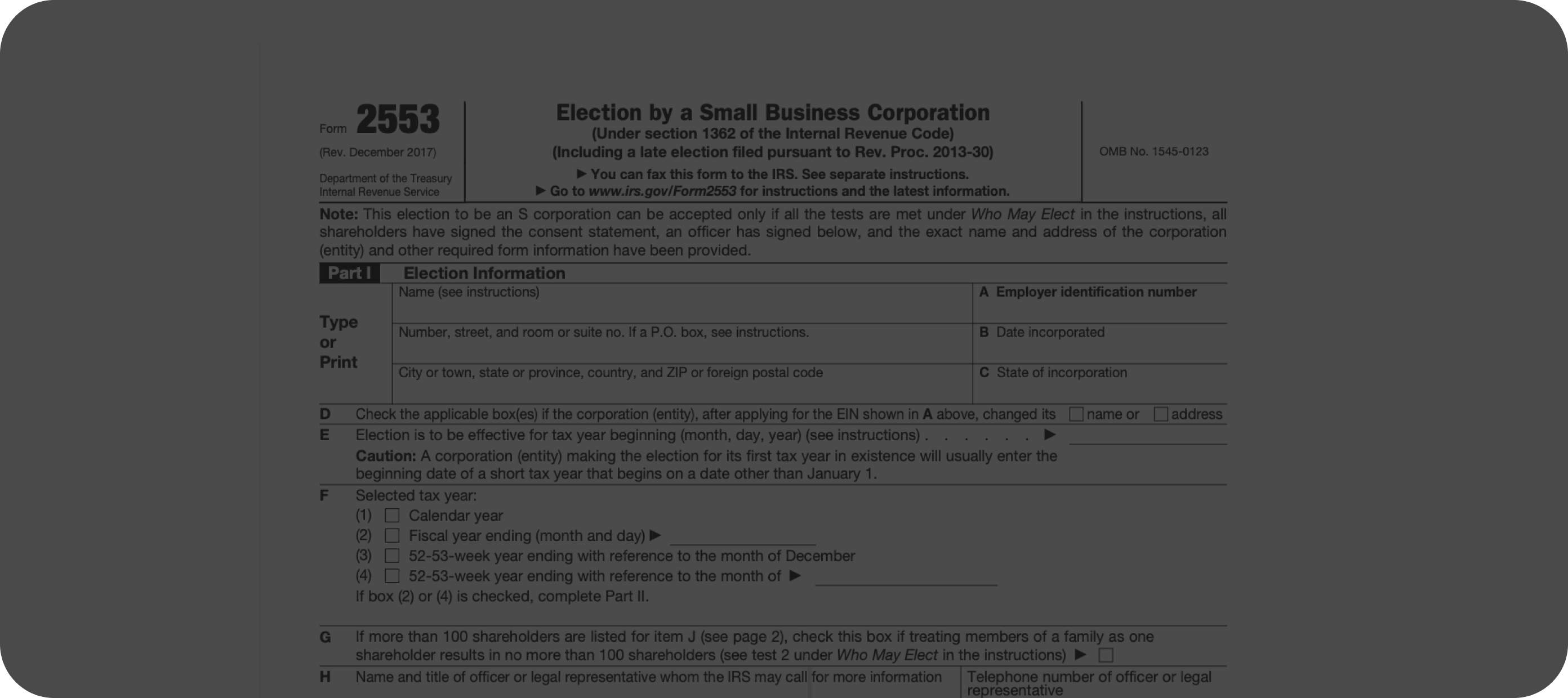

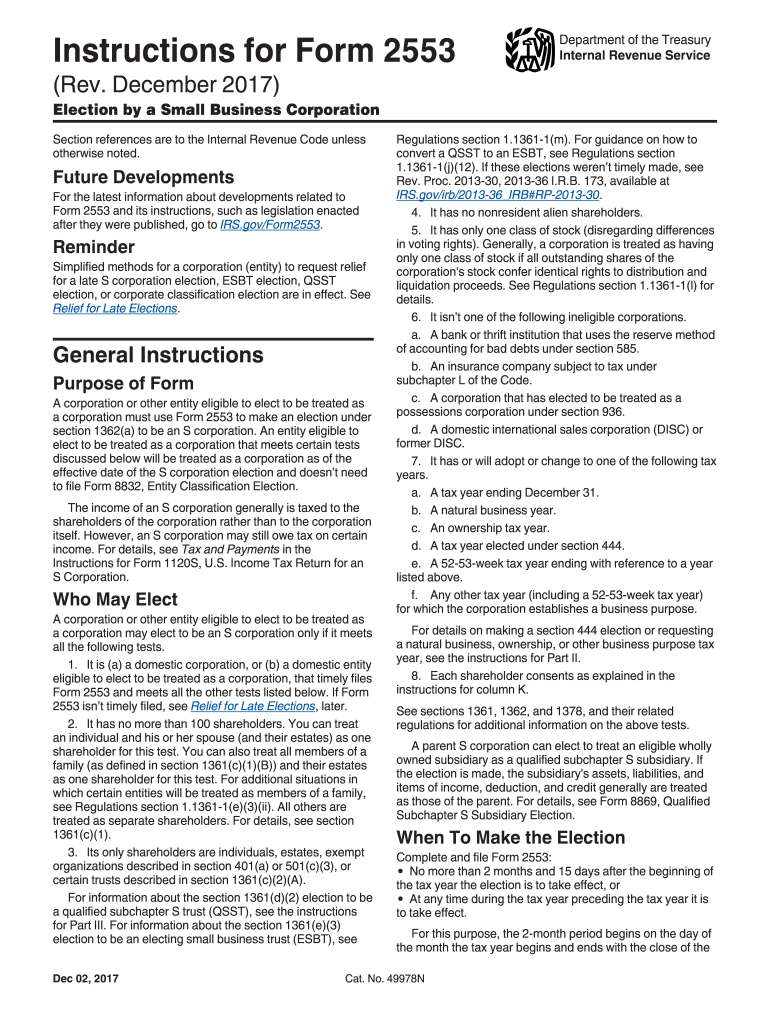

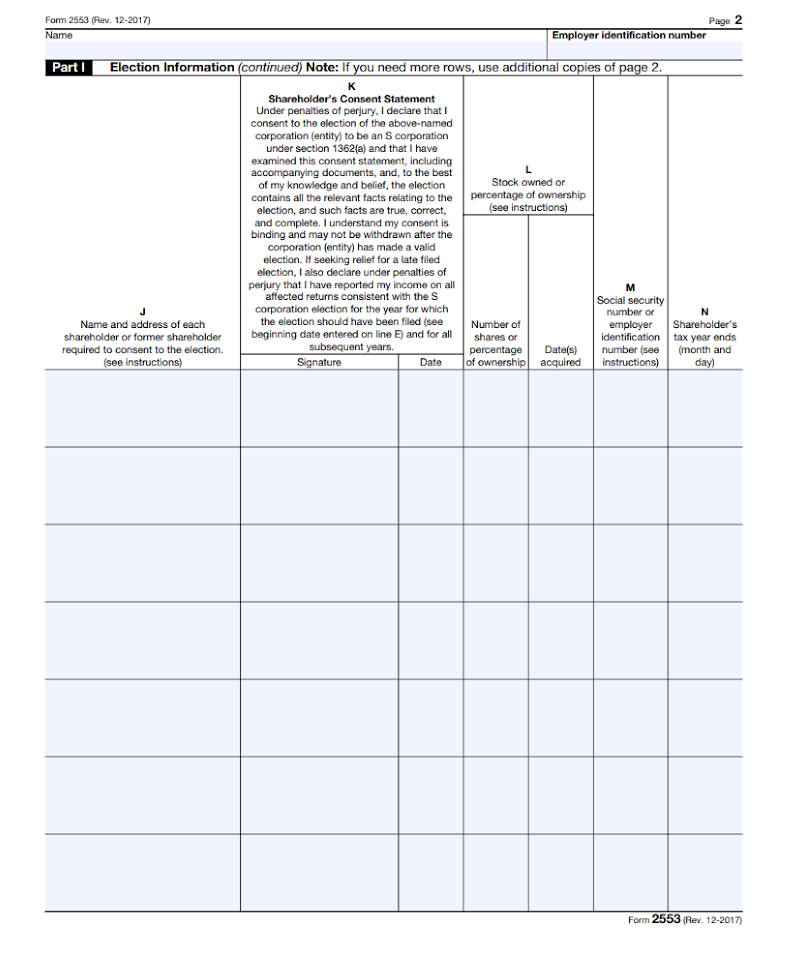

Form 2553 Instruction - For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn how to make an s corporation election using form 2553, who can qualify, when to file, and what information to include. Find the current revision, pdf. Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s corporation status for your business. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code.

Learn how to make an s corporation election using form 2553, who can qualify, when to file, and what information to include. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code. For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Find the current revision, pdf. Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s corporation status for your business.

Find the current revision, pdf. For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code. Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s corporation status for your business. Learn how to make an s corporation election using form 2553, who can qualify, when to file, and what information to include.

IRS Form 2553 Easily Fill Out & Download Your Form PDF Master

Find the current revision, pdf. For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code. Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s.

IRS Form 2553 Instructions How and Where to File This Tax Form

Find the current revision, pdf. Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s corporation status for your business. For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn how to make an s corporation election using form 2553, who can qualify, when to.

20172020 Form IRS Instruction 2553 Fill Online, Printable, Fillable

Find the current revision, pdf. For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code. Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s.

Fillable Online 2001 version of 2553 form Fax Email Print pdfFiller

Learn how to make an s corporation election using form 2553, who can qualify, when to file, and what information to include. For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s corporation status for your.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Find the current revision, pdf. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code. Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s.

What is IRS Form 2553?

For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code. Find the current revision, pdf. Learn how to make an s corporation election using form 2553, who can qualify, when to.

Government Templates ONLYOFFICE

Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s corporation status for your business. Find the current revision, pdf. For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn how to make an s corporation election using form 2553, who can qualify, when to.

Form "2553" All About It & Why's IRS Form 2553 Important?

Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s corporation status for your business. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code. Find the current revision, pdf. Learn how to make an s corporation election using form 2553, who can.

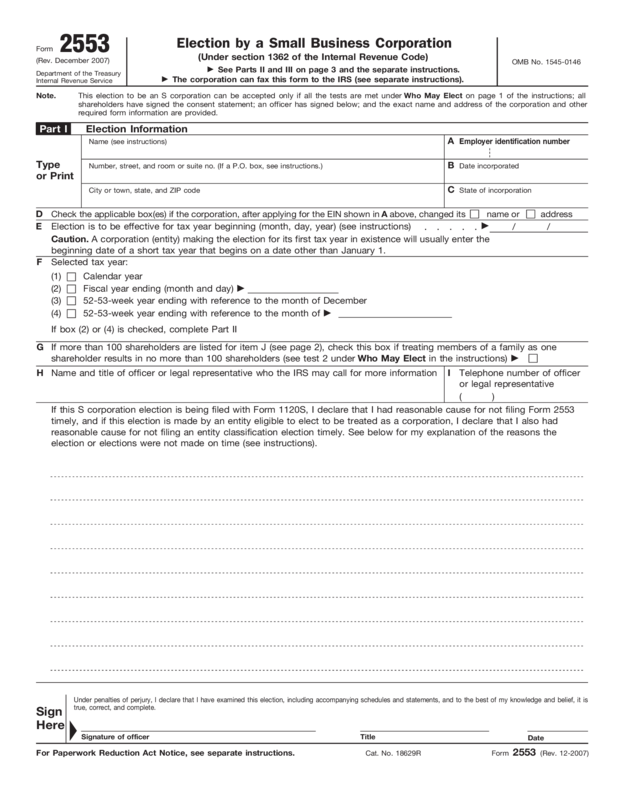

Form 2553 (Rev December 2007) Edit, Fill, Sign Online Handypdf

Learn the benefits, eligibility and steps to file form 2553 with the irs to elect s corporation status for your business. Find the current revision, pdf. Learn how to make an s corporation election using form 2553, who can qualify, when to file, and what information to include. Learn how to file form 2553 to elect to be an s.

3 Reasons to File a Form 2553 for Your Business The Blueprint

For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Learn how to make an s corporation election using form 2553, who can qualify, when to file, and what information to include. Find the current revision, pdf. Learn how to file form 2553 to elect to be an s corporation under section.

Learn The Benefits, Eligibility And Steps To File Form 2553 With The Irs To Elect S Corporation Status For Your Business.

For the latest information about developments related to form 2553 and its instructions, such as legislation enacted after. Find the current revision, pdf. Learn how to make an s corporation election using form 2553, who can qualify, when to file, and what information to include. Learn how to file form 2553 to elect to be an s corporation under section 1362 of the internal revenue code.