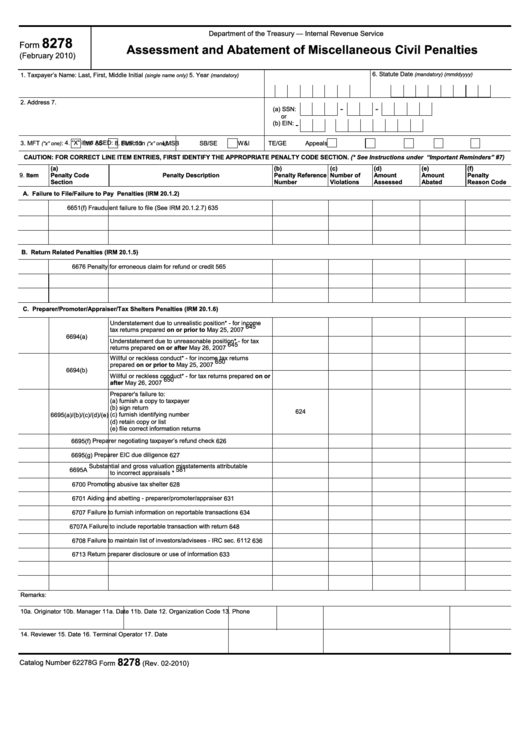

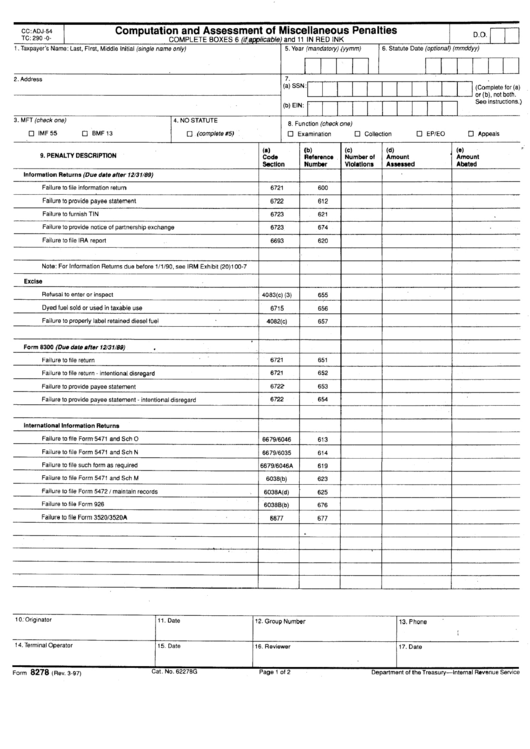

Irs Tax Form 8278 - Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. It is essential for taxpayers seeking to resolve. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs.

Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. It is essential for taxpayers seeking to resolve.

Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. It is essential for taxpayers seeking to resolve.

TAX Refund Check Your IRS Tax Return Status, Refund Timetable & Date

Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. It is essential for taxpayers seeking to resolve. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert.

A Frivolous Return Penalty Fraud

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. It is essential for taxpayers seeking to.

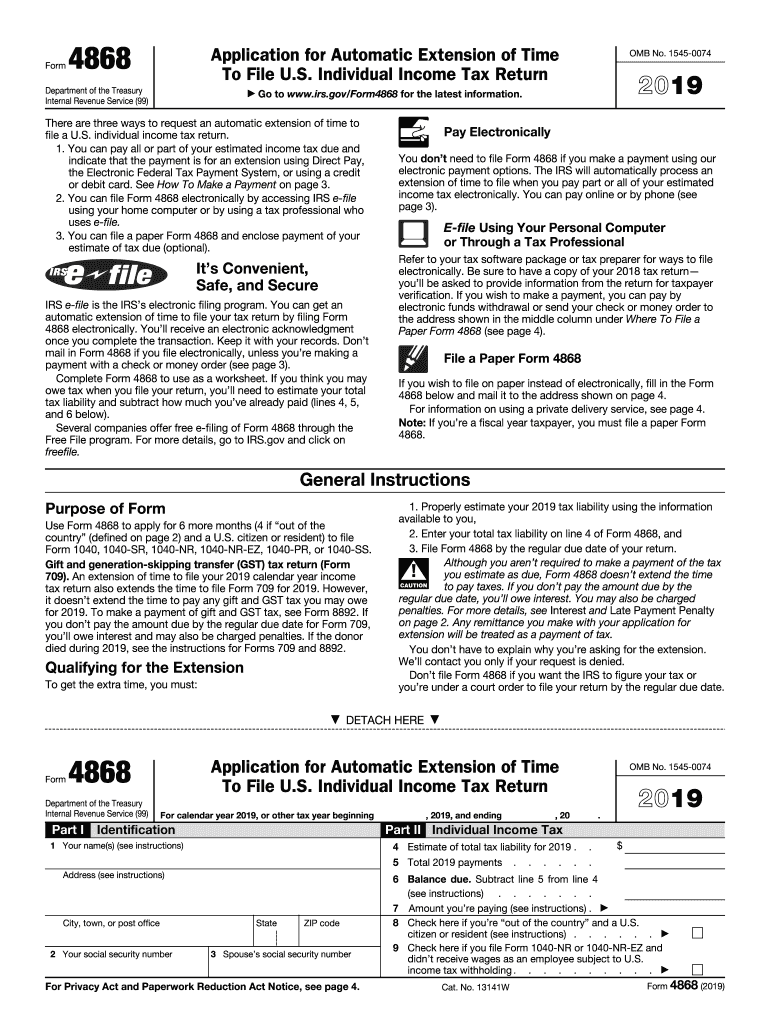

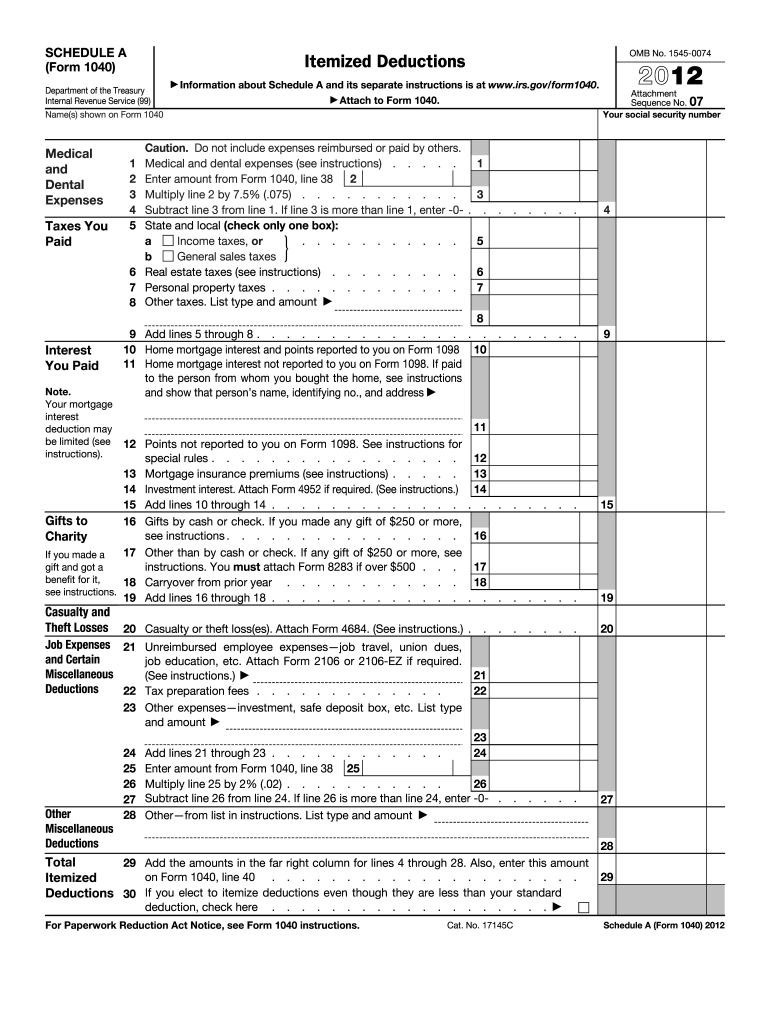

Irs Gov Printable Forms

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. It is essential for taxpayers seeking to resolve. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties,.

Fillable Form 8278 Assessment And Abatement Of Miscellaneous Civil

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. It is essential for.

Fillable Online irs irs Fax Email Print pdfFiller

It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form.

Form 8278 Computation And Assessment Of Miscellaneous Penalties Form

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278.

IRS FORM 5498 Automated Systems, Inc.

Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. It is essential for taxpayers seeking to resolve. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert.

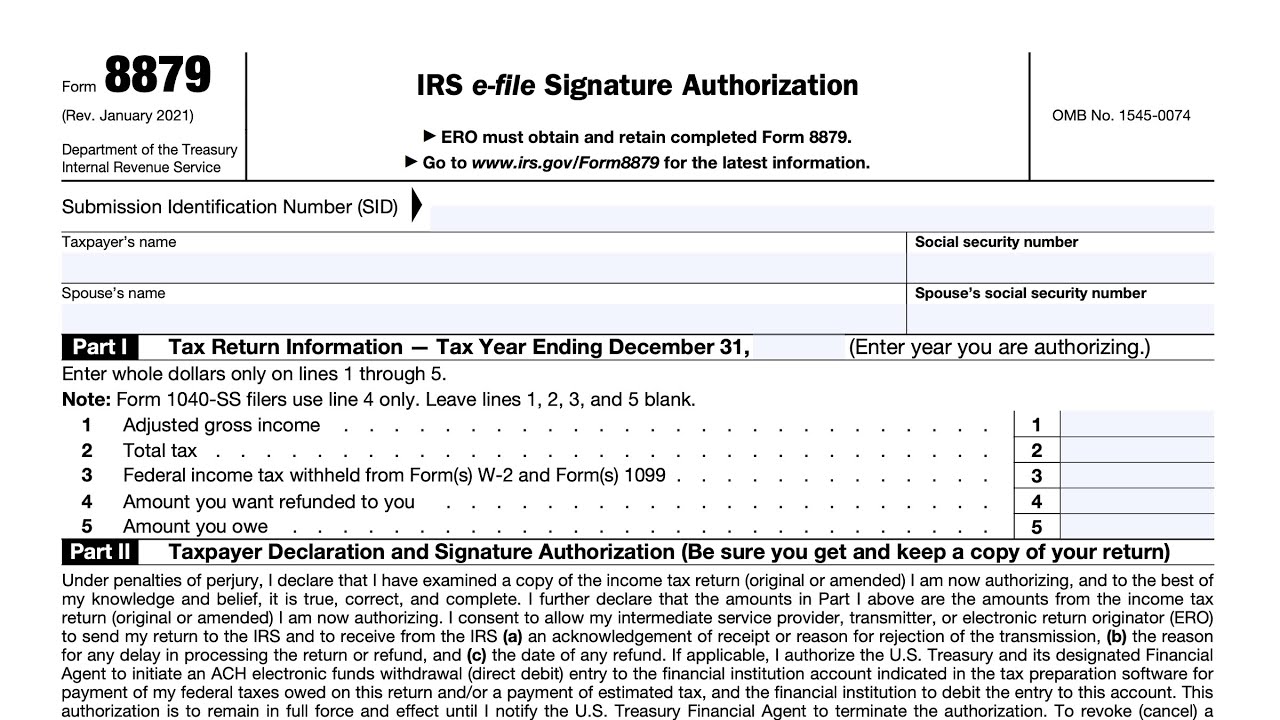

Downloadable Form 8879 IRS EFile Signature Authorization, 42 OFF

It is essential for taxpayers seeking to resolve. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278.

IRS Extends 2022 Tax Deadline to October 16 for CA Disaster Victims

Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886. Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form.

IRS Tax Form 4506T Automation for Document Processing

It is essential for taxpayers seeking to resolve. Form 8278 is used to assess and abate miscellaneous civil penalties by the irs. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form.

Form 8278 Is Used To Assess And Abate Miscellaneous Civil Penalties By The Irs.

Form 8278, assessment and abatement of miscellaneous civil penalties, is used to assert tax return preparer penalties. Form 8278, assessment and abatement of miscellaneous civil penalties, requires that both the originator and supervisor sign and date. It is essential for taxpayers seeking to resolve. Form 8278 —international penalties are assessed on form 8278, assessment and abatement of miscellaneous civil penalties, with a form 886.