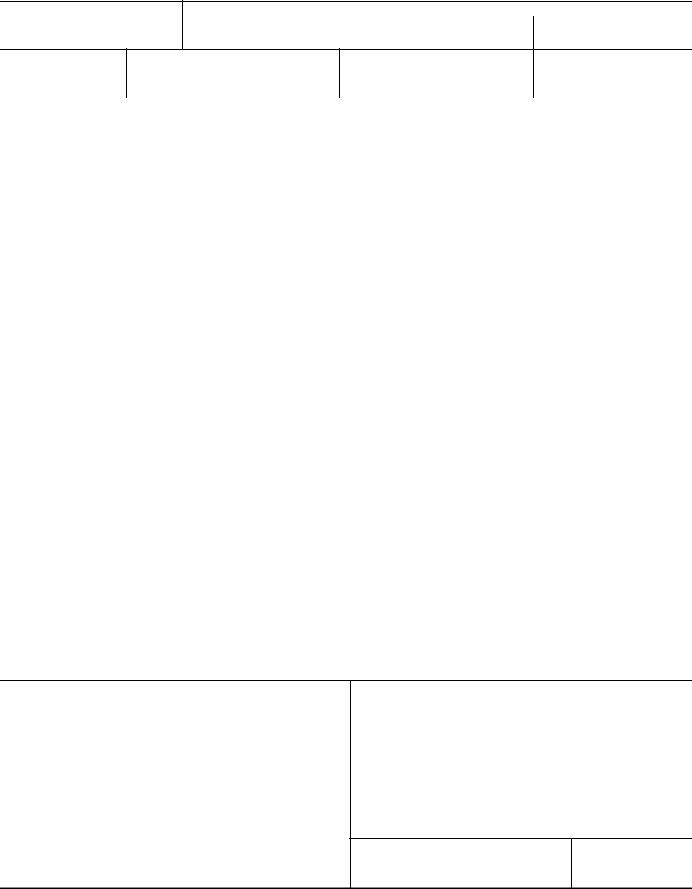

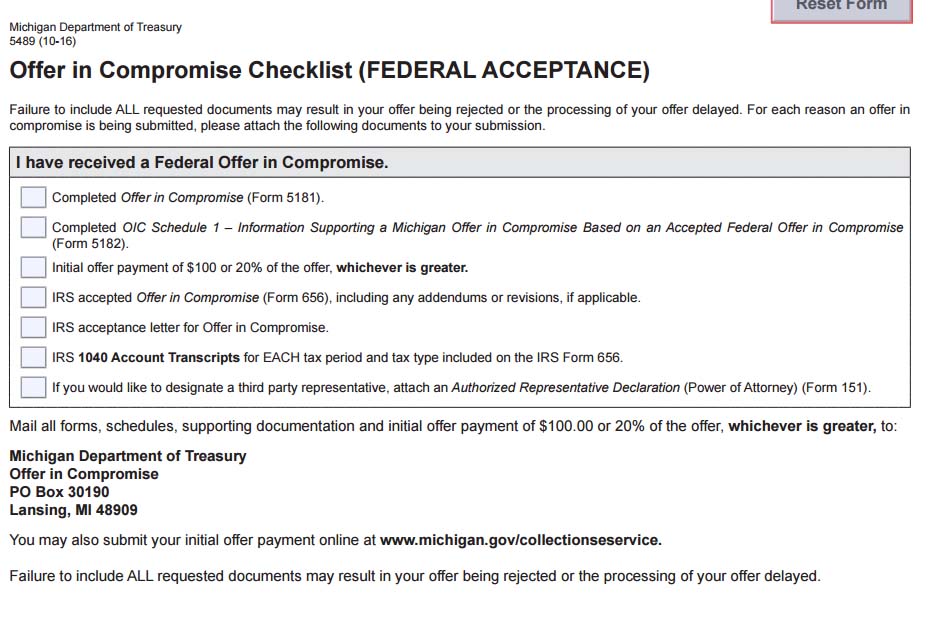

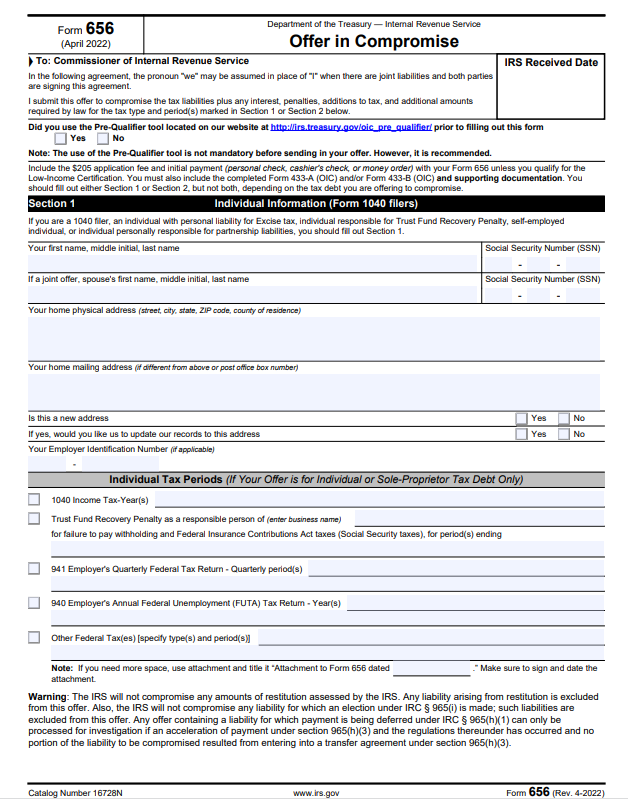

Michigan Offer In Compromise Form 5181 - Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). The taxpayer must state on the form the. Taxpayers who wish to submit an oic must submit the offer using form 5181. 11 they must submit this form along with all. What is a michigan offer in compromise? Michigan form 5181 is used to request an offer in compromise from the state of michigan. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. You can request a michigan offer in compromise if you.

A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Michigan form 5181 is used to request an offer in compromise from the state of michigan. What is a michigan offer in compromise? Taxpayers who wish to submit an oic must submit the offer using form 5181. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. 11 they must submit this form along with all. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. A taxpayer will need to. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is.

11 they must submit this form along with all. The taxpayer must state on the form the. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. What is a michigan offer in compromise? This package includes the forms required for a business to file an offer in compromise based on doubt as to liability. A taxpayer will need to. Michigan form 5181 is used to request an offer in compromise from the state of michigan. An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if.

Da Form 5181 R ≡ Fill Out Printable PDF Forms Online

A taxpayer will need to. The taxpayer must state on the form the. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). 11 they must submit this form along with all. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if.

Fillable Online Offer in compromise fillable form Fax Email Print

This package includes the forms required for a business to file an offer in compromise based on doubt as to liability. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. You can request a michigan offer in compromise if you. Michigan form 5181 is used to request an offer in compromise from the state.

IRS Form 656 Understanding Offer in Compromise YouTube

11 they must submit this form along with all. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. You can request a michigan offer in compromise if you. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is.

Form 14773 Offer in Compromise Withdrawal Sign on the Sheet Stock Photo

A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). Michigan form 5181 is used to request an offer in compromise from the state of michigan. The taxpayer must state on the form the. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what.

Michigan Offer In Compromise How To Settle MI Tax Debt

Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. 11 they must submit this form along with all. Taxpayers who wish to submit an oic must submit the offer using form 5181. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is..

Form 656 Fillable Offer In Compromise Printable Forms Free Online

You can request a michigan offer in compromise if you. Taxpayers who wish to submit an oic must submit the offer using form 5181. 11 they must submit this form along with all. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. The taxpayer must state on.

Michigan Offer In Compromise How To Settle MI Tax Debt

An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles. Taxpayers who wish to submit an oic must submit the offer using form 5181. You can request a michigan offer in compromise if you. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if..

How To Write An Offer In Compromise Letter Amelie Text

The taxpayer must state on the form the. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. A taxpayer will need to. You can request a michigan offer in compromise if you. A taxpayer must submit an offer in compromise on michigan offer in compromise.

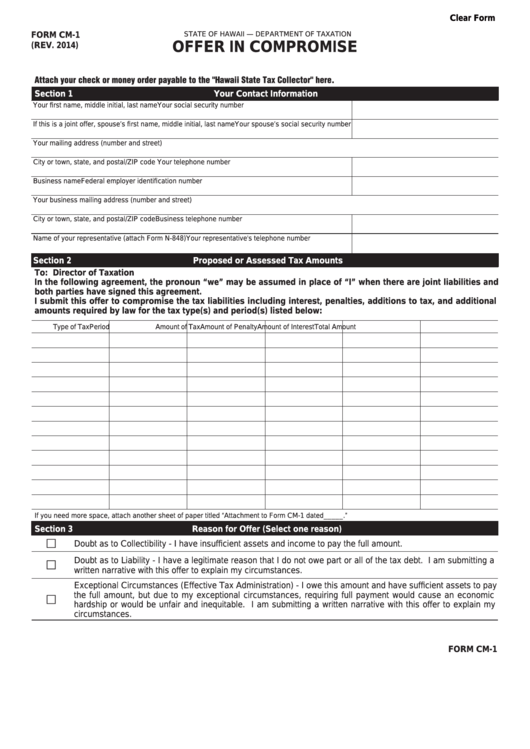

Fillable Form Cm1 Offer In Compromise printable pdf download

11 they must submit this form along with all. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. A taxpayer will need to. Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. You can request a michigan offer in.

Offer In Compromise Letter Template Fill Online, Printable, Fillable

Taxpayers who wish to submit an oic must submit the offer using form 5181. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. Michigan form 5181 is used to request an offer in compromise from the state of michigan. 11 they must submit this form.

11 They Must Submit This Form Along With All.

This package includes the forms required for a business to file an offer in compromise based on doubt as to liability. You can request a michigan offer in compromise if you. Under the offer in compromise program, treasury may compromise all or part of any outstanding tax debt that is subject to administration under the. What is a michigan offer in compromise?

Taxpayers Who Wish To Submit An Oic Must Submit The Offer Using Form 5181.

Michigan form 5181 is used to request an offer in compromise from the state of michigan. Michigan department of treasury allows taxpayers to submit three different offer types to compromise a tax debt for less than what is. A taxpayer must submit an offer in compromise on michigan offer in compromise (form 5181). An offer in compromise (offer) is an agreement between you (the taxpayer) and the michigan department of treasury (treasury) that settles.

The Taxpayer Must State On The Form The.

Taxpayer can offer the state less than the actual liability to eliminate unpaid taxes if. A taxpayer will need to.