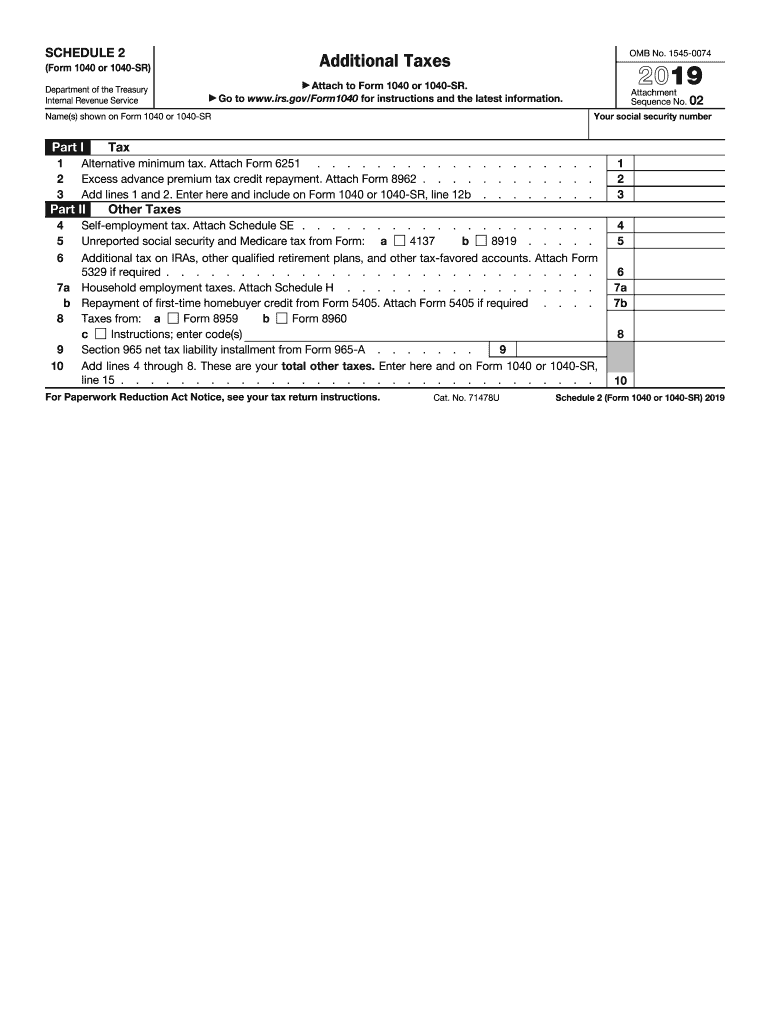

Does Everyone Have A Schedule 2 Tax Form - Repayment of new clean vehicle credit(s). Excess advance premium tax credit repayment. How do you report additional taxes with schedule 2? You must complete schedule 2 if you owe any of the additional taxes listed on the form. Even if you only have one item to report, you’re required to use. Schedule 2 is used to report taxes not included on form 1040.

Excess advance premium tax credit repayment. You must complete schedule 2 if you owe any of the additional taxes listed on the form. Repayment of new clean vehicle credit(s). Schedule 2 is used to report taxes not included on form 1040. How do you report additional taxes with schedule 2? Even if you only have one item to report, you’re required to use.

Excess advance premium tax credit repayment. Repayment of new clean vehicle credit(s). Even if you only have one item to report, you’re required to use. How do you report additional taxes with schedule 2? You must complete schedule 2 if you owe any of the additional taxes listed on the form. Schedule 2 is used to report taxes not included on form 1040.

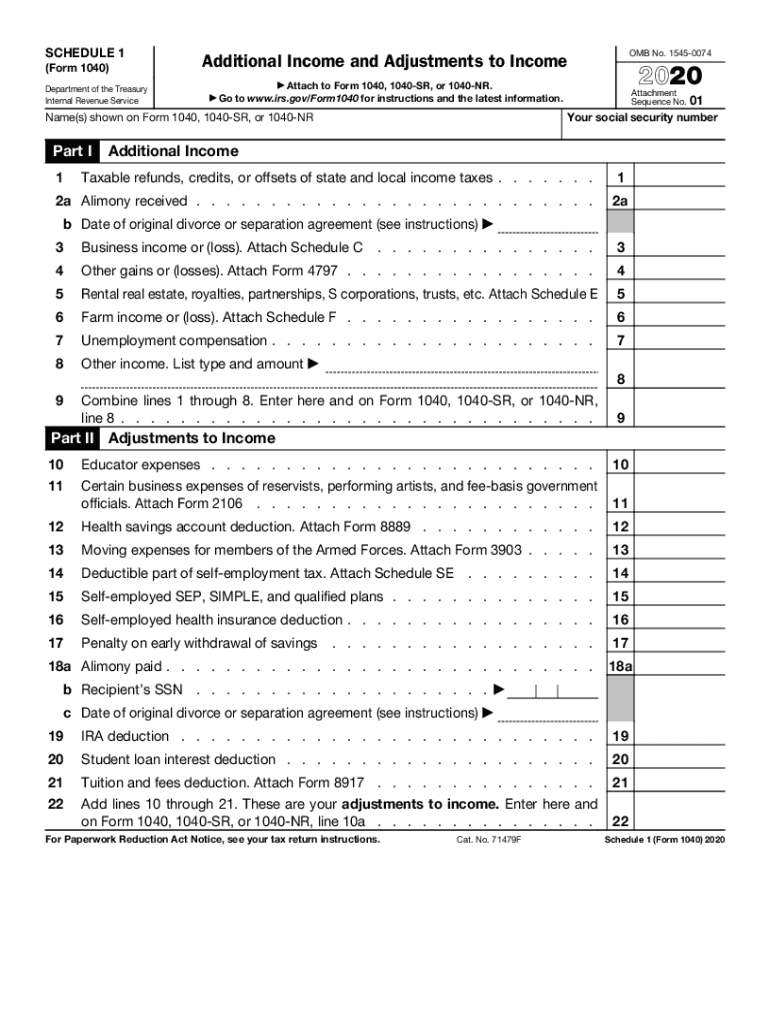

Irs Schedule 2 20192024 Form Fill Out and Sign Printable PDF

Excess advance premium tax credit repayment. Repayment of new clean vehicle credit(s). How do you report additional taxes with schedule 2? You must complete schedule 2 if you owe any of the additional taxes listed on the form. Even if you only have one item to report, you’re required to use.

What is the W2 Form Used For?

Excess advance premium tax credit repayment. Schedule 2 is used to report taxes not included on form 1040. Even if you only have one item to report, you’re required to use. Repayment of new clean vehicle credit(s). How do you report additional taxes with schedule 2?

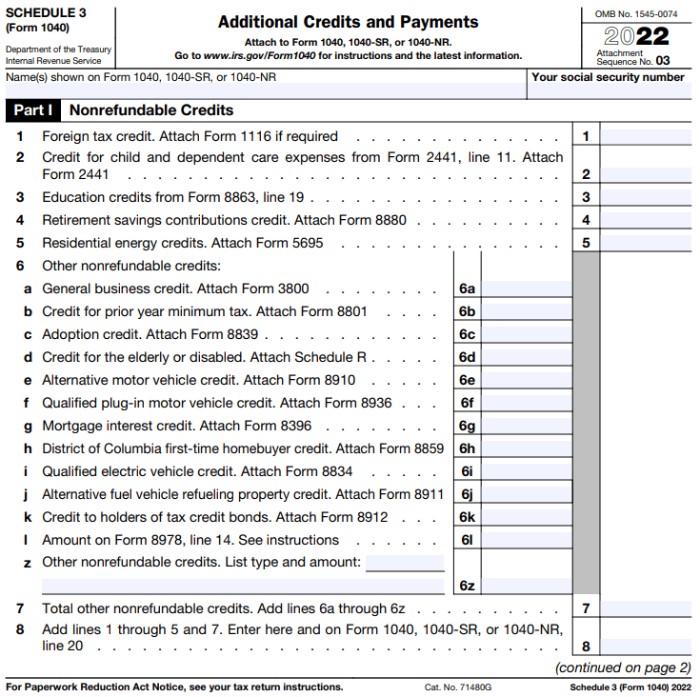

How to Quickly Fill Out Form 1040 Schedule 3

You must complete schedule 2 if you owe any of the additional taxes listed on the form. Excess advance premium tax credit repayment. Even if you only have one item to report, you’re required to use. Repayment of new clean vehicle credit(s). How do you report additional taxes with schedule 2?

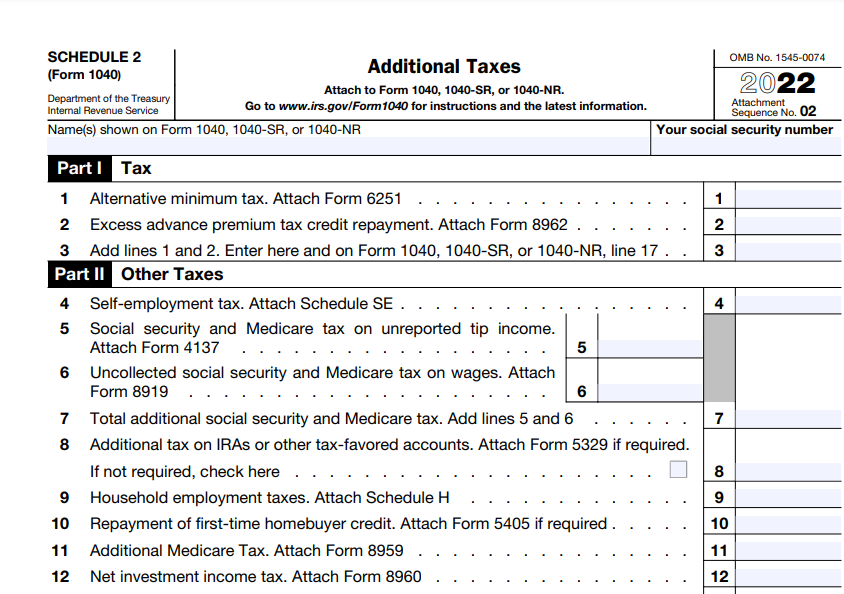

IRS Form 1040 Schedule 2. Additional Taxes Forms Docs 2023

Excess advance premium tax credit repayment. Even if you only have one item to report, you’re required to use. Repayment of new clean vehicle credit(s). You must complete schedule 2 if you owe any of the additional taxes listed on the form. How do you report additional taxes with schedule 2?

Tax Form 2022

How do you report additional taxes with schedule 2? Schedule 2 is used to report taxes not included on form 1040. Excess advance premium tax credit repayment. Even if you only have one item to report, you’re required to use. Repayment of new clean vehicle credit(s).

What is IRS Form 1040 Schedule 2 and How to Fill it Correctly

You must complete schedule 2 if you owe any of the additional taxes listed on the form. How do you report additional taxes with schedule 2? Even if you only have one item to report, you’re required to use. Repayment of new clean vehicle credit(s). Excess advance premium tax credit repayment.

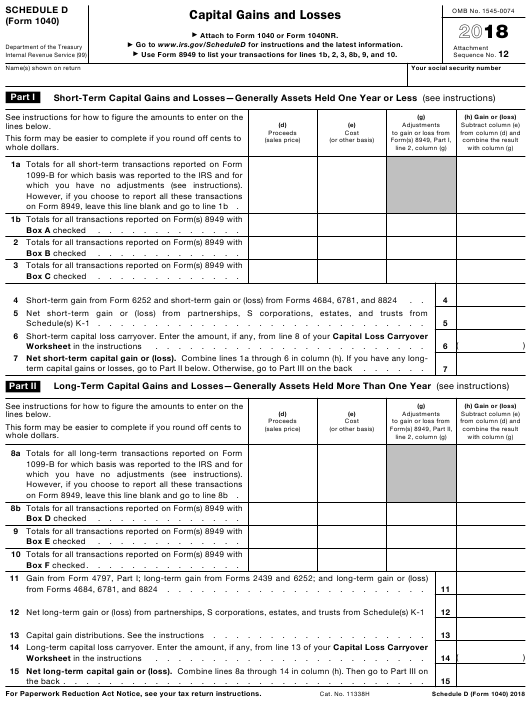

IRS Tax Form 1040 Schedule D 1040 Form Printable

You must complete schedule 2 if you owe any of the additional taxes listed on the form. How do you report additional taxes with schedule 2? Schedule 2 is used to report taxes not included on form 1040. Even if you only have one item to report, you’re required to use. Repayment of new clean vehicle credit(s).

Printable Irs Form Schedule A Printable Forms Free Online

How do you report additional taxes with schedule 2? Repayment of new clean vehicle credit(s). You must complete schedule 2 if you owe any of the additional taxes listed on the form. Even if you only have one item to report, you’re required to use. Schedule 2 is used to report taxes not included on form 1040.

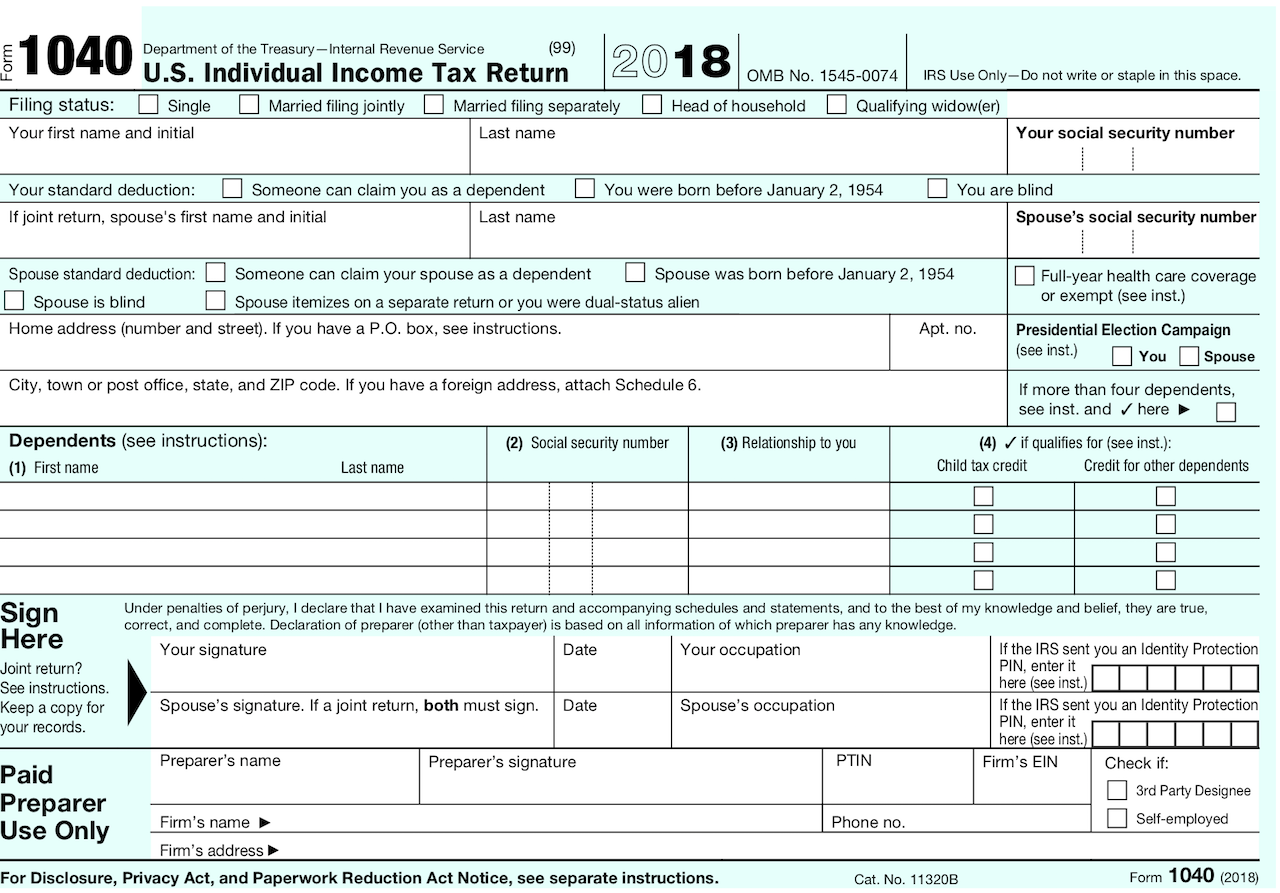

Describes new Form 1040, Schedules & Tax Tables

Even if you only have one item to report, you’re required to use. How do you report additional taxes with schedule 2? You must complete schedule 2 if you owe any of the additional taxes listed on the form. Schedule 2 is used to report taxes not included on form 1040. Repayment of new clean vehicle credit(s).

Curious About US Tax Forms 2024? A Quick Guide!

Even if you only have one item to report, you’re required to use. How do you report additional taxes with schedule 2? You must complete schedule 2 if you owe any of the additional taxes listed on the form. Excess advance premium tax credit repayment. Schedule 2 is used to report taxes not included on form 1040.

Schedule 2 Is Used To Report Taxes Not Included On Form 1040.

You must complete schedule 2 if you owe any of the additional taxes listed on the form. Excess advance premium tax credit repayment. Even if you only have one item to report, you’re required to use. How do you report additional taxes with schedule 2?