Form For Vat Return - Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

VAT Return Form VAT 3 (Kenya)

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

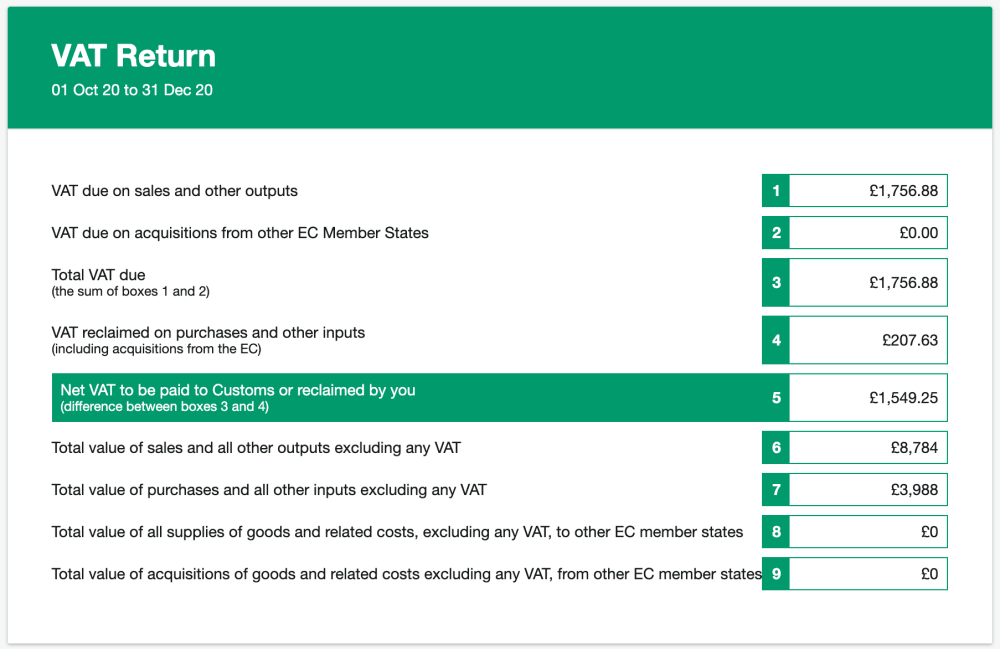

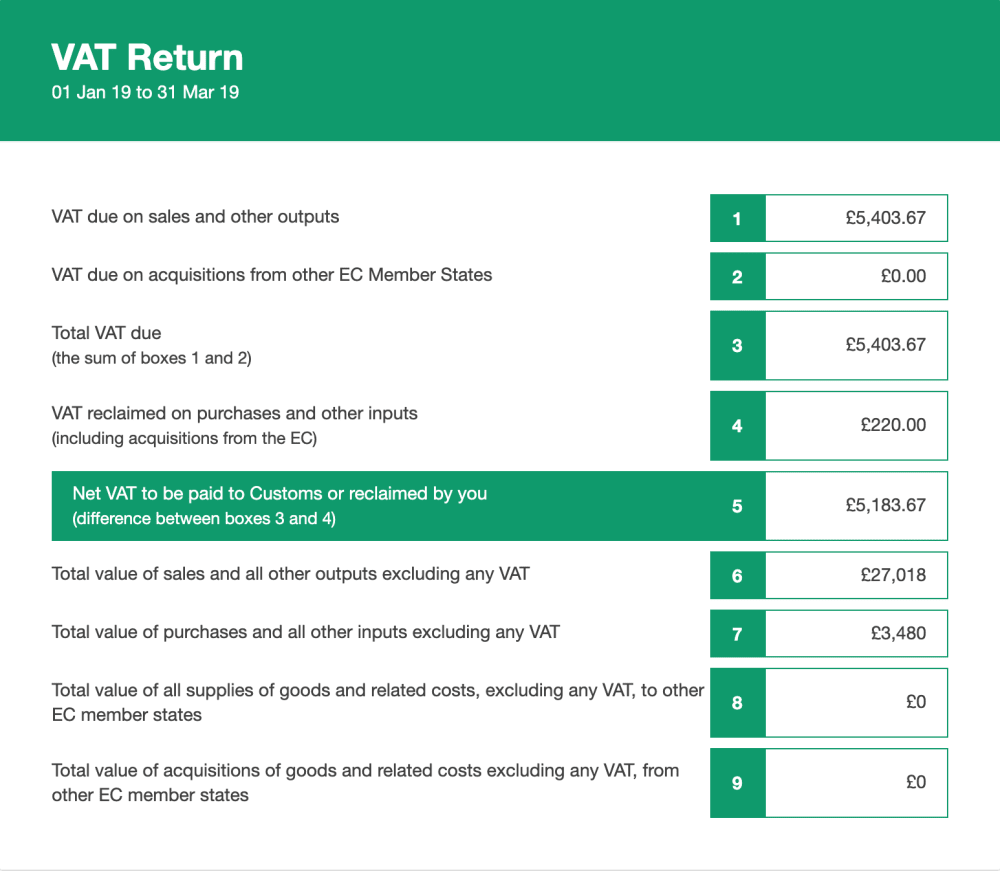

What is a VAT return? FreeAgent

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

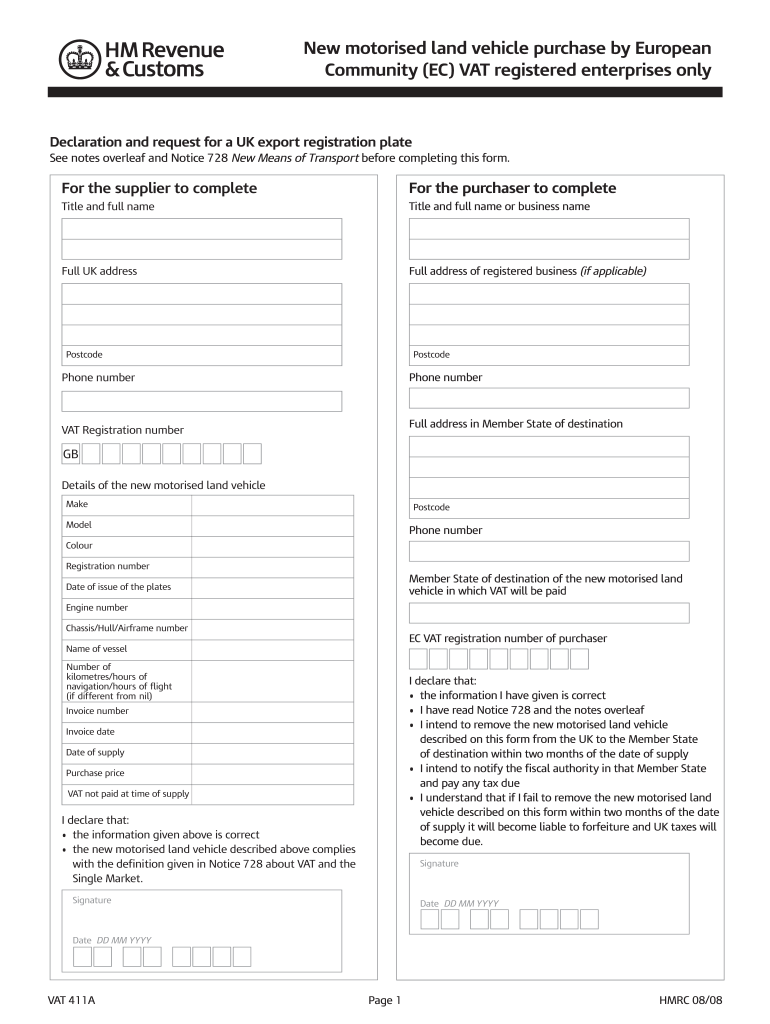

Vat 411a Form Complete with ease airSlate SignNow

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

VAT return template EasyBooks Small Business Bookkeeping App Try

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

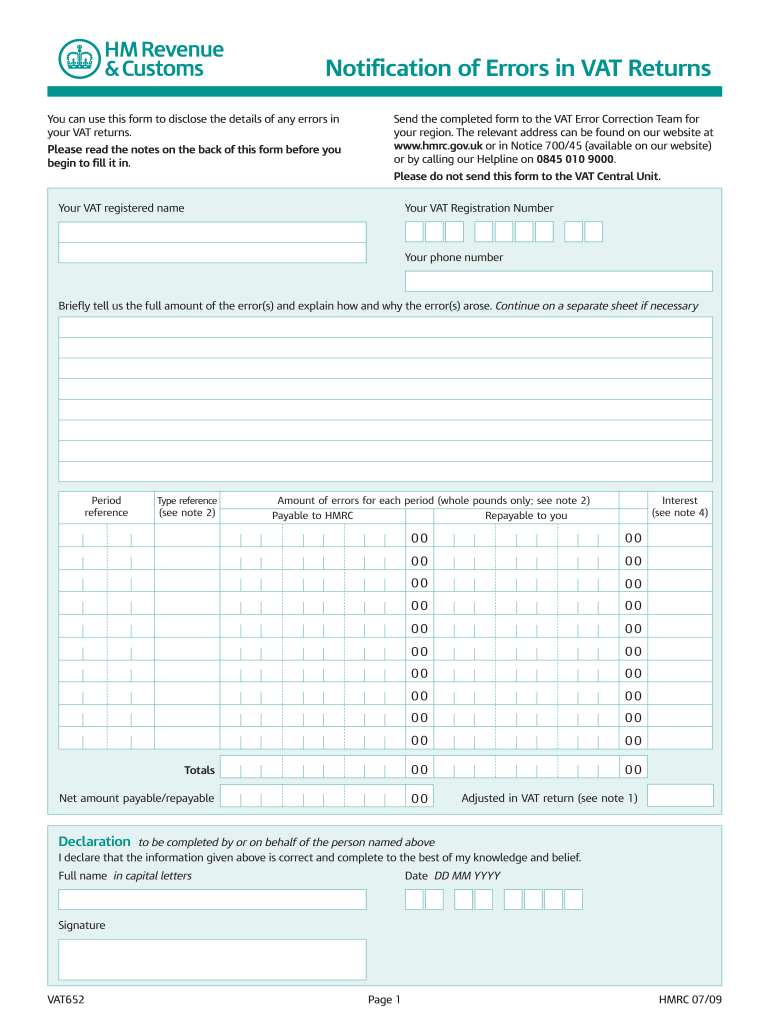

Product Update 417 VAT return correction form for year 2018 available

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

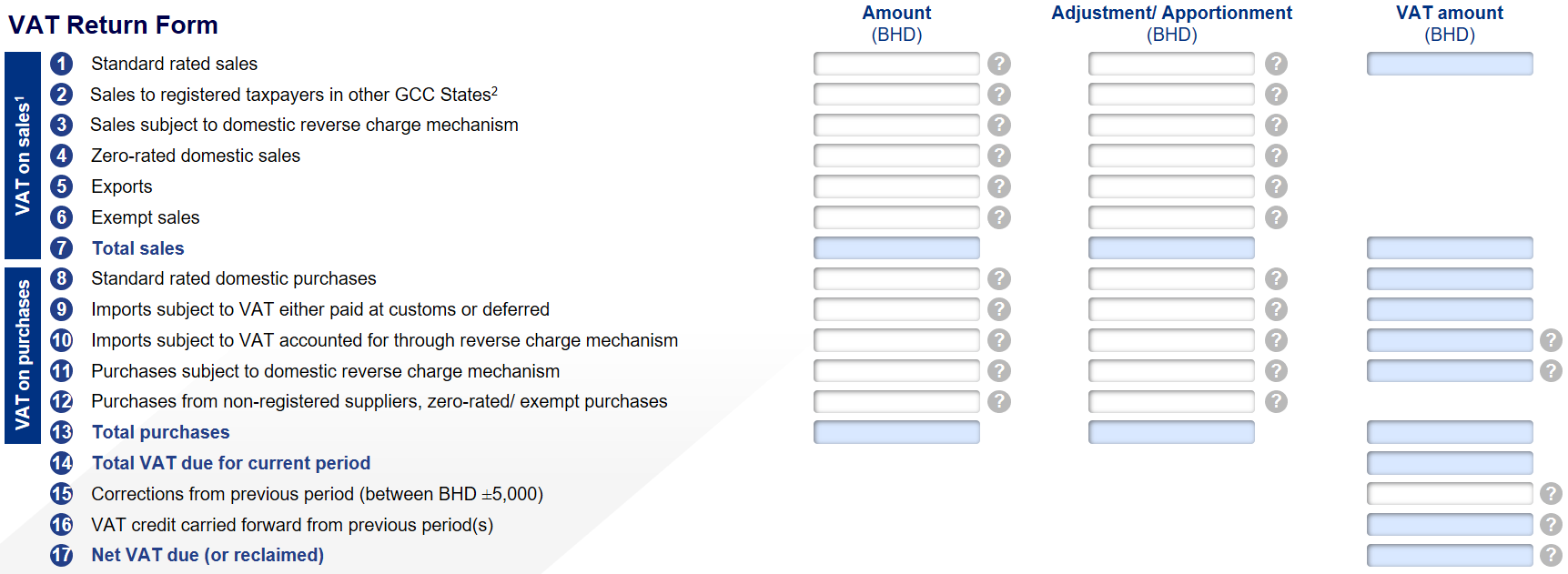

VAT Return Format in Bahrain Tally Solutions

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

Checking, editing and locking a VAT return FreeAgent Support

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

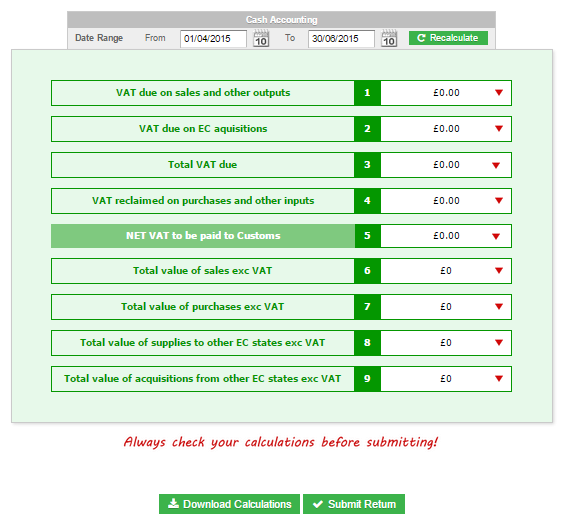

VAT Returns Guide VAT QuickFile

A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to. Forms for claiming a vat refund if your business is registered in a country outside the uk

What is a VAT return? FreeAgent

Forms for claiming a vat refund if your business is registered in a country outside the uk A vat return is a form you fill in to tell hm revenue and customs (hmrc) how much vat you’ve charged and how much you’ve paid to.

A Vat Return Is A Form You Fill In To Tell Hm Revenue And Customs (Hmrc) How Much Vat You’ve Charged And How Much You’ve Paid To.

Forms for claiming a vat refund if your business is registered in a country outside the uk