K 1 Tax Form Deadline - Include your share on your tax return if a return. 15 or the third month after the end of the entity's fiscal year. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. You may be liable for tax on your share of the corporation's income, whether or not distributed.

15 or the third month after the end of the entity's fiscal year. You may be liable for tax on your share of the corporation's income, whether or not distributed. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. Include your share on your tax return if a return.

Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. 15 or the third month after the end of the entity's fiscal year. Include your share on your tax return if a return. You may be liable for tax on your share of the corporation's income, whether or not distributed.

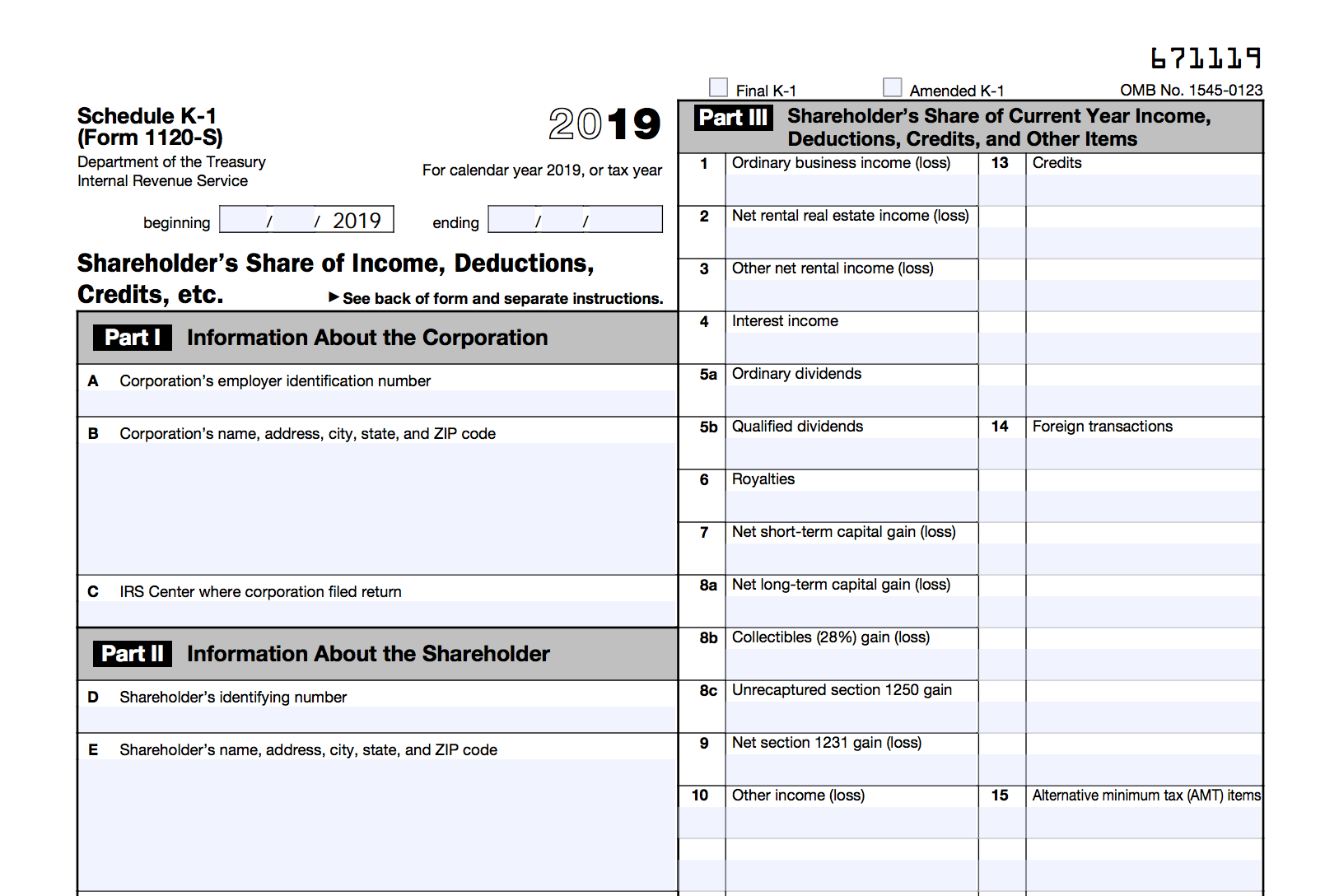

Barbara Johnson Blog Schedule K1 Tax Form What Is It and Who Needs

Include your share on your tax return if a return. You may be liable for tax on your share of the corporation's income, whether or not distributed. 15 or the third month after the end of the entity's fiscal year. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them.

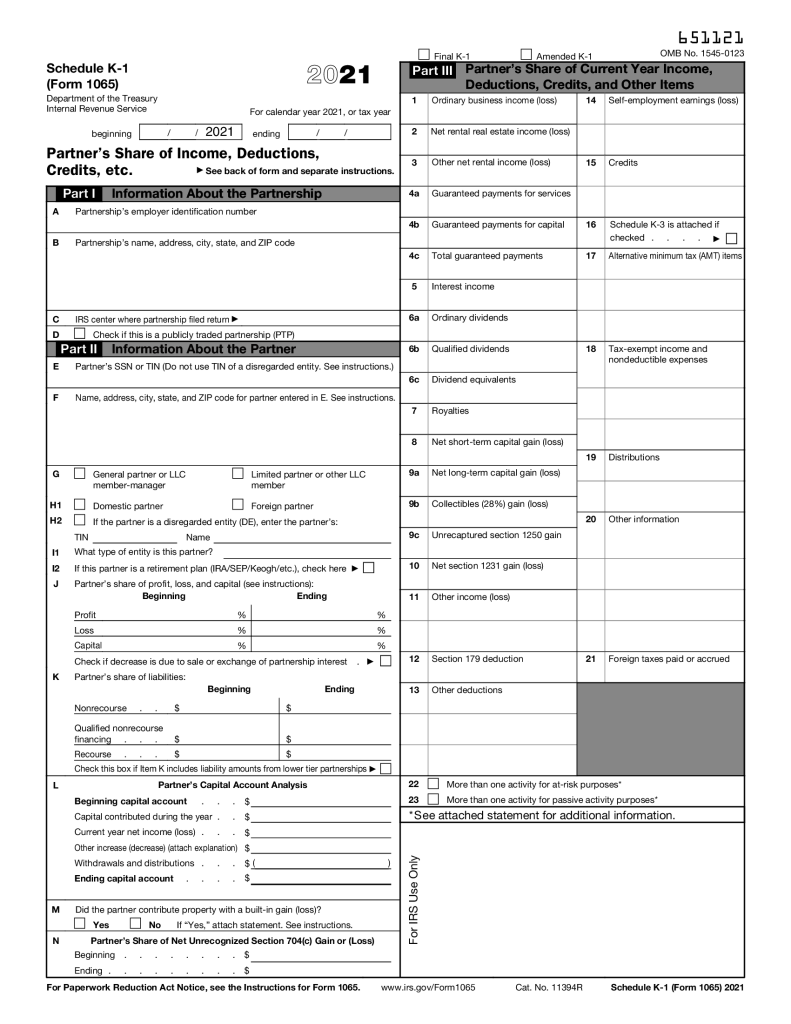

Printable K 1 Form Fillable Form 2023

You may be liable for tax on your share of the corporation's income, whether or not distributed. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. 15 or the third month after the end of the entity's fiscal year. Include your share on your tax.

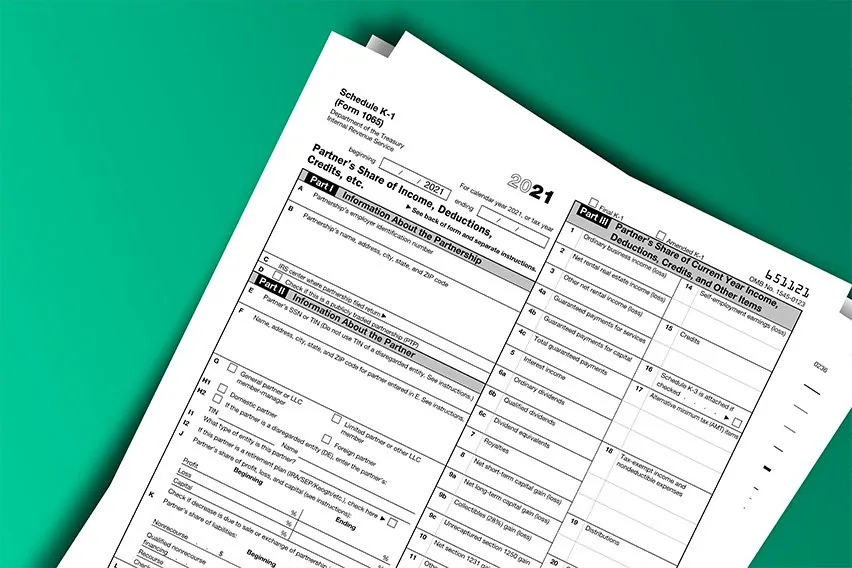

Is K1 Deadline March 15 2024 Or April 15 2024 Dale Mignon

Include your share on your tax return if a return. You may be liable for tax on your share of the corporation's income, whether or not distributed. 15 or the third month after the end of the entity's fiscal year. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them.

K1 deadline 2023 Fill online, Printable, Fillable Blank

You may be liable for tax on your share of the corporation's income, whether or not distributed. Include your share on your tax return if a return. 15 or the third month after the end of the entity's fiscal year. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them.

Stunning Compilation of Over 999k Images in Full 4K Quality

Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. You may be liable for tax on your share of the corporation's income, whether or not distributed. 15 or the third month after the end of the entity's fiscal year. Include your share on your tax.

IRS Schedule K1 When should you file a K1 Tax form? Marca

Include your share on your tax return if a return. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. You may be liable for tax on your share of the corporation's income, whether or not distributed. 15 or the third month after the end of.

Deadline For K1 Form 2023 Printable Forms Free Online

Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. Include your share on your tax return if a return. 15 or the third month after the end of the entity's fiscal year. You may be liable for tax on your share of the corporation's income,.

2023 K1 Form Printable Forms Free Online

Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. Include your share on your tax return if a return. You may be liable for tax on your share of the corporation's income, whether or not distributed. 15 or the third month after the end of.

K1 Tax Form 2024

You may be liable for tax on your share of the corporation's income, whether or not distributed. 15 or the third month after the end of the entity's fiscal year. Include your share on your tax return if a return. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them.

Deadline For K1 Form 2023 Printable Forms Free Online

You may be liable for tax on your share of the corporation's income, whether or not distributed. 15 or the third month after the end of the entity's fiscal year. Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. Include your share on your tax.

Include Your Share On Your Tax Return If A Return.

Forms and instructions are subject to omb approval before they can be officially released, so we post drafts of them until they are approved. You may be liable for tax on your share of the corporation's income, whether or not distributed. 15 or the third month after the end of the entity's fiscal year.

:max_bytes(150000):strip_icc()/Schedule-K-1-1aa047bad9a2416bbe2f5874193b1a45.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)