It 4 Tax Form - The employer is required to have each employee that works in ohio to. Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. This updated form, or an electronic. Ohio it 4 is an ohio employee withholding exemption certificate. The department of taxation recently revised form it 4, employee’s withholding exemption certificate.

The employer is required to have each employee that works in ohio to. Ohio it 4 is an ohio employee withholding exemption certificate. Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. This updated form, or an electronic. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation.

Ohio it 4 is an ohio employee withholding exemption certificate. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. This updated form, or an electronic. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. The employer is required to have each employee that works in ohio to.

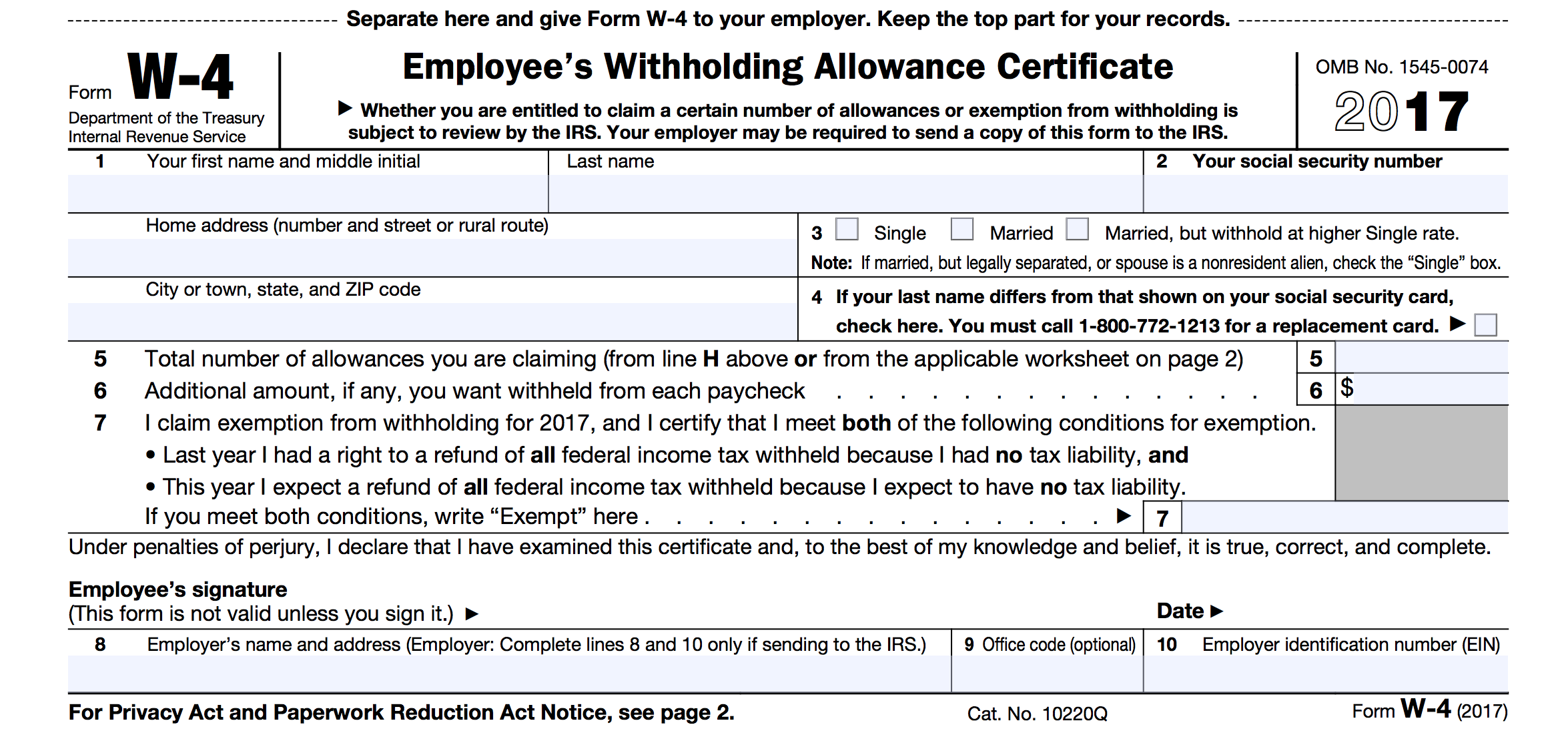

Figuring Out Your Form W4 How Many Allowances Should You, 58 OFF

Ohio it 4 is an ohio employee withholding exemption certificate. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. The.

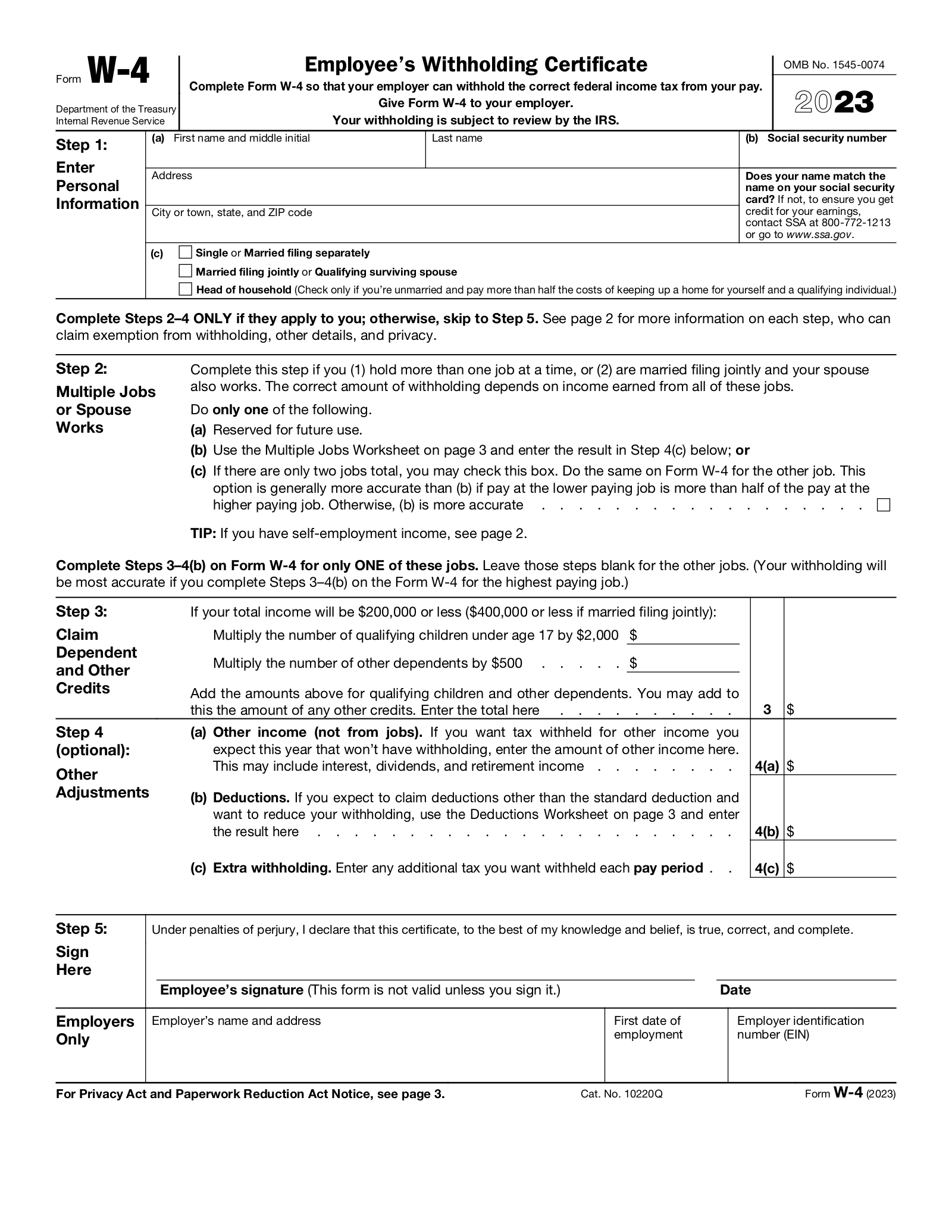

W 4 Tax Forms Printable

Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. Ohio it 4 is an ohio employee withholding exemption certificate. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Ohio.

Employee Tax Form W 4 2022 W4 Form

Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. This updated form, or an electronic. The employer is required to have each employee.

How to Fill Out a W4 Optima Tax Relief

The department of taxation recently revised form it 4, employee’s withholding exemption certificate. The employer is required to have each employee that works in ohio to. Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. Ohio it 4 is an ohio employee withholding exemption certificate. Submit form.

Tax Forms 2024 Harri

Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. This updated form, or an electronic. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Ohio it 4 is an ohio employee withholding exemption certificate. The employer is required to have each employee that.

W4 Tax Form Withholding 2024 Kara Merissa

The employer is required to have each employee that works in ohio to. Ohio it 4 is an ohio employee withholding exemption certificate. This updated form, or an electronic. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. Business in ohio must.

Tax Form W 4 Printable Printable Forms Free Online

This updated form, or an electronic. The employer is required to have each employee that works in ohio to. Ohio it 4 is an ohio employee withholding exemption certificate. Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. The department of taxation recently revised form it 4,.

State Withholding Tax Form 2023 Printable Forms Free Online

Ohio it 4 is an ohio employee withholding exemption certificate. Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. This updated form, or an electronic. The employer is required to have each employee that works in ohio to. The department of taxation recently revised form it 4,.

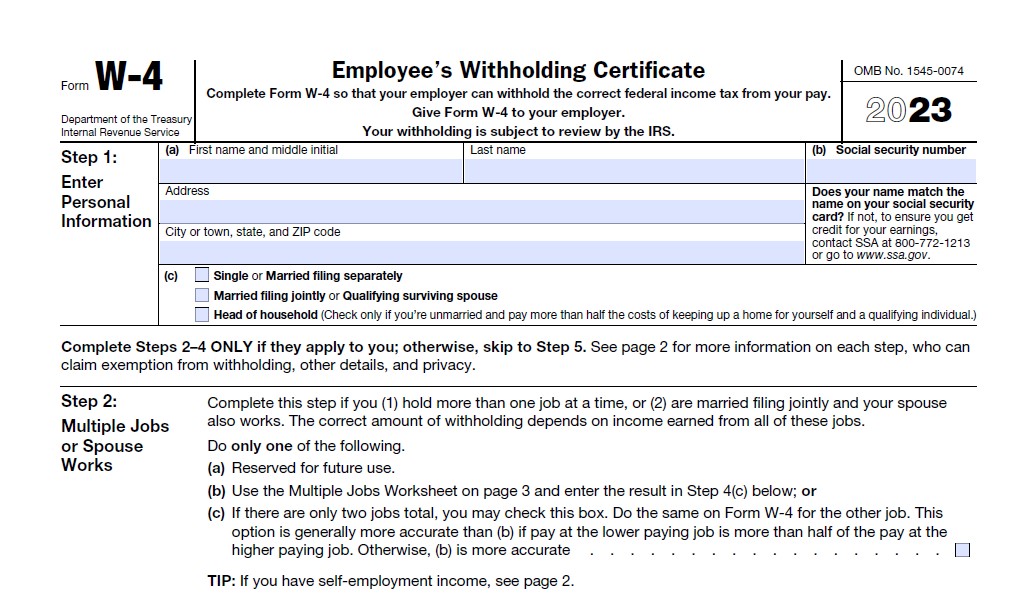

W4 Form 2023 Printable Employee's Withholding Certificate

This updated form, or an electronic. The department of taxation recently revised form it 4, employee’s withholding exemption certificate. Ohio it 4 is an ohio employee withholding exemption certificate. Ohio form it 4, employee’s withholding exemption certificate, is a tax form issued by the ohio department of taxation. Business in ohio must withhold ohio income tax, and school district income.

The W4 Form Explained How To Fill It Out And Why It, 55 OFF

Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee. Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your. The department of taxation recently revised form it 4, employee’s withholding.

Ohio Form It 4, Employee’s Withholding Exemption Certificate, Is A Tax Form Issued By The Ohio Department Of Taxation.

The employer is required to have each employee that works in ohio to. Ohio it 4 is an ohio employee withholding exemption certificate. This updated form, or an electronic. Business in ohio must withhold ohio income tax, and school district income tax if applicable, from each individual who is an employee.

The Department Of Taxation Recently Revised Form It 4, Employee’s Withholding Exemption Certificate.

Submit form it 4 to your employer on or before the start date of employment so your employer will withhold and remit ohio income tax from your.