Lowest Home Equity Line Rates - The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. Citizens offers helocs with loan amounts starting at $17,500; However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. Find the best heloc offer for your unique borrowing needs. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey.

18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. Citizens offers helocs with loan amounts starting at $17,500; The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. Find the best heloc offer for your unique borrowing needs. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available.

The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. Find the best heloc offer for your unique borrowing needs. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. Citizens offers helocs with loan amounts starting at $17,500; A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available.

Are Home Equity Lines of Credit a Good Idea? Lionsgate Financial Group

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. Citizens offers helocs with loan amounts.

A Home Equity Loan Alterra Home Loans

Find the best heloc offer for your unique borrowing needs. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. Citizens offers helocs with loan amounts starting at $17,500; 18,.

Rising mortgage rates keep home equity line of credit usage down

Find the best heloc offer for your unique borrowing needs. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. Citizens offers helocs with loan amounts starting at $17,500; However, you must have a credit line.

What are the pros and cons of pulling equity from your home? Leia aqui

Find the best heloc offer for your unique borrowing needs. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. However, you must have a credit line of more than $200,000 to get the.

What is the Interest Rate on a Home Equity Loan? Lionsgate Financial

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. Find the best heloc.

Home Equity Loan vs Line of Credit Finance Strategists

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. Citizens offers helocs with loan amounts starting at $17,500; 18, its lowest level in almost a year and a half, according to.

Home Equity Loan vs. Line of Credit Cobalt Credit Union

However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. Citizens offers helocs with loan amounts starting at $17,500; A home equity line of credit (heloc) gives homeowners with at least 15% to 20%.

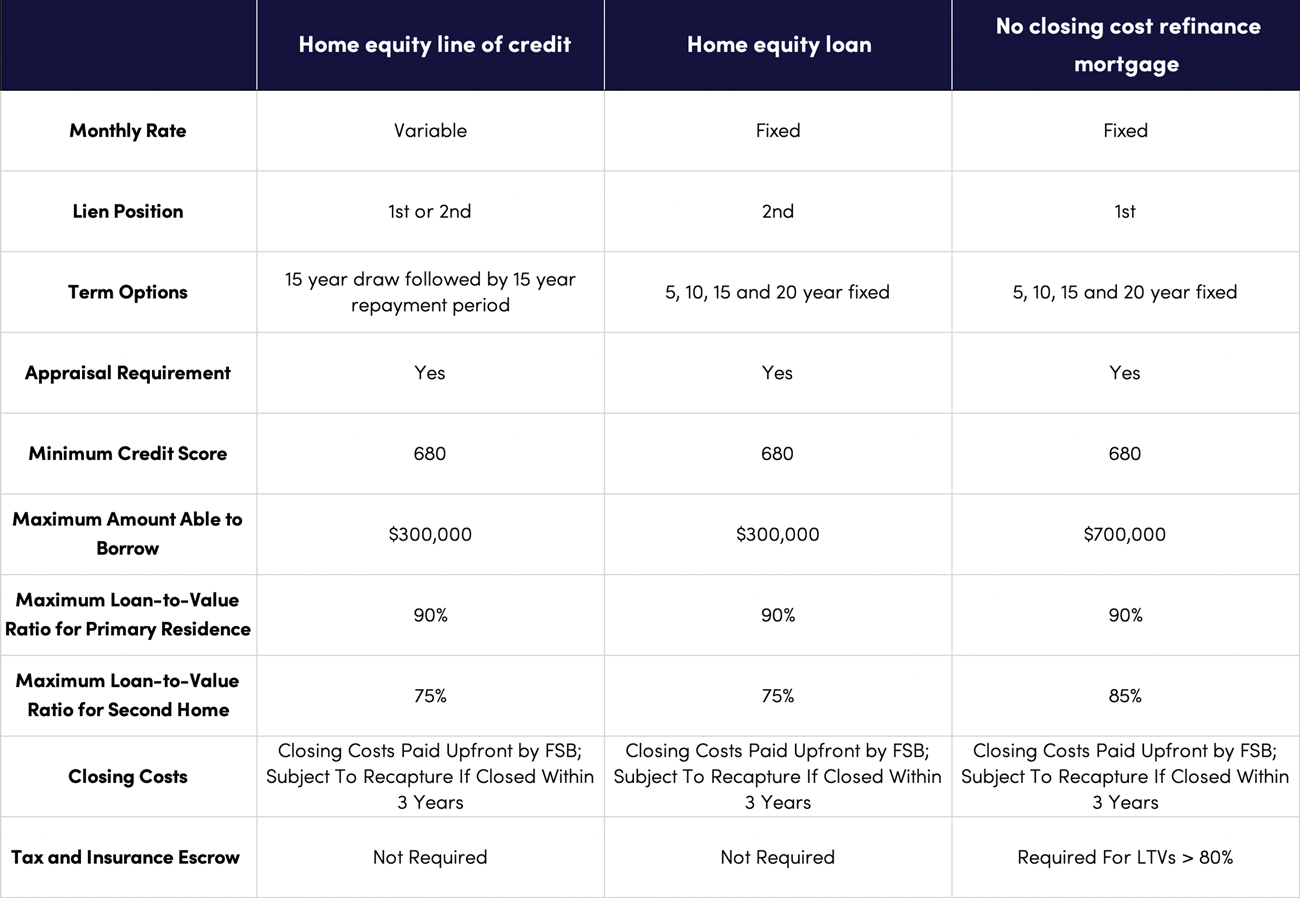

home equity › Five Star Bank

18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. Citizens offers helocs with.

Guide to Understanding Home Equity Lines (HELOC) and Loans AmeriSave

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. Citizens offers helocs with loan amounts starting at $17,500; Find the best heloc offer for your unique borrowing needs. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. However, you must.

Home Equity Line of Credit What Are They and How Do They Work? Earnest

Find the best heloc offer for your unique borrowing needs. A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. Citizens offers helocs with loan amounts starting at $17,500; However, you must have a credit line of more than $200,000 to get the lowest annual percentage rate (apr) available. 18,.

However, You Must Have A Credit Line Of More Than $200,000 To Get The Lowest Annual Percentage Rate (Apr) Available.

A home equity line of credit (heloc) gives homeowners with at least 15% to 20% equity access to flexible financing. 18, its lowest level in almost a year and a half, according to bankrate’s nationwide survey. The average rate on a home equity line of credit (heloc) dropped to 8.52 percent as of dec. Find the best heloc offer for your unique borrowing needs.

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)