Hybrid Forms Of Business Organization - These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. After reading this chapter, you should understand the following: Here we take up the most. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. This chapter provides a bridge between the partnership and.

The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. Here we take up the most. After reading this chapter, you should understand the following: This chapter provides a bridge between the partnership and.

This chapter provides a bridge between the partnership and. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. Here we take up the most. After reading this chapter, you should understand the following:

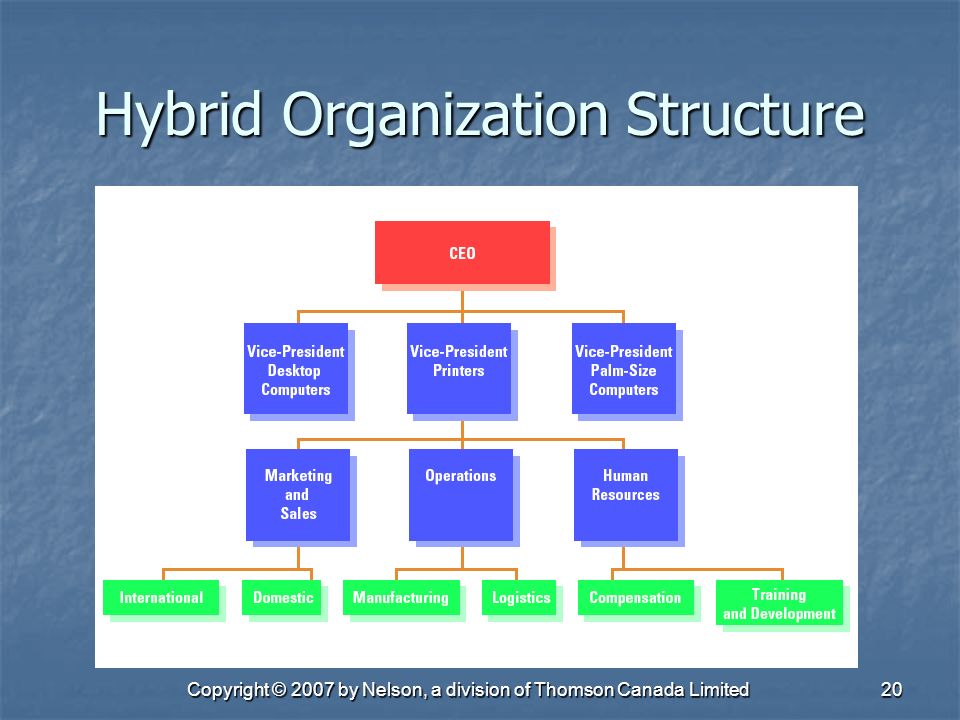

Hybrid Organization Structure PowerPoint Presentation Slides PPT

The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. This chapter provides a bridge between the partnership and. After reading this chapter, you should understand the following: Here we take.

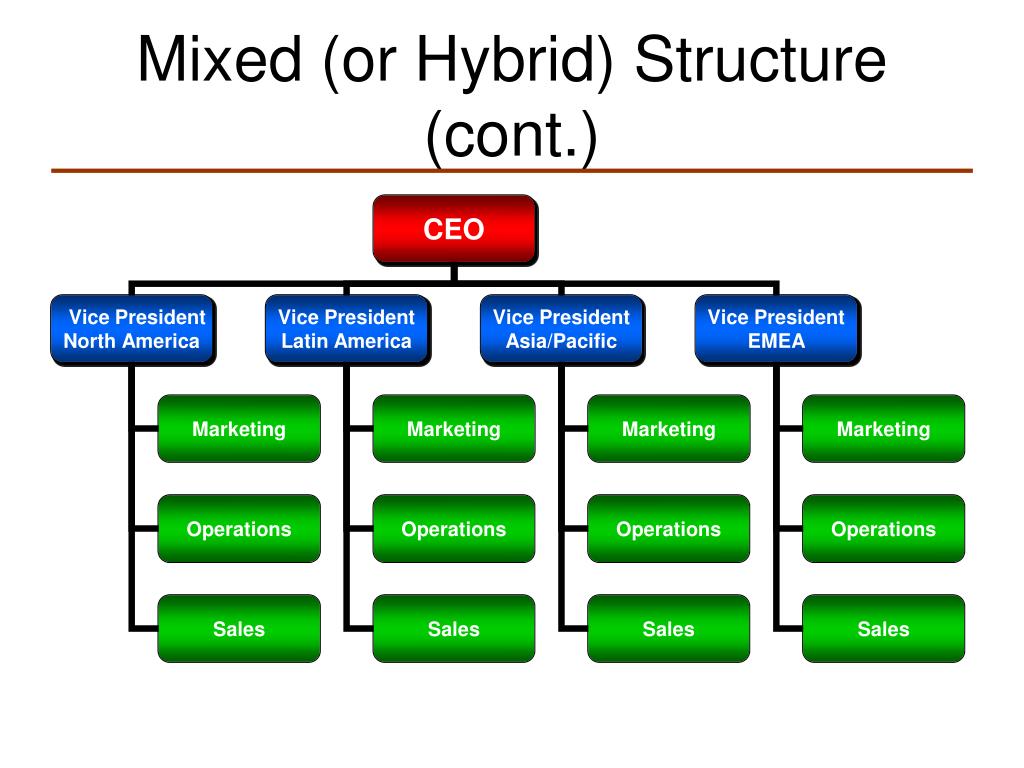

Types of Organizational Structure and Their Pros and Cons PLANERGY

Here we take up the most. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. This chapter provides a bridge between the partnership and. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. After reading this chapter, you should.

Top 5 Profitable Advantages of a Hybrid Organizational Structure

After reading this chapter, you should understand the following: Here we take up the most. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. This chapter provides a bridge between.

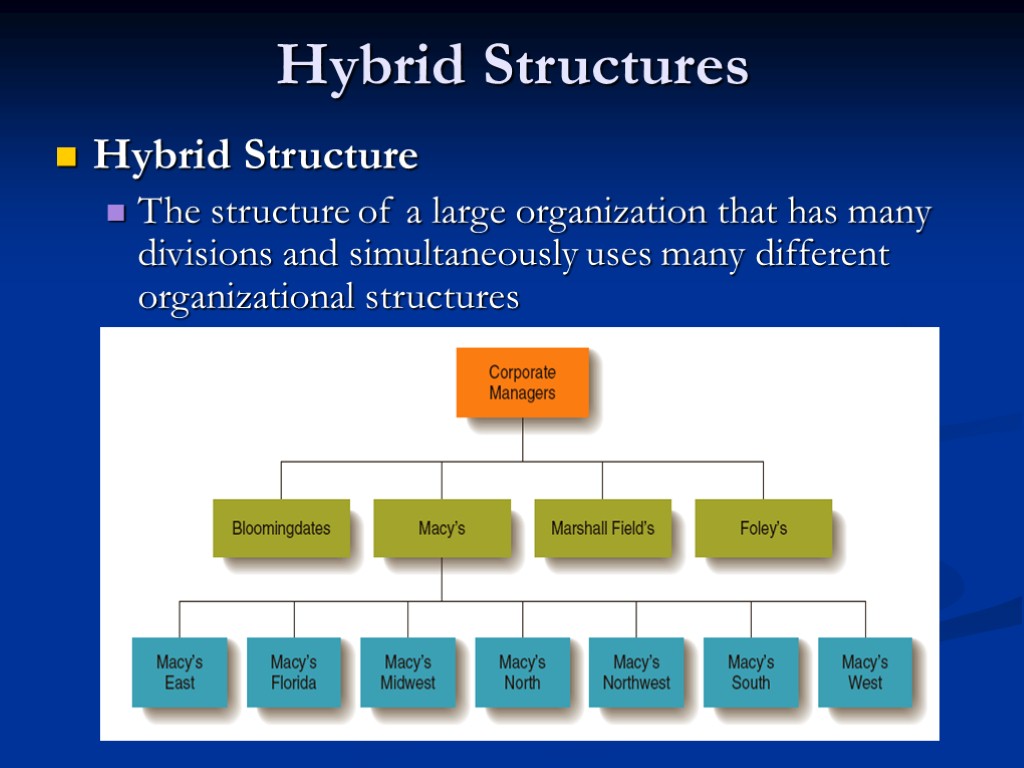

Hybrid Organizational Structure Examples

Here we take up the most. This chapter provides a bridge between the partnership and. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. After reading this chapter, you should understand the following: These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no.

Hybrid organizational structure is used in many multinational companies

Here we take up the most. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. This chapter provides a bridge between the partnership and. After reading this chapter, you should understand the following: These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no.

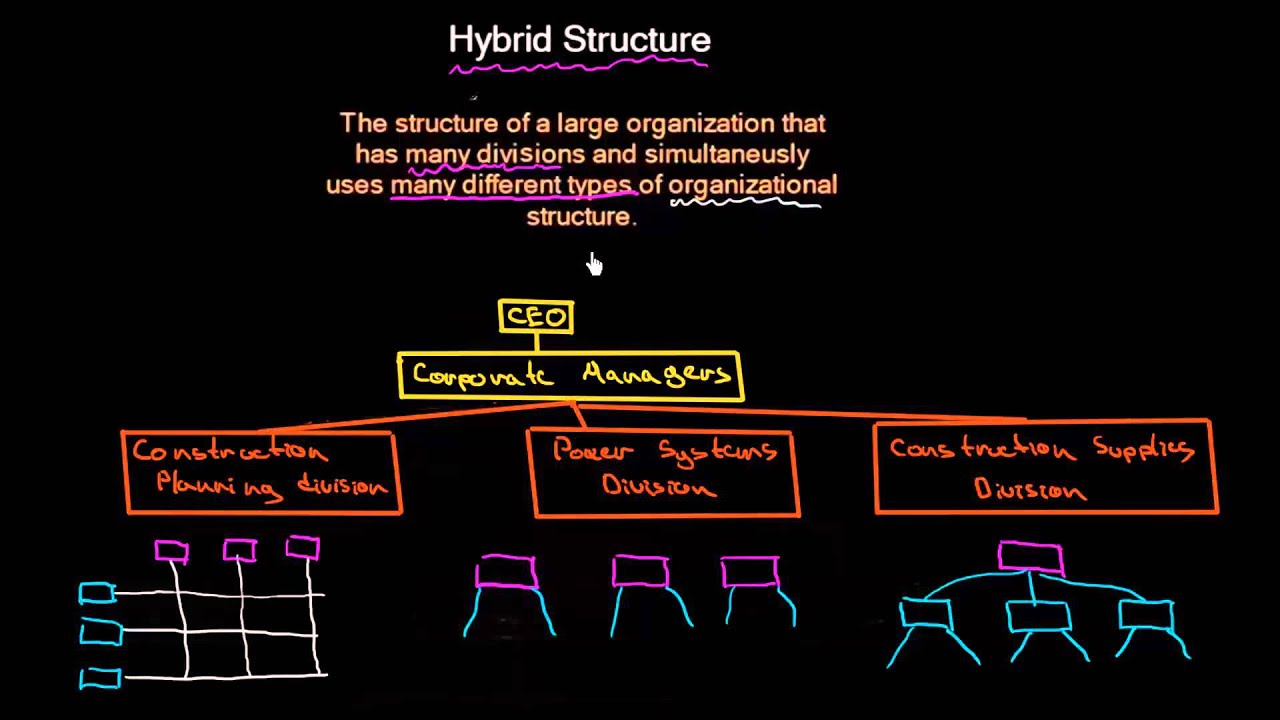

Organizational structure Lecture 5 What Is Organizing? Organizing

These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. This chapter provides a bridge between the partnership and. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. Here we take up the most. After reading this chapter, you should.

3 Example of Hybrid Business and Companies That You Can Try Ginee

This chapter provides a bridge between the partnership and. After reading this chapter, you should understand the following: Here we take up the most. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and.

Hybrid Organization Structure Business powerpoint templates, Company

After reading this chapter, you should understand the following: This chapter provides a bridge between the partnership and. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. Here we take.

(PDF) Hybrid Forms of Business Organization The Interfirm Cooperation

This chapter provides a bridge between the partnership and. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. Here we take up the most. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. After reading this chapter, you should.

Hybrid Organisational Structure Organisational Design MeanThat

Here we take up the most. This chapter provides a bridge between the partnership and. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. The rationale for the invention of these hybrid business forms, then, is (1) risk reduction and (2) tax reduction. After reading this chapter, you should.

The Rationale For The Invention Of These Hybrid Business Forms, Then, Is (1) Risk Reduction And (2) Tax Reduction.

After reading this chapter, you should understand the following: This chapter provides a bridge between the partnership and. These hybrid organization forms provide business owners with limited liability (the attractive feature of corporations) and no double taxation (the. Here we take up the most.