Form 8300 Letter To Customer - Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the.

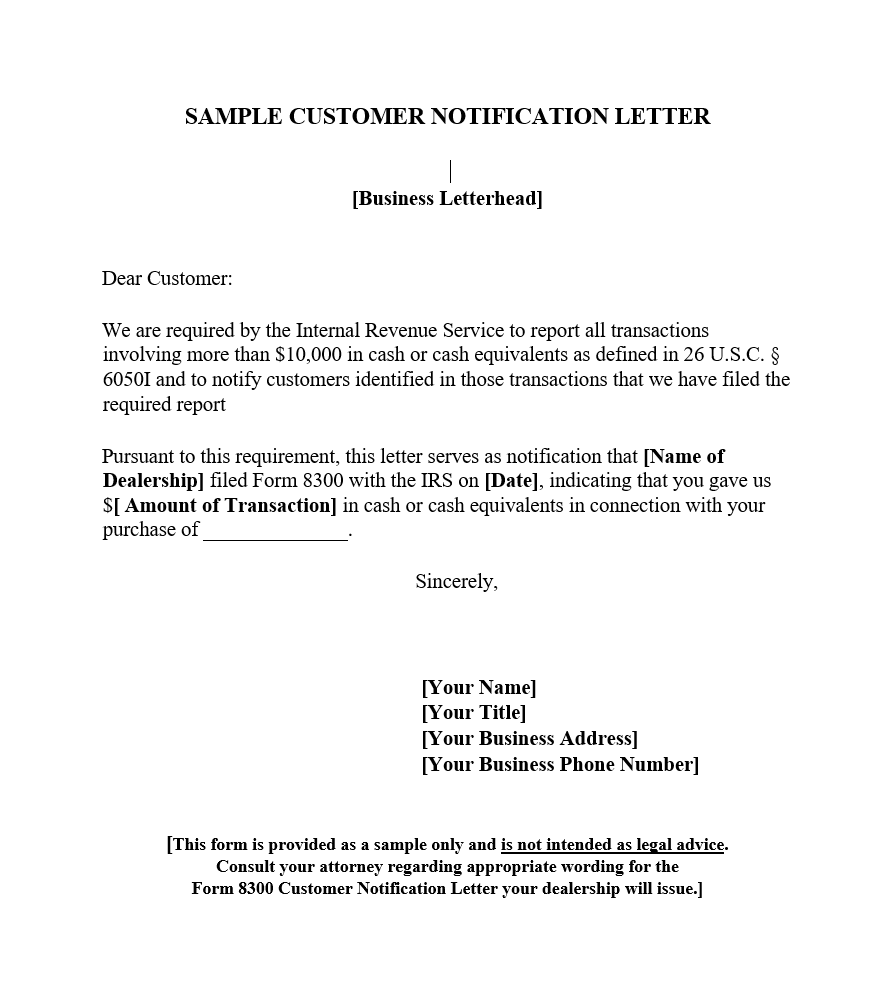

Customer Notification Letter form 8300 Forms Docs 2023

Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

Form 8300 Letter to Customer Letter Draft

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Under the irs rules, a business must notify its customers, in writing,.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Each person engaged in a trade or business who, in the course of that trade.

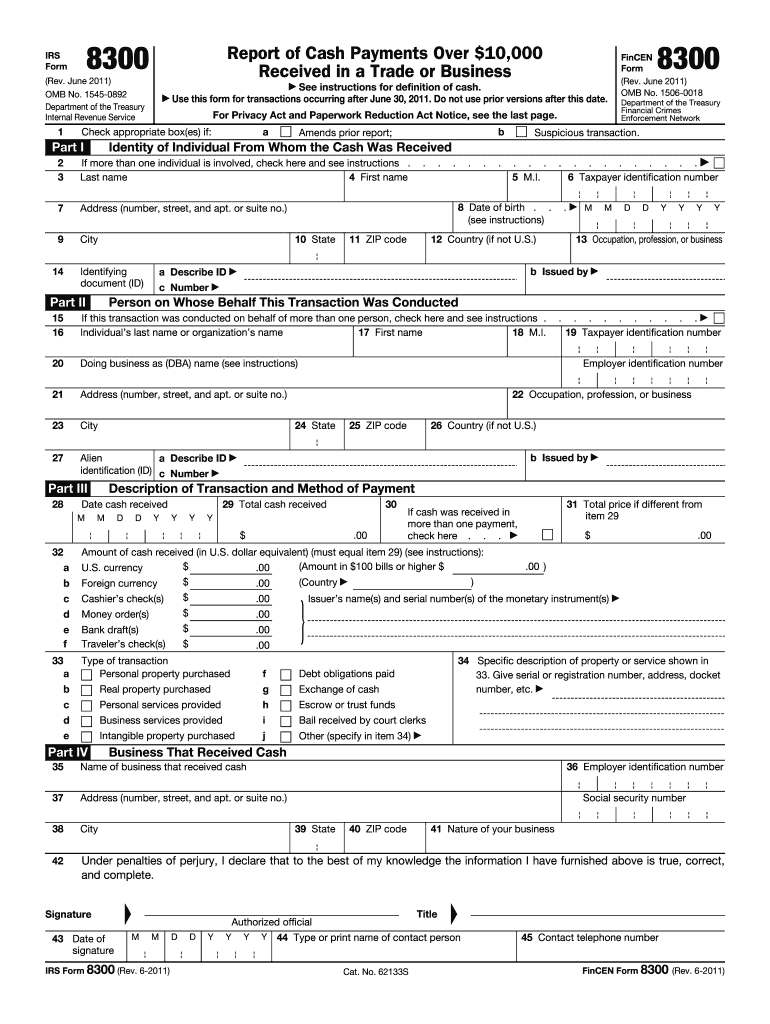

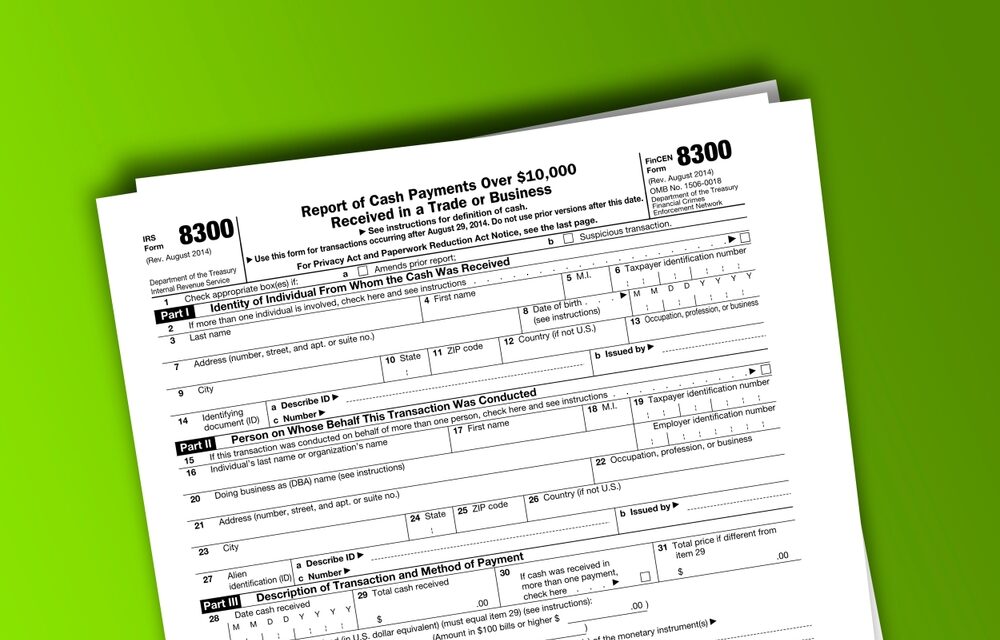

Fillable Form 8300 Report Of Cash Payments Over 10,000 Received In A

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Under the irs rules, a business must notify its customers, in writing, by january 31 of the.

8300 form pdf Fill out & sign online DocHub

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with.

Form 8300 Letter to Customer Letter Draft

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Under the irs rules, a business must notify its customers, in writing,.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership].

Form 8300 Letter To Customer Sample Letter Hub

Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with.

Form 8300 Reporting Cash Payments over 10,000 HM&M

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the.

Pursuant To This Requirement, This Letter Serves As Notification That [Name Of Dealership] Filed Form 8300 With The Irs On [Date] , Indicating That You.

Under the irs rules, a business must notify its customers, in writing, by january 31 of the subsequent calendar year that the. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on. Each person engaged in a trade or business who, in the course of that trade or business, receives more than $10,000 in cash.