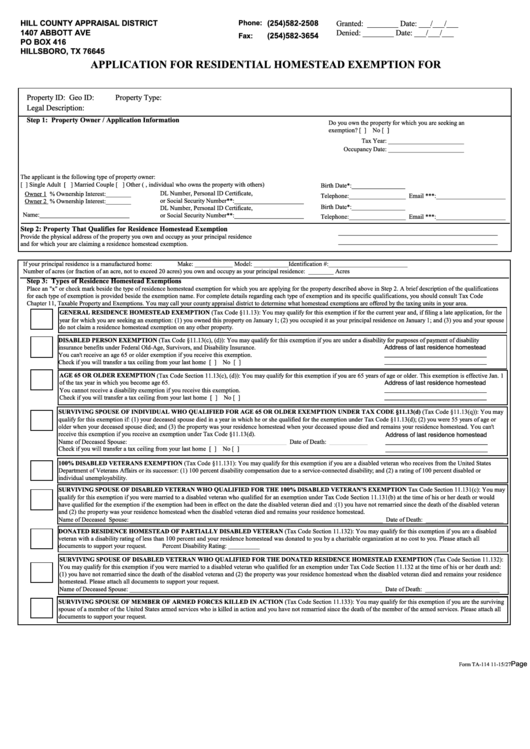

Homestead Exemption Form Tarrant County - This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. There is no fee for filing an application. Failure to complete all applicable parts and attach all required documentation may result in denial of. View list of entities we.

Failure to complete all applicable parts and attach all required documentation may result in denial of. There is no fee for filing an application. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. View list of entities we. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the.

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. There is no fee for filing an application. View list of entities we. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. Failure to complete all applicable parts and attach all required documentation may result in denial of.

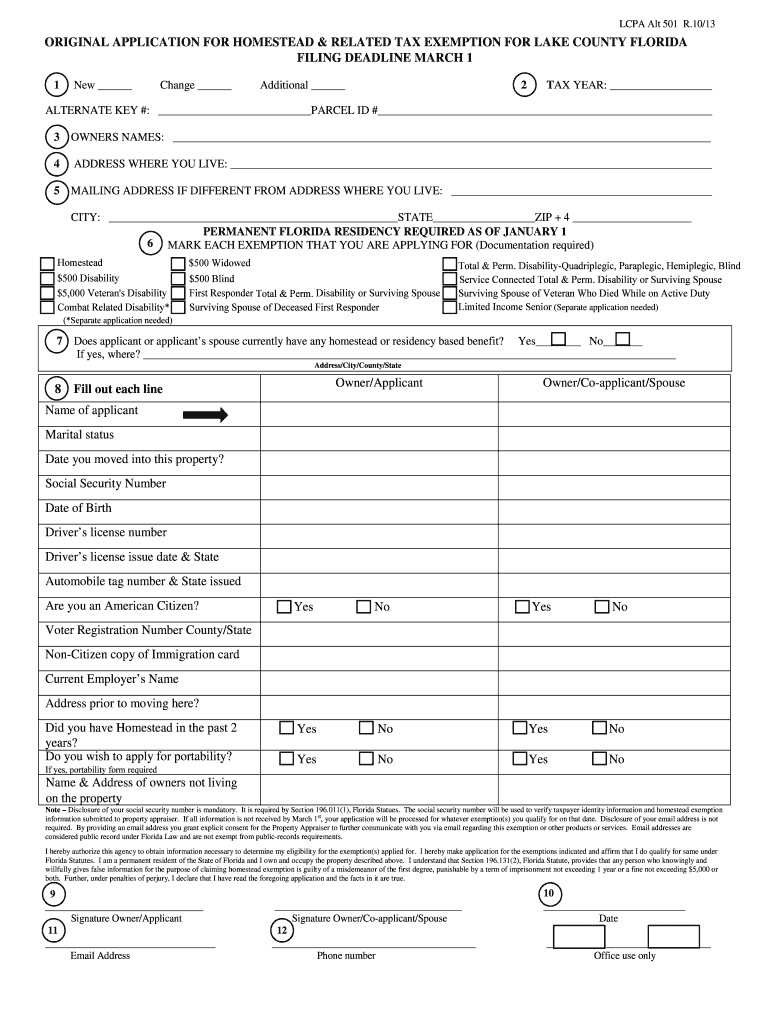

Riverside County Homestead Exemption Form

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach all required documentation may result in denial of. View list of entities we. There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value.

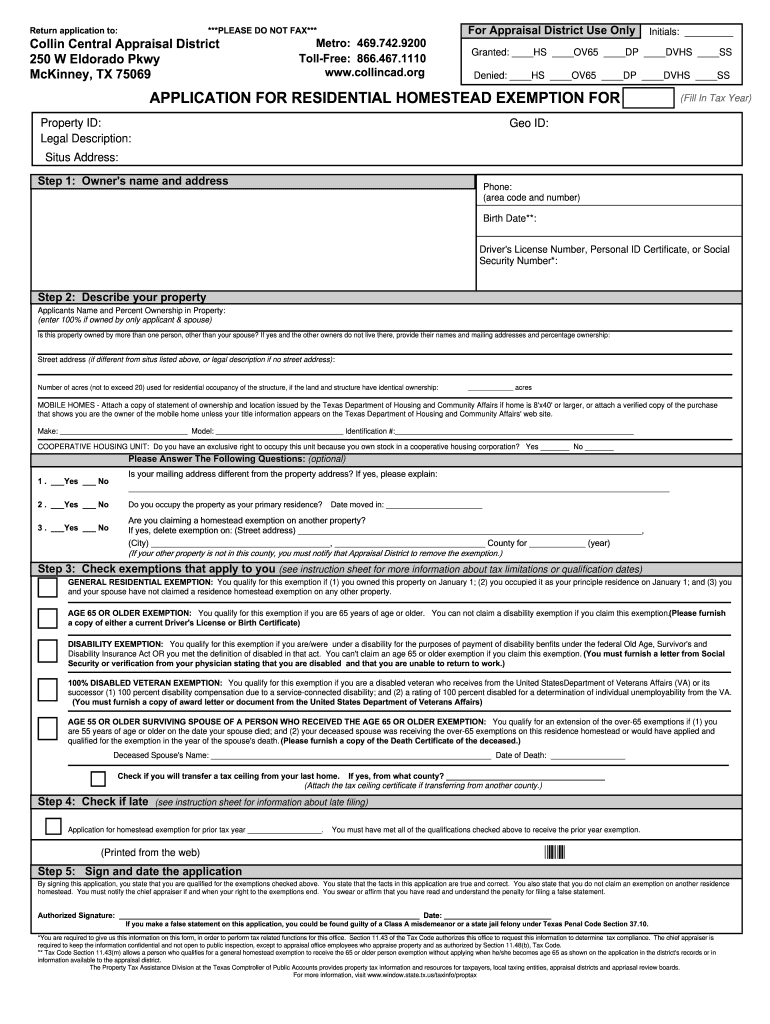

Collin County Homestead Exemption 2024 Helga Kristin

Failure to complete all applicable parts and attach all required documentation may result in denial of. View list of entities we. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the..

Harris County Homestead Exemption Form

A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. There is no fee for filing an application. Failure to complete all applicable parts and attach all required documentation may result in denial of. This application is for use in claiming general homestead exemptions pursuant to tax code.

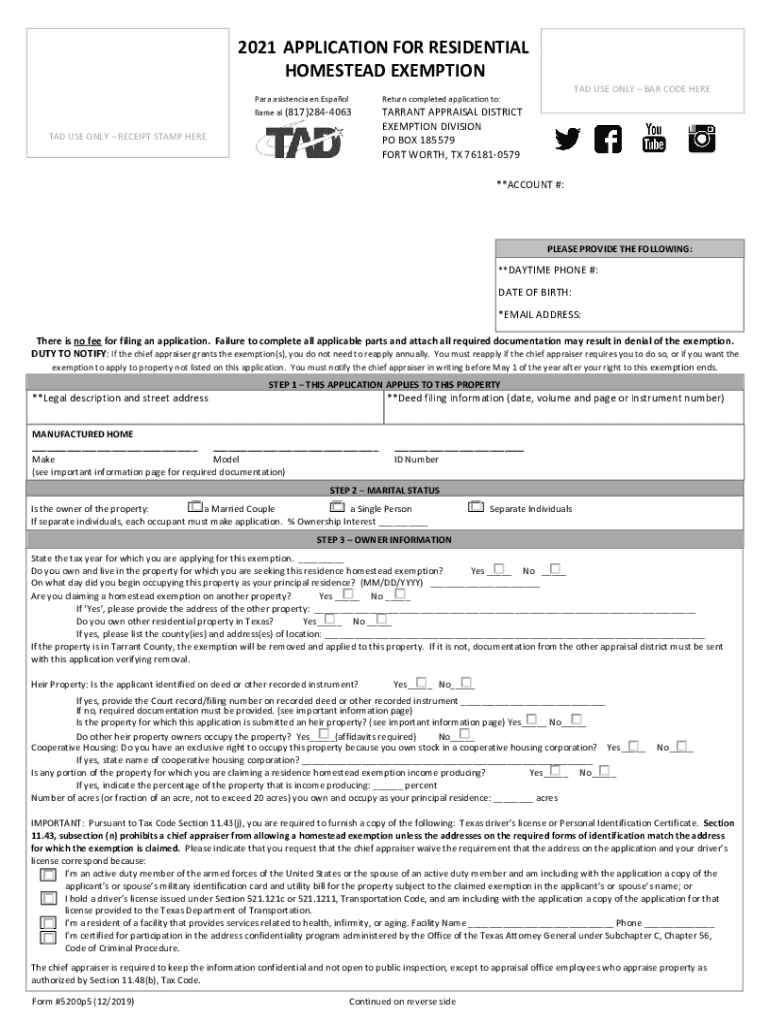

Tarrant county homestead exemption form Fill out & sign online DocHub

A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach all required documentation may result in denial of. View list of entities we..

Free Tarrant County Homestead Exemption YouTube

Failure to complete all applicable parts and attach all required documentation may result in denial of. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. View list of entities we..

How a Homestead Exemption Can Save You Taxes Orchard

This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. There is no fee for filing an application. Failure to complete all applicable parts and attach all required documentation may result in denial of. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as.

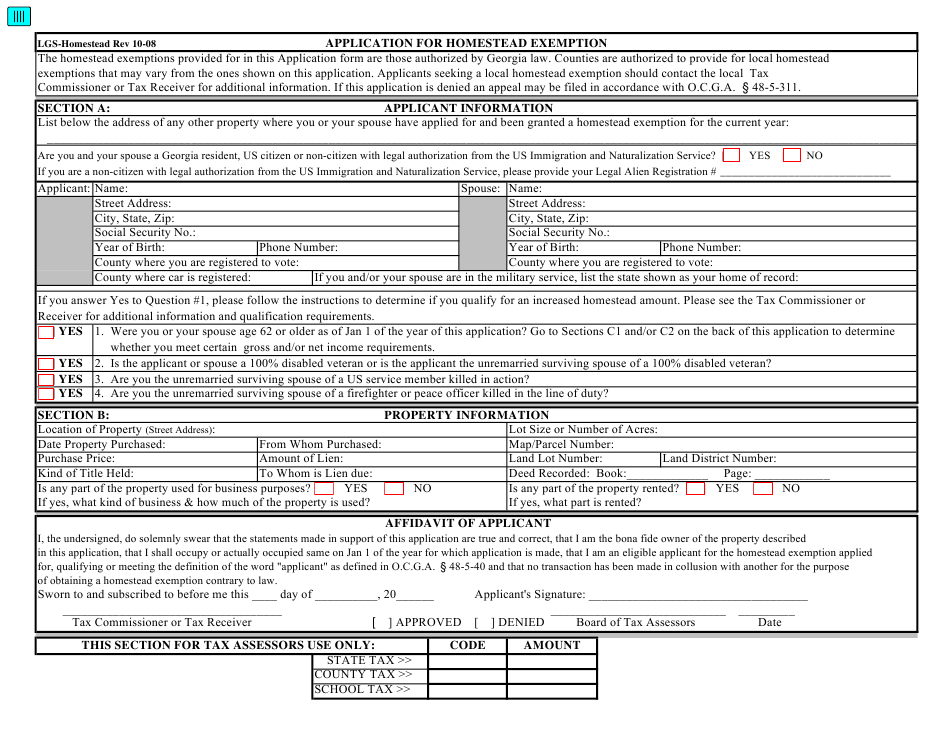

Chatham County Ga Homestead Exemption Form

There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the. View list of entities we. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach.

Tarrant County Homestead Exemption Deadline 2024 Lotta Rhiamon

View list of entities we. There is no fee for filing an application. Failure to complete all applicable parts and attach all required documentation may result in denial of. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. A homestead exemption is an exemption that removes all or a portion of value.

How to File for a Homestead Exemption in Tarrant County TX Step by

Failure to complete all applicable parts and attach all required documentation may result in denial of. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. There is no fee for filing an application. View list of entities we. A homestead exemption is an exemption that removes all or a portion of value.

Homestead Exemption Disappearing For Some Tarrant County Taxpayers

View list of entities we. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. Failure to complete all applicable parts and attach all required documentation may result in denial of. There is no fee for filing an application. A homestead exemption is an exemption that removes all or a portion of value.

Failure To Complete All Applicable Parts And Attach All Required Documentation May Result In Denial Of.

There is no fee for filing an application. View list of entities we. This application is for use in claiming general homestead exemptions pursuant to tax code §11.13 and §11.131. A homestead exemption is an exemption that removes all or a portion of value from your residence homestead as authorized by the.