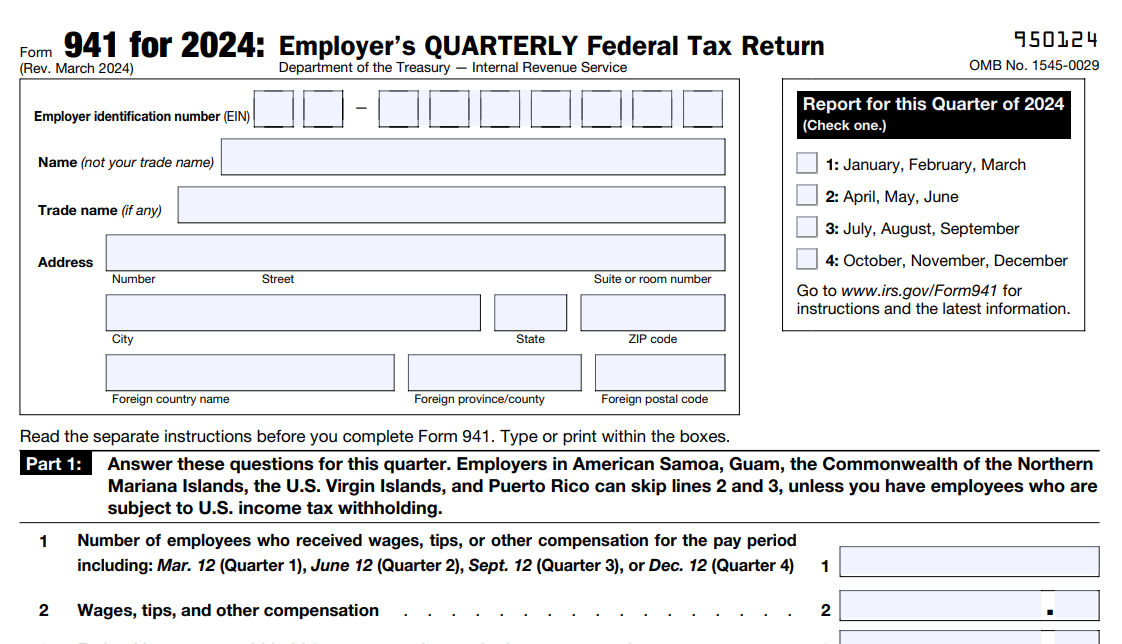

Form 941 Due Dates - Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. When is form 941 due? For more information on depositing and filing these. See the employment tax due dates page for filing and depositing due dates. Most businesses are required to submit form 941 on the last day of the month following each quarter. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry.

For more information on depositing and filing these. See the employment tax due dates page for filing and depositing due dates. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. When is form 941 due? If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. Most businesses are required to submit form 941 on the last day of the month following each quarter.

When is form 941 due? For more information on depositing and filing these. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. Most businesses are required to submit form 941 on the last day of the month following each quarter. See the employment tax due dates page for filing and depositing due dates. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry.

2024 Payroll Tax & Form 941 Due Dates Paylocity Paylocity

Most businesses are required to submit form 941 on the last day of the month following each quarter. For more information on depositing and filing these. See the employment tax due dates page for filing and depositing due dates. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for”.

Form 941 Due Dates 2024 Dara Felecia

For more information on depositing and filing these. See the employment tax due dates page for filing and depositing due dates. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. Irs form 941, the employer’s quarterly federal tax return, is.

2023 Form 941 Due Dates Printable Forms Free Online

For more information on depositing and filing these. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. When is form 941 due? Most businesses are required to submit form 941 on the last day of the month following each quarter. See the employment tax due.

Irs Form 941 Due Dates 2024 Moina Terrijo

See the employment tax due dates page for filing and depositing due dates. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. Most businesses are required to submit form 941 on the last day of the month following each quarter..

What Are The Form 941 Quarterly Due Dates 2024 Cati Mattie

When is form 941 due? See the employment tax due dates page for filing and depositing due dates. For more information on depositing and filing these. Most businesses are required to submit form 941 on the last day of the month following each quarter. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue.

When Are 941 Forms Due 2024 Ivory Arluene

If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. When is form 941 due? Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. Most businesses.

When Are 941 Forms Due 2024 Cayla Nellie

Most businesses are required to submit form 941 on the last day of the month following each quarter. See the employment tax due dates page for filing and depositing due dates. For more information on depositing and filing these. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for”.

Quarterly 941 Due Dates 2024 Dulce Glenine

Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. See the employment tax due dates page.

Irs Form 941 Due Dates 2024 Deana Estella

When is form 941 due? Most businesses are required to submit form 941 on the last day of the month following each quarter. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your. If you haven't received your ein by the due date of form 941,.

Quarterly 941 Due Dates 2024 Dulce Glenine

See the employment tax due dates page for filing and depositing due dates. For more information on depositing and filing these. If you haven't received your ein by the due date of form 941, file a paper return and write “applied for” and the date you applied in this entry. When is form 941 due? Irs form 941, the employer’s.

If You Haven't Received Your Ein By The Due Date Of Form 941, File A Paper Return And Write “Applied For” And The Date You Applied In This Entry.

When is form 941 due? Most businesses are required to submit form 941 on the last day of the month following each quarter. For more information on depositing and filing these. Irs form 941, the employer’s quarterly federal tax return, is how you tell the internal revenue service (irs) how much was withheld from your.