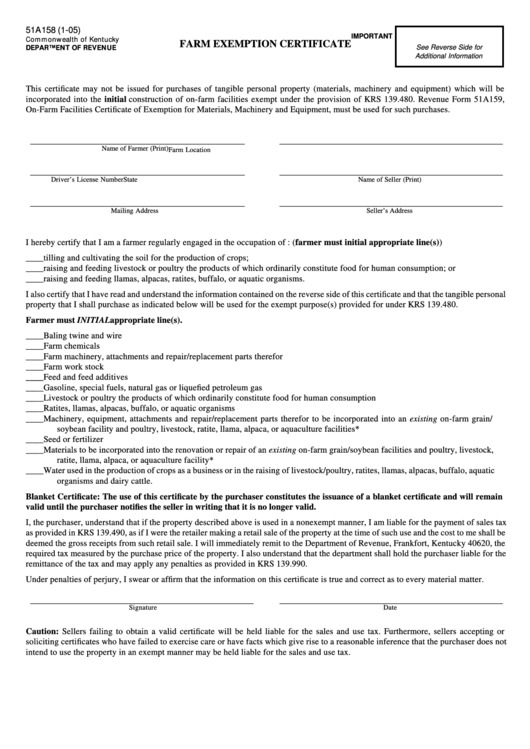

Kentucky Farm Exemption Form - A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the.

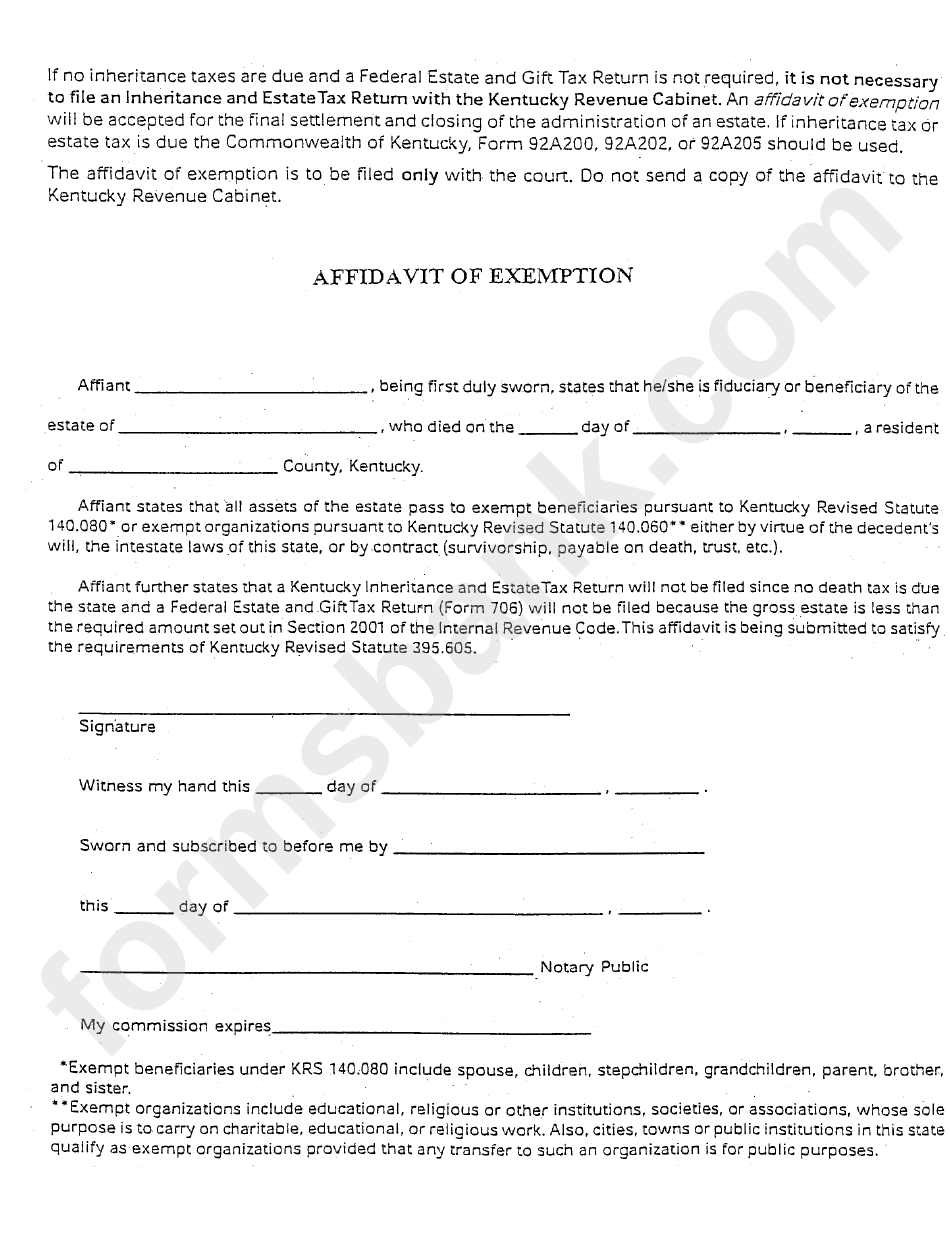

Affidavit Of Exemption Form Kentucky Revenue Kentucky

Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the.

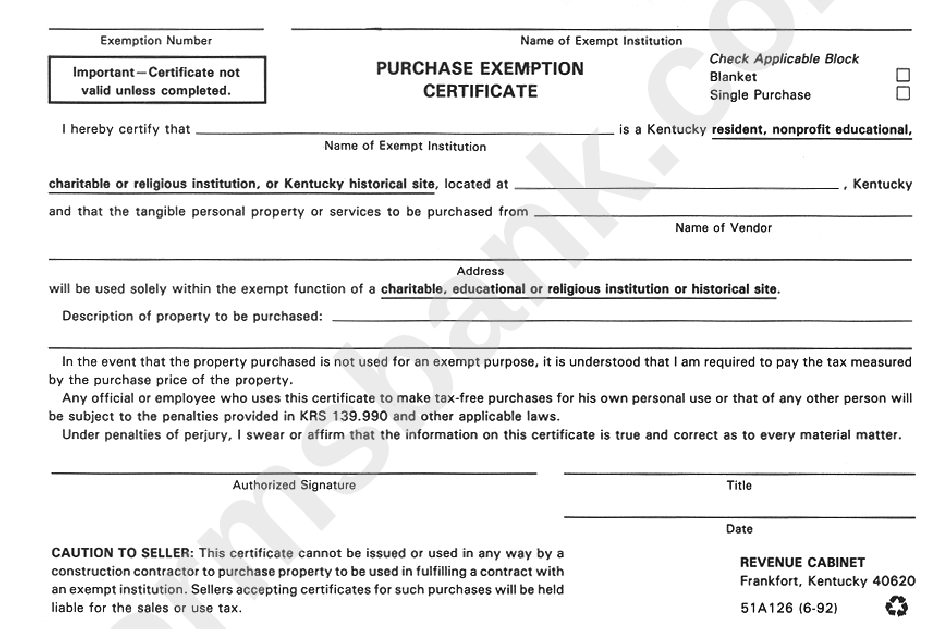

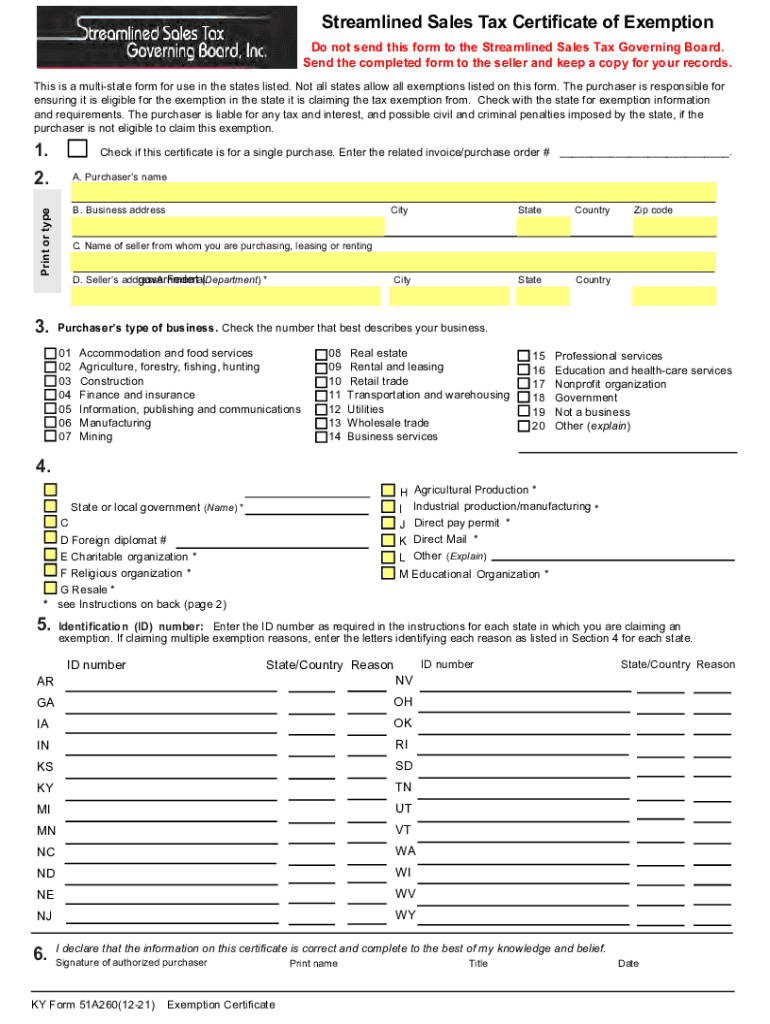

Form 51a126 Purchase Exemption Certificate printable pdf download

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

Kentucky Homestead Exemption Application Form 2024 2025

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the.

Kentucky Sales Tax Farm Exemption Form Fill Online Printable

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

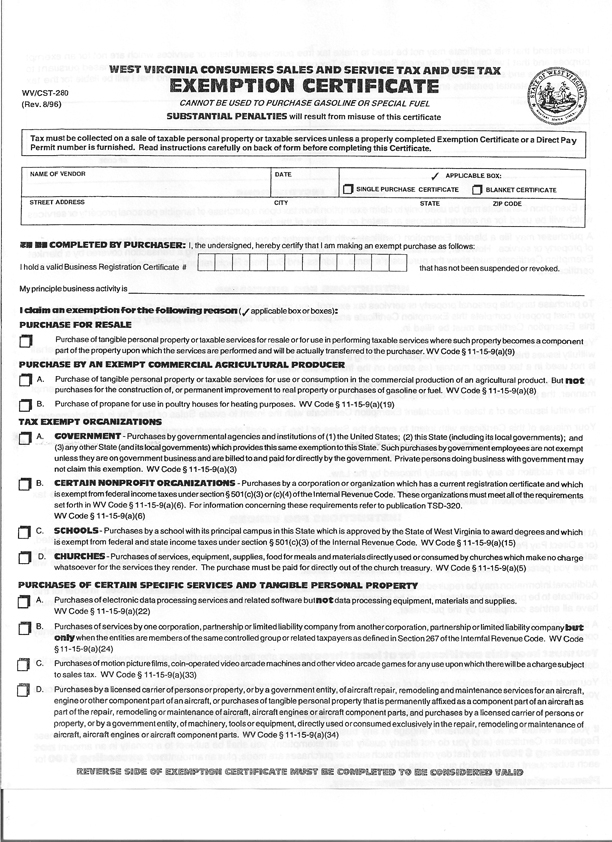

Ky Revenue Form 51a105 REVNEUS

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

Individual Tax Exemption 2024 Mona Sylvia

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

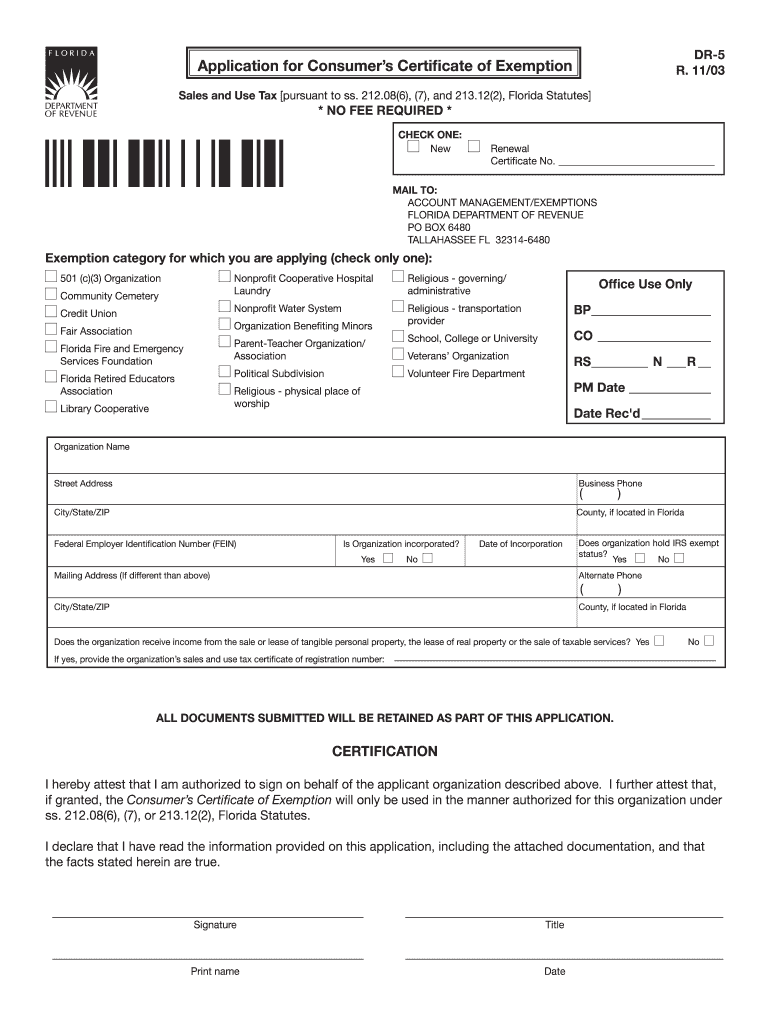

Agriculture Tax Exempt Form Florida

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items.

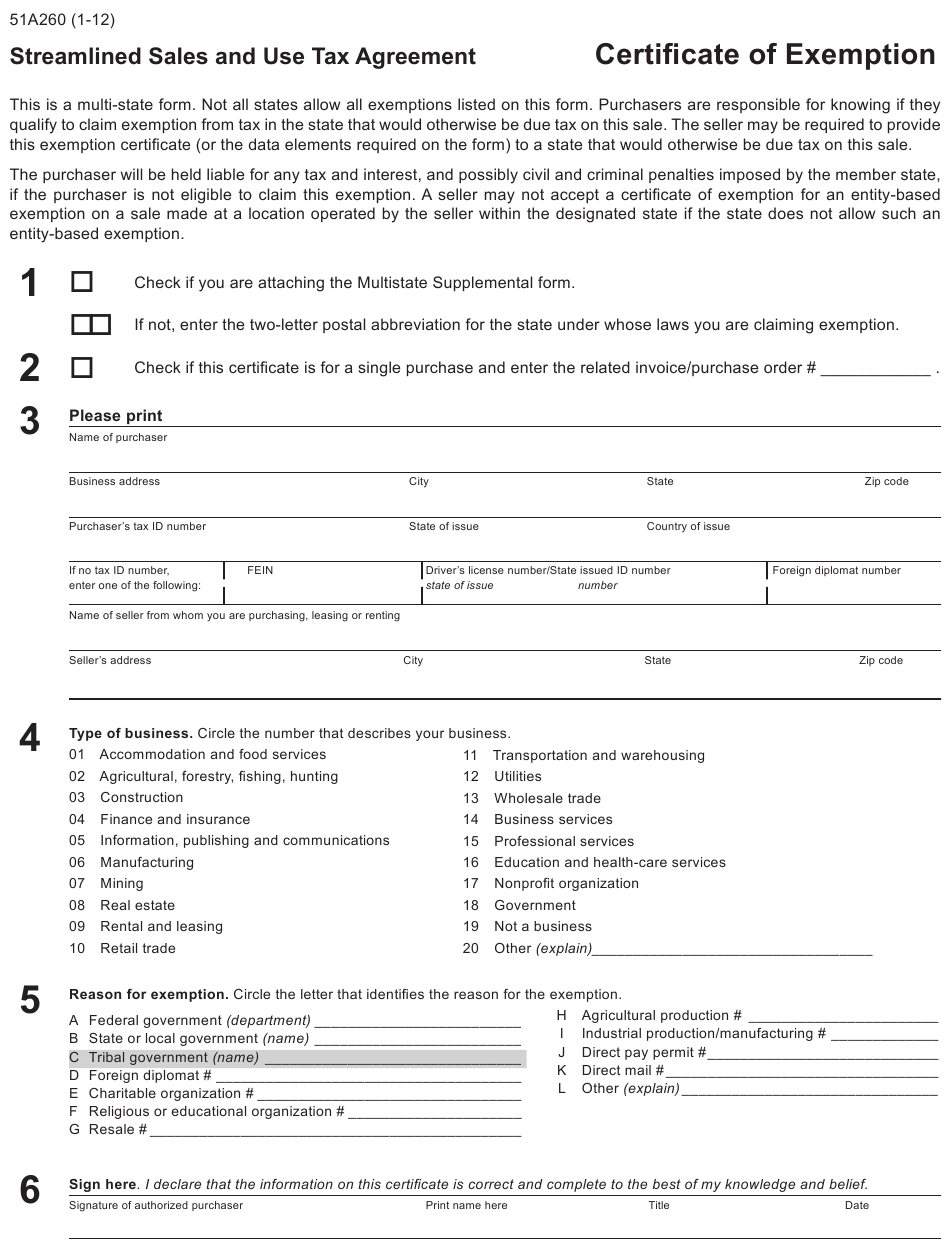

Ky tax exempt form pdf Fill out & sign online DocHub

Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the.

Kentucky Sales Tax Exemption Form

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

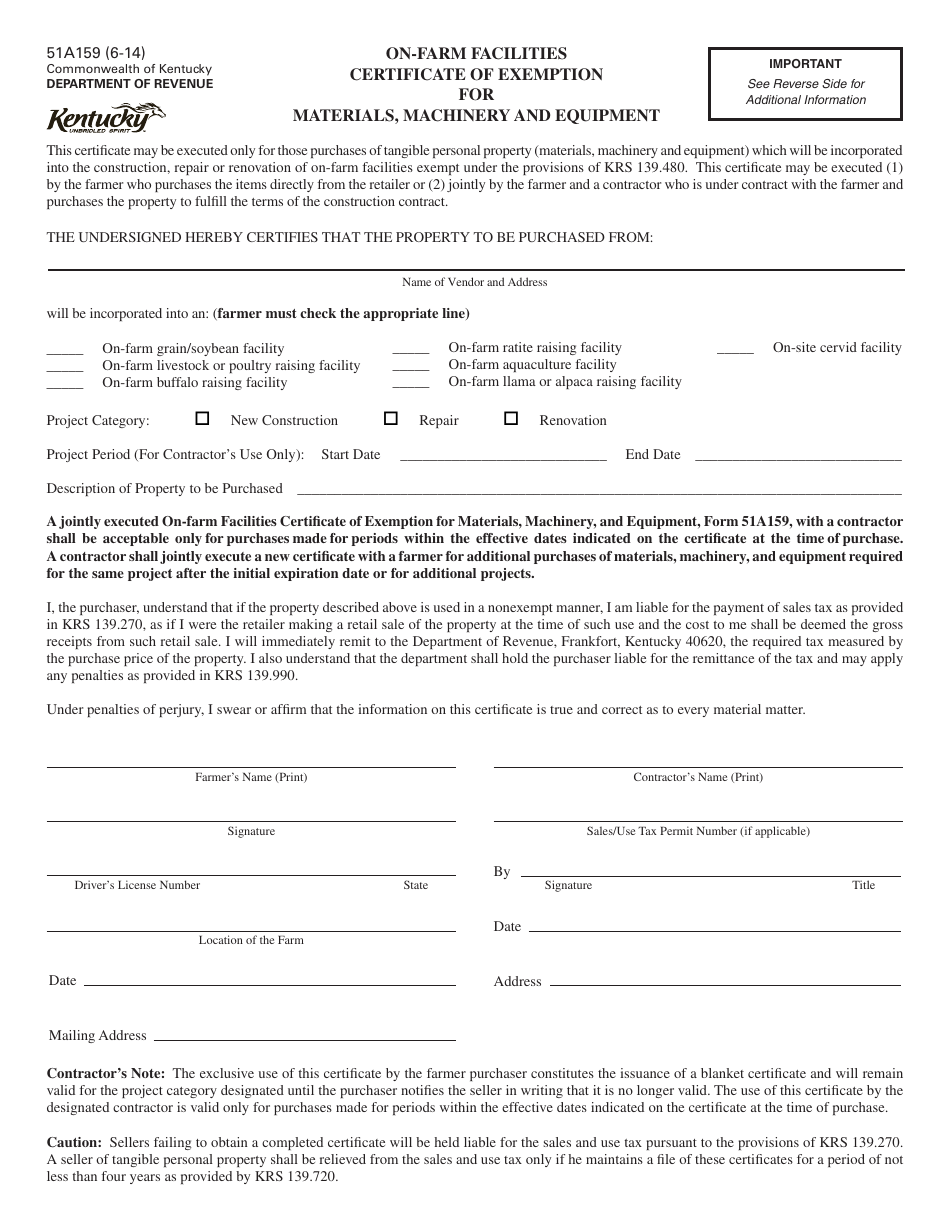

Form 51A159 Fill Out, Sign Online and Download Printable PDF

A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the. Eligible farmers must apply for and use a new tax id number to claim sales and use tax exemptions for certain items. Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in.

Eligible Farmers Must Apply For And Use A New Tax Id Number To Claim Sales And Use Tax Exemptions For Certain Items.

Learn how to apply for a sales tax exemption number and a farm exemption certificate for agricultural purchases in. A new kentucky law requires that farmers apply for an agriculture exemption number to make qualified purchases for the.