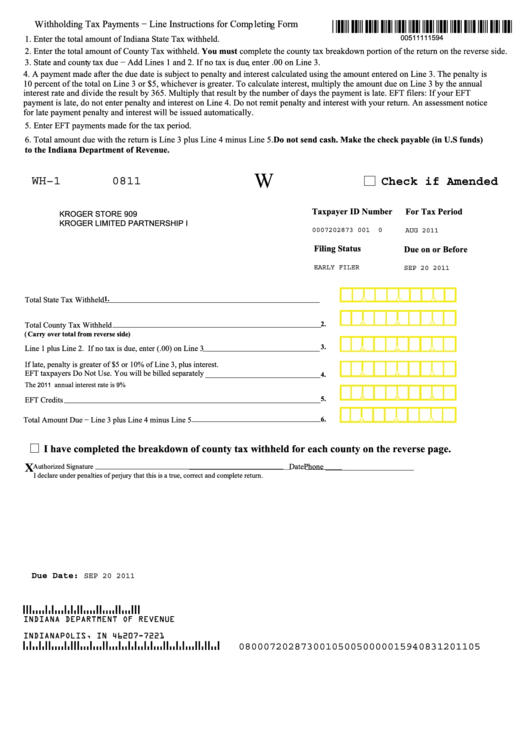

Indiana Form Wh 1 - Find important information regarding withholding tax forms from the indiana department of revenue. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. You'll receive your account number and tax rate. Businesses currently filing paper coupons will. Register online with the indiana department of workforce development. All businesses in indiana must file and pay their sales and withholding taxes electronically. Discover essential forms for withholding tax.

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. Find important information regarding withholding tax forms from the indiana department of revenue. All businesses in indiana must file and pay their sales and withholding taxes electronically. Businesses currently filing paper coupons will. You'll receive your account number and tax rate. Discover essential forms for withholding tax. Register online with the indiana department of workforce development.

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. Businesses currently filing paper coupons will. Discover essential forms for withholding tax. Register online with the indiana department of workforce development. All businesses in indiana must file and pay their sales and withholding taxes electronically. You'll receive your account number and tax rate. Find important information regarding withholding tax forms from the indiana department of revenue.

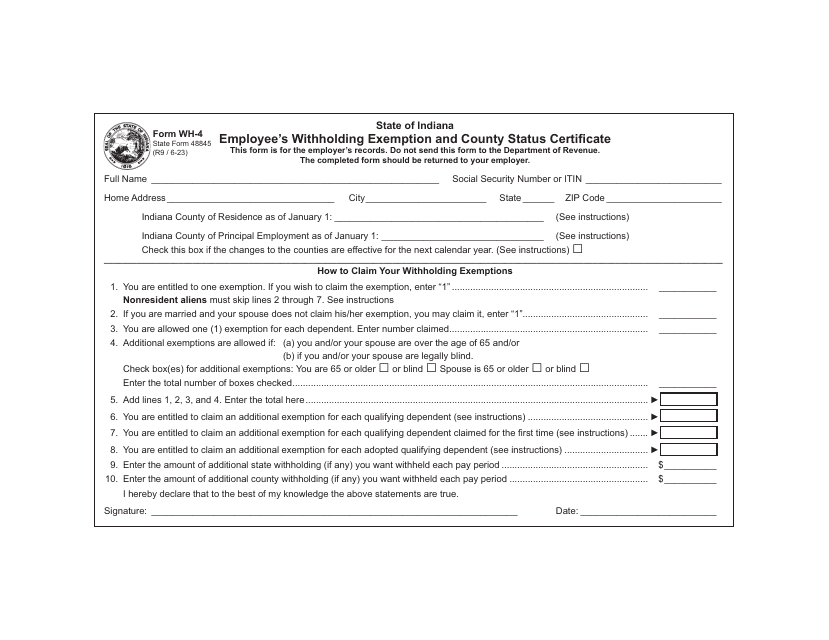

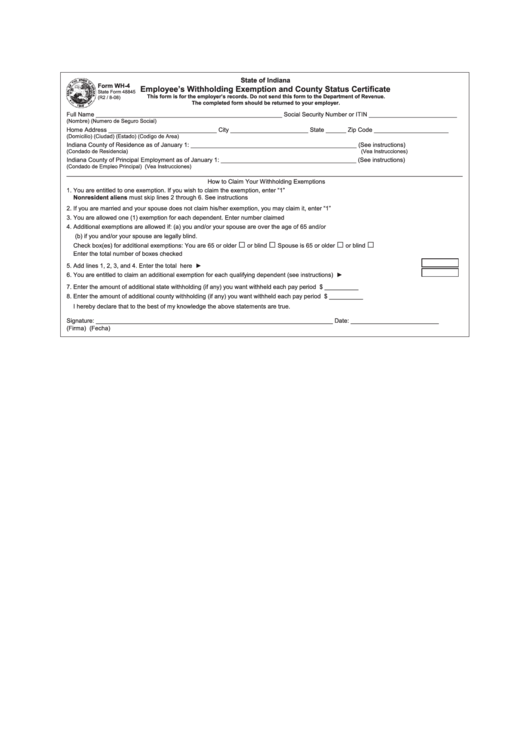

Form WH4 (State Form 48845) Download Fillable PDF or Fill Online

Find important information regarding withholding tax forms from the indiana department of revenue. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. You'll receive your account number and tax rate. All businesses in indiana must file and pay their sales and withholding taxes electronically. Register online with the.

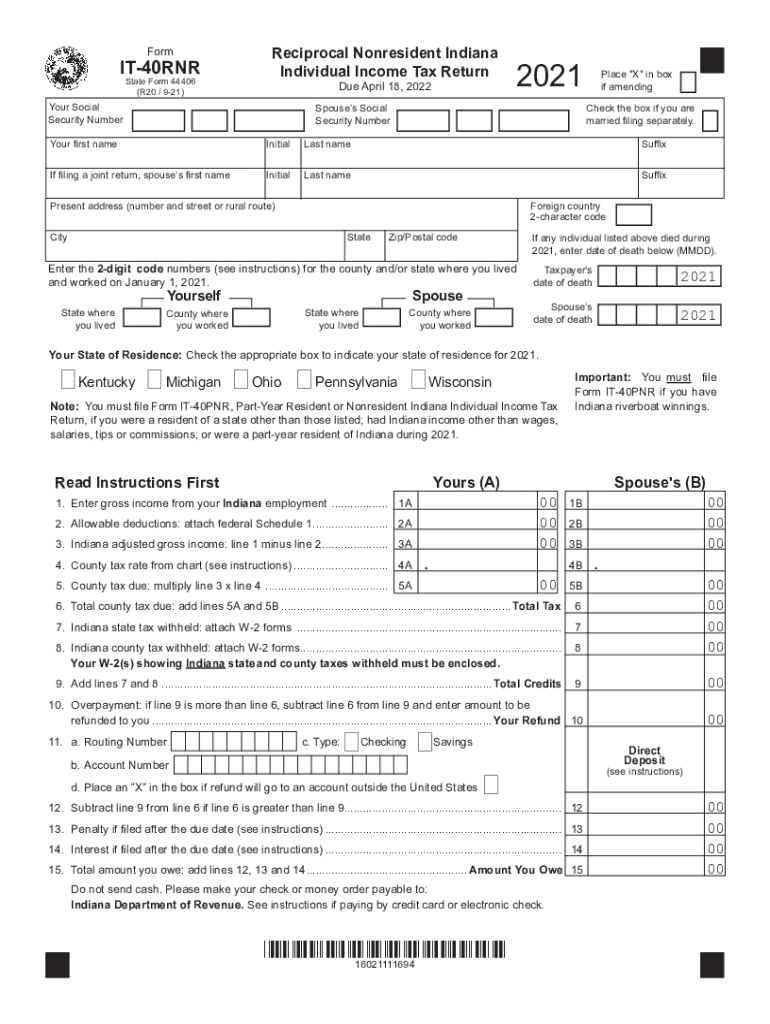

Indiana it 40rnr 20212024 Form Fill Out and Sign Printable PDF

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. Discover essential forms for withholding tax. All businesses in indiana must file and pay their sales and withholding taxes electronically. Register online with the indiana department of workforce development. You'll receive your account number and tax rate.

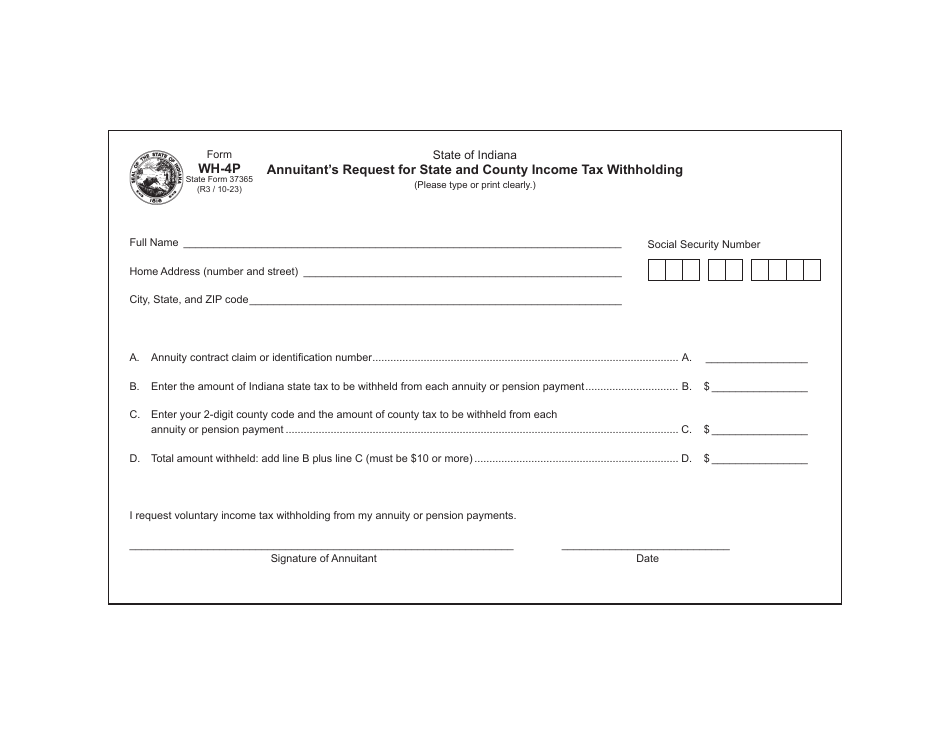

Form WH4P (State Form 37365) Fill Out, Sign Online and Download

Register online with the indiana department of workforce development. You'll receive your account number and tax rate. Businesses currently filing paper coupons will. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. Discover essential forms for withholding tax.

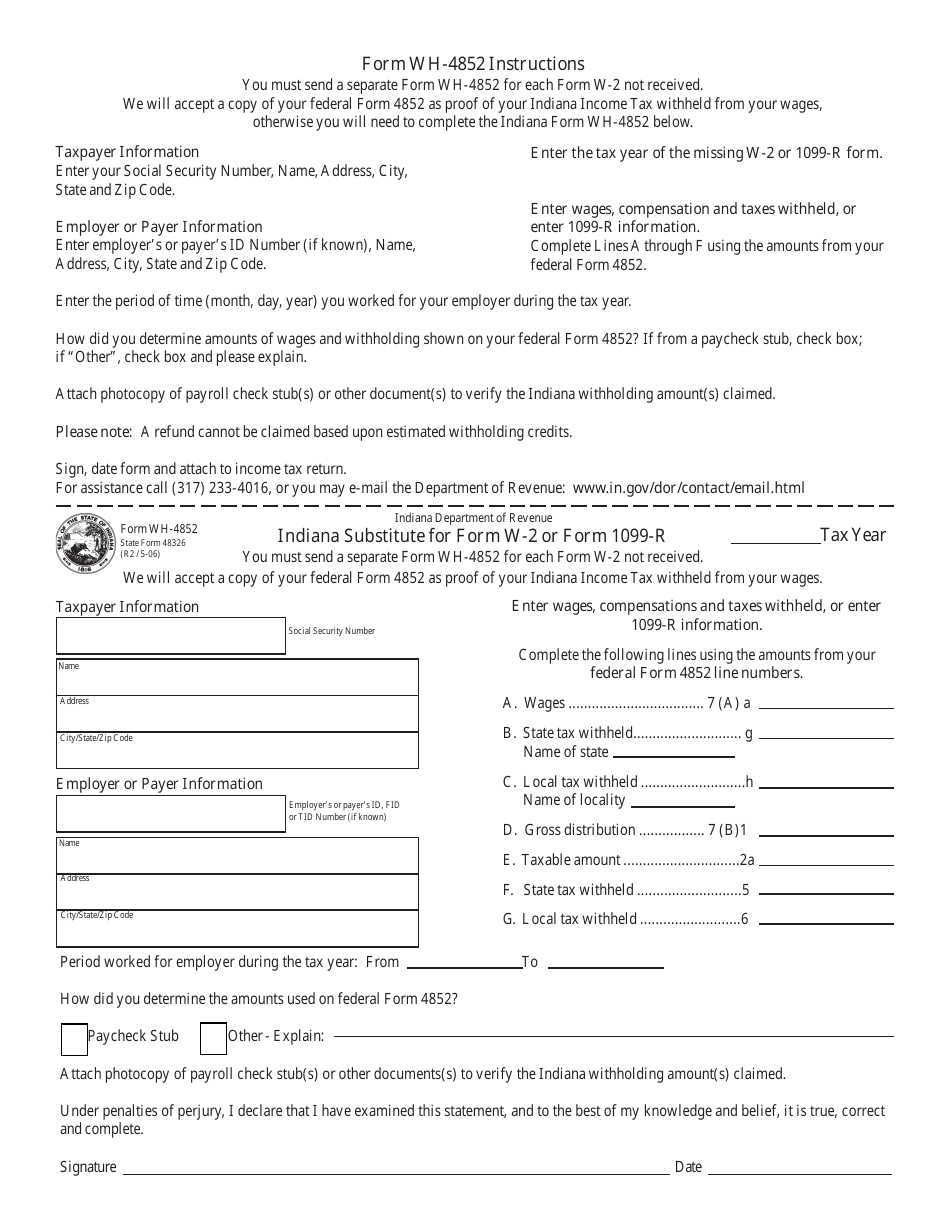

Form WH4852 Fill Out, Sign Online and Download Fillable PDF, Indiana

You'll receive your account number and tax rate. Find important information regarding withholding tax forms from the indiana department of revenue. All businesses in indiana must file and pay their sales and withholding taxes electronically. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. Discover essential forms for.

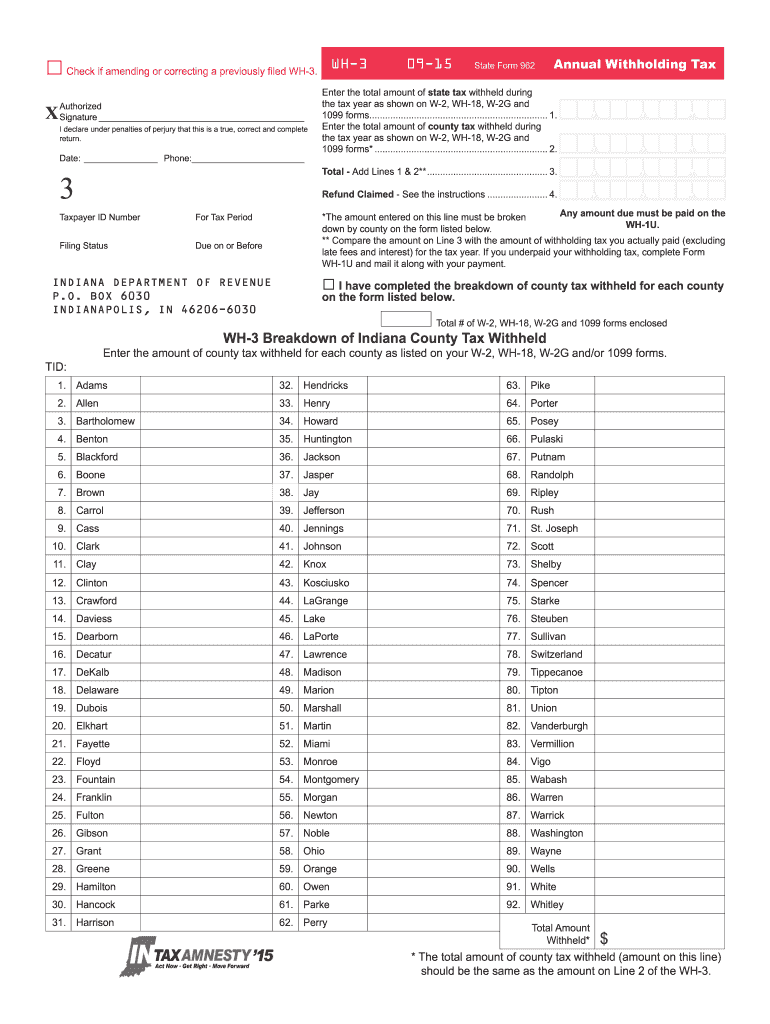

Fillable Online Indiana wh 3 form pdf. Indiana wh 3 form pdf.If the

Register online with the indiana department of workforce development. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. All businesses in indiana must file and pay their sales and withholding taxes electronically. You'll receive your account number and tax rate. Find important information regarding withholding tax forms from.

Indiana state form 18733 Fill out & sign online DocHub

Register online with the indiana department of workforce development. Discover essential forms for withholding tax. All businesses in indiana must file and pay their sales and withholding taxes electronically. Find important information regarding withholding tax forms from the indiana department of revenue. Businesses currently filing paper coupons will.

Mo State Tax Withholding Form

Find important information regarding withholding tax forms from the indiana department of revenue. You'll receive your account number and tax rate. Businesses currently filing paper coupons will. Discover essential forms for withholding tax. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county.

Wh 3 20152024 Form Fill Out and Sign Printable PDF Template

Businesses currently filing paper coupons will. Find important information regarding withholding tax forms from the indiana department of revenue. Register online with the indiana department of workforce development. All businesses in indiana must file and pay their sales and withholding taxes electronically. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana.

How to Start an LLC in Indiana Key Steps and Formation Costs

Businesses currently filing paper coupons will. Register online with the indiana department of workforce development. Discover essential forms for withholding tax. All businesses in indiana must file and pay their sales and withholding taxes electronically. You'll receive your account number and tax rate.

Printable Indiana Form Wh 1 Printable Form 2024

You'll receive your account number and tax rate. Discover essential forms for withholding tax. Register online with the indiana department of workforce development. Find important information regarding withholding tax forms from the indiana department of revenue. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county.

Register Online With The Indiana Department Of Workforce Development.

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana state and/or county. You'll receive your account number and tax rate. Discover essential forms for withholding tax. Businesses currently filing paper coupons will.

Find Important Information Regarding Withholding Tax Forms From The Indiana Department Of Revenue.

All businesses in indiana must file and pay their sales and withholding taxes electronically.