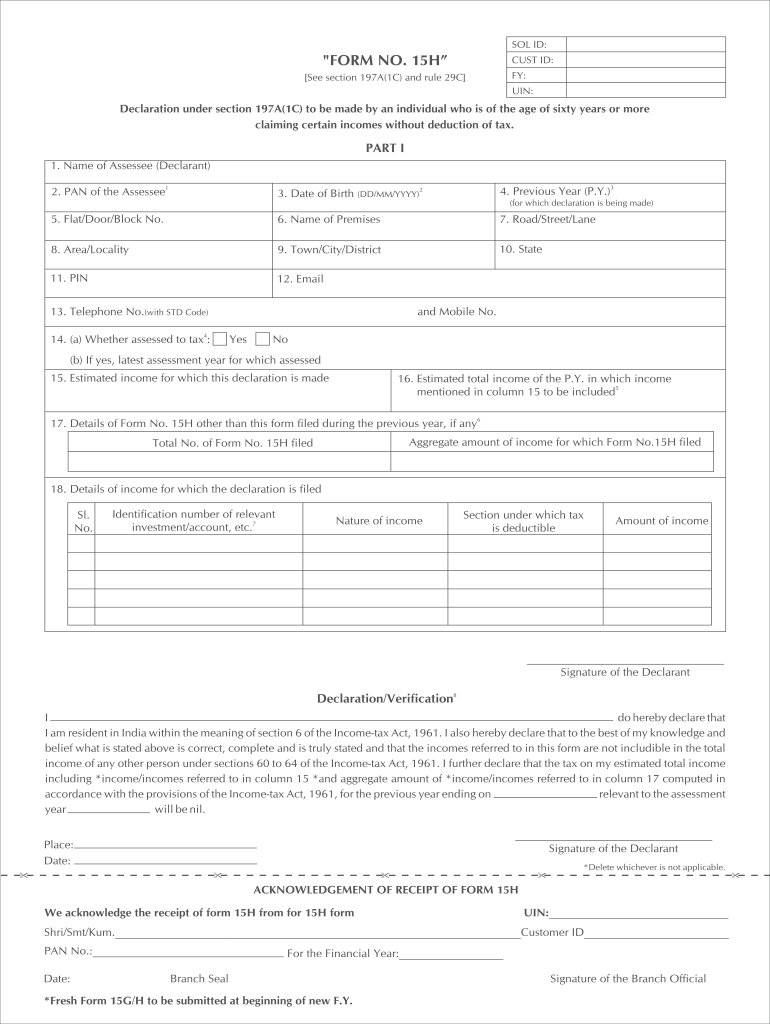

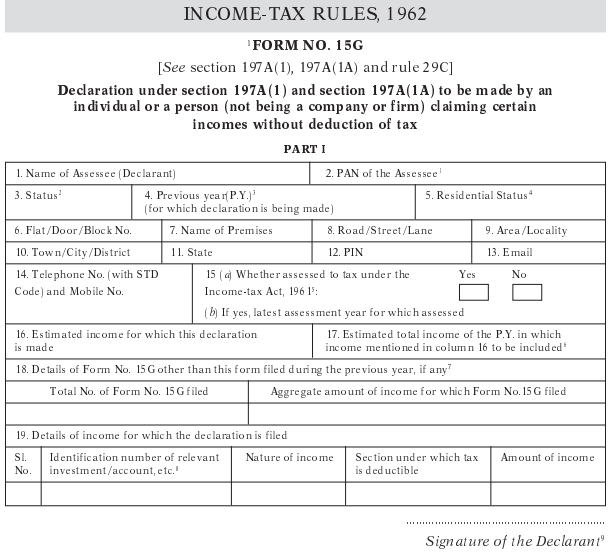

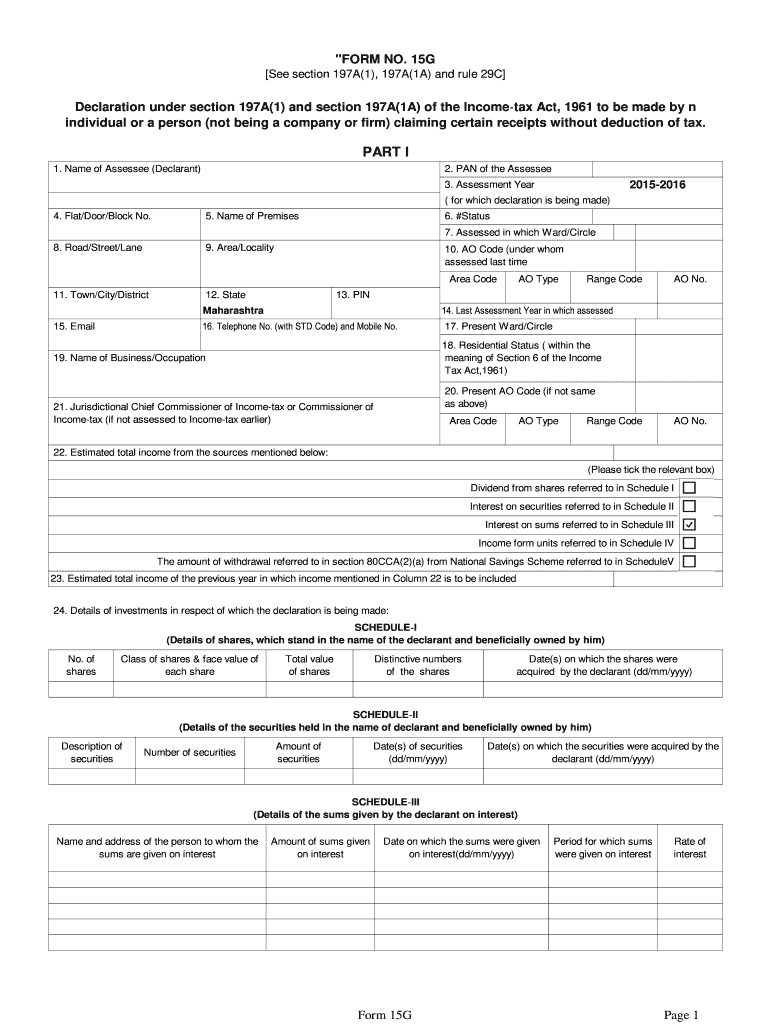

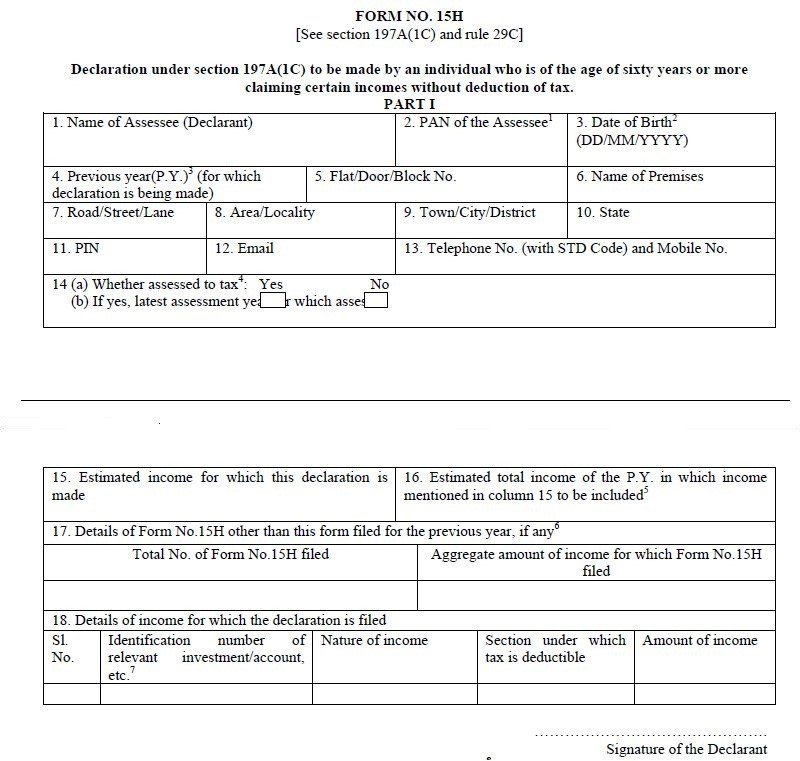

Form 15G Form - 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.

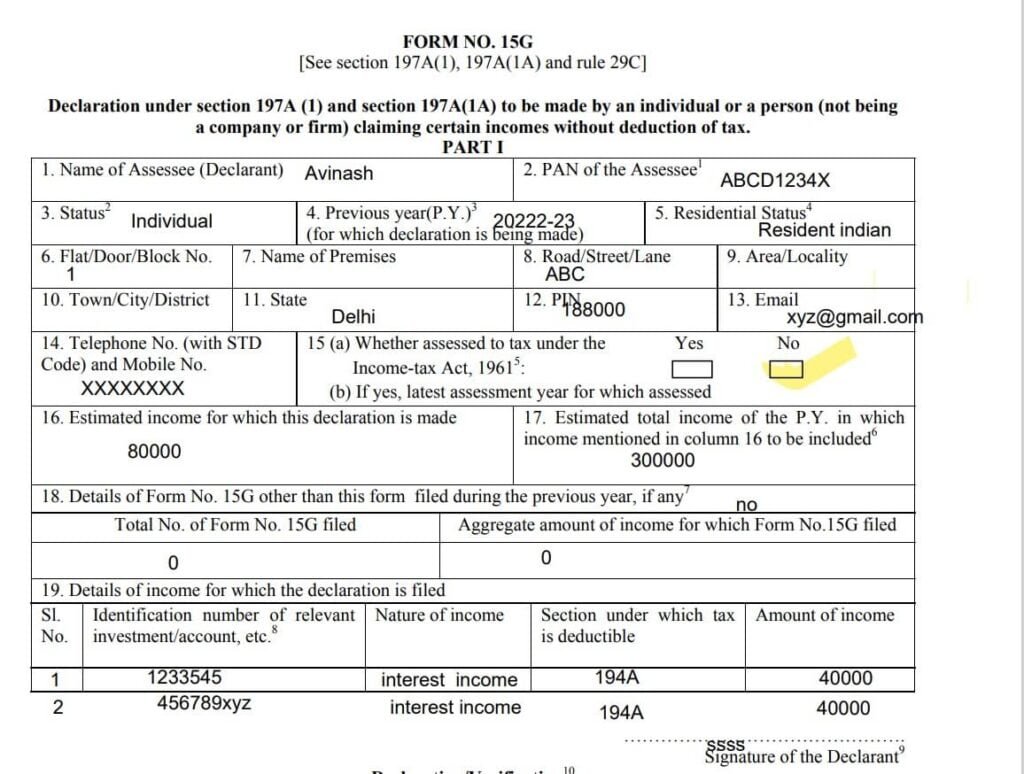

15g form fill up Download form 15G

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.

How to Download Form 15G Online PDF How to fill Form 15G

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.

Download Form 15G for PF Withdrawal 2022

15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

New Form 15G & Form 15H New format & procedure

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.

How to fill new FORM 15G or New FORM No.15H?

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.

Where To Submit Form 15g For Pf Withdrawal Online Printable Forms

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.

Form 15g Fillable Complete with ease airSlate SignNow

15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

Form 15G How to Download Form 15G Online

15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

Form 15g Download In Word Format Fill Online, Printable, Fillable

15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,. Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm).

How To Fill New Form 15G / Form 15H ROYS FINANCE

Declaration under section 197a(1) and section 197a(1a) to be made by an individual or a person (not being a company or firm). 15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.

Declaration Under Section 197A(1) And Section 197A(1A) To Be Made By An Individual Or A Person (Not Being A Company Or Firm).

15g [see section 197a(1c), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a (1a) of the income tax act,.