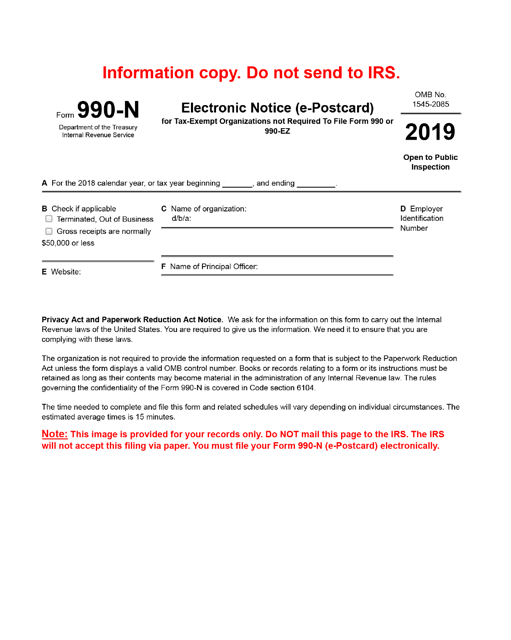

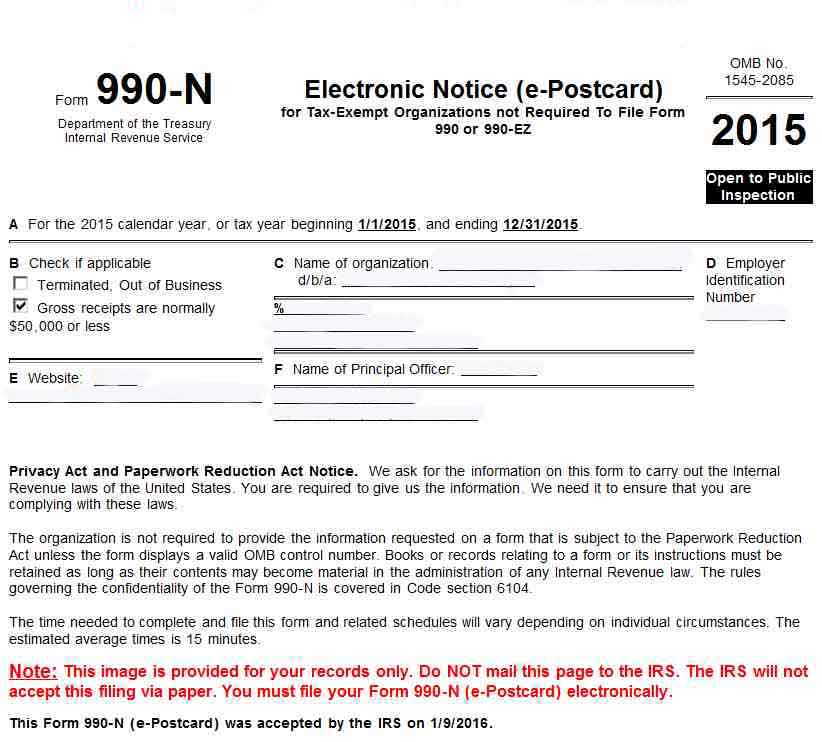

Form 990 N - Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Efile Form 990N 2020 IRS Form 990N Online Filing

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Quick Guide to file form 990N by Tax990 Issuu

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

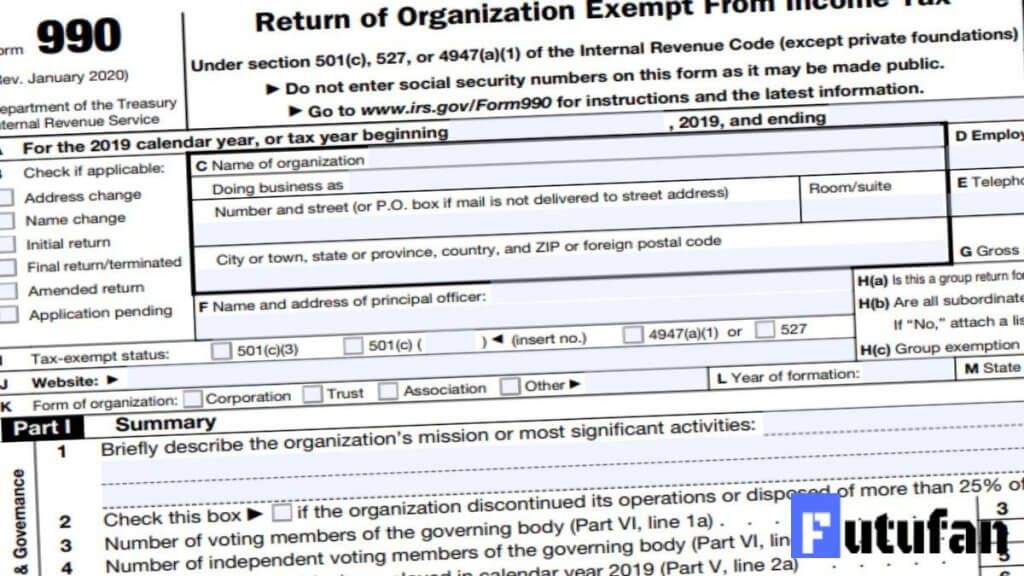

How to Read a Form 990 8 Things To Look For Instrumentl

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

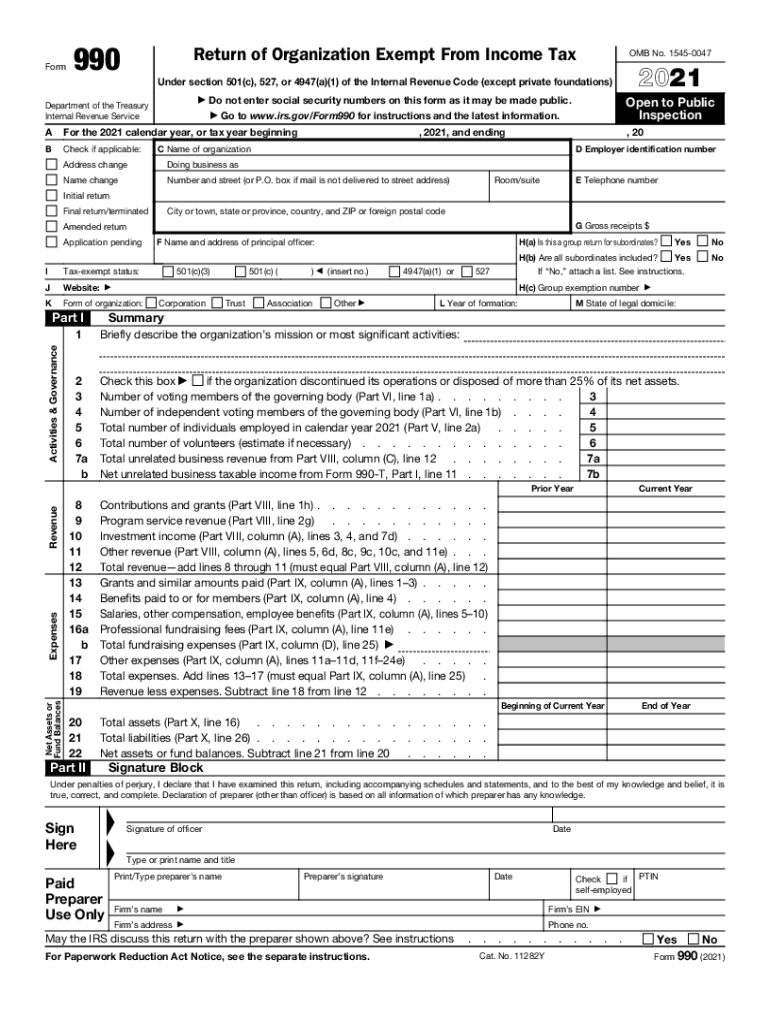

2021 Form IRS 990 Fill Online, Printable, Fillable, Blank pdfFiller

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Demystifying IRS Form 990N What Nonprofits Should Know Instrumentl

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

IRS Form 990N 2019 Fill Out, Sign Online and Download Printable

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Form 990N ePostcard

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Printable 990 N Form Printable Form 2024

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.

Form 990 N Pdf 20202022 Fill and Sign Printable Template Online US

Small public charities with annual gross receipts of normally $50,000 or less must file the electronic form 990 n.