Medical Expenses For Parents Tax Relief Malaysia - Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents. Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical expenses which qualify for deductions include:

Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents. Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or.

Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents. Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical expenses which qualify for deductions include:

Personal Tax Relief 2022 L & Co Accountants

Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents. Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or.

The Futurizts on Twitter "G2. Medical treatment for parents RM8,000 If you paid for medical

Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents. Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or.

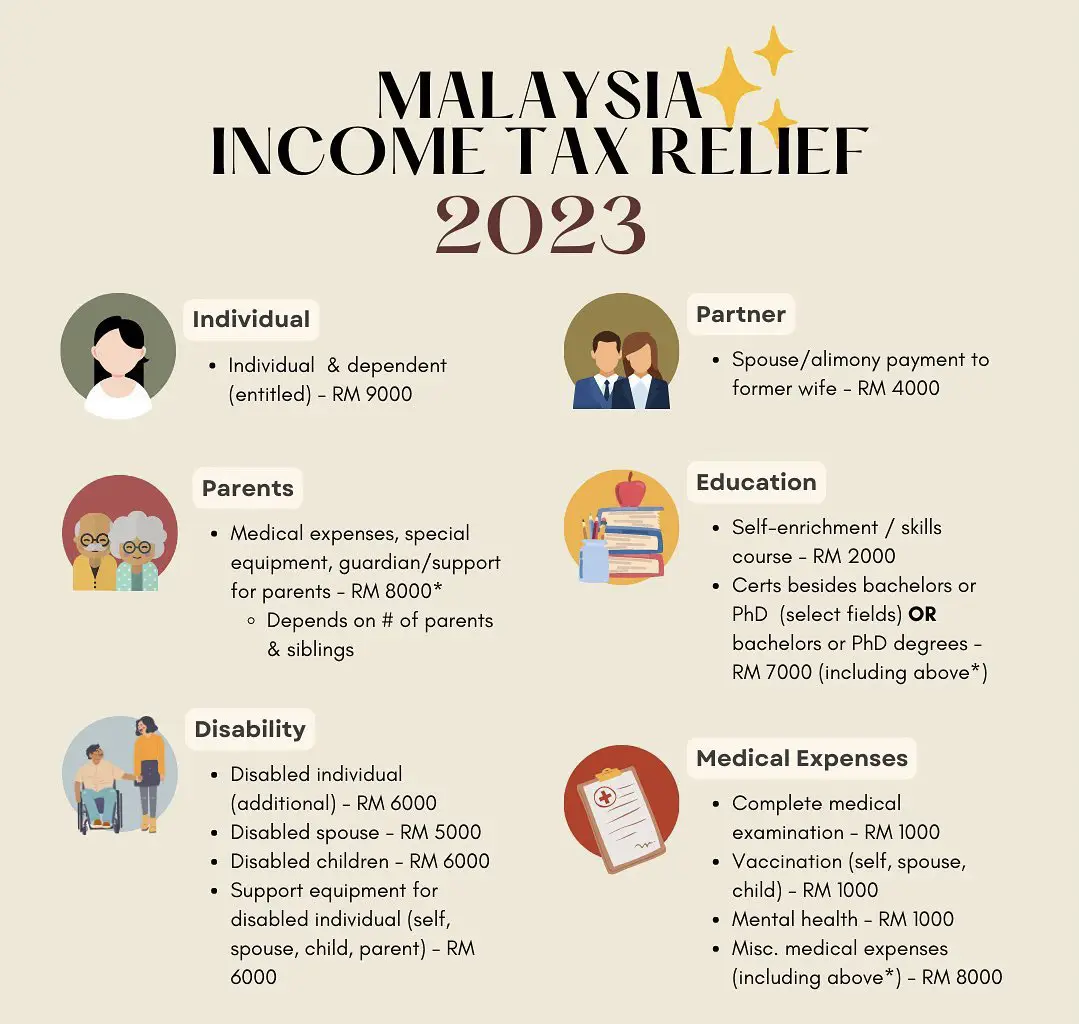

2023 Tax Relief oh 2023 Tax Relief KLSE malaysia

Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents. Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical expenses which qualify for deductions include:

Personal Tax Relief Malaysia Y.A. 2023 L & Co Accountants

Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical expenses which qualify for deductions include: Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents.

Malaysia Personal Tax Relief 2021

Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical treatment, special needs and carer expenses for parents.

What Can You Claim For Tax Relief Under Medical Expenses?

Medical treatment, special needs and carer expenses for parents. Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or.

Tax Relief 2023 Malaysia Printable Forms Free Online

Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents.

Malaysia tax Here are the tax reliefs to claim for YA 2022

Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents.

Tax oh Tax 🗂️ Galeri disiarkan oleh Fyah Ahmad Lemon8

Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents.

What Medical Expenses Are Tax Deductible? Optima Tax Relief

Medical expenses which qualify for deductions include: Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical. Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical treatment, special needs and carer expenses for parents.

Medical Treatment, Special Needs And Carer Expenses For Parents.

Medical expenses which qualify for deductions include: Medical treatment, special needs and carer expenses for parents (medical condition certified by medical practitioner) or. Medical expenses for the year of assessment 2025 (ya2025), the maximum tax relief amount that you can claim on medical.