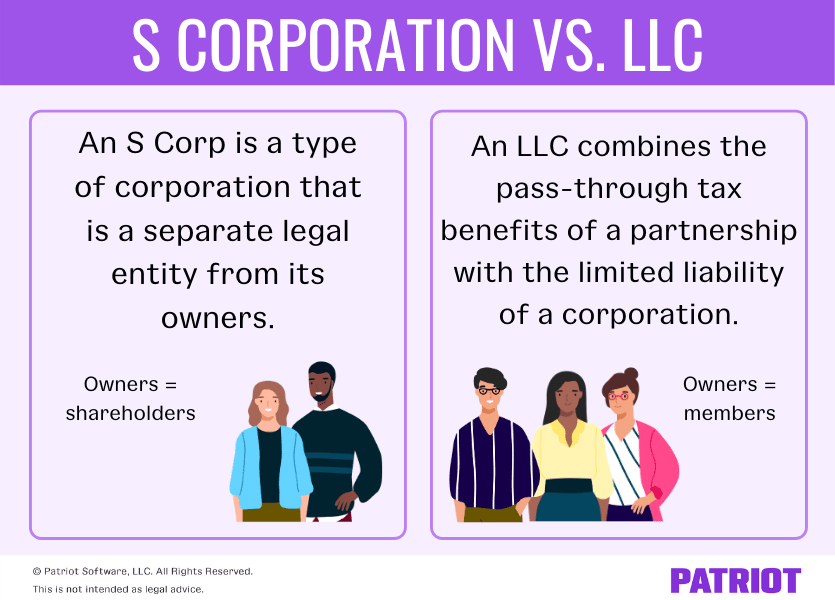

Difference Between S Corporation And Llc - Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. A limited liability company (llc) is a legal business structure. This means an llc can attain. As we explained above, an s corp is a tax classification, while an llc is a business entity. An llc is a type of business entity, while an s corporation is a tax classification. What's the difference between an s corp and an llc? Which is right for you? To be taxed as an s corporation, your business must first register as a c corporation or an llc. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. The irs rules restrict s corporation.

What's the difference between an s corp and an llc? There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. To be taxed as an s corporation, your business must first register as a c corporation or an llc. The irs rules restrict s corporation. As we explained above, an s corp is a tax classification, while an llc is a business entity. This means an llc can attain. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. A limited liability company (llc) is a legal business structure. Which is right for you? An llc is a type of business entity, while an s corporation is a tax classification.

The irs rules restrict s corporation. Which is right for you? This means an llc can attain. An llc is a type of business entity, while an s corporation is a tax classification. A limited liability company (llc) is a legal business structure. What's the difference between an s corp and an llc? There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. To be taxed as an s corporation, your business must first register as a c corporation or an llc. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. As we explained above, an s corp is a tax classification, while an llc is a business entity.

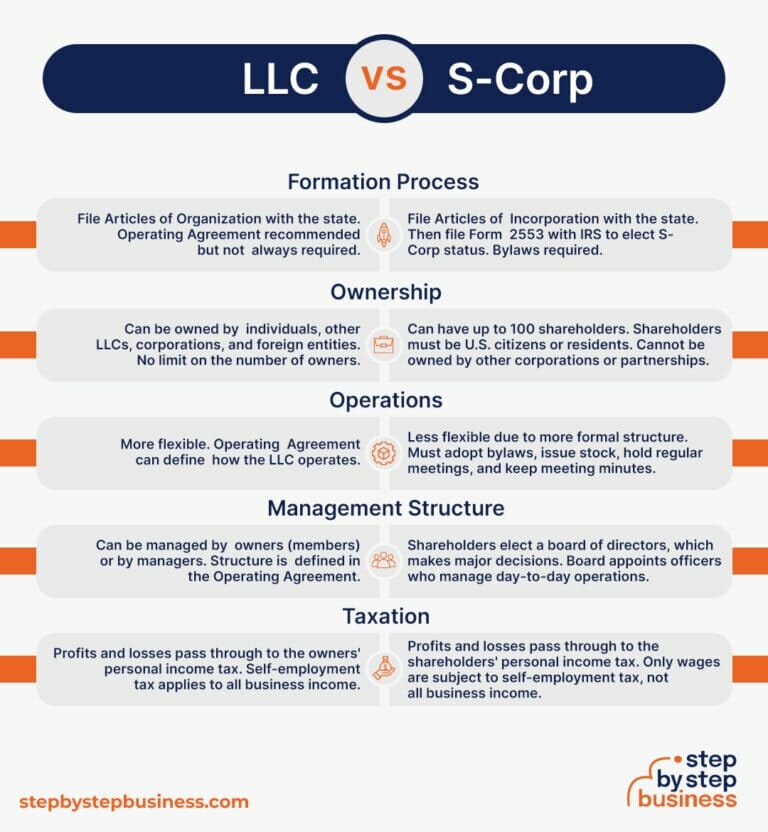

LLC vs. SCorp Key Differences Step By Step Business

The irs rules restrict s corporation. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. What's the difference between an s corp and an llc? To be taxed as an s corporation, your business must first register as a c corporation or an llc. An llc is a type of business.

CCorp vs LLC what's the difference? Latitud

The irs rules restrict s corporation. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. Which is right for you? To be taxed as an s corporation, your business must first register as a c corporation or an llc. This means an llc can attain.

CCorp vs LLC what's the difference? Latitud

The irs rules restrict s corporation. Which is right for you? To be taxed as an s corporation, your business must first register as a c corporation or an llc. This means an llc can attain. An llc is a type of business entity, while an s corporation is a tax classification.

S corp vs. LLC Legalzoom

A limited liability company (llc) is a legal business structure. An llc is a type of business entity, while an s corporation is a tax classification. This means an llc can attain. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. What's the difference between an.

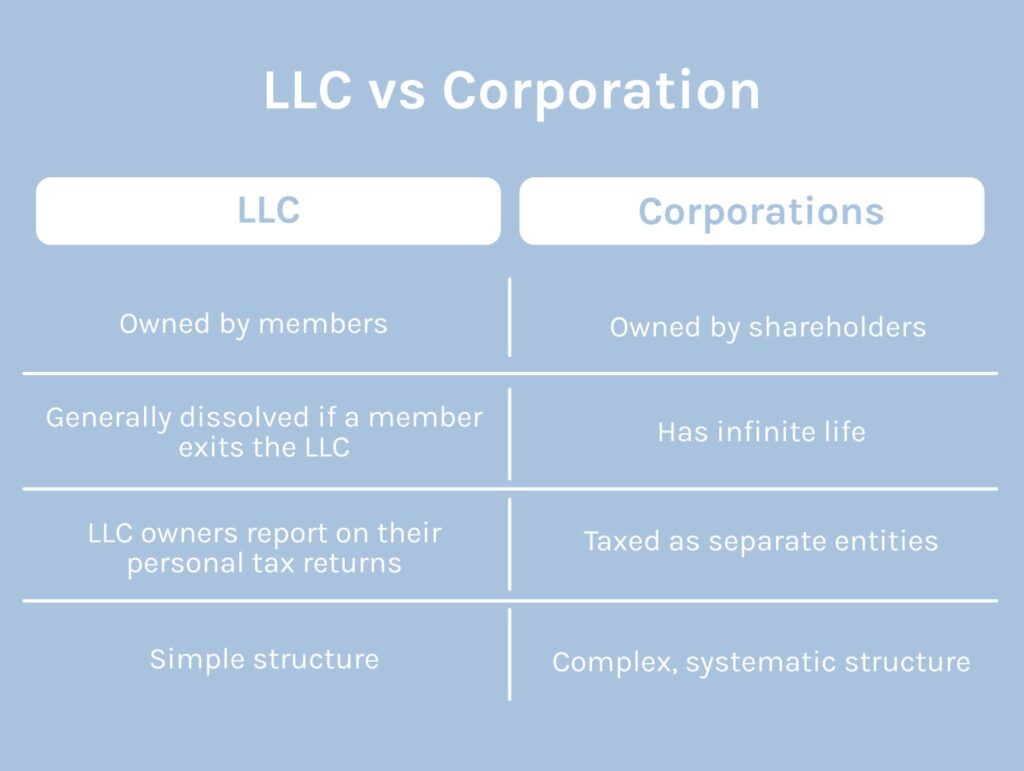

LLC vs Corporation How Does Each Work?

Which is right for you? As we explained above, an s corp is a tax classification, while an llc is a business entity. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. The irs rules restrict s corporation. What's the difference between an s corp and an llc?

Detailed Explanation For Difference Between LLC and S Corp

What's the difference between an s corp and an llc? There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. A limited liability company (llc) is a legal business structure. The irs rules restrict s corporation. Which is right for you?

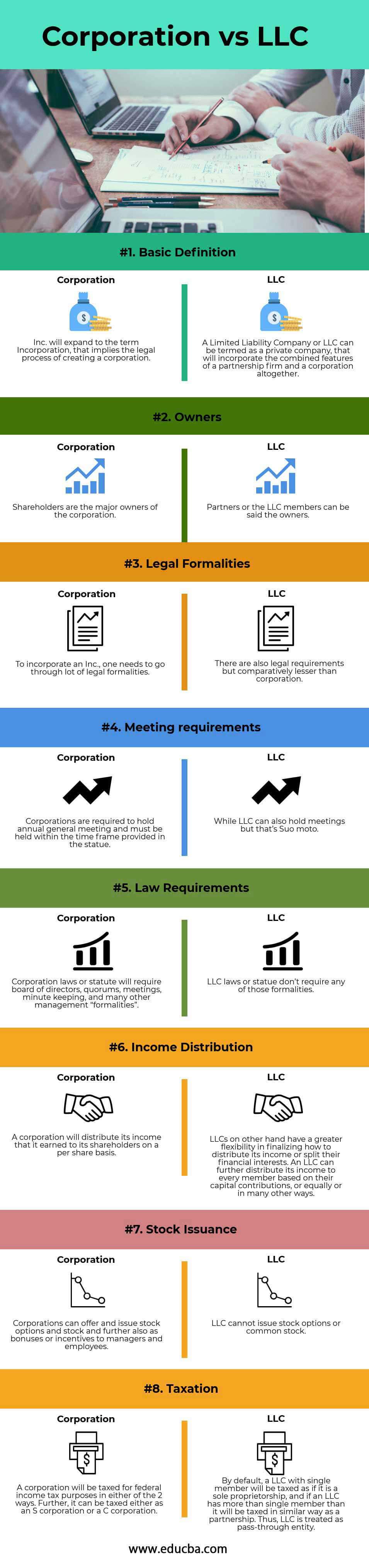

Corporation vs LLC Top 8 Best Differences (With Infographics)

There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. A limited liability company (llc) is a legal business structure. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. An llc is a type of business entity, while.

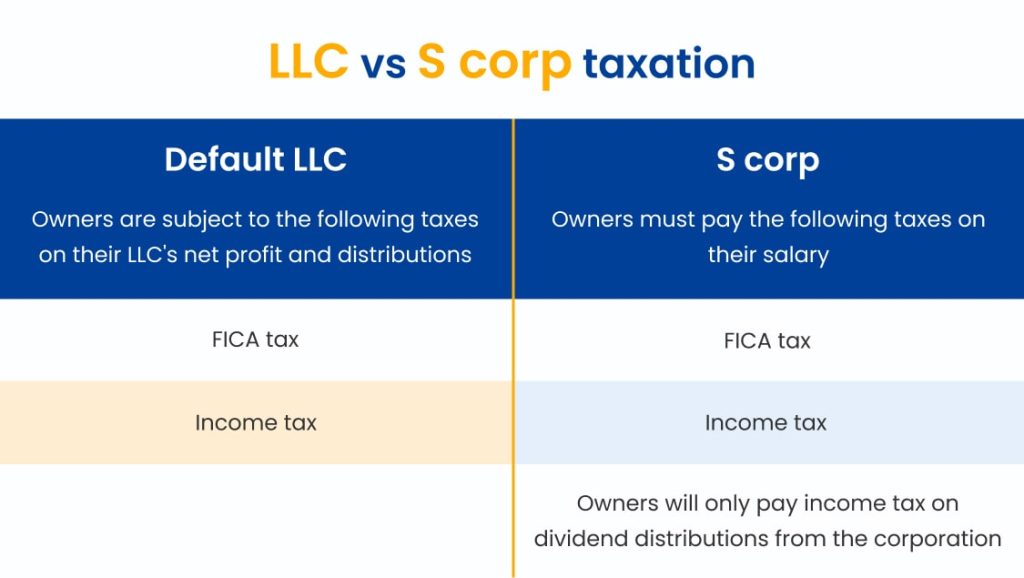

Should My Llc Be Taxed As An S Corp Or C Corp? registered agent

This means an llc can attain. Which is right for you? To be taxed as an s corporation, your business must first register as a c corporation or an llc. An llc is a type of business entity, while an s corporation is a tax classification. What's the difference between an s corp and an llc?

S Corp vs. LLC Q&A, Pros & Cons of Each, and More

To be taxed as an s corporation, your business must first register as a c corporation or an llc. As we explained above, an s corp is a tax classification, while an llc is a business entity. This means an llc can attain. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc.

Corporation vs LLC Information. What are the differences?

The irs rules restrict s corporation. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. Which is right for you? To be taxed as an s corporation, your business must first register as a c corporation or an llc. A limited liability company (llc) is a.

A Limited Liability Company (Llc) Is A Legal Business Structure.

An llc is a type of business entity, while an s corporation is a tax classification. Your specific business, financial, and lifestyle goals can help determine whether an s corp or an llc is the right choice for you. What's the difference between an s corp and an llc? This means an llc can attain.

Which Is Right For You?

As we explained above, an s corp is a tax classification, while an llc is a business entity. There are several key differences between an llc and s corp pertaining to ownership, management, and ongoing formalities. To be taxed as an s corporation, your business must first register as a c corporation or an llc. The irs rules restrict s corporation.