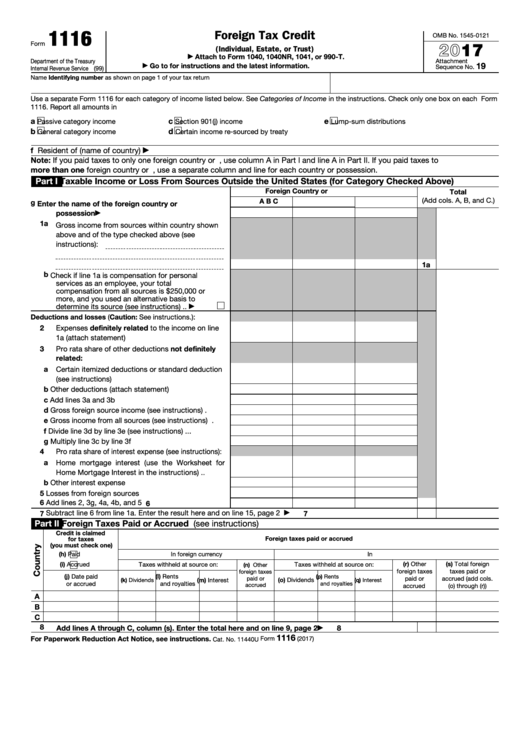

Form 1116 High Tax Kickout - The instructions say, specifically for high tax income: Use a separate form 1116 for each category of income listed below. On your form 1116 for passive category income, passive income. As shown on page 1 of your tax return.

As shown on page 1 of your tax return. Use a separate form 1116 for each category of income listed below. The instructions say, specifically for high tax income: On your form 1116 for passive category income, passive income.

The instructions say, specifically for high tax income: On your form 1116 for passive category income, passive income. Use a separate form 1116 for each category of income listed below. As shown on page 1 of your tax return.

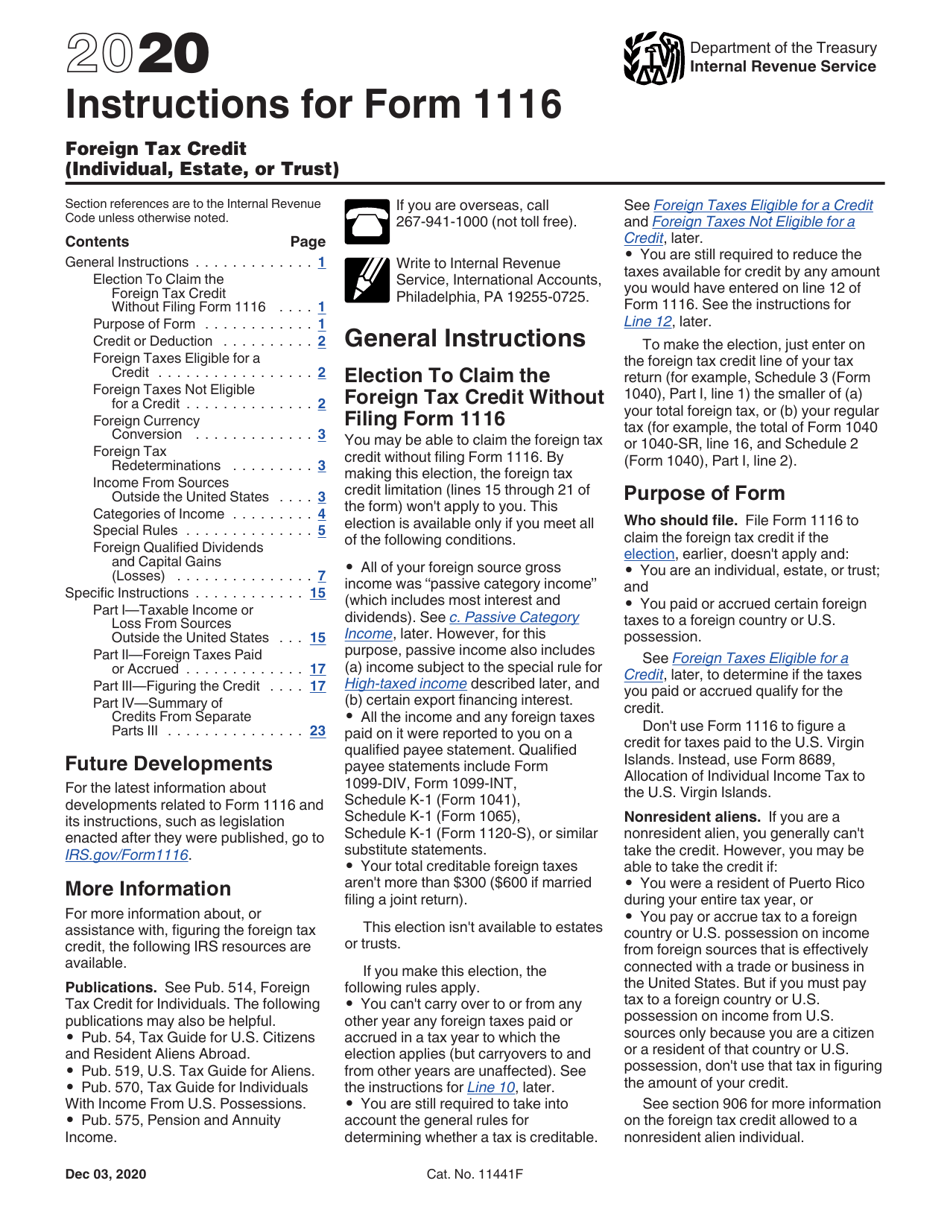

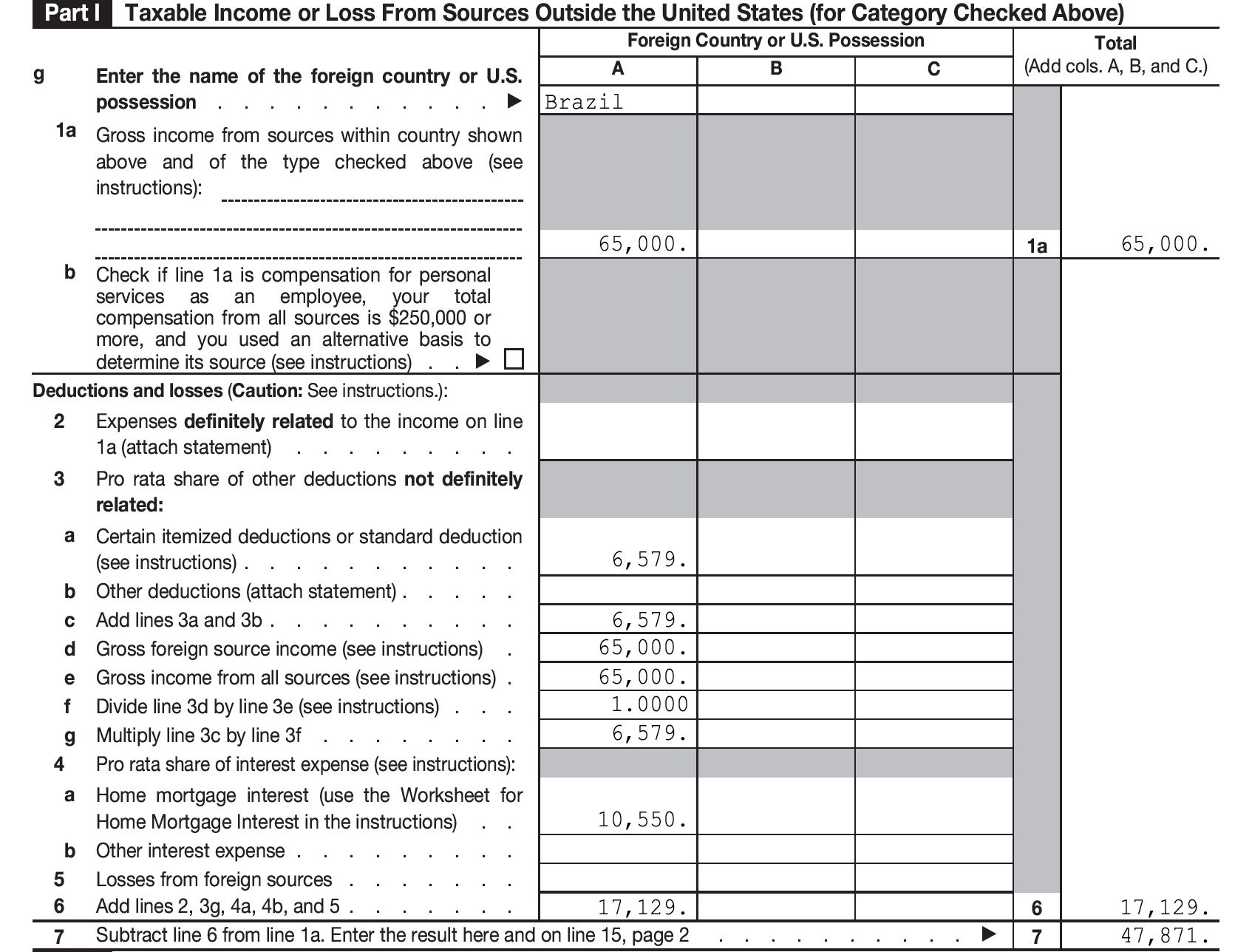

Form 1116 Instructions for Expats Claiming the Foreign Tax Credit

The instructions say, specifically for high tax income: As shown on page 1 of your tax return. Use a separate form 1116 for each category of income listed below. On your form 1116 for passive category income, passive income.

Irs Form 1116 Printable Printable Forms Free Online

On your form 1116 for passive category income, passive income. As shown on page 1 of your tax return. The instructions say, specifically for high tax income: Use a separate form 1116 for each category of income listed below.

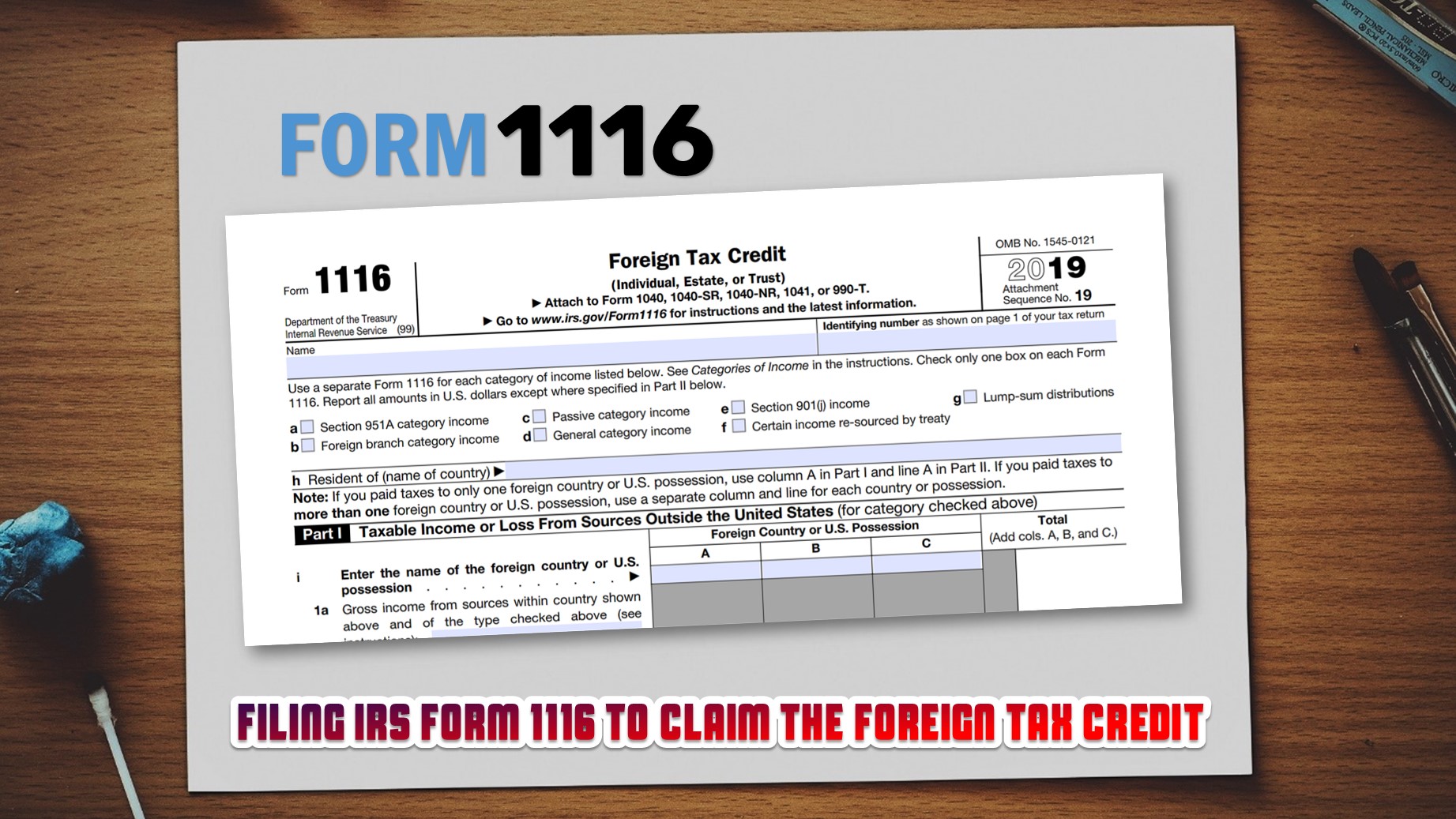

Foreign Tax Credit Your Guide to the Form 1116 SDG Accountant

On your form 1116 for passive category income, passive income. As shown on page 1 of your tax return. Use a separate form 1116 for each category of income listed below. The instructions say, specifically for high tax income:

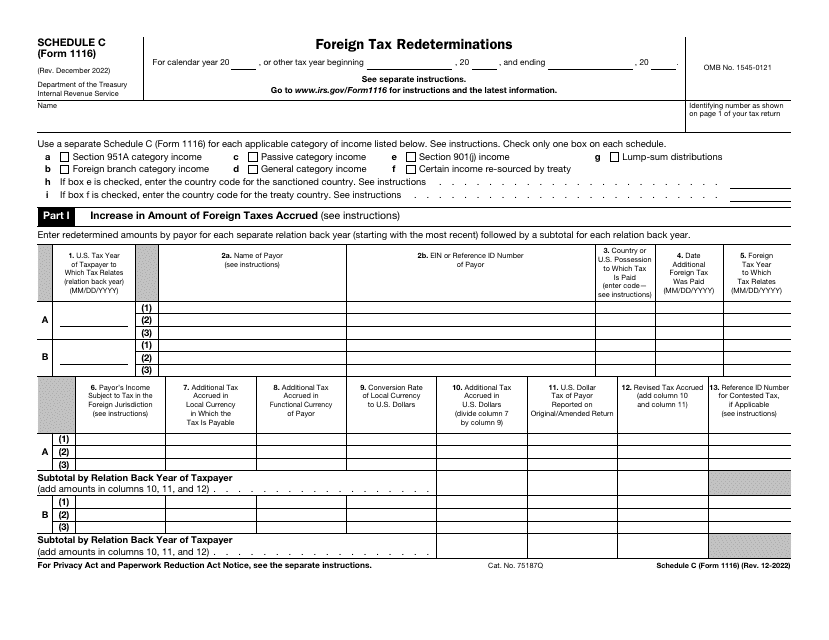

IRS Form 1116 Schedule C Download Fillable PDF or Fill Online Foreign

On your form 1116 for passive category income, passive income. The instructions say, specifically for high tax income: As shown on page 1 of your tax return. Use a separate form 1116 for each category of income listed below.

Fillable Form 1116 Foreign Tax Credit 2017 printable pdf download

As shown on page 1 of your tax return. Use a separate form 1116 for each category of income listed below. On your form 1116 for passive category income, passive income. The instructions say, specifically for high tax income:

Casual What Is Form 1116 Explanation Statement? Proprietor Capital

Use a separate form 1116 for each category of income listed below. The instructions say, specifically for high tax income: As shown on page 1 of your tax return. On your form 1116 for passive category income, passive income.

Claiming the Foreign Tax Credit with Form 1116 TurboTax Tax Tips & Videos

Use a separate form 1116 for each category of income listed below. On your form 1116 for passive category income, passive income. As shown on page 1 of your tax return. The instructions say, specifically for high tax income:

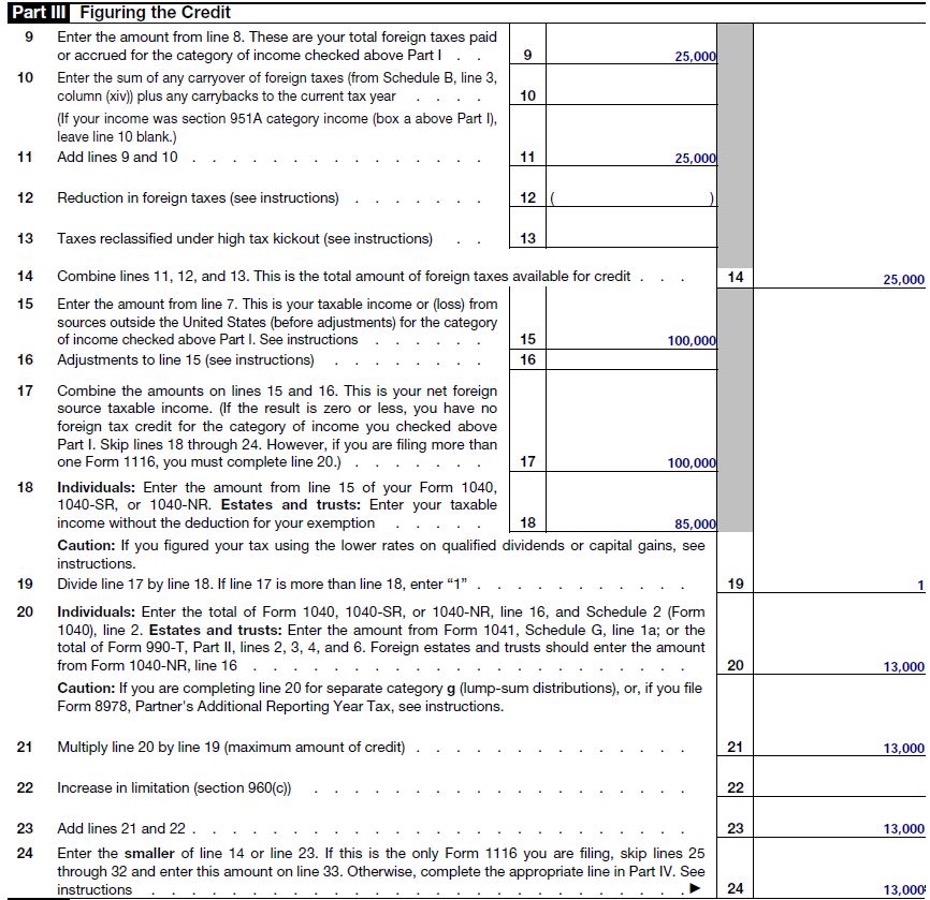

IRS Form 1116 Foreign Tax Credit With An Example Worksheets Library

On your form 1116 for passive category income, passive income. Use a separate form 1116 for each category of income listed below. As shown on page 1 of your tax return. The instructions say, specifically for high tax income:

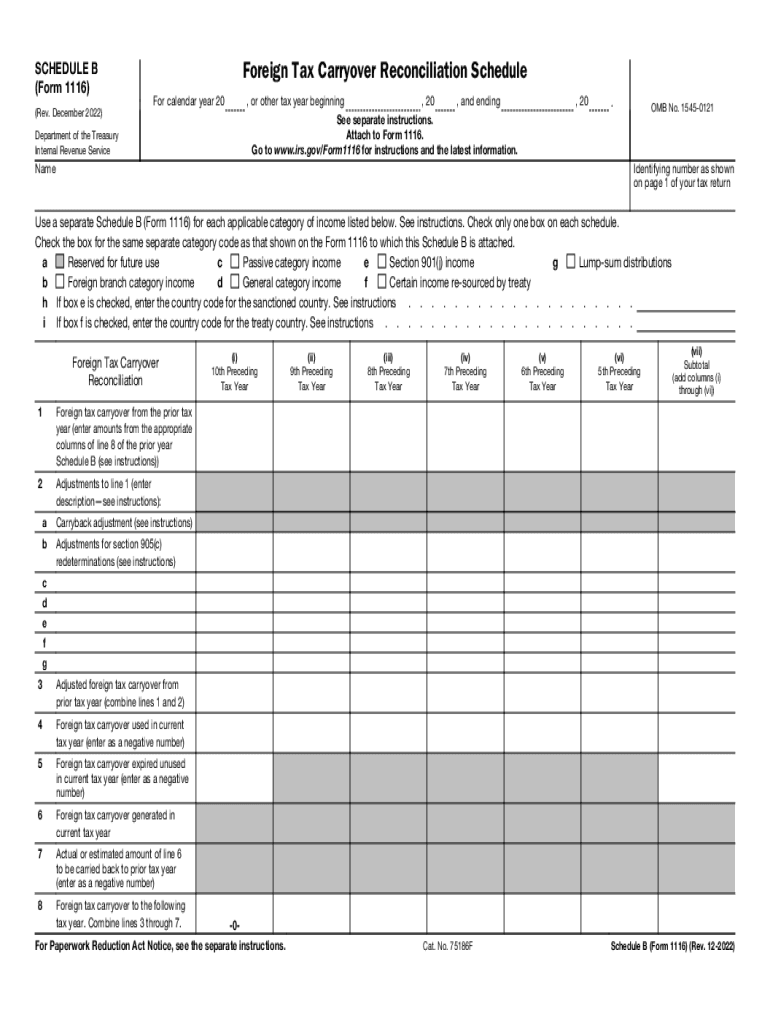

Fillable Online Schedule B (Form 1116) (Rev. December 2022). Foreign

Use a separate form 1116 for each category of income listed below. The instructions say, specifically for high tax income: As shown on page 1 of your tax return. On your form 1116 for passive category income, passive income.

As Shown On Page 1 Of Your Tax Return.

The instructions say, specifically for high tax income: On your form 1116 for passive category income, passive income. Use a separate form 1116 for each category of income listed below.