Form 966 Certified Copy Of Resolution - If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. Information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions on how to file. Irs form 966 for dissolution of corporation requires me to submit a certified copy of the resolution or plan. When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified copy of the. File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock.

Information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions on how to file. When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified copy of the. File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. Irs form 966 for dissolution of corporation requires me to submit a certified copy of the resolution or plan.

Information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions on how to file. When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified copy of the. Irs form 966 for dissolution of corporation requires me to submit a certified copy of the resolution or plan. File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed.

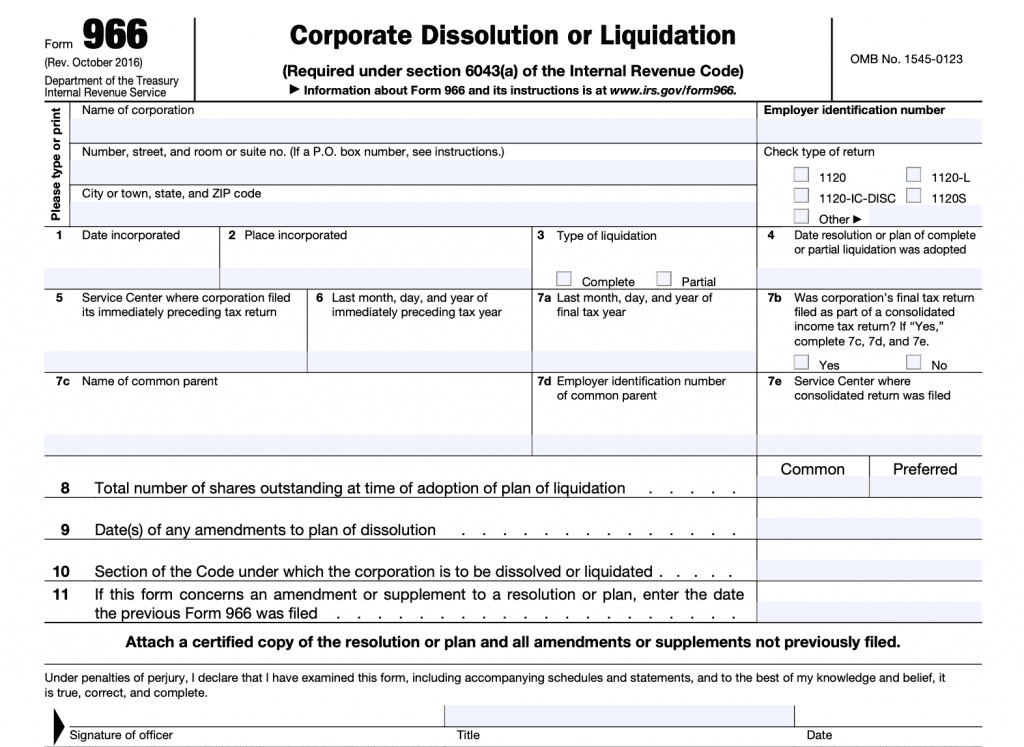

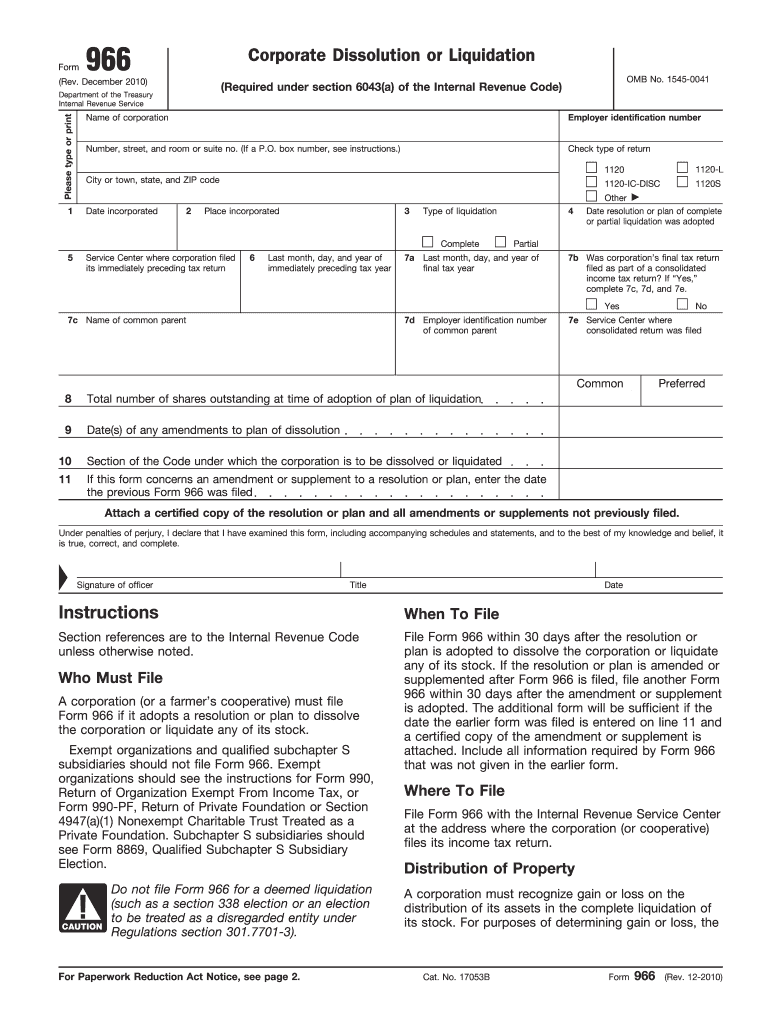

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified copy of the. File form 966 within 30 days after the resolution or plan is adopted to dissolve the.

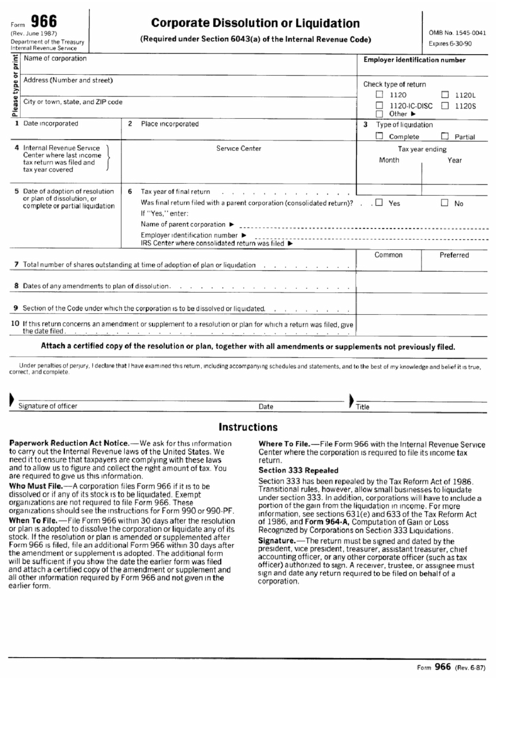

Form 966 (Rev. 061987) printable pdf download

When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified copy of the. File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If this form concerns an amendment or supplement to a resolution or plan, enter the.

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions on how to file. If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous.

IRS Form 966 Instructions Corporate Dissolutions & Liquidations

If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. Irs form 966 for dissolution of corporation requires me to submit a certified copy of the resolution or plan. When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified.

Form 966 How 5471 Penalty can Stem from an IRS Form 966 Corporate

If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. Information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions on how to file. File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate.

Fillable Online Form 966 (Rev. June 2001), ( Fill in Version) Fax

File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. Information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions.

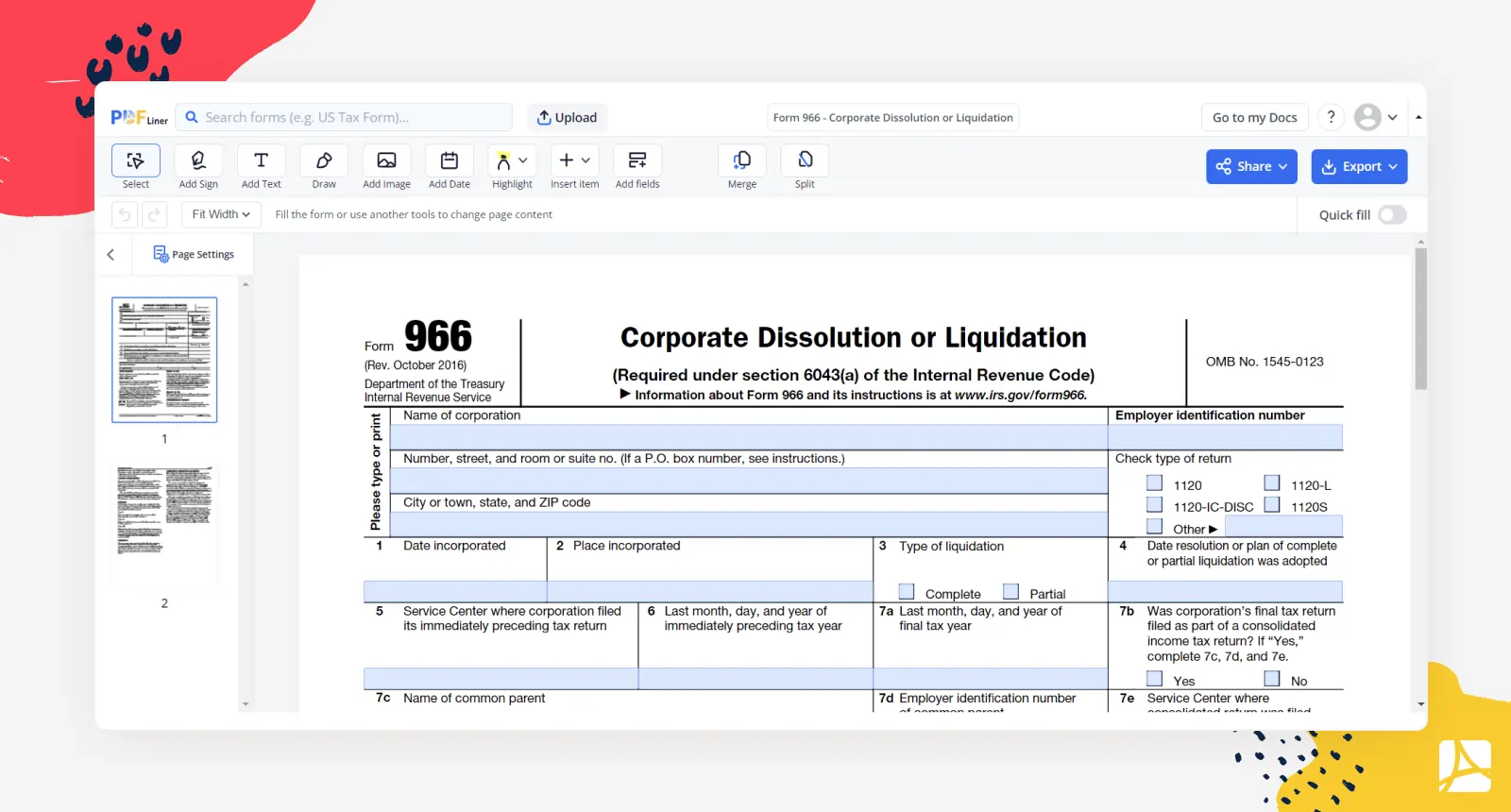

Form 966 Corporate Dissolution or Liquidation blank — PDFliner

Information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions on how to file. Irs form 966 for dissolution of corporation requires me to submit a certified copy of the resolution or plan. When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified copy of the..

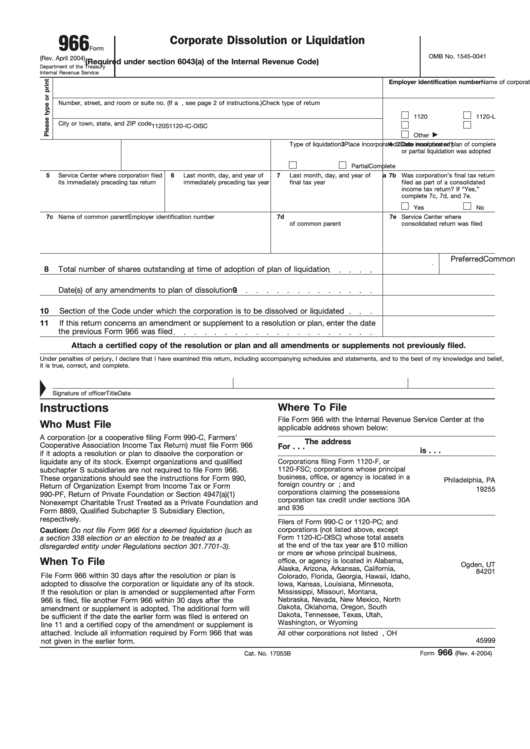

Fillable Form 966 2004 Corporate Dissolution Or Liquidation printable

When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified copy of the. If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. File form 966 within 30 days after the resolution or plan is adopted to dissolve the.

2010 Form IRS 966 Fill Online, Printable, Fillable, Blank pdfFiller

If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. Irs form 966 for dissolution of corporation requires me to submit a certified copy of.

Fillable Online mccsc * CERTIFIED COPY 16 Fax Email Print pdfFiller

Irs form 966 for dissolution of corporation requires me to submit a certified copy of the resolution or plan. File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock. When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a.

Irs Form 966 For Dissolution Of Corporation Requires Me To Submit A Certified Copy Of The Resolution Or Plan.

Information about form 966, corporate dissolution or liquidation, including recent updates, related forms and instructions on how to file. When a corporation dissolves, the internal revenue code requires the corporation to file form 966 along with a certified copy of the. If this form concerns an amendment or supplement to a resolution or plan, enter the date the previous form 966 was filed. File form 966 within 30 days after the resolution or plan is adopted to dissolve the corporation or liquidate any of its stock.