Goodwill Itemized Donation Form - If you itemize your deductions on your tax return, you can deduct these donations. Not all donations to goodwill automatically qualify for tax deductions. To claim such a deduction, the donations must be made. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition.

Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. If you itemize your deductions on your tax return, you can deduct these donations.

Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. Not all donations to goodwill automatically qualify for tax deductions. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. To claim such a deduction, the donations must be made. If you itemize your deductions on your tax return, you can deduct these donations.

Goodwill Donation Valuation Guide 2022

Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. If you itemize your deductions on your tax return, you can deduct these donations. Federal law states that taxpayers.

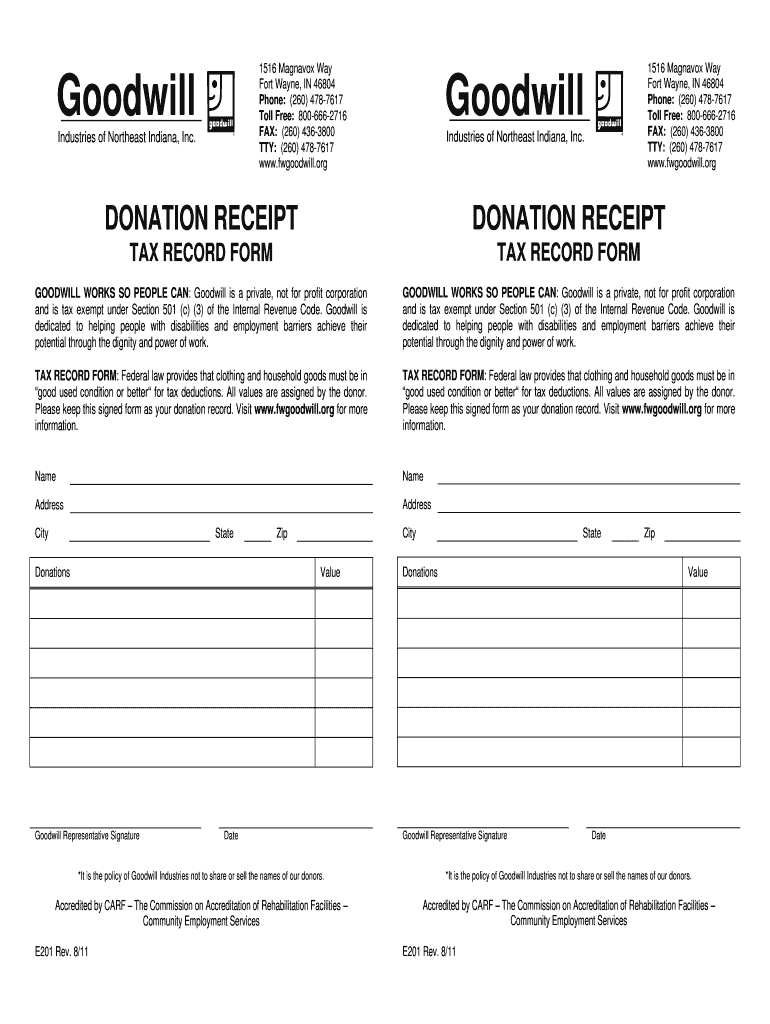

Goodwill Donation Receipt Fill Online Printable Fillable —

Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. If you itemize your deductions on your tax return, you can deduct these donations. To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. Learn how to value your donations.

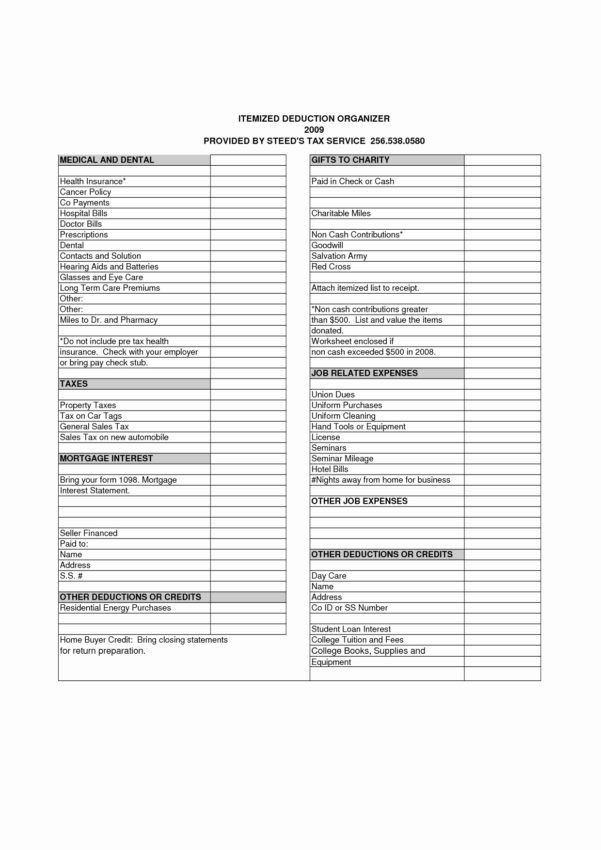

Itemized Donation List For Taxes

Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. Not all donations to goodwill automatically qualify for tax deductions. To claim such a deduction, the donations must be.

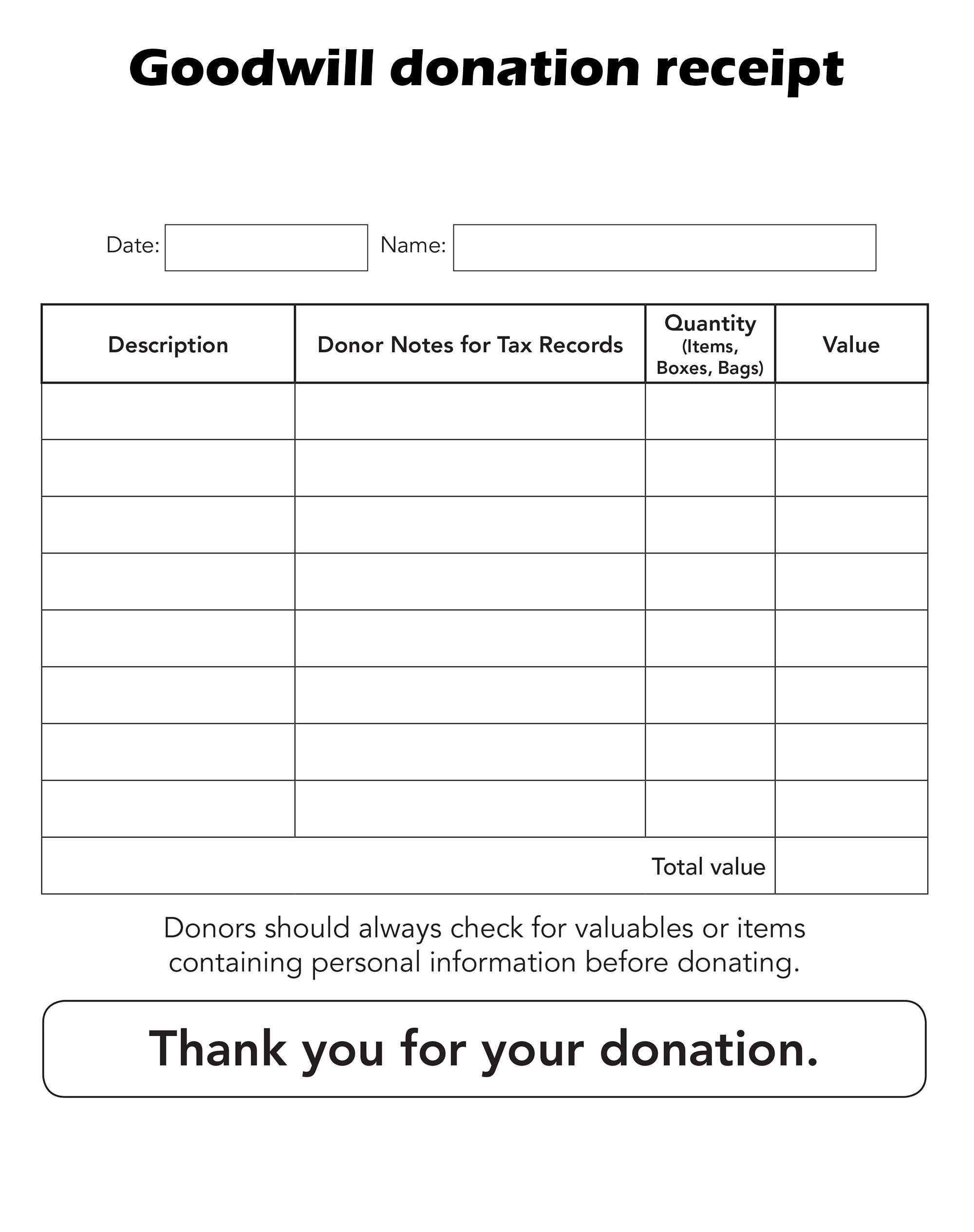

Donation Printable Form Printable Forms Free Online

To claim such a deduction, the donations must be made. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Not all donations to goodwill automatically qualify for tax.

Wigs For Kids Florida Printable Donation Form Printable Forms Free Online

To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good.

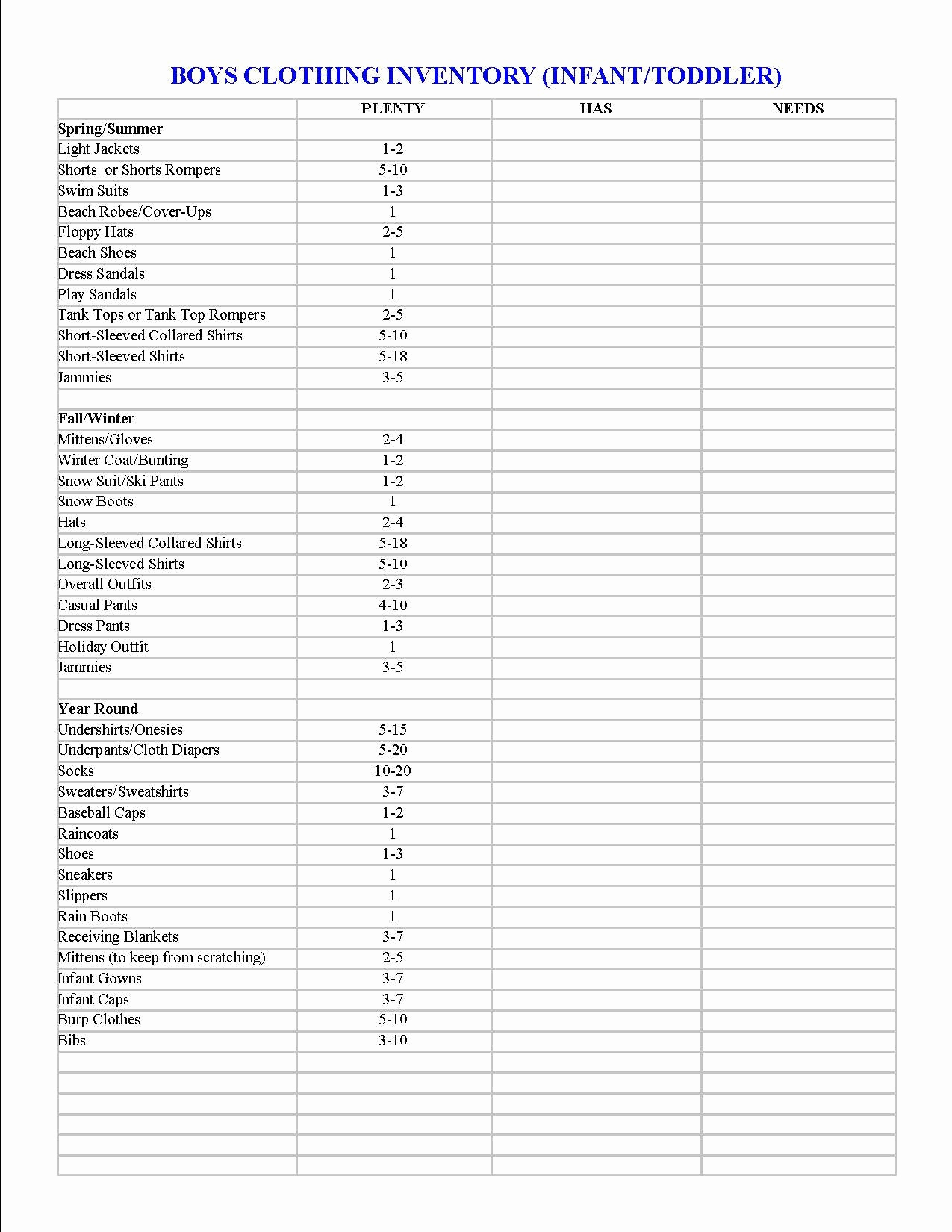

goodwill donations list Google Search Donate, Goodwill donations

If you itemize your deductions on your tax return, you can deduct these donations. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. Federal law states that taxpayers.

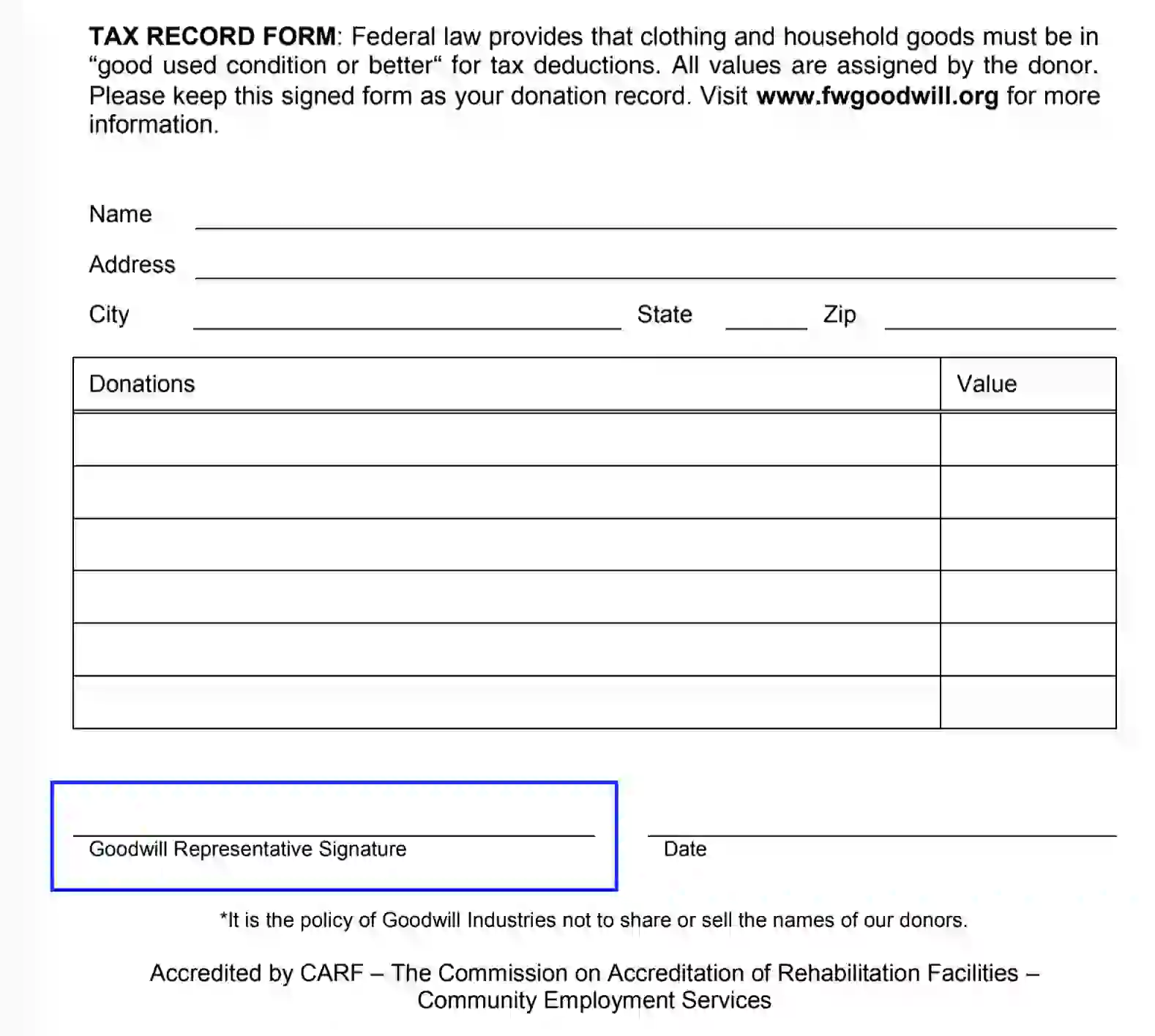

Printable Goodwill Donation Receipt

Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. To claim such a deduction, the donations must be made. Not all donations to goodwill automatically qualify for tax deductions. If you itemize your deductions on your tax return, you can deduct these donations. Learn how to value your donations.

Irs Donation Value Guide 2018 Spreadsheet Payment Spreadshee irs

To claim such a deduction, the donations must be made. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. If you itemize your deductions on your tax return, you can deduct these donations. Learn how to value your donations and claim a tax deduction for clothing and household items.

Goodwill Clothing Donation Form Template Donation form, Goodwill

Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes. If you itemize your deductions on your tax return, you can deduct these donations. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. To claim such a deduction,.

free goodwill donation receipt template pdf eforms free goodwill

Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. To claim such a deduction, the donations must be made. If you itemize your deductions on your tax return, you can deduct these donations. Not all donations to goodwill automatically qualify for tax deductions. Federal law states that taxpayers.

If You Itemize Your Deductions On Your Tax Return, You Can Deduct These Donations.

To claim such a deduction, the donations must be made. Learn how to value your donations and claim a tax deduction for clothing and household items that are in good condition. Not all donations to goodwill automatically qualify for tax deductions. Federal law states that taxpayers are responsible for determining the value of their donated items to goodwill® on their taxes.