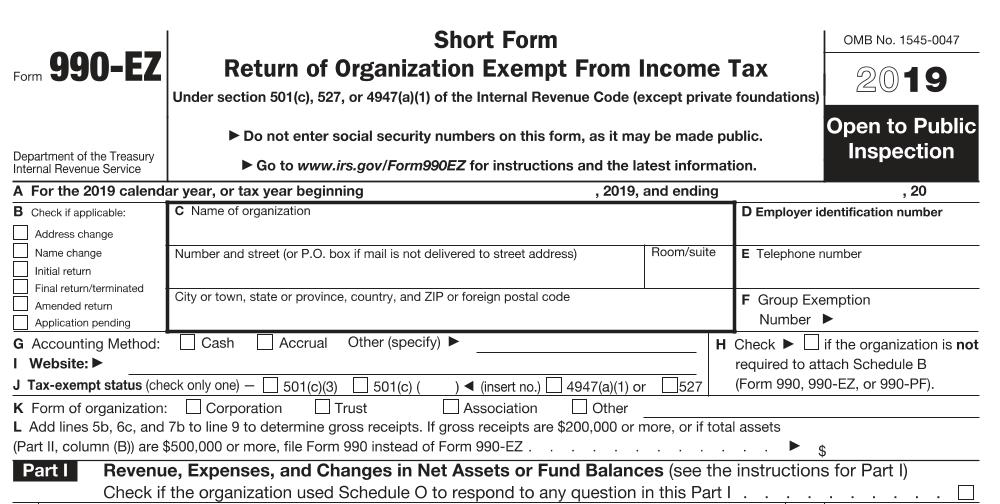

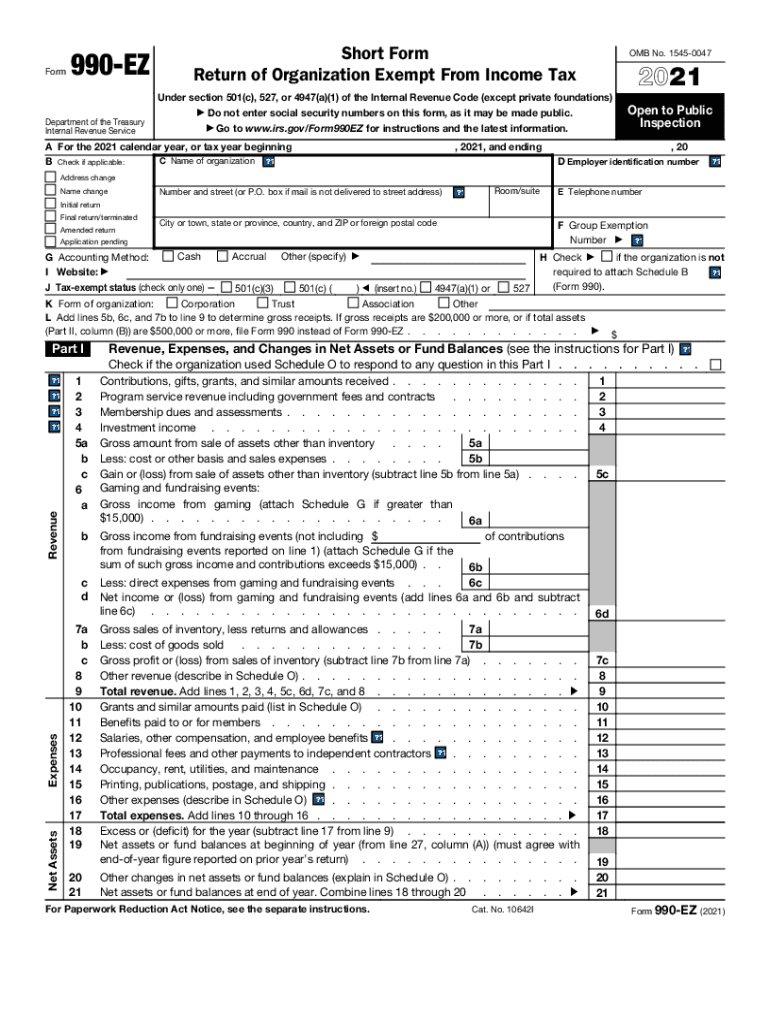

Form 990 Ez 2021 - Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Its gross receipts are normally $50,000 or less, The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Short form return of organization exempt from income tax omb no. Short form return of organization exempt from income tax omb no. Short form return of organization exempt from income tax omb no. Verification routines ensure your return is accurate and complete;

Short form return of organization exempt from income tax omb no. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Short form return of organization exempt from income tax omb no. Its gross receipts are normally $50,000 or less, Verification routines ensure your return is accurate and complete; Short form return of organization exempt from income tax omb no. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you.

The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Short form return of organization exempt from income tax omb no. Short form return of organization exempt from income tax omb no. Verification routines ensure your return is accurate and complete; Short form return of organization exempt from income tax omb no. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Its gross receipts are normally $50,000 or less,

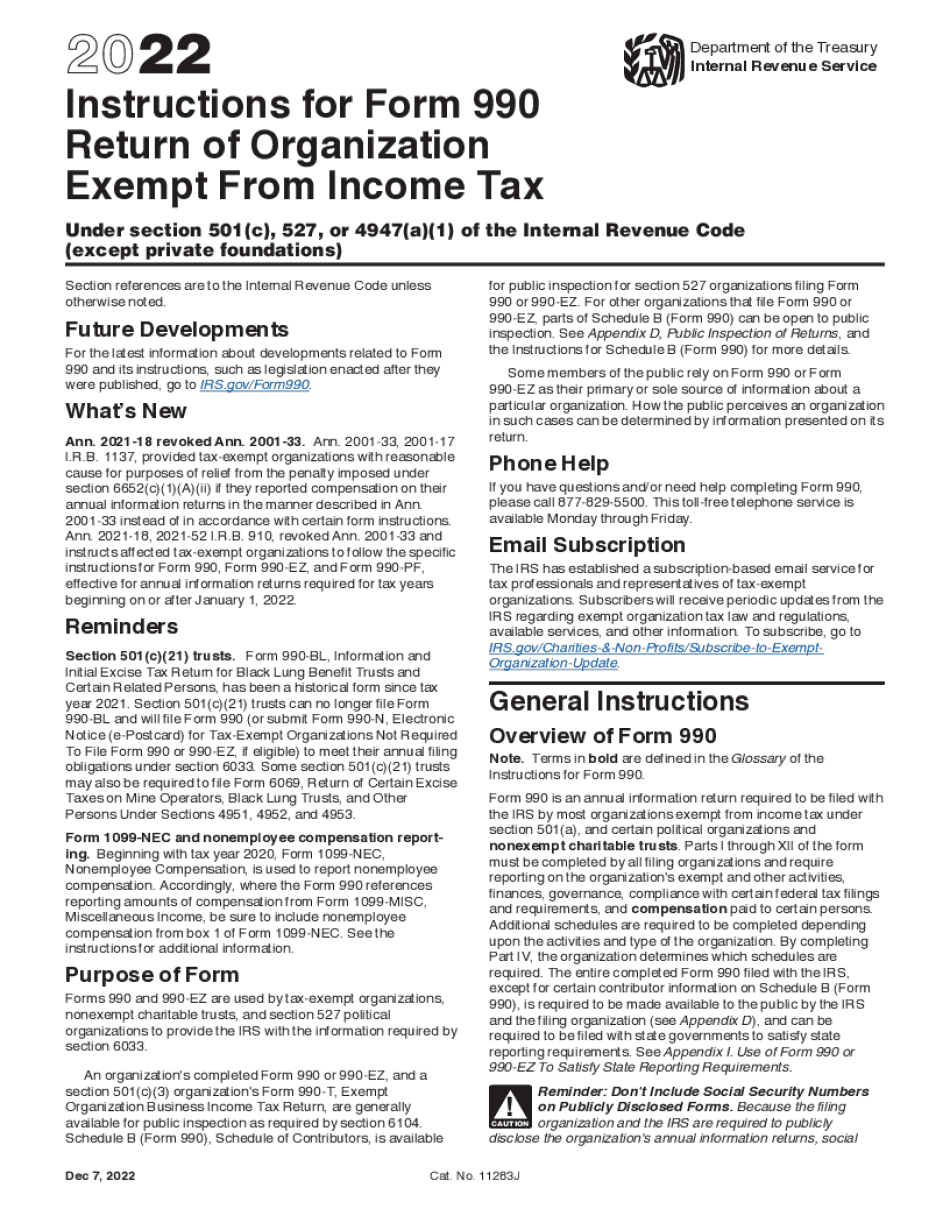

Instructions for Form 990EZ (2023)

Its gross receipts are normally $50,000 or less, Verification routines ensure your return is accurate and complete; Short form return of organization exempt from income tax omb no. Short form return of organization exempt from income tax omb no. Short form return of organization exempt from income tax omb no.

What is Form 990EZ and Who Qualifies for it? Foundation Group, Inc.

Short form return of organization exempt from income tax omb no. The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Its gross receipts are normally $50,000 or less, Verification routines ensure your return is accurate and complete; Short form return of organization exempt from income tax.

Efile Form 990N 2020 IRS Form 990N Online Filing

Its gross receipts are normally $50,000 or less, Short form return of organization exempt from income tax omb no. Short form return of organization exempt from income tax omb no. Short form return of organization exempt from income tax omb no. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security.

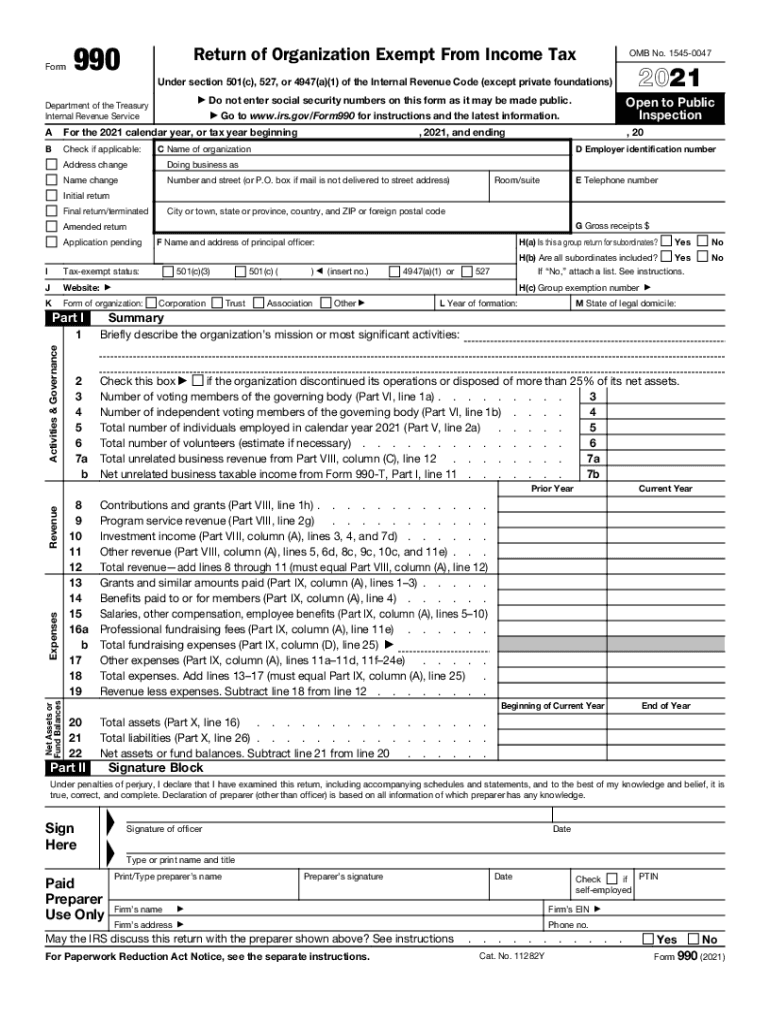

2021 IRS Form 990 by Ozarks Food Harvest Issuu

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Its gross receipts are normally $50,000 or less, Short form return of organization exempt from income tax omb no. Verification routines ensure your return is accurate and complete; The information provided.

990 N 20212024 Form Fill Out and Sign Printable PDF Template

Short form return of organization exempt from income tax omb no. Verification routines ensure your return is accurate and complete; Short form return of organization exempt from income tax omb no. Its gross receipts are normally $50,000 or less, Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on.

2020 Form IRS 990 Schedule A Fill Online, Printable, Fillable, Blank

Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Short form return of organization exempt from income tax omb no. Its gross receipts are normally $50,000 or less, Short form return of organization exempt from income tax omb no. Short.

Fillable Online Instructions for Form 990 Return of Organization

Short form return of organization exempt from income tax omb no. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Short form return of organization exempt from income tax omb no. The information provided will enable you to file a.

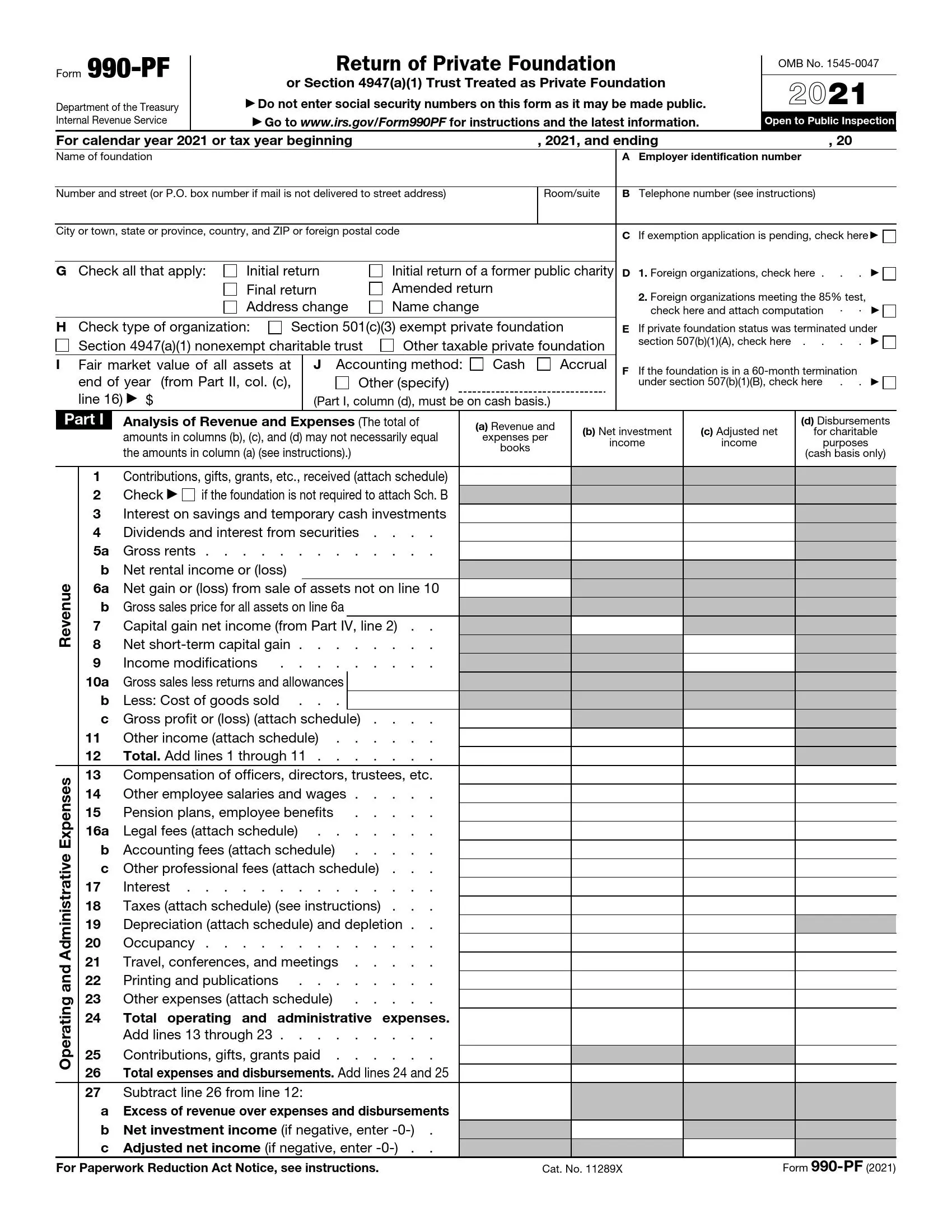

IRS Form 990PF ≡ Fill Out Printable PDF Forms Online

The information provided will enable you to file a more complete return and reduce the chances the irs will need to contact you. Short form return of organization exempt from income tax omb no. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

Verification routines ensure your return is accurate and complete; Short form return of organization exempt from income tax omb no. Short form return of organization exempt from income tax omb no. Its gross receipts are normally $50,000 or less, The information provided will enable you to file a more complete return and reduce the chances the irs will need to.

2021 Form IRS 990EZ Fill Online, Printable, Fillable, Blank pdfFiller

Short form return of organization exempt from income tax omb no. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Verification routines ensure your return is accurate and complete; Short form return of organization exempt from income tax omb no..

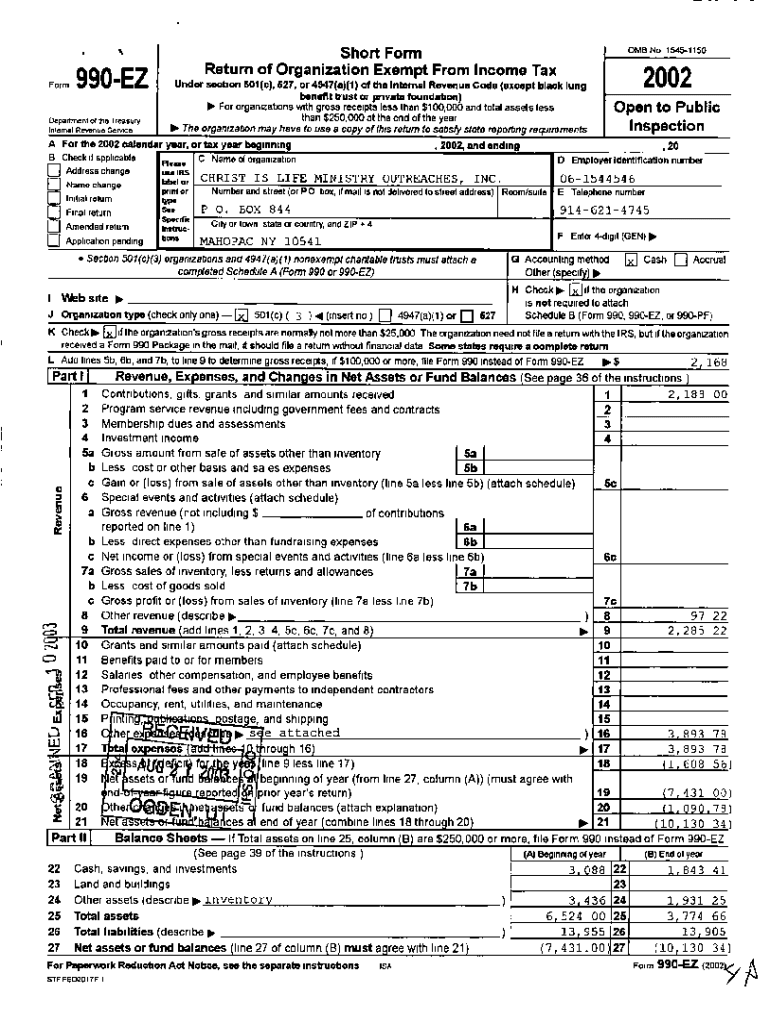

Short Form Return Of Organization Exempt From Income Tax Omb No.

Verification routines ensure your return is accurate and complete; Its gross receipts are normally $50,000 or less, Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Short form return of organization exempt from income tax omb no.

The Information Provided Will Enable You To File A More Complete Return And Reduce The Chances The Irs Will Need To Contact You.

Short form return of organization exempt from income tax omb no.