Is There A Penalty For Not Filing Form 56 - Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. You will not be penalized for forgetting to submit form 56. However, due to miscommunication, the irs may continue to. File form 56 with the internal revenue service. Information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. Sign form 56 under penalty of perjury and enter a title describing your role as a fiduciary (for example, assignee, executor,. There is no penalty for not filing form 56, but you will still be penalized for any late filing or errors in tax submissions. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is.

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. However, due to miscommunication, the irs may continue to. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is. You will not be penalized for forgetting to submit form 56. Sign form 56 under penalty of perjury and enter a title describing your role as a fiduciary (for example, assignee, executor,. File form 56 with the internal revenue service. There is no penalty for not filing form 56, but you will still be penalized for any late filing or errors in tax submissions. Information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file.

However, due to miscommunication, the irs may continue to. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is. Sign form 56 under penalty of perjury and enter a title describing your role as a fiduciary (for example, assignee, executor,. You will not be penalized for forgetting to submit form 56. File form 56 with the internal revenue service. Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. There is no penalty for not filing form 56, but you will still be penalized for any late filing or errors in tax submissions. Information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file.

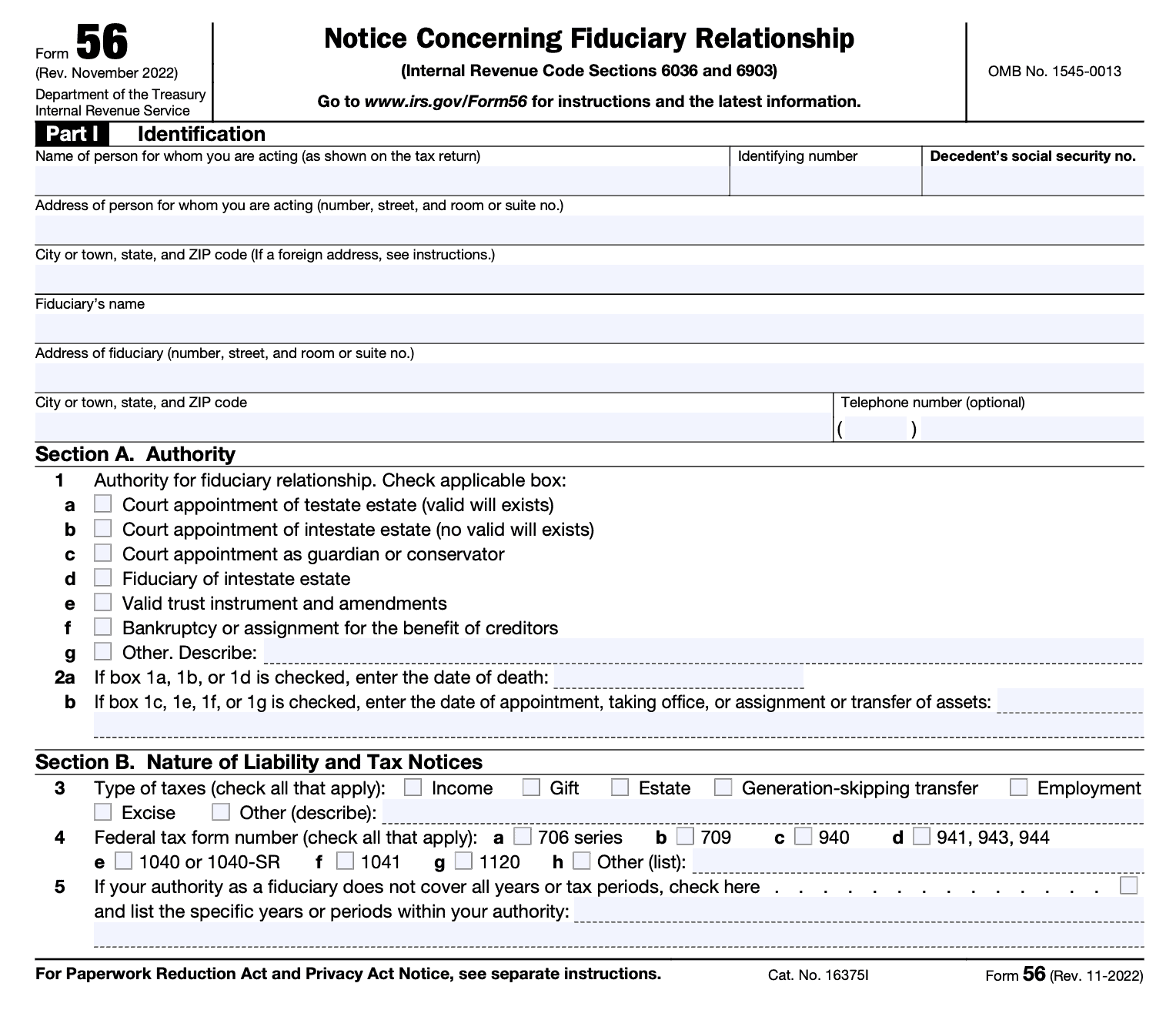

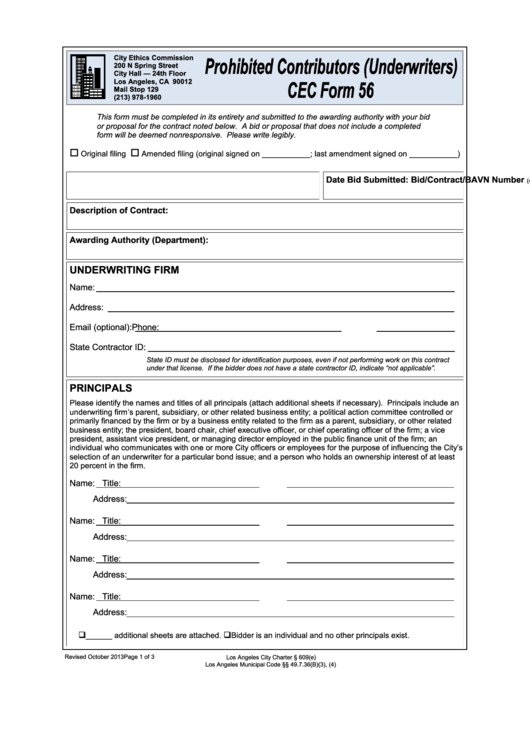

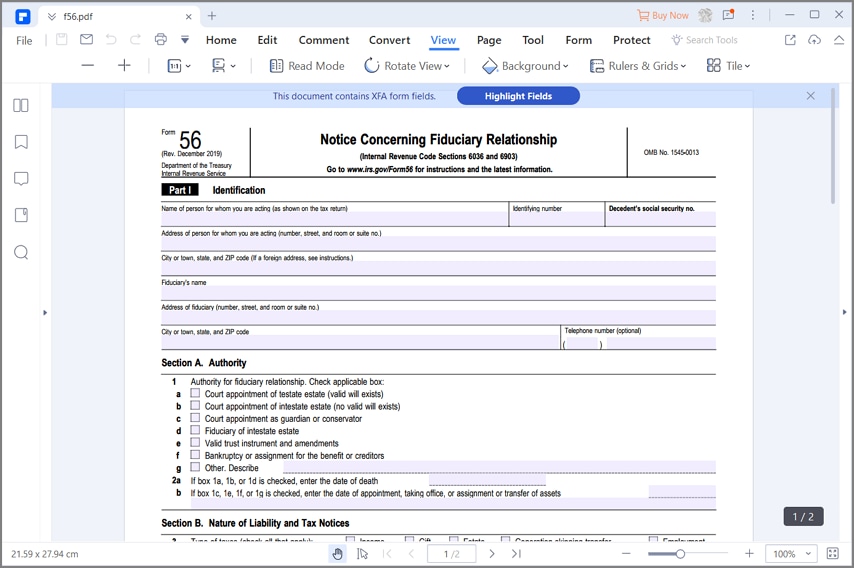

Irs Form 56 instructions Fill online, Printable, Fillable Blank

There is no penalty for not filing form 56, but you will still be penalized for any late filing or errors in tax submissions. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is. File form 56 with the internal revenue service. Generally, you.

FORM 56 Explained and The Fiduciary Relationship Explained YouTube

Sign form 56 under penalty of perjury and enter a title describing your role as a fiduciary (for example, assignee, executor,. There is no penalty for not filing form 56, but you will still be penalized for any late filing or errors in tax submissions. File form 56 with the internal revenue service. Information about form 56, notice concerning fiduciary.

Sample Penalty Abatement Letter To Irs To Waive Tax Penalties In Bank

The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is. Information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. File form 56 with the internal revenue service. Sign form 56 under penalty of perjury.

All About IRS Form 56

You will not be penalized for forgetting to submit form 56. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is. However, due to miscommunication, the irs may continue to. File form 56 with the internal revenue service. There is no penalty for not.

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. You will not be penalized for forgetting to submit form 56. However, due to miscommunication, the irs may continue to. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is..

Top 7 Irs Form 56 Templates free to download in PDF format

You will not be penalized for forgetting to submit form 56. There is no penalty for not filing form 56, but you will still be penalized for any late filing or errors in tax submissions. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone.

Form 56 Fillable Pd Printable Forms Free Online

The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is. However, due to miscommunication, the irs may continue to. File form 56 with the internal revenue service. There is no penalty for not filing form 56, but you will still be penalized for any.

Patrick Devine Form 56 Fill Online, Printable, Fillable, Blank

You will not be penalized for forgetting to submit form 56. Information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. However, due to miscommunication, the irs may continue to. Sign form 56 under penalty of perjury and enter a title describing your role as a fiduciary (for example, assignee, executor,..

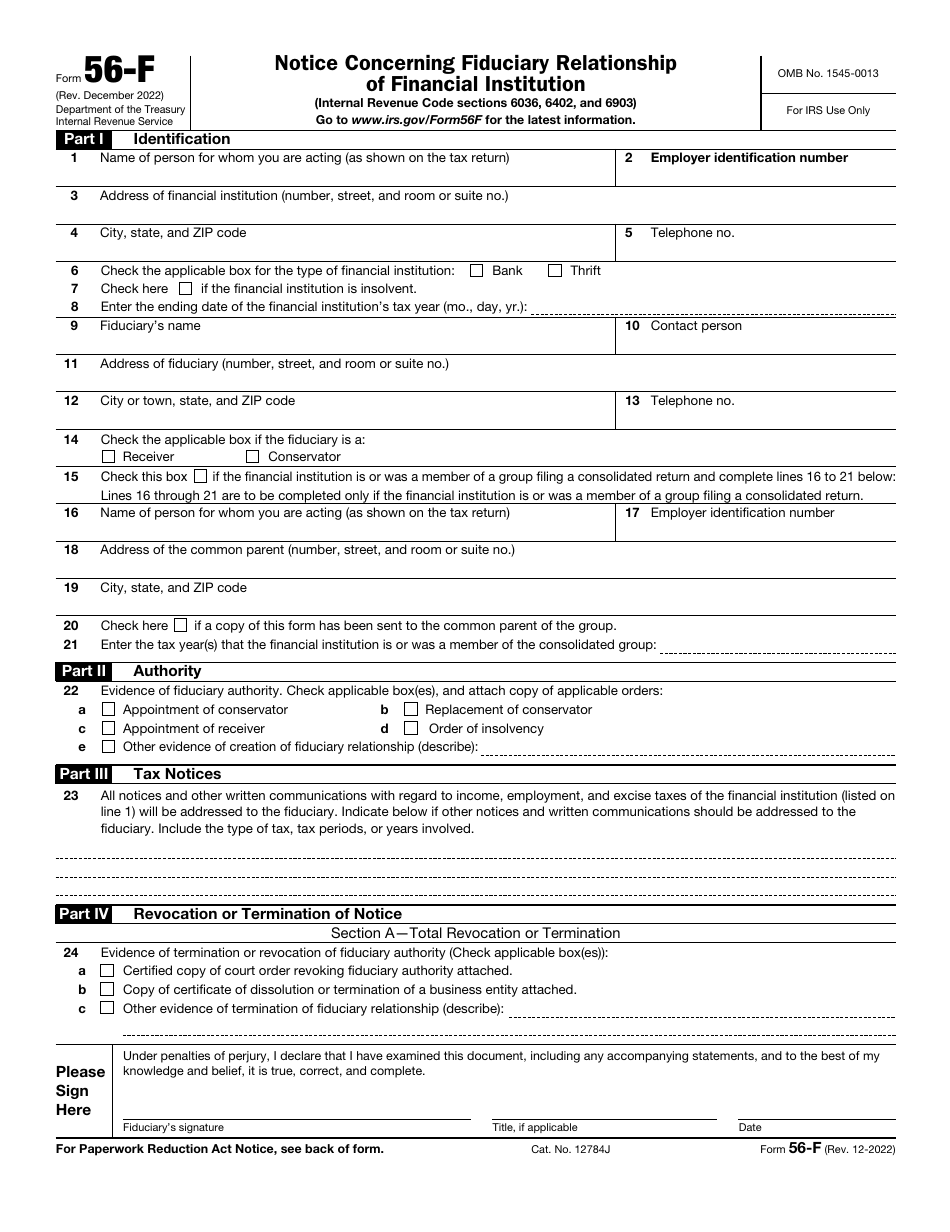

IRS Form 56F Download Fillable PDF or Fill Online Notice Concerning

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. Information about form 56, notice concerning fiduciary relationship, including recent updates, related forms, and instructions on how to file. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is. File.

IRS Form 56 Instructions IRS Notice of Fiduciary Relationship

Sign form 56 under penalty of perjury and enter a title describing your role as a fiduciary (for example, assignee, executor,. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is. There is no penalty for not filing form 56, but you will still.

Information About Form 56, Notice Concerning Fiduciary Relationship, Including Recent Updates, Related Forms, And Instructions On How To File.

You will not be penalized for forgetting to submit form 56. Sign form 56 under penalty of perjury and enter a title describing your role as a fiduciary (for example, assignee, executor,. File form 56 with the internal revenue service. However, due to miscommunication, the irs may continue to.

There Is No Penalty For Not Filing Form 56, But You Will Still Be Penalized For Any Late Filing Or Errors In Tax Submissions.

Generally, you should file form 56 when you create (or terminate) a fiduciary relationship. The irs tax form 56 is used to inform the irs that there has been a change in a fiduciary relationship, one in which someone is.