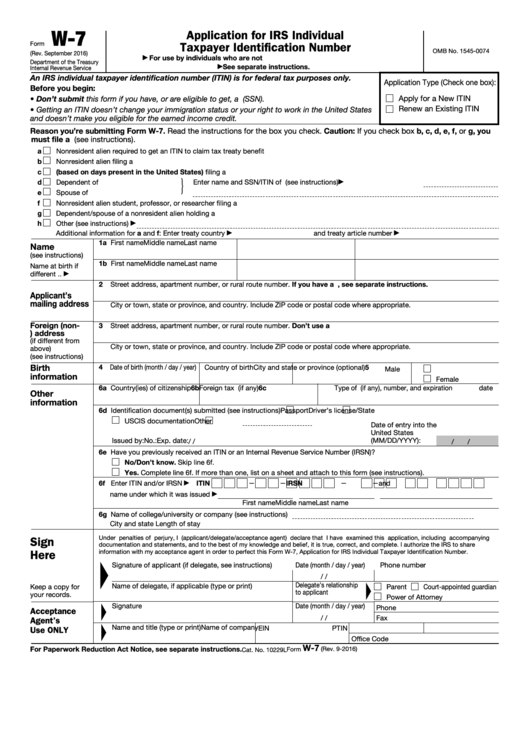

Form W 7 Instructions - If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. Federal tax return unless they meet. Common mistakes such as providing incorrect or. Individuals applying for an itin must include a u.s. To apply for a new itin.

To apply for a new itin. Common mistakes such as providing incorrect or. Individuals applying for an itin must include a u.s. Federal tax return unless they meet. If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification.

If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. To apply for a new itin. Individuals applying for an itin must include a u.s. Federal tax return unless they meet. Common mistakes such as providing incorrect or.

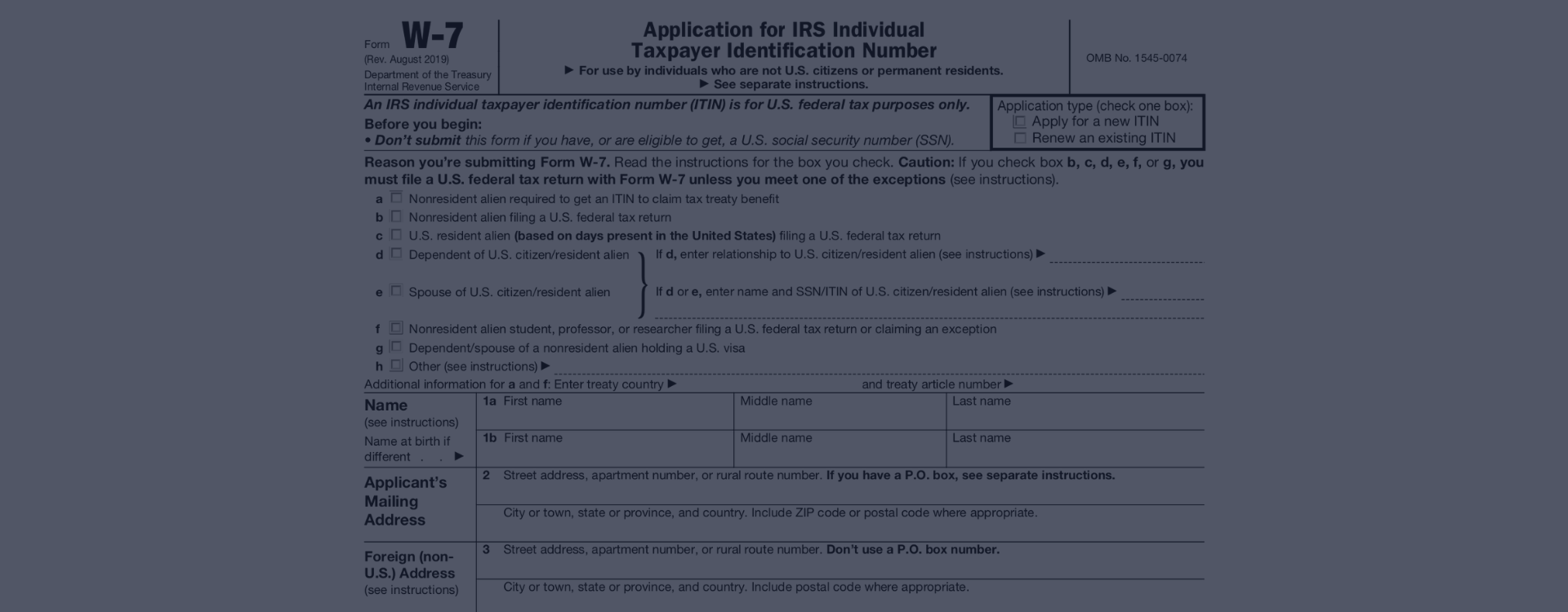

IRS Form W7 2016 2019 Fill out and Edit Online PDF Template

To apply for a new itin. If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. Federal tax return unless they meet. Common mistakes such as providing incorrect or. Individuals applying for an itin must include a u.s.

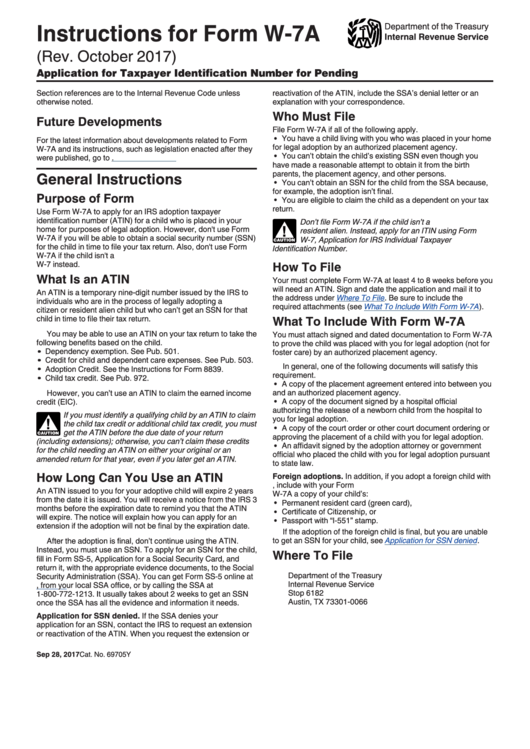

Instructions For Form W7A Application For Taxpayer Identification

If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. Federal tax return unless they meet. Individuals applying for an itin must include a u.s. To apply for a new itin. Common mistakes such as providing incorrect or.

Form W7 Printable Form W7 Blank, Sign Online PDFliner, 50 OFF

To apply for a new itin. If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. Common mistakes such as providing incorrect or. Federal tax return unless they meet. Individuals applying for an itin must include a u.s.

1999 Form IRS W7 Fill Online, Printable, Fillable, Blank pdfFiller

If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. Individuals applying for an itin must include a u.s. To apply for a new itin. Common mistakes such as providing incorrect or. Federal tax return unless they meet.

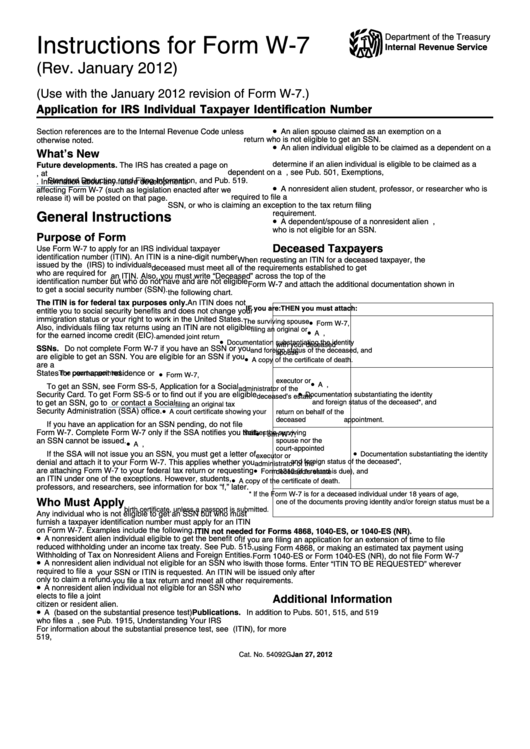

Instructions For Form W7 Application For Irs Individual Taxpayer

Individuals applying for an itin must include a u.s. Federal tax return unless they meet. If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. To apply for a new itin. Common mistakes such as providing incorrect or.

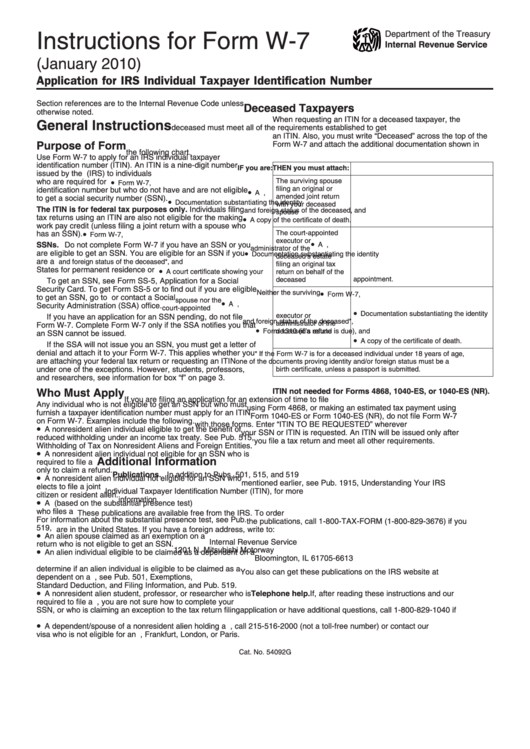

Instructions For Form W7 Application For Irs Individual Taxpayer

Common mistakes such as providing incorrect or. Individuals applying for an itin must include a u.s. If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. To apply for a new itin. Federal tax return unless they meet.

W7 Form > IRS W7 ITIN Application Instructions & Printable PDF for

Federal tax return unless they meet. Individuals applying for an itin must include a u.s. To apply for a new itin. If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. Common mistakes such as providing incorrect or.

W7 Fillable Form Printable Forms Free Online

Federal tax return unless they meet. Individuals applying for an itin must include a u.s. To apply for a new itin. Common mistakes such as providing incorrect or. If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification.

Example w7 form Lucian Poll's Web Ramblings

To apply for a new itin. If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. Individuals applying for an itin must include a u.s. Federal tax return unless they meet. Common mistakes such as providing incorrect or.

Form W 7 Instructions

If you do not have a social security number and cannot qualify for one, you may need to apply for an irs individual taxpayer identification. Individuals applying for an itin must include a u.s. To apply for a new itin. Common mistakes such as providing incorrect or. Federal tax return unless they meet.

If You Do Not Have A Social Security Number And Cannot Qualify For One, You May Need To Apply For An Irs Individual Taxpayer Identification.

To apply for a new itin. Federal tax return unless they meet. Individuals applying for an itin must include a u.s. Common mistakes such as providing incorrect or.