Director Fee Malaysia - Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. The level of remuneration for ned. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment.

The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. The level of remuneration for ned. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which.

If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. The level of remuneration for ned.

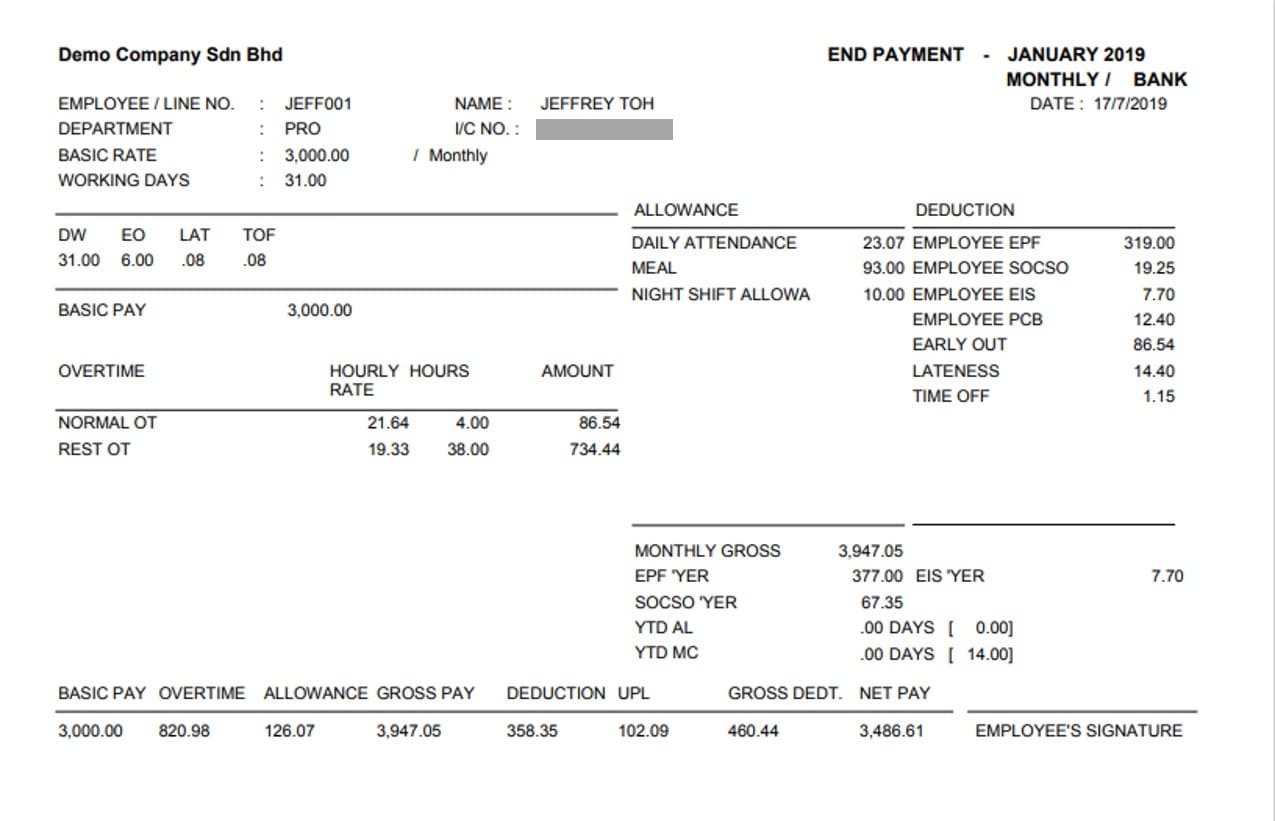

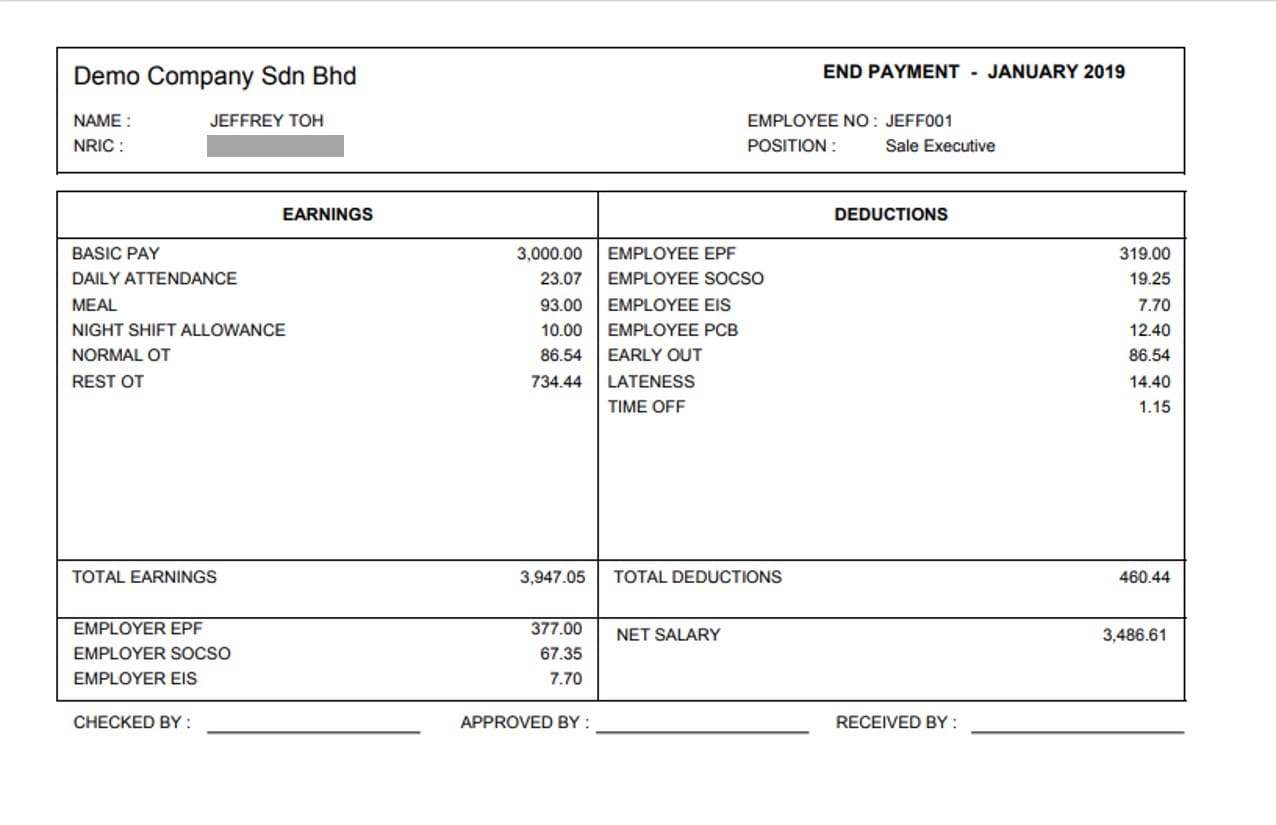

Payslip Template And Employee's Salary Slip In Malaysia, 48 OFF

In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection.

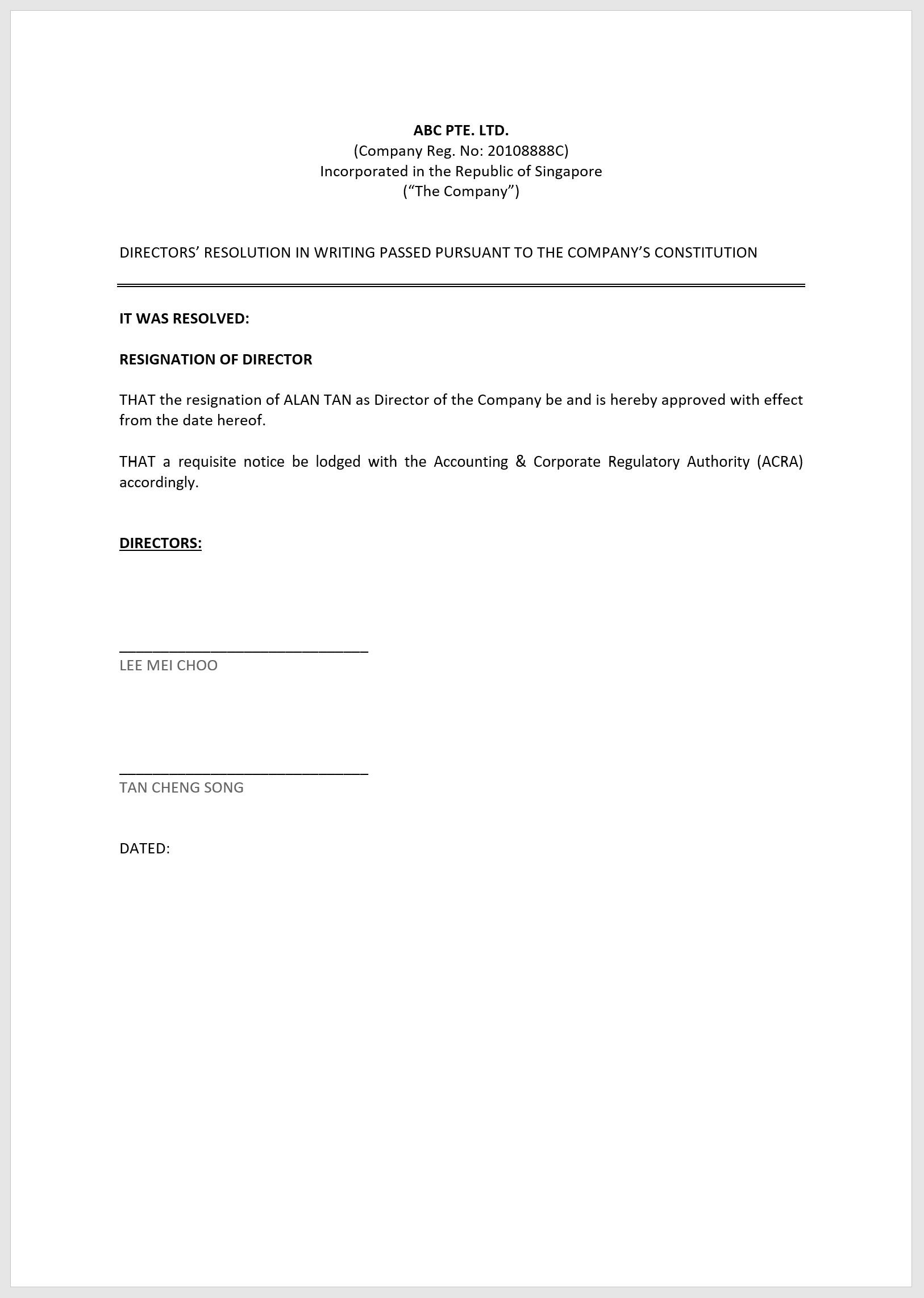

Resolution Of Board Of Directors Template

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. The level of remuneration for ned. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards.

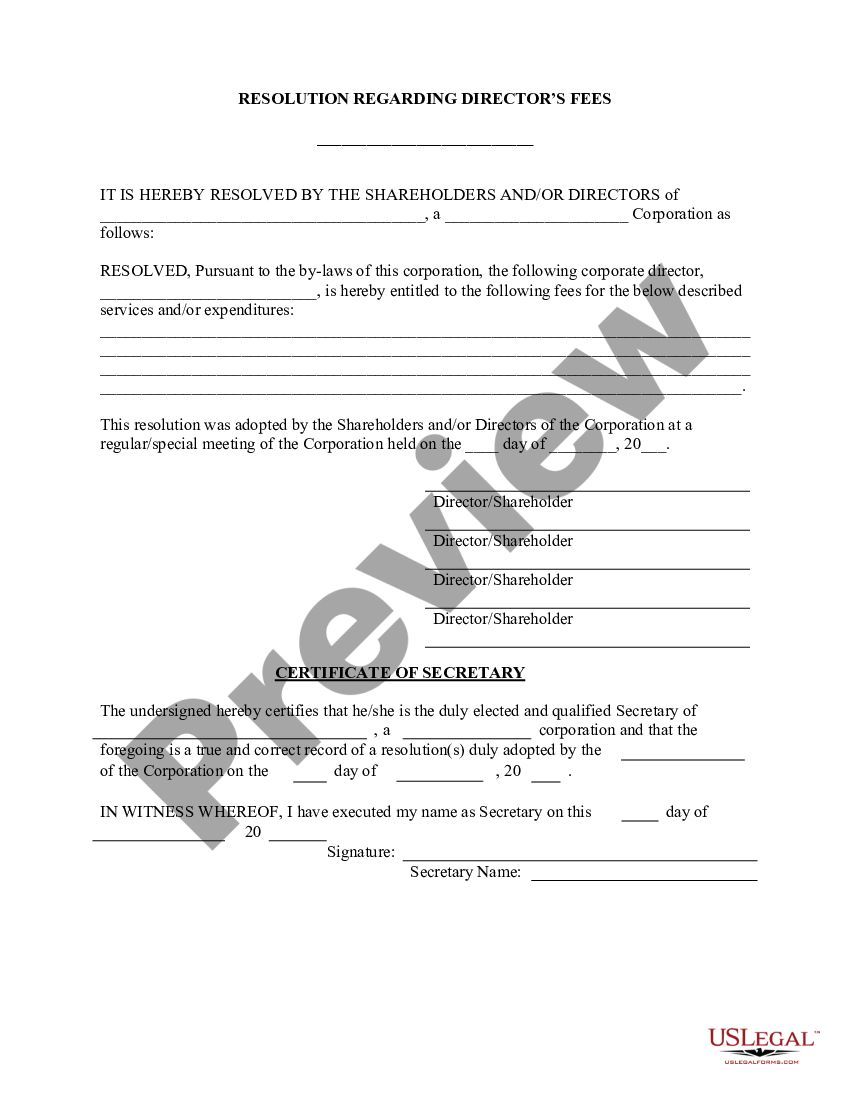

North Dakota Director's Fees Resolution Form Corporate Resolutions

The level of remuneration for ned. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. The remuneration of ned is made up of directors’ fees and other.

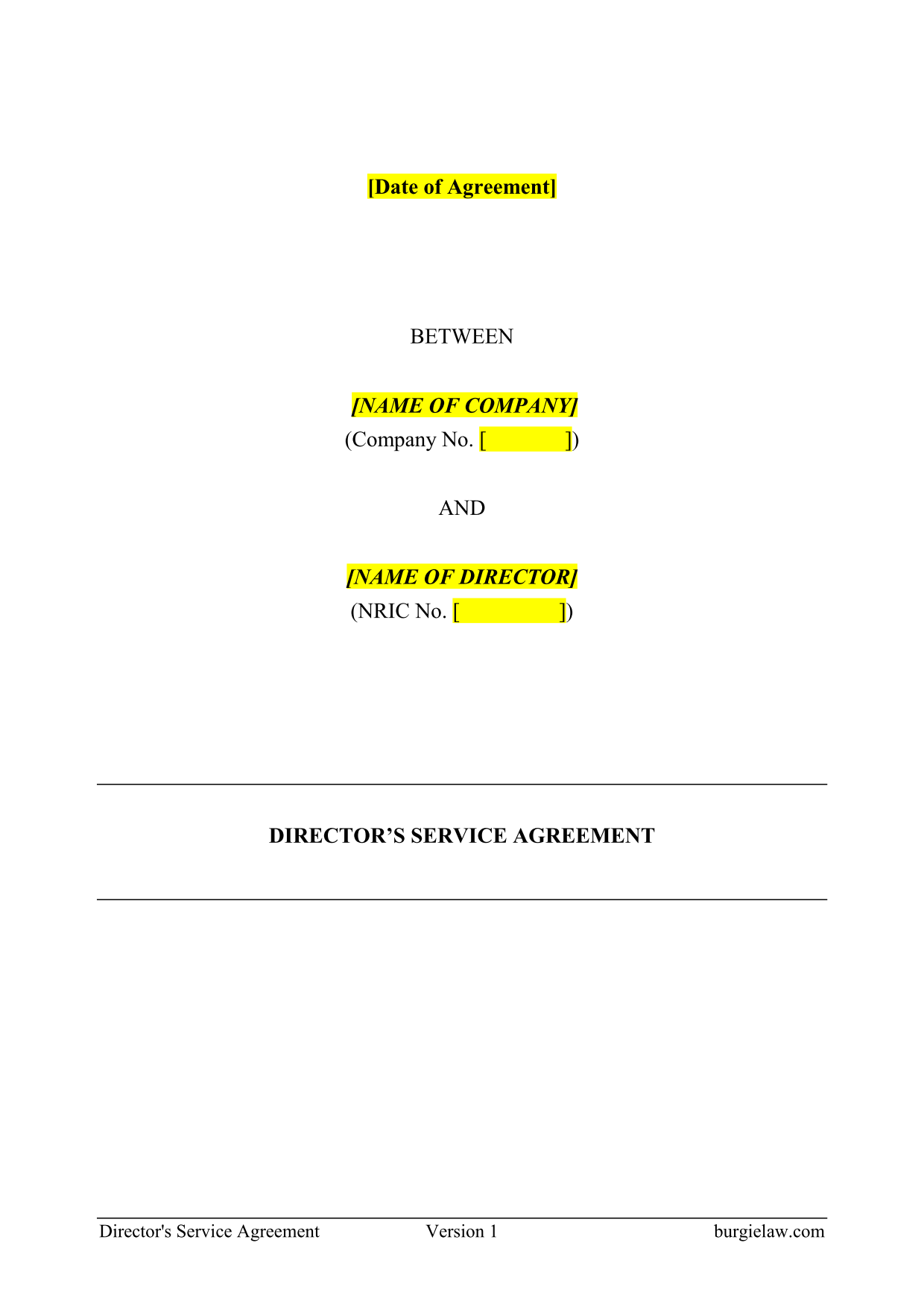

Directors Service Agreement Template

In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. The level of remuneration for ned. Directors’ fees and benefits payable to directors are subject to annual shareholder.

Consultant Fee Schedule Template Fee Structure Bonsai

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. The remuneration of ned is made up of directors’ fees and other benefits such as meeting.

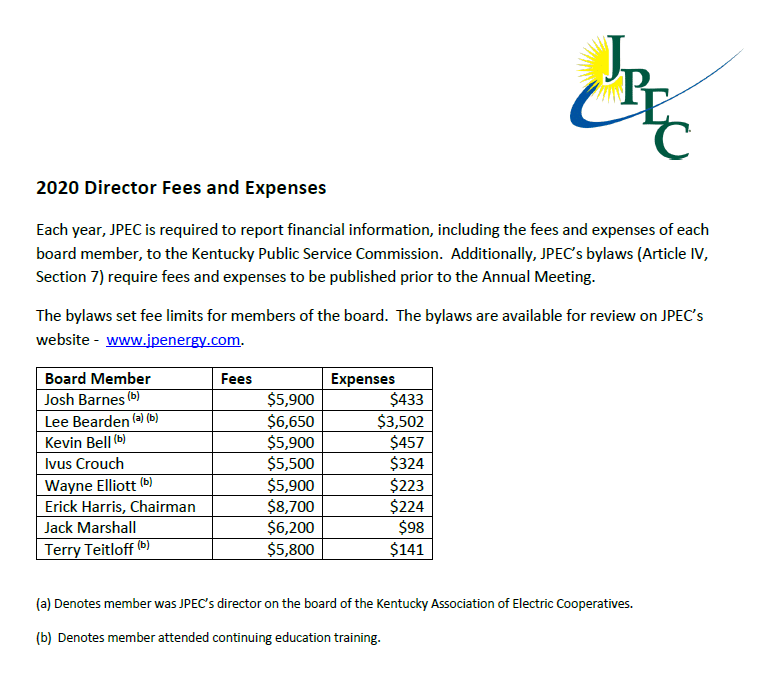

Directors Fees & Expenses Jackson Purchase Energy Cooperative

The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. Directors’ fees for a public company, shall be approved at a general meeting pursuant to subsection (1), failing which the company shall,. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph..

Directors Service Agreement Template

The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Directors’ fees.

Salary Slip Template Excel Malaysia NBKomputer

The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. The level of remuneration for ned. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment. Directors’ fees and benefits payable to directors are subject to annual shareholder approval at.

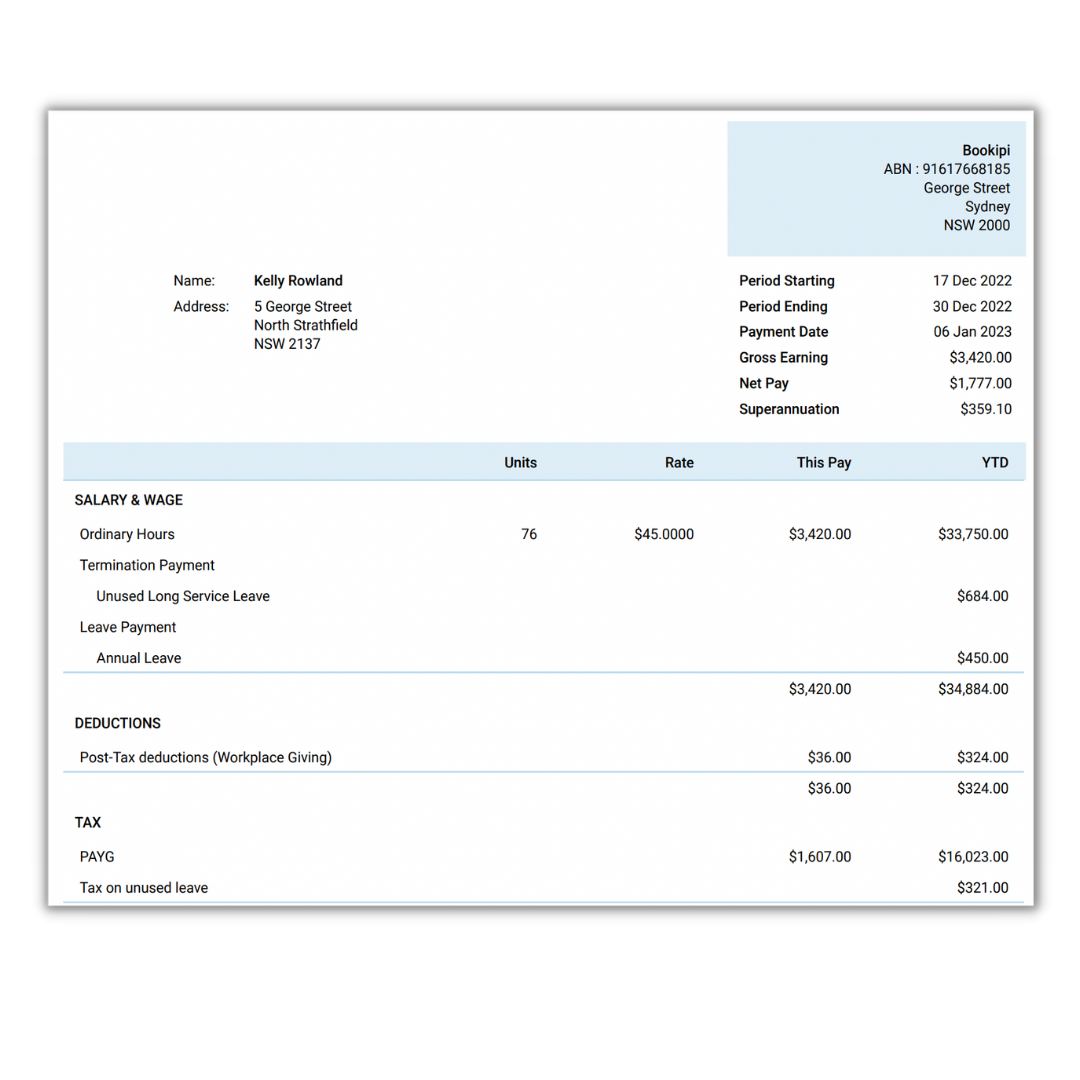

Payslip Template And Employee's Salary Slip In Malaysia, 59 OFF

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment. Directors’ fees and benefits payable to directors are subject to annual shareholder approval.

Is the Director Fee In Singapore Taxable? Learn More

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. The remuneration of ned is made up of directors’ fees and other benefits such as meeting allowances. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. Negara malaysia.

The Remuneration Of Ned Is Made Up Of Directors’ Fees And Other Benefits Such As Meeting Allowances.

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph. Negara malaysia has outlined guiding principles for remuneration paid to directors as primarily outlined in standards 19.2 and 19.4 of bank negara. In malaysia, the payment of directors’ fees and benefits and directors’ service contracts are subject to certain legal requirements, which. If a company, whether public or private, intends to pay fees and benefits to its directors, its constitution must allow for such payment.

Directors’ Fees For A Public Company, Shall Be Approved At A General Meeting Pursuant To Subsection (1), Failing Which The Company Shall,.

Directors’ fees and benefits payable to directors are subject to annual shareholder approval at a general meeting, as provided under paragraph 7.24 of the. The level of remuneration for ned.