Form For Vat Refund - They'll need your passport (or a photo of it) to complete the form. Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. You must claim your vat refund online, via the authorities in the country where your business is based. Have the merchant completely fill out the refund document; Email hmrc to ask for this form. Forms for claiming a vat refund if your business is registered in a country outside the uk If you are eligible for a.

Forms for claiming a vat refund if your business is registered in a country outside the uk Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. Have the merchant completely fill out the refund document; They'll need your passport (or a photo of it) to complete the form. Email hmrc to ask for this form. You must claim your vat refund online, via the authorities in the country where your business is based. If you are eligible for a.

If you are eligible for a. Have the merchant completely fill out the refund document; You must claim your vat refund online, via the authorities in the country where your business is based. They'll need your passport (or a photo of it) to complete the form. Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. Forms for claiming a vat refund if your business is registered in a country outside the uk Email hmrc to ask for this form.

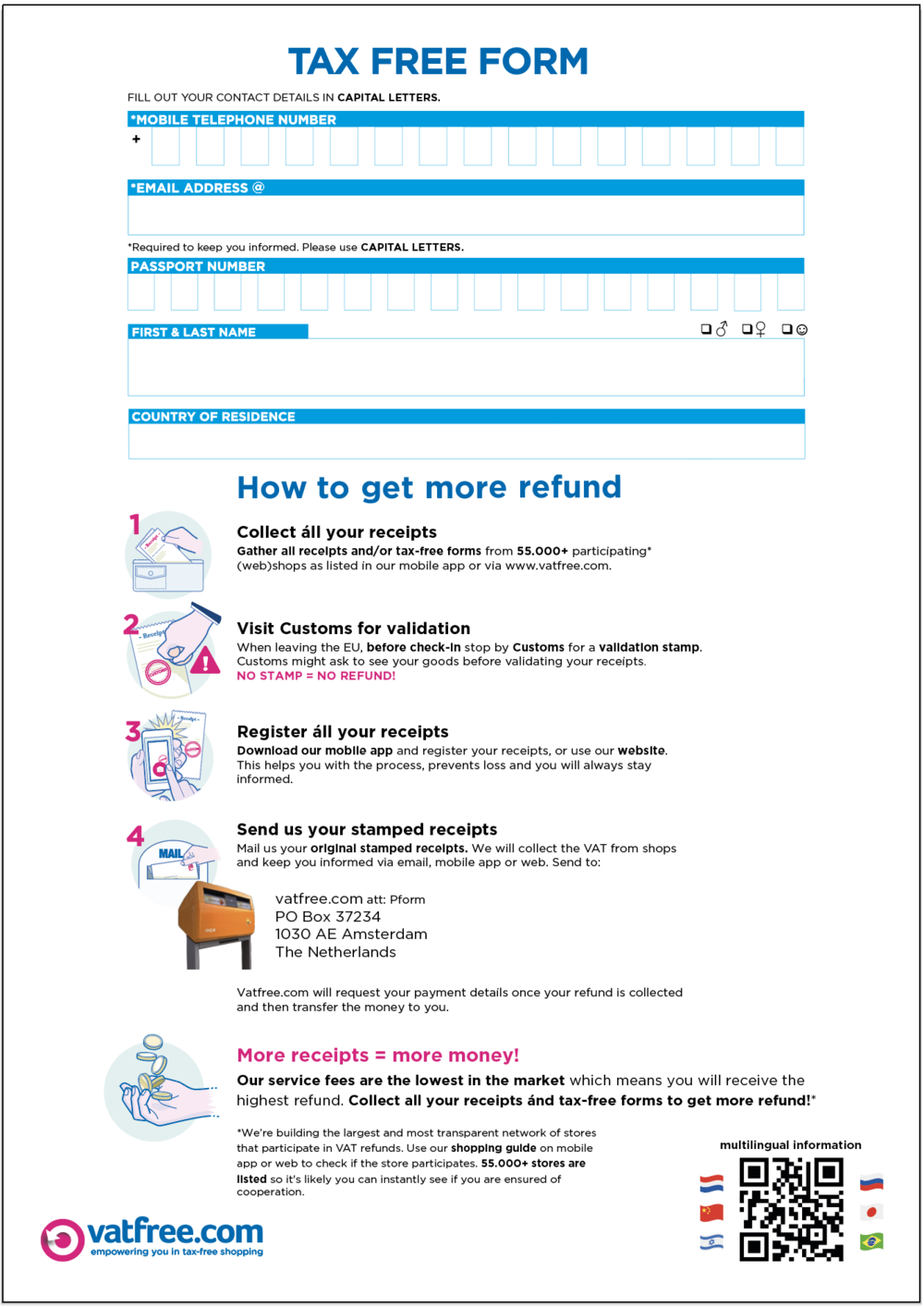

Download a VAT refund form

They'll need your passport (or a photo of it) to complete the form. Have the merchant completely fill out the refund document; You must claim your vat refund online, via the authorities in the country where your business is based. Forms for claiming a vat refund if your business is registered in a country outside the uk If you are.

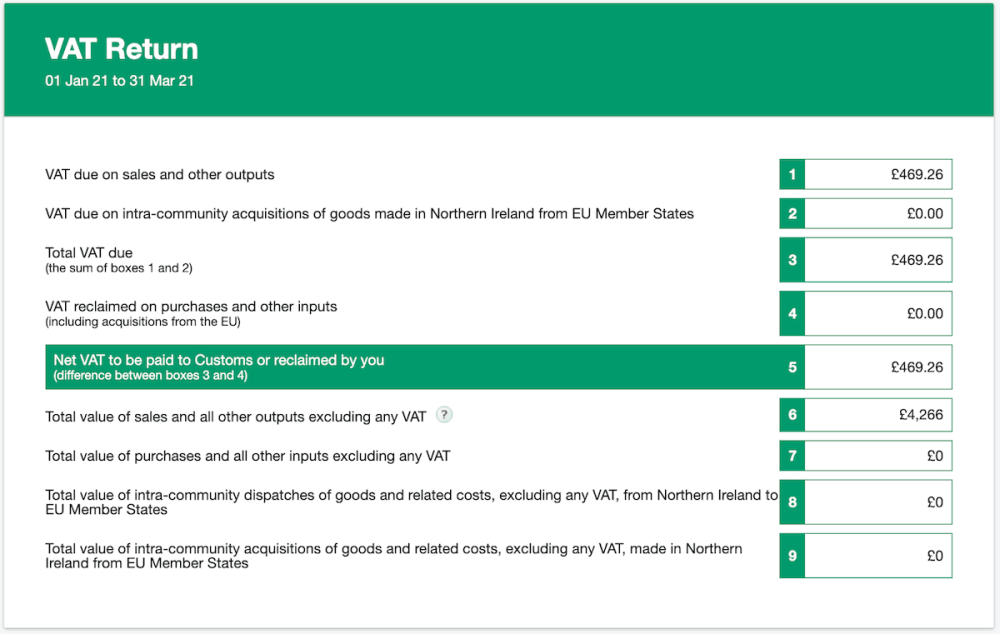

Co to jest deklaracja VAT? FreeAgent I'm running

You must claim your vat refund online, via the authorities in the country where your business is based. Have the merchant completely fill out the refund document; Forms for claiming a vat refund if your business is registered in a country outside the uk If you are eligible for a. Businesses registered in the eu must use this form to.

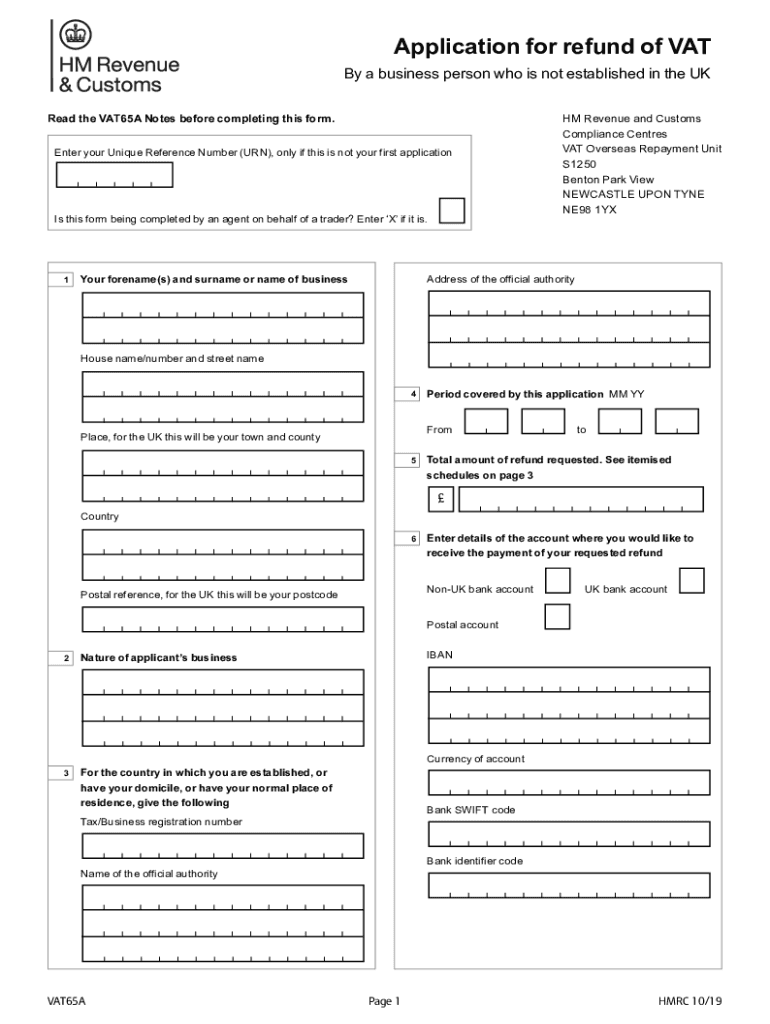

Hmrc Refund 20192024 Form Fill Out and Sign Printable PDF Template

Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. Email hmrc to ask for this form. If you are eligible for a. They'll need your passport (or a photo of it) to complete the form. Forms for claiming a vat refund if your business is registered in a country.

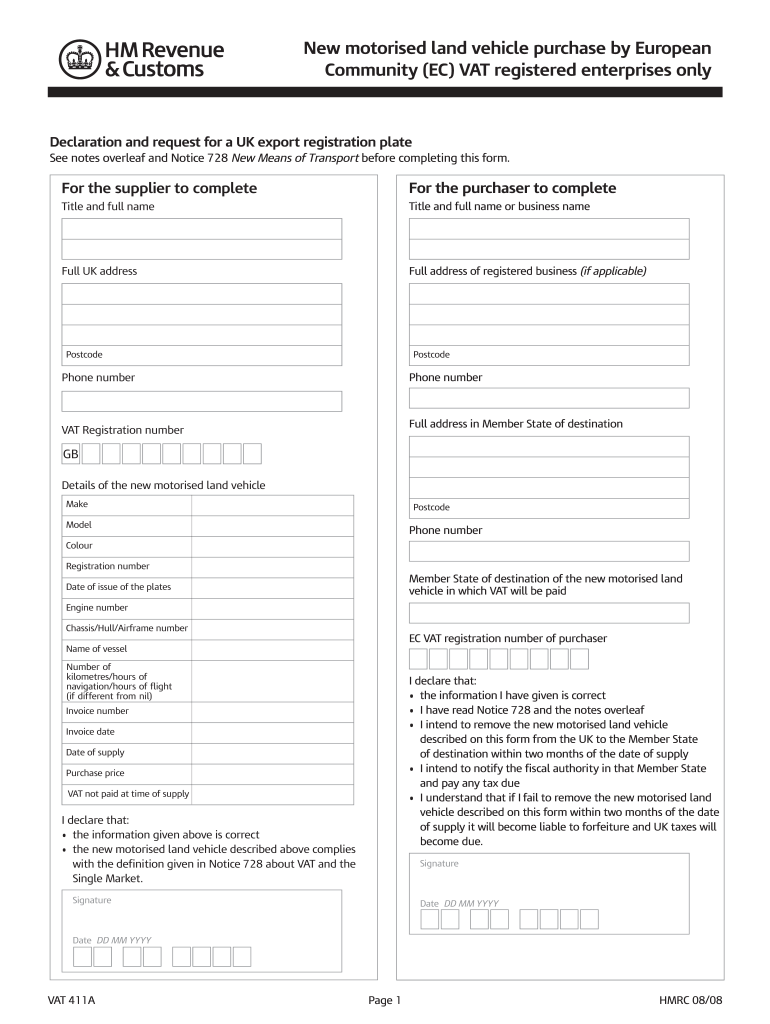

Vat 411a Form Complete with ease airSlate SignNow

Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. They'll need your passport (or a photo of it) to complete the form. If you are eligible for a. You must claim your vat refund online, via the authorities in the country where your business is based. Forms for claiming.

Product Update 417 VAT return correction form for year 2018 available

Email hmrc to ask for this form. Have the merchant completely fill out the refund document; You must claim your vat refund online, via the authorities in the country where your business is based. Forms for claiming a vat refund if your business is registered in a country outside the uk If you are eligible for a.

VAT Refund Claim of Registered dealers under C Form not be denied as

If you are eligible for a. Have the merchant completely fill out the refund document; You must claim your vat refund online, via the authorities in the country where your business is based. Forms for claiming a vat refund if your business is registered in a country outside the uk Email hmrc to ask for this form.

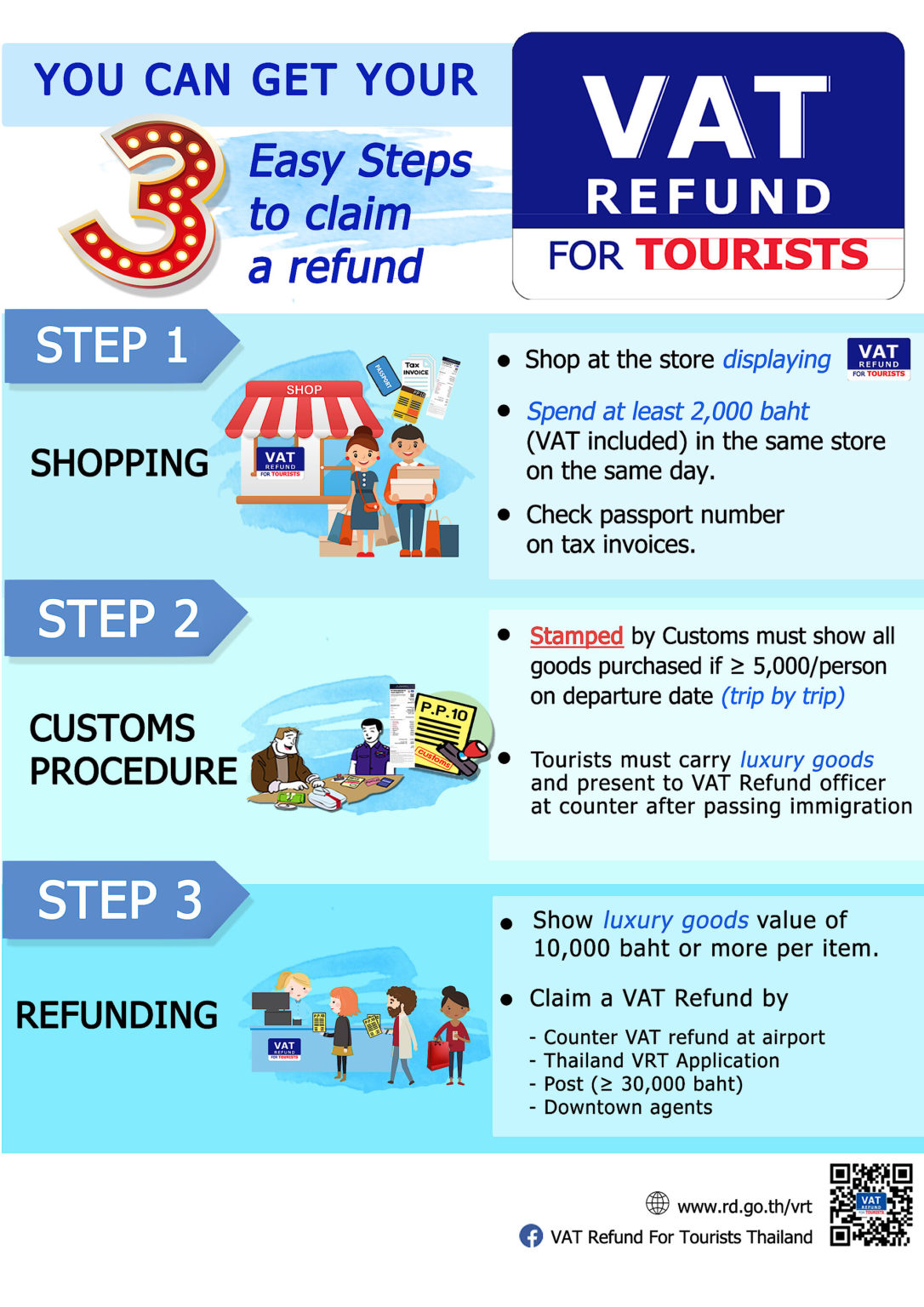

Thailand Offers VAT Refund for Tourists Thailand Insider

Forms for claiming a vat refund if your business is registered in a country outside the uk If you are eligible for a. Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. Email hmrc to ask for this form. Have the merchant completely fill out the refund document;

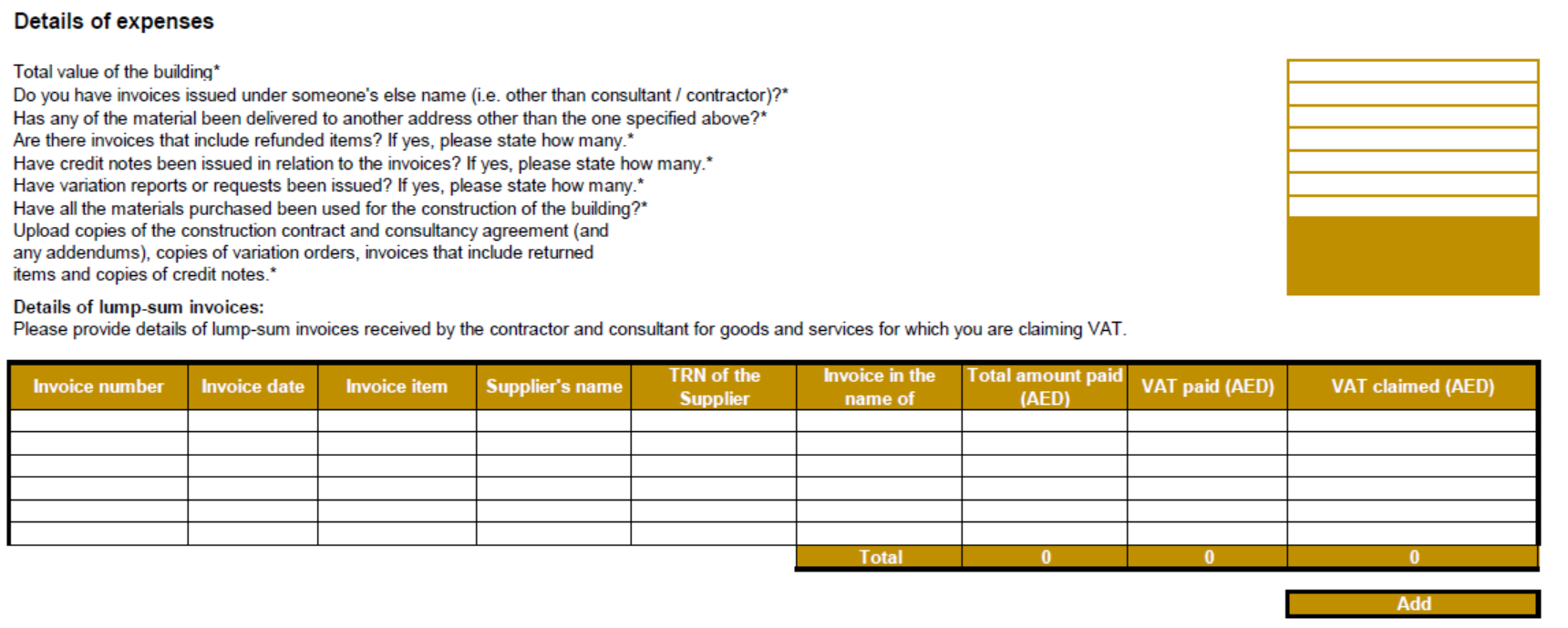

VAT Refund for UAE Nationals How a UAE Nationals Can Get Back the Tax

Email hmrc to ask for this form. They'll need your passport (or a photo of it) to complete the form. Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. If you are eligible for a. Forms for claiming a vat refund if your business is registered in a country.

VAT Refund for UAE Nationals How a UAE Nationals Can Get Back the Tax

You must claim your vat refund online, via the authorities in the country where your business is based. They'll need your passport (or a photo of it) to complete the form. Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. Forms for claiming a vat refund if your business.

How to Claim a VAT Refund? Everything you Need to Know

Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021. They'll need your passport (or a photo of it) to complete the form. If you are eligible for a. You must claim your vat refund online, via the authorities in the country where your business is based. Have the merchant.

You Must Claim Your Vat Refund Online, Via The Authorities In The Country Where Your Business Is Based.

Email hmrc to ask for this form. They'll need your passport (or a photo of it) to complete the form. Have the merchant completely fill out the refund document; Businesses registered in the eu must use this form to reclaim vat paid in the uk from 1 january 2021.

If You Are Eligible For A.

Forms for claiming a vat refund if your business is registered in a country outside the uk